Nothing beats a takeover bid to restore your faith in value investing. If the market refuses to recognise a company’s true value, a predator will eventually swoop.

That’s the theory. The reality is that some stocks look undervalued, yet become even cheaper as the market loses interest. Or they drift lower for years.

Other stocks that look like screaming takeover targets fail to get a bid. Or they eventually get a bid years later when the stock is in the doldrums.

Consider United Malt Group (ASX: UMG), a producer of malts and hops for beer. I liked the look of United Malt when it demerged from Graincorp in 2020.

But I usually wait with demergers because the ‘child’ company has a habit of underperforming the ‘parent’ in the first year as a separate listed entity.

It’s a bit like selling a house. The homeowner cuts back on maintenance or underinvests in the property because they know they are selling. Or worse, paints over cracks in the walls, hoping the buyer won’t notice.

Demergers sometimes struggle in their first few years because the parent company has underinvested in the child company or left it in a mess. The easiest solution is to offload the asset and let new owners fix the problems and give the asset the attention it deserves.

United Malt had a tough first year as a listed company. Investors feared the COVID-19 pandemic would hurt demand for hops, as pubs shut worldwide. United Malt benefited from the boom in craft beers, which rely on people consuming pricey beers at pubs.

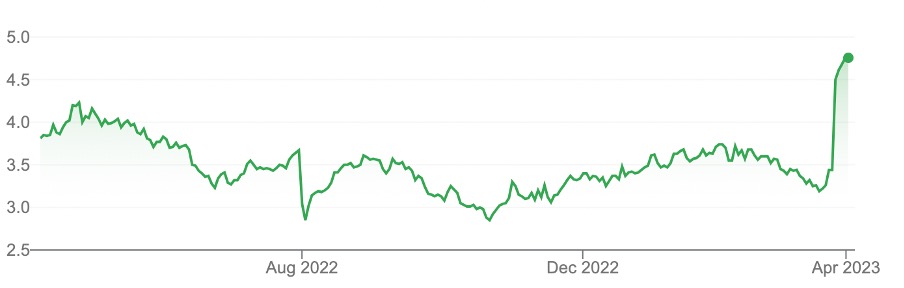

I wrote about United Malt for this Report in January 2021. The stock had fallen from a 52-week high of $5.24 to $3.91 and looked undervalued.

Much to my chagrin, United Malt hit $2.85 in October 2022. In late 2022, I suggested the stock could be a takeover target, but nothing happened for months.

United Malt finally got an approach in late March from Malteries Soufflet, a European malt company. The indicative proposal price of $5 a share put a rocket under United Malt shares. The stock is now $4.69.

Chart 1: United Malt Group

Source: Google Finance

United Malt’s Board has sensibly granted Malteries Soufflet exclusive access to due diligence. It’s not a done deal, although Malteries’s indicative proposal price reinforces the value in United Malt – and how the market undervalued the stock.

The United Malt bid made me think about other mid- and small-cap alcohol-related stocks that offer value prices and might also attract a suitor if their price continues to drift.

As I have written many times, the key is to buy stocks that are attractive with or without a takeover. A bid should be viewed as the cream rather than the cake, and validation that the market did not sufficiently recognise the company’s value.

Here are two alcohol-related stocks that stand out:

- Hotel Property Investments (ASX: HPI)

You wouldn’t know Australia risks recession and sharply lower consumer discretionary spending, judging by interest in pub sales.

Some freehold pubs have achieved staggering sales prices in recent years. Annual hotel sales have reportedly nearly doubled over the past three years. As office and retail property valuations struggle after COVID-19, pub values have gone the other way.

This is a good time to own a large portfolio of pubs. In September 2021, Charter Hall, a property fund manager, bought out ALE Property Group, for almost $1.7 billion. The deal made Charter Hall the country’s largest pub owner.

Hotel Property Investments, an Australian Real Estate Investment Trust, owns a portfolio of 59 freehold pubs and associated tenancies worth $1.2 billion The majority of the pubs are in Queensland and leased to HPI’s main tenant, Queensland Venue Company (a joint-venture with Coles Group.) Coles is a strong anchor tenant.

However, the view that alcohol sales are largely recession-proof is simplistic. For starters, people tend to drink less at pubs and more at home, to save money.

As with food, some people downgrade to cheaper alcohol alternatives. High-end discretionary purchases ($300 whiskies) or event-related sales (champagne) tend to suffer more.

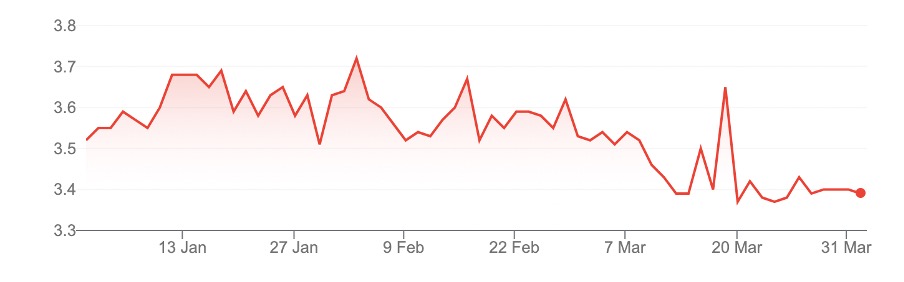

HPI had bounced a little in early 2022 but has drifted from its 52-week high of $4.14 to $3.38, amid broader weakness in A-REITs and the sharemarket generally this year.

In February, HPI announced almost 12% growth in rental revenue from its properties to $35.3 million for the first half of FY23. Operating profit rose 14% to $31.1 million.

HPI’s distribution per security fell to 9.2 cents, from 10.2 cents a year earlier, principally because of higher interest rates. The net asset per security was slightly down at $4.06.

The well-run HPI is doing a good job in a challenging market. HPI is not a screaming buy, but larger property funds will surely have a closer look at acquiring the small-cap A-REIT if its price edges lower, during a time of great interest in pub assets.

HPI’s pub portfolio is hard to replicate and has strategic value. A prominent anchor tenant, long-term leases, inflation protection (almost three-quarters of its leases are CPI-linked) and reasonable gearing levels are other attractions for suitors.

Chart 2: Hotel Property Investments

Source: Google Finance

- Australian Vintage (ASX: AVG)

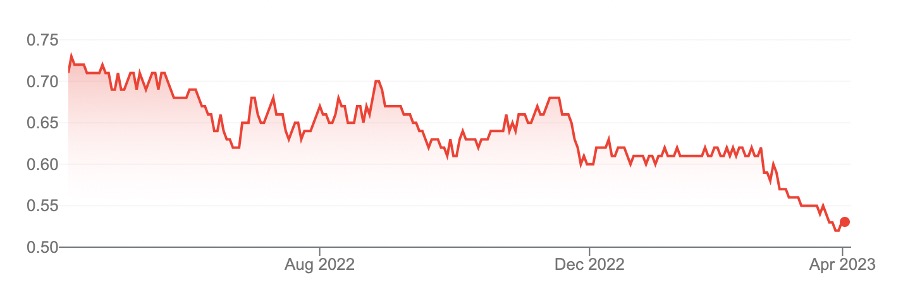

The owner of McGuigan Wines and other popular labels has been a frustrating stock over the years. AVG rallied from 38 cents during the COVID-19 crash in March 2020 to 88 cents in July 2021. The stock is now back at 52 cents.

It’s hard to reconcile the extent of that fall with AVG’s operational performance. Britain’s decision last month to slap new tax increase on wine will hurt Australian wine exporters to the UK, such as AVG. But it’s not huge in the scheme of things.

In February, AVG reported 29% growth in after-tax net profit to $12.9 million for the first half of FY23 but did not declare an interim dividend. The company absorbed $11 million in inflationary costs through asset sales.

The market is underestimating two factors with AVG. The first is the progress in its premiumisation strategy. The knock on AVG over the years was its focus on lower-margin, commoditised bulk wines. Sales of its premium labels are growing.

The second factor is AVG’s underlying asset value. In February, AVG reported net tangible assets per security of 97 cents. The NTA was 88 cents a year earlier.

AVG reported shareholders’ equity of $303 million in the first half of FY23. The company’s market capitalisation is $132 million (at 53 cents).

AVG faces challenging market conditions due to an ongoing soft trading situation, rising interest rates, aggressive export behaviour (from a red-wine glut) and greater competition in the no-and-low alcohol segment.

Ongoing uncertainty about China’s wine market and export tax increases add to the challenges for AVG, which is barely covered by brokers these days.

However, every stock has its price. At the current valuation, AVG must look more interesting to suitors. AVG’s improving earnings, market-share gains and implementation of its premiumisation strategy are good signs.

For a predator, the main attraction might be AVG’s asset value and ability to “sell off pieces of the farm” to minimise acquisition risk and unlock hidden value.

As a thinly traded microcap, AVG suits experienced investors who have higher risk tolerance and can withstand any further short-term price falls.

Chart 3: Australian Vintage

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 29 March 2023.