Investors in energy infrastructure company APA Group (APA) will need to consider whether a yield of 6.6% is “enough” when they decide whether to take part in APA’s share purchase plan (SPP). While distributions should increase in subsequent years, APA is the classic low growth, reliable, defensive stock.

The 6.6% yield, which is largely unfranked, is based on APA’s forecast distribution of 56c for FY24 and a share purchase plan price of $8.50 per share. APA is raising capital to fund the $1.7bn purchase of Alinta Energy’s portfolio of energy infrastructure assets in the Pilbara.

APA is a leading energy infrastructure business that owns a $22 billion portfolio of gas, electricity, solar and wind assets. Formerly known as the Australian Pipeline Authority, most of its revenue (and earnings) comes from the network of gas pipelines that it owns and manages. It is also involved in power generation (gas and renewables) and electricity transmission. Strategically, it has been diversifying away from gas into renewables.

The Alinta Energy portfolio in the Pilbara comprises:

- The 210 MW gas power station at Port Headland;

- A 232 MW gas/diesel power station at Newman, plus 35MW operating battery;

- 60MW operating solar farm at Chichester;

- More than 200km of operating electricity transmission lines; and

- The remaining 11.8% interest in Goldfields Gas Transmission Pipeline (which runs 1,378km of pipeline from Yarraloola in the Pilbara to the Kalgoorlie goldfields in the south) – APA already owns the other 88%.

Further, there is a development pipeline of another 60MW of gas generation, over 1GW of wind, solar and battery storage, and 600km of electricity transmission. Already under construction is a 47MW solar farm at Port Headland and 35MW battery.

Alinta’s major customers include BHP, Fortescue and Roy Hill.

Financially, Alinta Energy in the Pilbara earns $235m in revenue and $124m of EBITDA. This is underpinned by inflation linked contracts with leading iron ore producers with a weighted average contract life of 7 years.

The implied enterprise value of $1,722m (purchase price of $1,657m and acquired debt of $65m) puts the transaction on a multiple of 12.9x FY24 forecast EBITDA.

Strategically, APA argues that the acquisition is attractive:

- Financially, the acquisition is free cash flow accretive in its first full year of ownership and is value accretive. It has predictable earnings, supported by long-term customer contracts;

- It leverages APA’s expertise in providing remote energy infrastructure solutions to the resources sector;

- Electricity demand in the Pilbara is expected to grow at CAGR (compound annual growth rate) of 4.6% to 2050 driven by miner decarbonisation targets and the switch away from diesel (particularly in regard to mine haulage);

- There will be a major increase in demand for renewables as miners implement decarbonisation targets, with gas used as firming;

- Alinta has an attractive pipeline of renewable opportunities with strong connectivity to existing assets; and

- From a Group perspective, the acquisition diversifies APA’s revenue and earnings composition away from gas transmission, storage and processing.

The acquisition (which includes $75m in transaction costs) will be funded by $750m in equity (institutional placement of $675 and SPP of $75m) and new debt of $993m.

The share purchase plan (SPP)

The share purchase plan allows retail investors to purchase up to $30,000 of APA shares at a price no higher than $8.50. This is the same price that institutional investors paid in the $675m placement completed last Thursday.

APA intends to raise $75m through the SPP, so applications may be subject to a scale back in the event of strong demand. It is due to open on Thursday 31 August and close on Friday 15 September.

The actual issue price will be the lower of $8.50 and a 2% discount to the weighted average trading price of APA shares in the five days leading up to the close of the offer. This means that shareholders who apply early are largely “protected” from a fall in APA’s share price during the offer period.

What do the brokers say about APA?

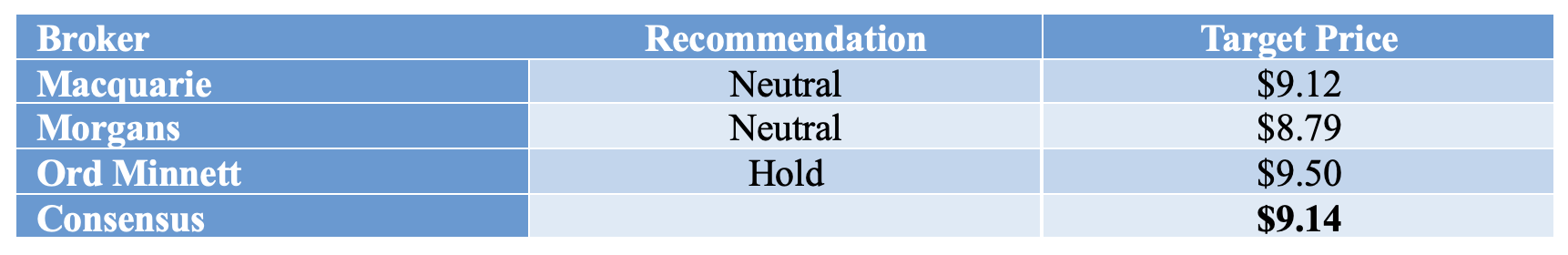

The major brokers are neutral on APA. According to FN Arena, the consensus target price is $9.14, about 5% higher than Friday’s closing ASX price of $8.71.

In the main, the brokers were underwhelmed with APA’s FY23 financial result, and in particular, higher cost and capex guidance for FY24 along with distribution guidance of 56c per unit, which was a couple cents short of broker forecasts.

Looking at the acquisition of the Alinta portfolio in the Pilbara, most felt the price was a touch on the high side. Macquarie was a little more positive, saying that: “it considers the acquisition of Alinta a positive and the multiple paid, whilst high, is attractive as earnings growth is well-established for the next two years”.

Bottom line

I think a 6.6% yield is interesting rather than compelling. That’s not to say that there isn’t upside in both the share price and the distribution (it wasn’t that long ago that the stock was trading over $11, and APA has historically grown the distribution, being 51c in FY21, 53c in FY22 and 55c in FY23).

APA Group (APA) – last 12 months

A small element of the distribution should be franked (about 15%), which further improves the return. However, in the order of 7% grossed up return is no steal compared to “zero risk” term deposits, where rates in the high 4’s are readily available.

This all said, as a defensive stock, the equity risk is relatively low. Taking this into account and that the acquisition appears to make strategic sense, I can get comfortable at $8.50 per share and think existing shareholders should consider taking part in the SPP.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.