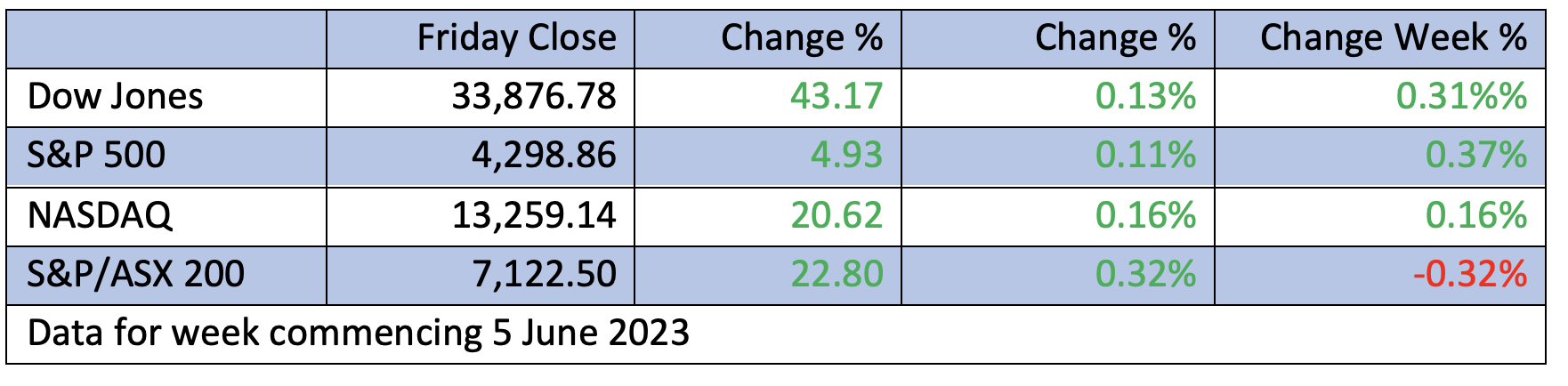

All big three US market indexes ended the week in positive territory with the S&P 500 up for the fourth week in a row, while the Nasdaq has racked up seven in-the-green finishes for the tech sector index. This has market influencers rallying to say yes to the question — are US stocks now in a bull market?

America’s most well-known bull — Tom Lee of Fundstrat Global Advisors — thinks the bull market started in October. That’s the time I had earmarked for the comeback of stock prices, when we were all worried about the collapse of the market in the first half of 2022.

Don’t forget at one stage the Nasdaq was off over 30% and the S&P 500 lost close to 25% before July and then October ushered in a change of market sentiment. This coincided with progress on the fight against inflation and the hope that the Fed would start to ease up on interest rate hikes.

Along the way there were the additional headwinds of recession fears because of the aggressive rate hikes, a banking crisis, a US debt-ceiling challenge and a concern about the stickiness of inflation, but most of these have dissipated.

The stickiness of inflation will be the issue most key market players will want to hear the Fed talk about with next week’s interest rate meeting of the Federal Open Market Committee. This is the body that’s likely to have the biggest say on whether Wall Street is now in a bull market or not, and the downward course of inflation will be the critical issue.

Central bankers (who really don’t have a great history of being astute with their timing when it comes to rate cuts or rate rises as a response to what the economy needs at critical turning points) are set to be the biggest influencers of what happens to stock prices.

This week the European Central Bank hinted that inflation is on the slide, but more rate hikes were likely. The Bank of Canada raised the official rate to a 22-year high and inferred more hikes were going to be needed. This was a similar script to the one Dr Phil Lowe followed on Tuesday, when he cited concerns over wage-driven inflation. His taking of the cash rate to 4.15% surprised many professional economists.

By the way, this is an 11-year high, and I think represents a big mistake by Dr Lowe and his Board, but only economic data over the next few months will influence the RBA and other central banks that they’ve done enough to KO inflation.

In fact, the CPI reading in the US on Tuesday will underline how important the data drop is going to be for what the Fed and other central banks do in coming months.

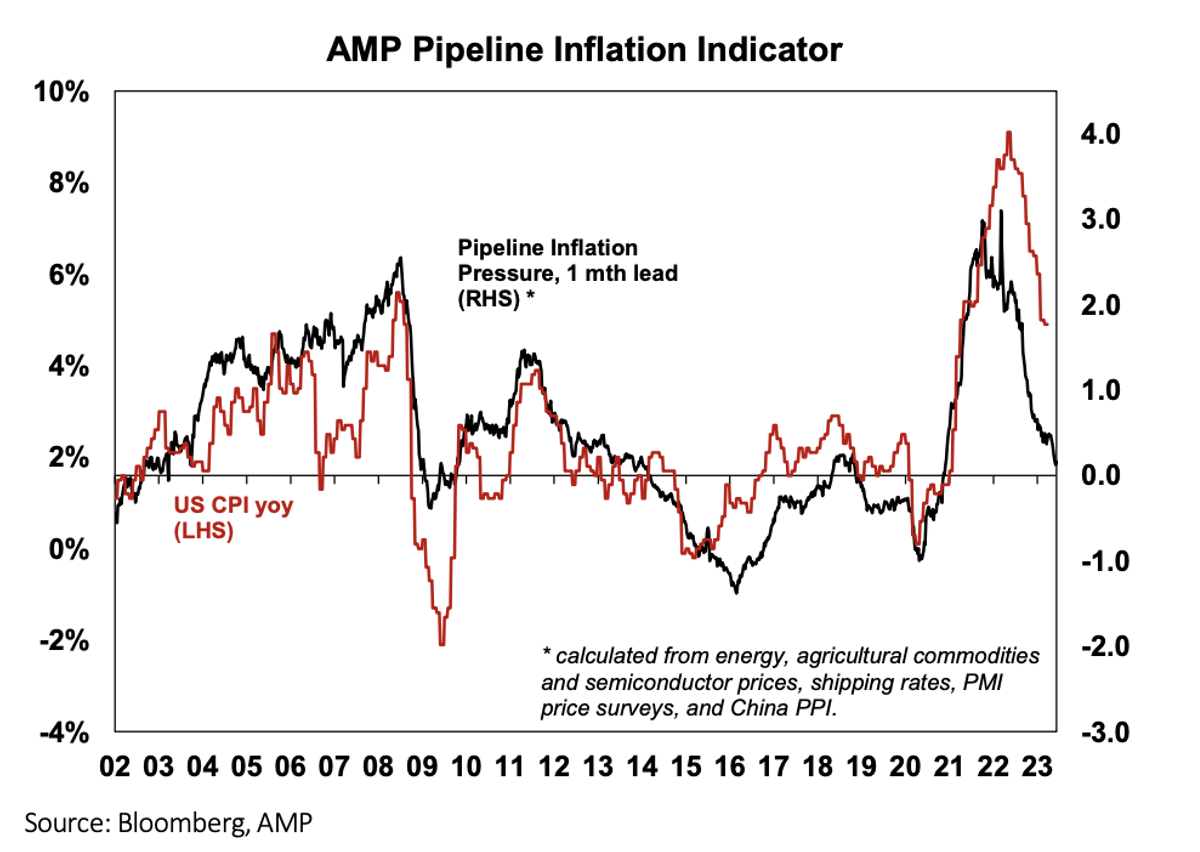

When inflation is no longer a big threat, that’s when you’ll see a fair dinkum bull market with few doubters, which is why I’ve been forecasting nice returns from stocks for later this year, rolling into 2024. This chart shows why believing inflation will be beaten this year in the US isn’t an unwise position to hold.

Note how the red line — US CPI — and the black Pipeline Inflation Indicator, are really falling strongly, which is a great sign.

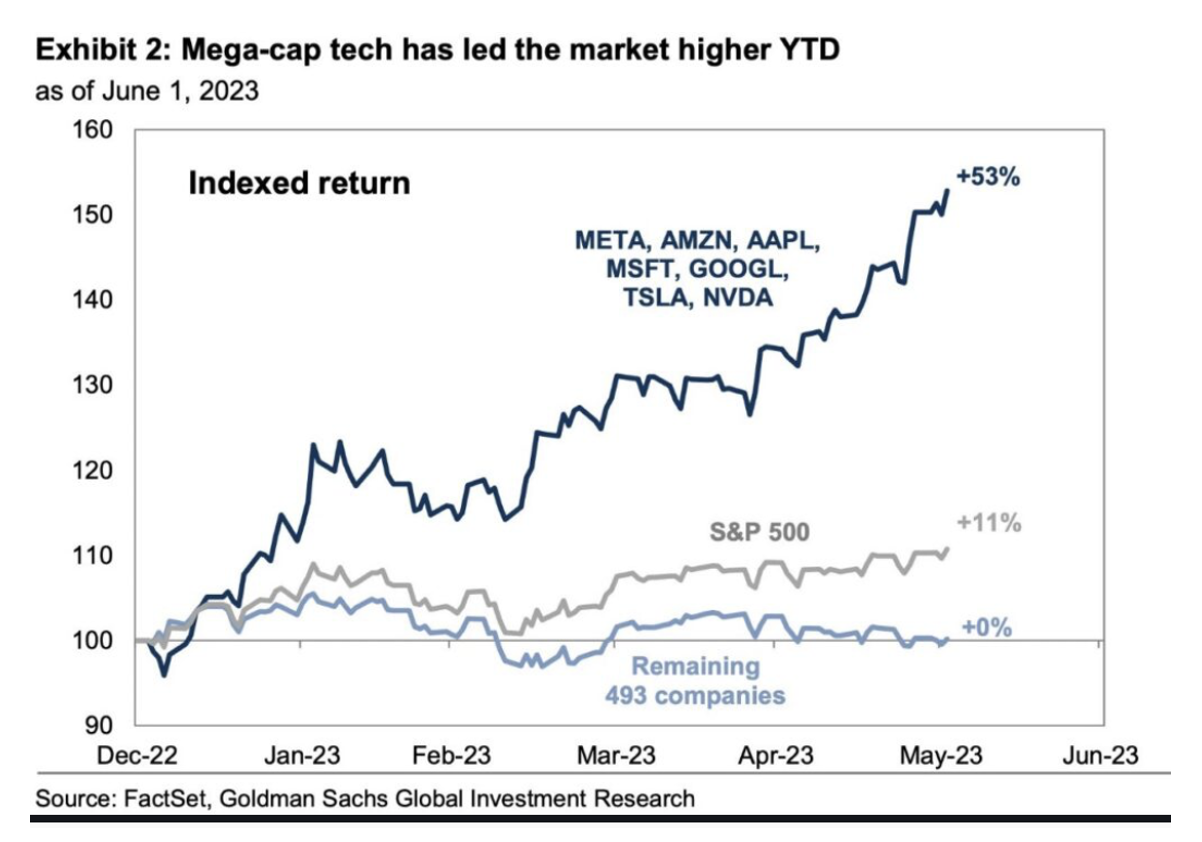

If the US can see the end of Fed rate rises without a worrying recession, which is what the bulls on Wall Street think right now, then that will be a great set up for many growth and tech stocks that haven’t participated in this possible early-stage bull market, to start playing catch up.

Right now, a lot of the bullish bounces for US stock market indexes have come from a group now being tagged The Magnificent Seven — Apple, Meta, Tesla, Nvidia, Alphabet, Amazon and Microsoft. This group has returned 53% year-to-date, so they’re definitely running with the bulls.

On the other hand, the S&P 500 is up around 12% year-to-date, and it’s why plenty of market players are speculating that the bears have had their day.

However, as I’ve already emphasized — central banks could spoil the party.

To the local story and despite some positive signs out of Wall Street, our market was down for the third week in a row. The S&P/ASX 200 Index lost 0.3% to 7122.5 and the RBA’s excessive 0.25% rate rise this week was no help, especially as it has increased recession talk, which wasn’t on the cards three months ago.

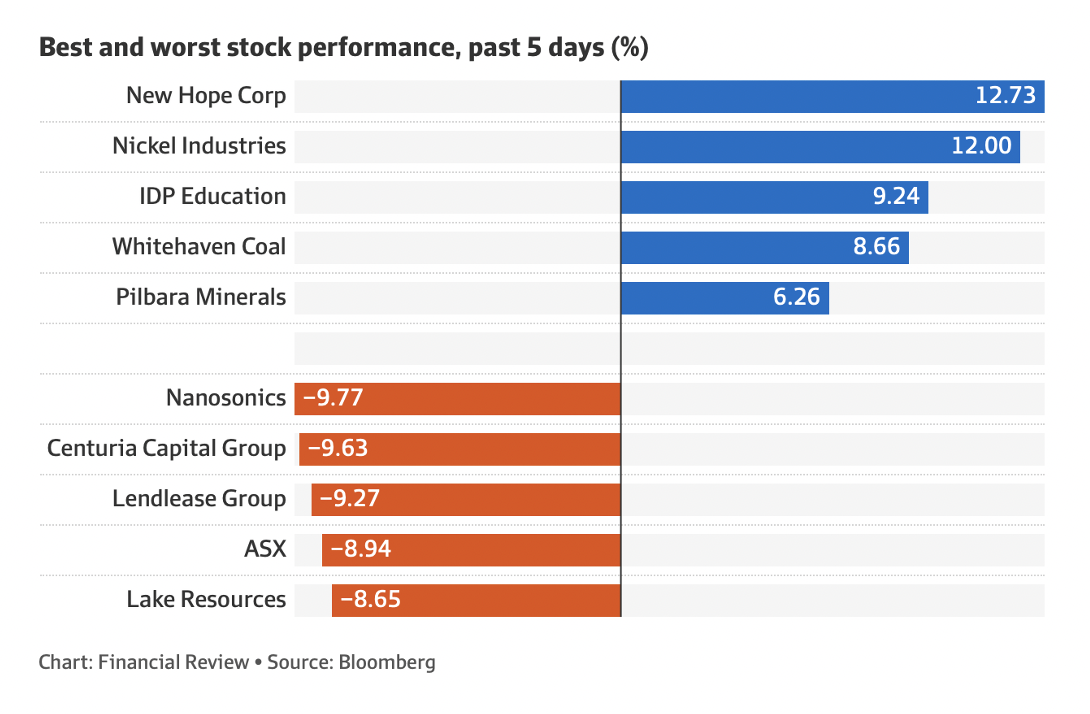

While it wasn’t a great week for stocks compared to the US, I did like to see Friday bringing better prices for tech and mining stocks.

Wisetech was up 2.62% to $75.88 and Xero added 2.7% to $109.08, while the likes of BHP rose 1.34% to $44.72 on slightly higher iron ore prices.

It was good to see my TV experts were on the money with IDP Education, with Jun Bei Liu of Tribeca Alpha Plus on my Monday show arguing that the market sell-off of the online educator was way too negative.

Banks had a largely negative week, with Westpac the biggest loser, off 2.64% to $20.25.

Here are the big winners and losers of the week:

What I liked

- Real GDP rose by 0.2% in quarter one 2023 to be up 2.3% on year ago levels. The increase was weaker than the market median forecast of 0.3% and annual GDP growth is now a touch below the long‑term trend pace, which shows rate rises to kill inflation are working, even if the RBA can’t see it!

- Business profitsrose 0.5% in the March quarter, slowing substantially from a 12.7% gain in the December quarter. This should help inflation fall.

- ANZ job adsrose 0.1% in May. This followed a 0.7% fall in April (revised from an initial minus 0.3% reading). The outcome was the first monthly rise following three consecutive falls. In annual terms, job ads fell 6.1%. I like anything that might help us dodge a recession, which recent rate rises could create.

- The US services sector expanded at a slower-than-expected rate in May. The ISM services index slipped to 50.3 in May, from 51.9 in April, and is a sign of a slowdown rather than a recession.

- Rate rises are working in the US when factory orders grew 0.4% in April. This was down from a revised 0.6% in March (revised down from an initial 0.9% reading). The outcome was below consensus expectations of 0.8%.

What I didn’t like

- The RBA Board this week increased the cash rate by 25 basis points to 4.1%, in a move most economists didn’t anticipate.

- CBA places the chance of a local recession at 50/50!

- The CBA’s view on why the rate rise this week: “We attribute the rate hike today primarily to the Fair Work Commission’s decision, delivered last Friday, to increase the award rates of pay by 5.75%, effective from 1 July 2023.” Dr Chalmers needs to note this!

- Wages and salaries rose by 1.8% in the quarter to be 11.4% higher on an annual basis, which can’t be good for inflation killing.

- Central bankers seem to be copying each other with European Central Bank (ECB) member, Klaas Knot, saying that inflation is still way too high but acknowledged that the worst is behind us. Knot says the ECB will keep tightening policy until inflation is clearly returning to the 2% target, adding that we are starting to see the first signs that policy tightening is being transmitted to the real economy.

Bears on the run

CNBC spotlighted Wolfe Research’s Rob Ginsberg analysis this week and this is what he said: “The bears are capitulating. Persistently negative since early 2022, the bulls exploded this week to levels last seen in late 2021, right around the market’s peak. Add into the mix the collapse in the VIX (the fear index), explosion in IWM call volumes and a drop in put/call ratios, and it’s evident that (investor) complacency (positivity) is rapidly building.” (By the way, IWM is the ticker symbol for iShares Russell 2000 ETF, which is one of the main ETFs that track the Russell 2000 index, which is a sign that the broader market is starting to follow The Magnificent Seven.)

The Week in Review

Switzer TV

- Switzer Investing Peter talks with the co-founder of Zip, can its share price rebound?

- Boom Doom Zoom: JUNE 8 2023

- Switzer Investing: Why does Shaw & Partners think ZIP will rise over 240%?

Switzer Report

- Questions of the Week 8 June

- Can you believe in the tech recovery? This US fund manager does!

- Portfolios retreat in May despite surge in IT stocks

Switzer Daily

- The rise & rise of women CEOs

-

Which doctor, Phil or Jim, will we blame for a likely recession?

-

Will the RBA have the guts and brains NOT to raise rates today?

-

Will the RBA ignore the Misery Index and raise rates tomorrow?

Top Stocks — how they fared.

Chart of the Week

CBA’s view on the chart: “The economy grew by just 0.2% in the March quarter, down from a 0.6% pace the prior two quarters. Real GDP is now just 2.3% higher than a year ago and the six month annualised pace is slowing sharply, now at just 1.6%. Higher interest rates are impacting the consumer, with household spending slowing, driven by a pull back in discretionary spending.”

Stocks Shorted

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Quote of the Week

This from the RBA on the forward guidance states that, “…some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon how the economy and inflation evolve”. (I think the RBA board is badly mistaken and is making a recession more and more likely!)

P.S. There’s no Report on Monday because of the public holiday but we will do a bumper issue on Thursday. Have a great weekend!

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.