I received a phone call yesterday afternoon from one of my well-off financial planning clients, who’d been spooked by what he’d been hearing about the upcoming US Jobs Report, which was released overnight.

He was worried about his US shareholdings, which he brought to us when he became a client. My first words to him on the phone were: “If you want to sell those shares, I’ll buy them but at a 5% discount.”

His fears emanated out of an ADP private sector jobs report that comes out ahead of the official jobs data from the US statistician. I’ve watched this unofficial indicator for decades and it’s notoriously unreliable! Of course, sometimes it’s right but other times the ADP numbers are way off beam.

They were off beam again!

Yesterday they told us that employers put on 497,000 new workers in June, which was double what economists expected. However, when the official Jobs Report came out, we learnt that the US economy created 209,000 jobs, which was not only less than what the Dow Jones survey of economists tipped (i.e., 240,000) but was less than the 339,000 created in May.

That’s the kind of progress that could see the Fed pause again when it meets over July 25-26, and this could be helped if next Wednesday’s CPI number in the US comes in nice and low.

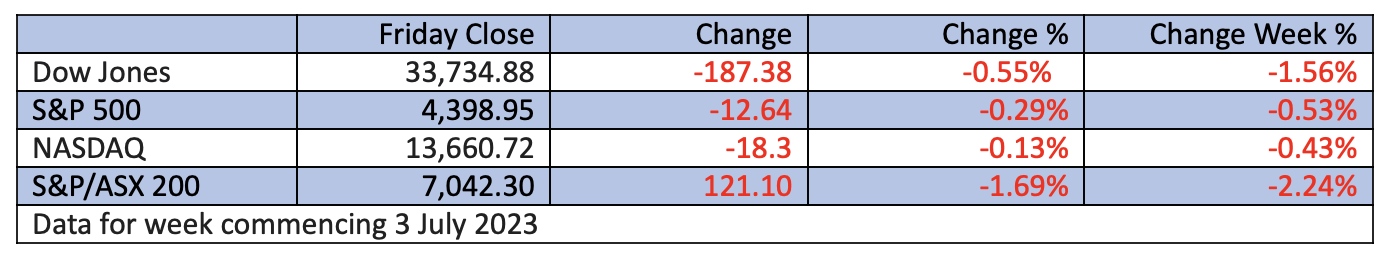

I didn’t need to ask my client for a 5% discount because the S&P 500 and the Nasdaq were only down marginally overnight, and that happened just before the closing bell! By the way, the Russell 2000, which is a small cap index was up 1.2%!

Of course, my client would never have sold because I would’ve talked him out of it, as I did. However, if he really was insistent, that 5% discount I asked for was linked to the possibility that a small sell-off of US stocks is possible, if the Fed surprises and plays hardball for one or two more rate rises. But after that, I expect stocks to rise across the December quarter and then into a solid 2024.

Could I be wrong? Of course, I could, if the Fed goes stir crazy and creates an unexpected worrying recession, but so far, these OK job numbers are not screaming that a big US slump is in train. That’s why Wall Street was up nicely most of Friday.

Kathy Jones, chief fixed income strategist for the Schwab Centre for Financial Research, sums up where the market is on rates watch now: “The Fed is signalling a willingness to keep tightening, but markets aren’t convinced it will happen as much as the Fed projects. The gap between the peak rate implied by the dot plot [of potential rate rises from Fed officials] and market expectations has narrowed but hasn’t closed.”

And this Jobs Report didn’t get us out of the woods yet because unemployment fell from 3.7% to 3.6% and average wages per hour rose 0.4% over June and are up 4.4% over the year. The Fed will need the CPI to drop notably to offset any concerns about wage rises. This makes next week’s CPI another big watch for stock markets.

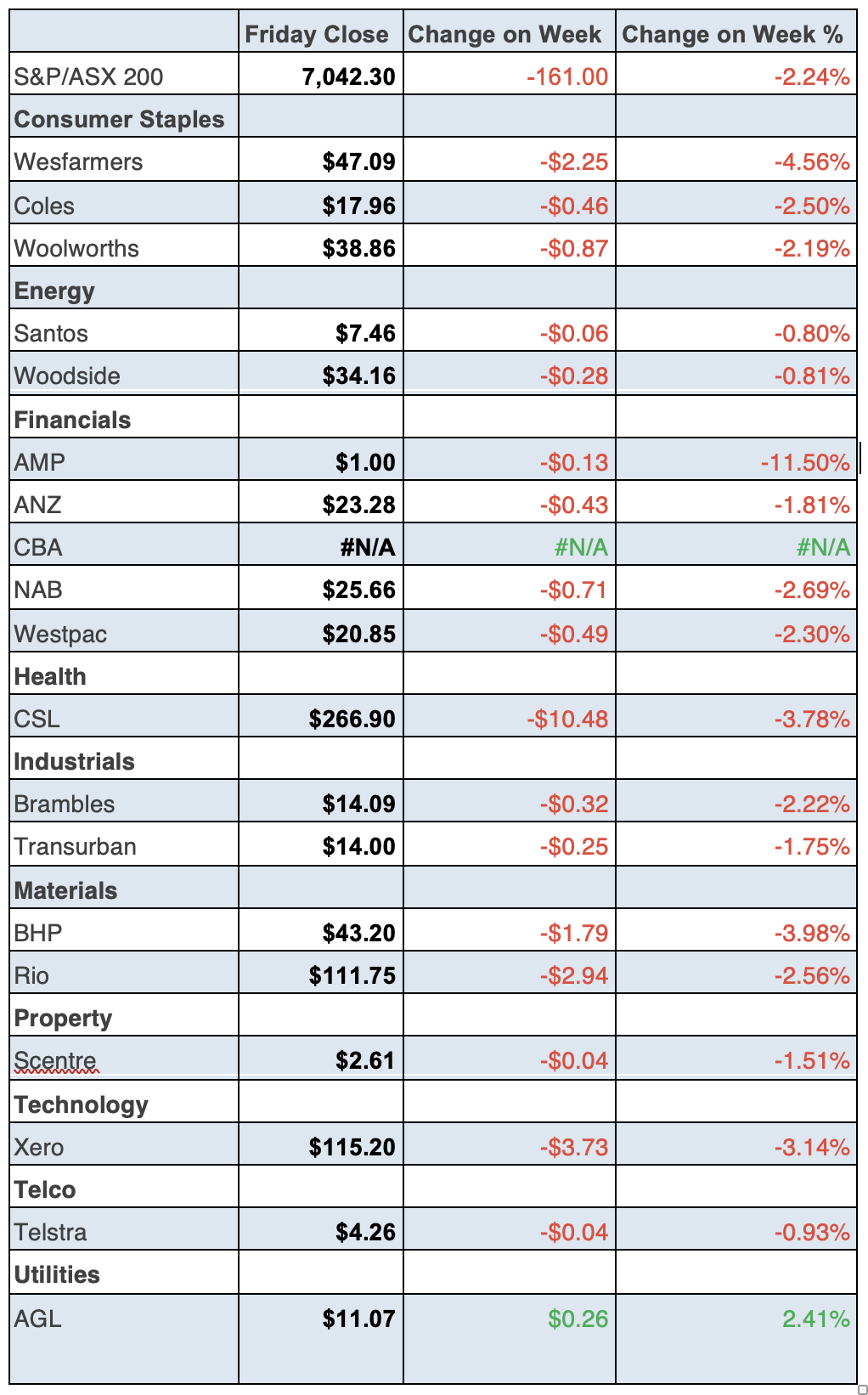

To the local story, and because we play follow the leader, that ADP report that worried Wall Street also knocked our market for a six! On Friday, the S&P/ASX 200 Index dropped 121.1 points (or 1.7%) to 7042.3 points. This was the lowest close since late March and was off 2.2% for the week.

The sell-off yesterday showed that interest rate sensitive sectors (i.e., tech, property, and consumer discretionary stocks) are vulnerable to future rate rises, but it shows you where to make money when rate rises are over. (More on that on Monday.)

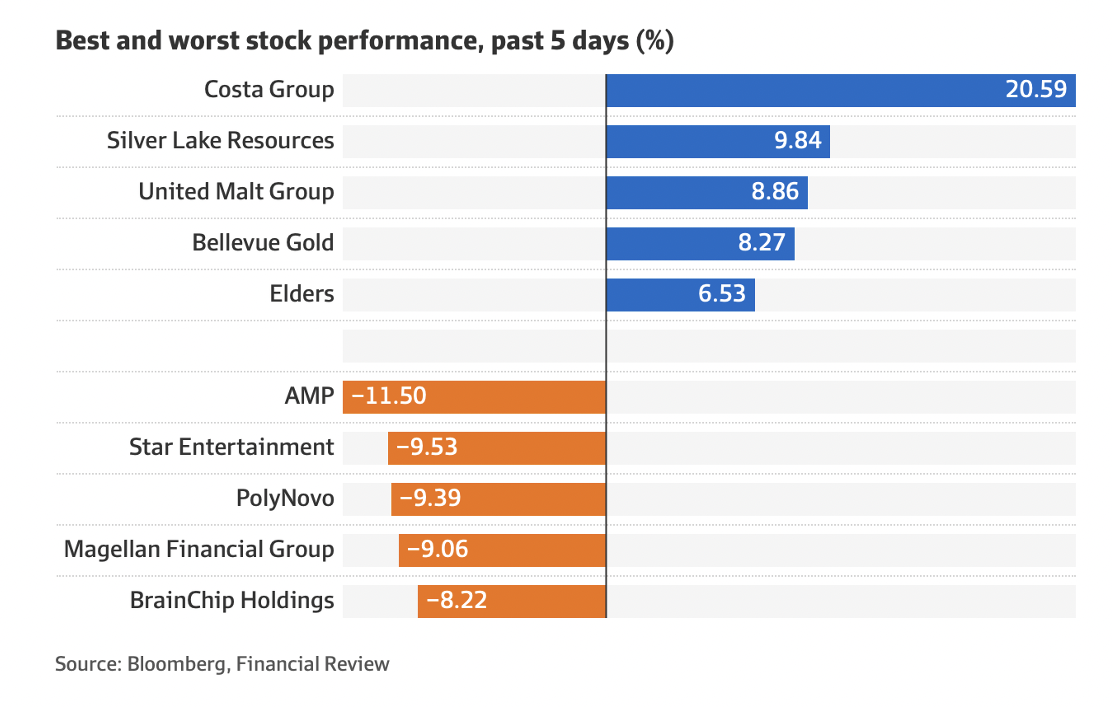

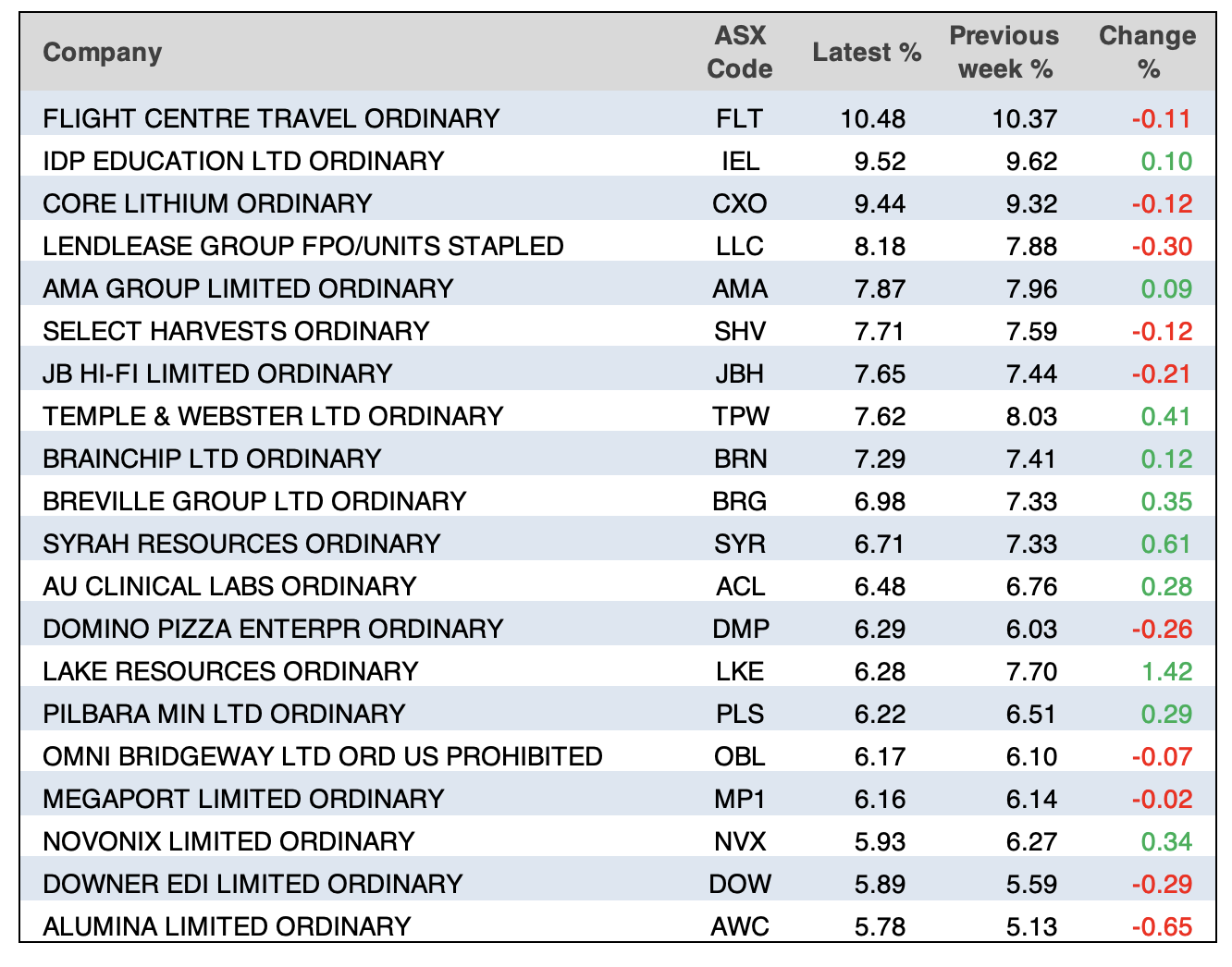

Here are the big winners and losers of the week, courtesy or the AFR and Bloomberg:

Aside from the market’s overreaction on Friday to the misleading ADP job creation news, one big story for the week was from UBS on Friday, who kept flying the flag for lithium. It believes in a structural shift that favours battery technology and especially electric vehicles. Interestingly, it likes IGO. FNArena’s survey of analysts says a 10.8% share price rise for IGO is expected over the year ahead. That said UBS and Macquarie forecast the stock price rise to be 26.16%. They both came up with the exact same number! (To check out how the top stocks performed over the week, look down below to the table that sums up the action.)

What I liked

- The RBA left rates on hold at 4.1% in July.

- Australian housing-related indicators were strong over the last week with building approvals, housing finance and home prices all up, which might fight those predictions that we’re heading for recession.

- Australia’s trade surplus rose slightly in May to $11.8 billion, with stronger exports. Exports to China are trending up but as a share of total goods exports are around 10% down from their high.

- The services ISM index in the US surprisingly rose to a solid 53.9, with employment up.Any number over 50 means expansion.

- Eurozone producer price inflation in May fell to -1.5% year-on-year from a high last year of over 40% pointing to a further fall in CPI inflation.

What I didn’t like

- CoreLogic data confirmed a fourth month of rising national home prices in June (led by Sydney), with prices now up 3.4% from their February low. I’m glad that these numbers show how silly 30% house price fall predictions were but it’s not good for getting the RBA to stop rate rises!

- The Melbourne Institute’s Inflation Gauge for June was up 5.7% year-on-year and looks to have peaked,but inflation in its trimmed mean still appears to be edging up, albeit at a much lower level than reported in the official CPI. We need to see a big drop ASAP!

- Newly approved wage rises under enterprise bargaining agreements in the March quarter rose to an annualised increase of 3.7%, their highest since 2012 but these are a lot less than inflation.

- Bond yields rose sharply on the back of ‘higher for longer’ interest rate expectations, with the Australian 10-year bond yield breaking up to its highest since 2014.

- Oil prices rose on the back of Saudi Arabia saying it will extend its production cuts into August, and Russia saying it will cut its oil exports.

- This from the RBA on Tuesday: “…some further tightening of monetary policy may be required”.

- La Nina, which brings rain, is now being replaced by El Nino which means a big dry is coming.

- The ISM manufacturing conditions index in the US fell to 46, its lowest level in more than three years, with employment down.

- As discussed above, that ADP private sector data showed employers added 497,000 jobs in June. That figure far exceeded the 220,000 estimate from economists polled by Dow Jones.

I must be honest…

It’s rare but the “What I liked” readings for the week (five) were well and truly trumped by the “What I didn’t like” revelations (nine). This isn’t a great sign but if inflation can drop better than expected, then we could easily see a nice bounce for stocks.

The Yanks get their latest CPI on July 12. That’s on Wednesday but our market will react on Thursday.

Our next CPI is released on Wednesday July 26, just before the next RBA meeting on August 1. It’s time to start praying for a good data drop!

The Week in Review

Switzer TV

- Switzer Investing: Jun Bei Liu names the hot stocks for 2023/24. How should AI influence your stock selection?

- Boom Doom Zoom: JULY 6 2023

Switzer Report

- Two listed funds management stocks to consider

- “HOT” stock: Fortescue Metals Group (FMG)

- 7 stars that will shine again

- Questions of the Week

- HOT stock: Sonic Healthcare Ltd (SHL)

- 5 AI stocks + 2 AI ETFs

- Portfolios gain in June as market posts double digit return for the financial year

- Buy, Hold, Sell — What the Brokers Say

Switzer Daily

- Oh no, not another social media platform for self-appointed commentators, time wasters and key board cowards!

- Are our universities educating unproductive bricks in the wall?

- Can renting put you on the road to riches?

- Will these house price rises force the RBA to hike again?

- Malcolm Mackerras on the Fadden by-election on July 15: Both Starmer and Sunak might well be happy about “Super Thursday”

Top Stocks — how they fared.

The Week Ahead

- In Australia, a speech by RBA Governor Lowe (Wednesday) on “The Reserve Bank Review and Monetary Policy” looks like it will discuss what impact if any the Review with have on monetary policy – probably not a lot in my view but if implemented it could make the RBA a bit more aggressive.

- Tuesday brings the NAB survey business conditions and confidence with both to be released on Tuesday.

- Wednesday brings the Westpac/MI consumer confidence data for July and this may show a bit of a rise from very depressed levels given the RBA’s decision to pause rate hikes, but softer PMIs point to weaker

- In the US, the focus will be back on inflation with June CPI data (Tuesday) expected to show a collapse in inflation to 3.1%yoy, but with a core inflation remaining a bit stickier for now albeit falling to 5%yoy (from 5.3%).

- Producer price inflation (Thursday) is also expected to slow further to 0.4%yoy from 1.1%.

- June small business optimism data will also be released on Monday. US June quarter earnings results are also expected to start flowing.

- Chinese June CPI inflation (Monday) is likely to have remained at just 0.2%yoy with producer prices down 5%yoy.

- Trade data (Thursday) is expected to see further falls in exports and imports. Money supply and credit data for June will also be released.

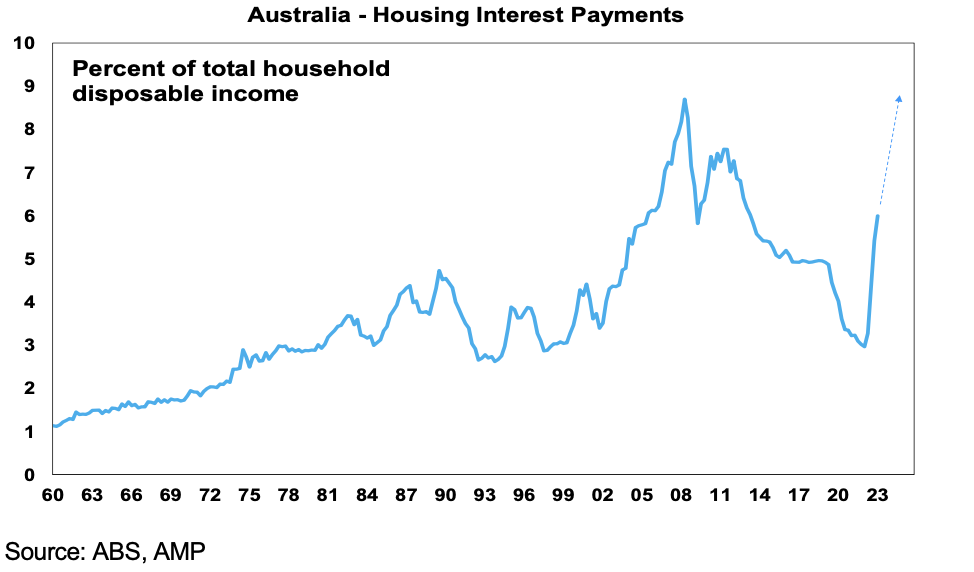

Chart of the Week

This chart made AMP’s Shane Oliver say this: “We remain of the view that the RBA has already done more than enough to slow the economy and bring inflation to target. Monetary policy impacts the economy with a lag of up to one year. The lagged impact on the household sector this time around has likely been lengthened thanks to savings buffers built up in the pandemic, the reopening boost and more than normal home borrowers locking in at 2% or so fixed rates.”

Stocks Shorted

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

View of the Week

“If I look at the NAB’s data, particularly on the consumption side, it’s very weak,” says National Australia Bank chief economist Alan Oster to the AFR. “We are seeing stress, particularly at the bottom end. Renters, in particular, because rents have gone up a lot. “There has been changed behaviour in the mortgage belt – that’s what the Reserve Bank wants. Most of them won’t fall over, but they will downscale their spending, or buy cheaper stuff.”

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.