Buying shares in asset managers seems a tough ask in this market. Volatile equity market conditions and the potential for underperformance and fund outflows are recurring threats.

Then there’s the poor performance of high-profile managers. Magellan Financial Group has been slaughtered in the past few years due to fund underperformance and outflows.

In June, Magellan reported net institutional flows into its funds were flat. After so much bad news, Magellan has rallied from $8 to $9.70 since then. Magellan might attract contrarians, but I prefer to watch and wait, having been burned on the stock before.

Platinum Asset Management has also disappointed. It has fallen from almost $5 in April 2021 to $1.72, after a period of previous fund underperformance.

Growth in Exchange Traded Funds (ETFs) and the effect on active managers is another long-term threat. More retail investors are embracing lower-cost index funds and shunning higher-cost active funds, many of which underperform their index over time.

Ongoing fee pressure in active funds, key personnel risk and the reduction in financial advisers (a key retail distribution channel for active funds) are other challenges.

After Magellan’s problems, investors could tread warily with fund-management stocks. But Australia has some terrific active managers in global equities, fixed income and other assets, and some look modestly undervalued after heavy price falls.

Moreover, the thematic of an ageing population and more money flowing into mandated retirement savings is a powerful tailwind for the fund-management sector.

Heightened market volatility creates opportunity for active managers. They mostly earn their fees at the big turning points for markets. This is their time.

ETFs have their place in portfolio construction and maintenance. But ETFs work best in momentum-based markets when asset prices are rising. Nobody wants the index return when markets are tanking and there is no manager to limit the damage.

Yes, ETF proponents will point to research from index providers that shows short- and long-term underperformance from the majority of active funds. I could create a list of thematic and other ETFs that have cashed in on hype and burned investors.

ETFs and active funds are not a binary choice. Each serves different portfolio needs. For example, low-cost index funds in the portfolio core earn the market return; and well-chosen active funds as portfolio satellites can outperform an index.

From a retail perspective, I wouldn’t give up on active funds or the managers behind them (at least in higher-quality providers). Some active fund managers look interesting on valuation grounds after price falls. Here are two to consider:

- GQG Partners Inc (ASX: GQG)

The US-based asset manager listed on ASX in October 2021 after raising $1.19 billion in the Initial Public Offering (IPO) at $2 a share. GQG was capitalised at almost $6 billion at listing, making it among the largest floats on ASX in the past few years.

GQG is a boutique asset manager that had US$98.5 billion in funds under management at end-May 2023. The firm had US$86 billion in funds when it listed on ASX.

Founded in 2016, GQG attracted strong funds inflow after its four main investment strategies outperformed their benchmark index and many of the firm’s peer group funds. GQG invests in global and emerging-market equities.

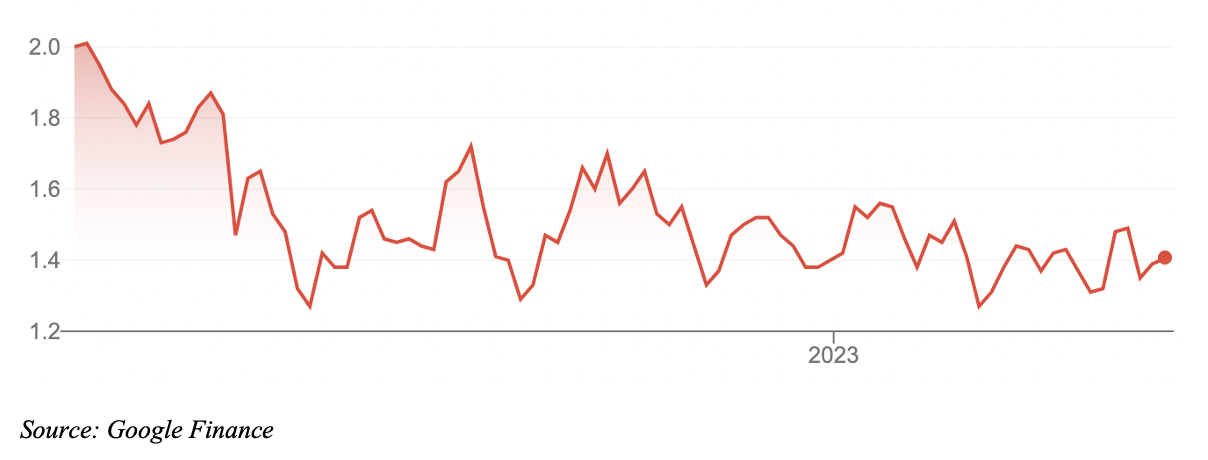

But like many IPOs, GQG has struggled after listing, unable to maintain the market’s interest. GQG’s $2-issued shares now trade at $1.41, having plumbed $1.23 in March.

This column’s readers know I follow IPOs closely in that 1-2-year period after listing. Good opportunities can emerge when quality companies sink below their issue price because of low liquidity, early investors selling out or limited investor relations.

It’s hard to reconcile the full extent of GQG’s price fall with its underlying operations and momentum. The company had net fund inflows of US$5.4 billion in FY23 (through to April 30), after attracting US$8 billion in FY22. Perhaps the market expected more.

GQG’s net operating income rose 2.7% in FY22 to $332.1 million. Revenue growth was stronger (9.8%) but higher wages and admin costs weighed on margins.

Two of four GQG investment strategies underperformed their benchmark index over one year to end-April 2023. But the strategies are mostly still ahead of their benchmark return over three years and all are well ahead over five years.

Investors can read this two ways. First, the market is concerned that GQG could be on the cusp of a longer period of underperformance (as often happens after an active manager strongly outperforms for a period). If that happens, funds inflow could slow.

The second interpretation is that the market has already priced this scenario into GQG –and then some. At $1.41, GQG trades on a forward Price/Earnings (PE) multiple of just under 10 times for FY24. The forward dividend yield is about 6%.

Morningstar values GQG at $1.90, a 26% discount to its current price. That’s a significantly larger discount than valuations for Platinum Asset Management, Magellan and Pinnacle Investment Management Group, another boutique manager.

Prospective investors in GQG watch its underlying fund performance and the effect on funds flow. But with good returns over three and five years, GQG should continue to grow funds under management and compound earnings growth.

Chart 1: GQG Partners Inc

- Challenger (ASX: CGF)

Challenger, another active fund manager, has also disappointed. After soaring for much of the previous decade, Challenger tumbled from $14 in late 2017 to $6.67 this week.

Challenger’s problems are well known. When interest rates were near zero, demand for annuities shrank. Fewer retirees wanted to invest in annuities when they had low returns. Challenger is by far the dominant provider of annuities in Australia.

At the same time, lower interest rates hurt Challenger’s profit margins; there were questions over its balance-sheet strength at the peak of COVID-19; management changes; a poor acquisition in banking; and a perception that Challenger lacked innovation.

That’s the bad news. The good news is annuities demand is rising again as interest rates increase. The three-year fixed annuity rate is currently the highest in a decade and more financial advisers are enquiring about annuities, says Challenger.

Headwinds for Challenger over the past few years (low rates, low annuity returns) are turning into tailwinds, not that one would know it by its share price.

An eventual takeover of Challenger by Apollo Global Management (it owns 19.1%) is a reasonable bet. Even without a takeover, Apollo’s stake in Challenger (and the strategic joint venture between the two) should boost Challenger’s product innovation.

I outlined a positive view on Challenger in this column in December 2021 at around $6 and nominated it as a takeover target in a follow-up column in May 2022.

My core view remains: Challenger is leveraged to an ageing population, growth in retirement savings and higher annuities demand.

At $6.67, Challenger is on forward PE of just under 12 times, based on consensus analyst estimates. At that price, Challenger is no screaming buy. But there’s scope for a higher valuation multiple and earnings growth to re-rate the stock in the next few years.

Chart 2: Challenger

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 5 July 2023.