We’re in the hands of central banks right now. They’re talking tough to make sure spenders with debts understand that they need them to stop spending to kill inflation and to ensure it doesn’t sustain itself at a lower albeit still too high level. It’s a tough job. It has the likes of Coolabah Capital’s Chris Joye writing in the AFR telling us: “In their quest to crush inflation, central bankers are going to crush everything”.

You have to hope that Chris is at his dramatic best and that he’s chiding the RBA’s Dr Phil Lowe to be careful.

He’s also directing his ominous warnings at the Fed’s Jerome Powell but I have to say the US central bank boss has been easing up on the ‘tough guy’ talk lately. In a question-and-answer session at the Economic Club of Washington on Tuesday, he said: “We think we are going to need to do further rate increases” and “the labour market is extraordinarily strong”.

However, he later said that he expects 2023 to be a year of “significant declines in inflation”.

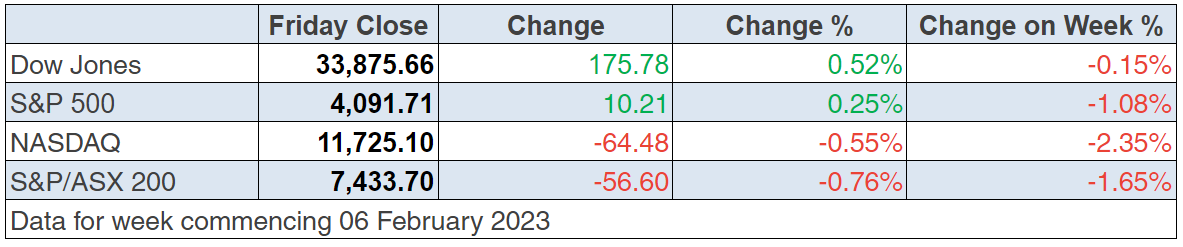

So it’s a mixed message giving the stock market hope that the official US interest rate is close to its peak. You know I’ve been arguing that when that looks pretty well certain, stocks will spike again, and we could stop talking about this bull market being a cyclical one inside a structural bear market. That said, current negatively-inclined volatility is based on uncertainty about what Jerome and his central bank buddies do next.

“There’s some mixed signals here, which I think is why volatility is up,” Shana Sissel, founder of Banríon Capital Management, said. “There’s not really a consensus coming out with leading indicators that give you a lot of confidence of what’s coming next. And the markets hate that.” (CNBC)

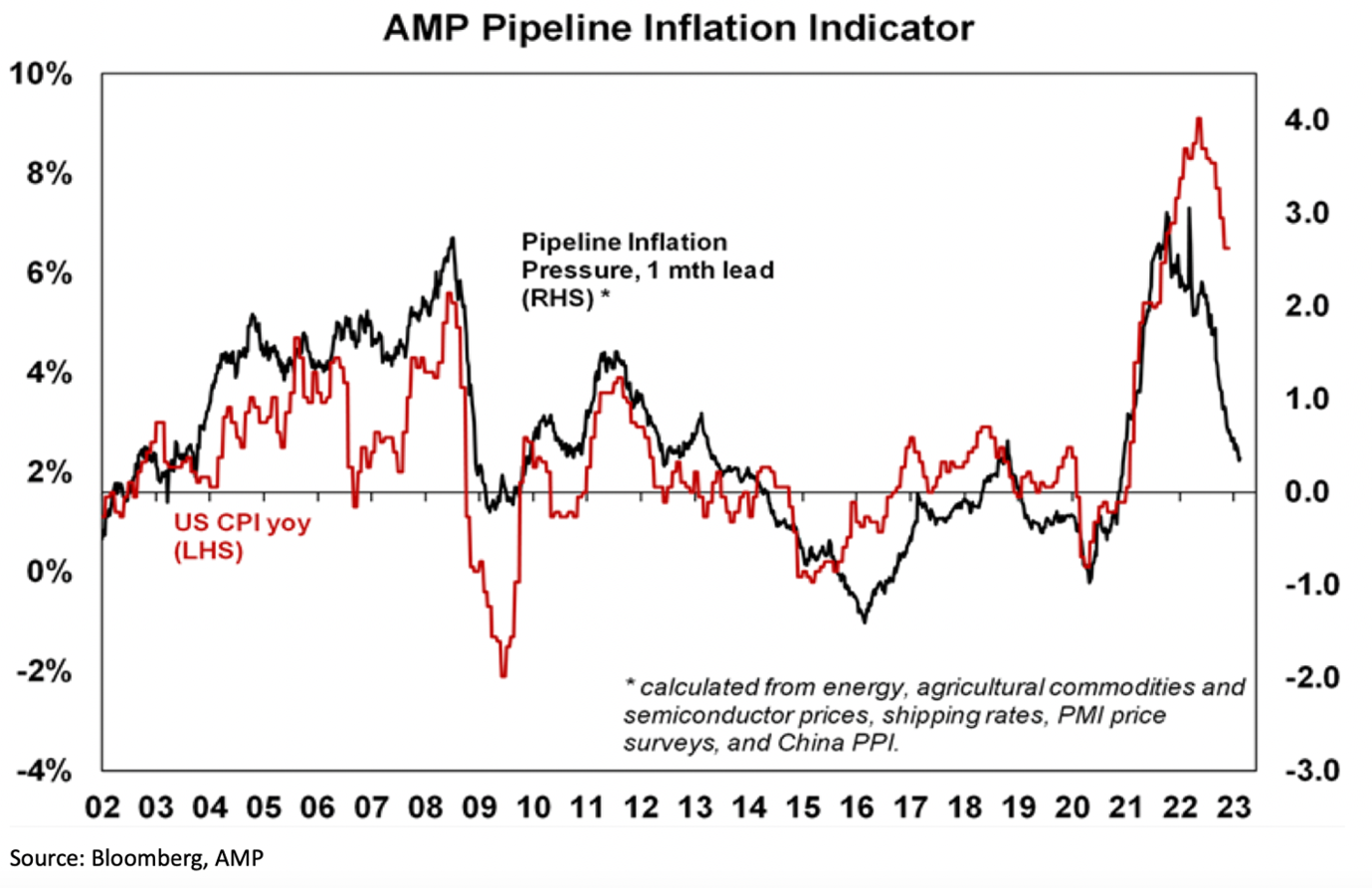

The upcoming US jobs number on March 10 will be important for guessing what the Fed will do next but before that, next week’s US inflation reading will be good or bad for stocks. On that subject, I do like what the black line in this graph says about falling inflation in the US.

Back home the news isn’t as good, with Dr Phil really talking tough, which he needs to do to keep scaring us out of being an accessory to inflation. However, he really has to be careful about his rate rises going forward. What he said after the Bank raised the cash rate by 0.25% to 3.35% spooked many stock players and normal people trying to make ends meet.

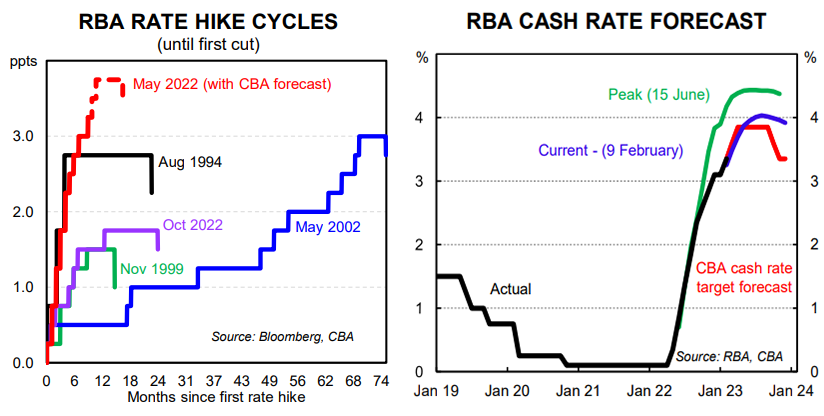

Market pricing now for Australia’s cash rate is tipped to go over 4% from an expected peak of 3.72% before this week’s RBA meeting, though the CBA economics team thinks rate cuts will be needed in the December quarter this year to avoid a recession.

The pressure is on Dr Phil, after his shocker ‘no rate rise until 2024’ call during the pandemic. Therefore, he must kill inflation without creating a recession or he’ll be pilloried and we investors could lose money, while businesses will lose profits and employees to the dole queue.

To the local trading story and coal stocks copped it this week as thermal coal prices tumbled. They’re now down around 50% since they peaked at $US450 in September because of Putin’s war. And the AFR reported that a whale of a shareholder sold a parcel of Whitehaven Coal stocks for $337 million!

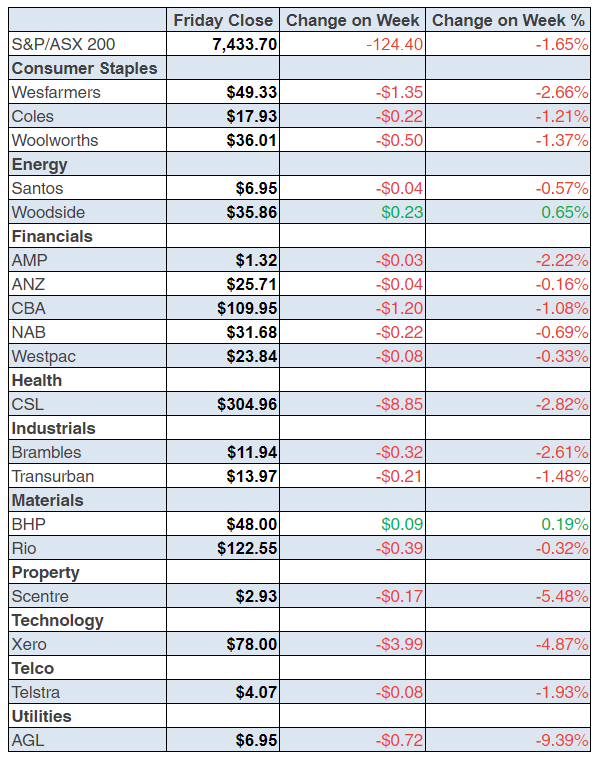

For the week, the S&P/ASX 200 was down 1.7% at a three-week low of 7433.7 but sell-offs had to be expected after a cracking January and the rebound in stocks since early October.

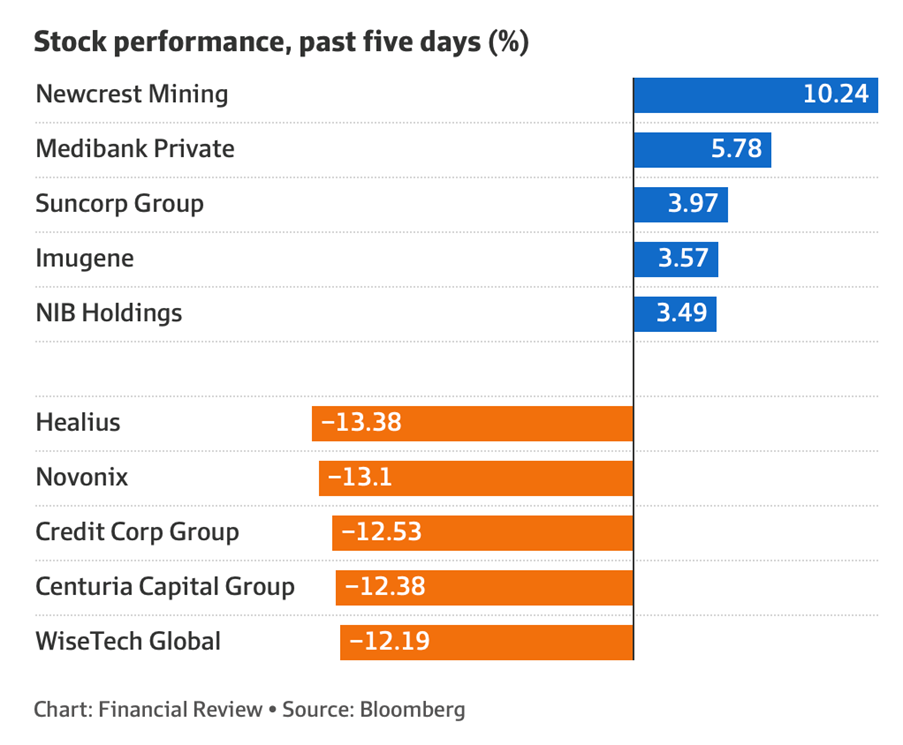

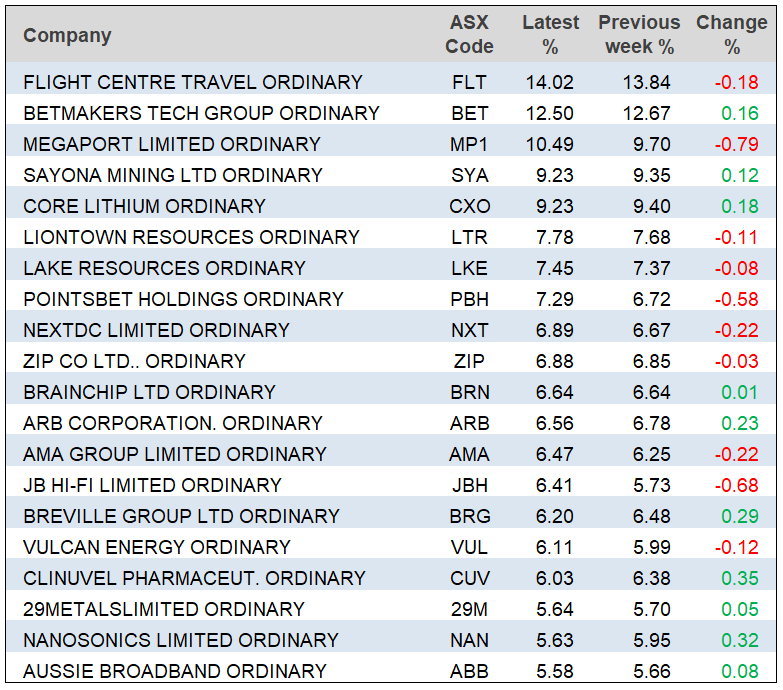

Here are the big winners and losers of the week:

Tech stocks weren’t helped by the tough interest rate talk from the Fed, the ECB and the RBA, with the sector down 2% for the week.

We’re now in reporting season so some stocks will cop it or spike on the actual news coming out of companies.

What I liked

- The RBA has made no material changes to their headline inflation, GDP or unemployment rate forecasts.

- The RBA expects the unemployment rate to be 3.8% in the fourth quarter of2023 and 4.1% in the second quarter of 2024, which looks optimistic.

- The RBA’s probable excessive tightening has the CBA predicting that a policy easing will be required in the fourth quarter of 2023 to avoid a hard landing. The bank’s economics team expect 50 basis points of rate cuts in the second quarter of 2023 and a further 50 basis points of easing in the first half of 2024!

- Retail trade volumes fell by 0.2% in the December quarter 2022, which is a sign that rate rises are working.

- In the US, initial jobless claims rose by 13,000 to 196,000 in the past week (survey: 190,000). The labour market must cool down for the Fed to stop raising interest rates, and that’s when stocks will surge again.

What I didn’t like

- The RBA expects annual inflation peaked in the first quarter of 2022 at 7.8%, and to be 4.8% in the fourth quarter of this year and 3.2% in the further quarter of 2024, which are both higher than their previous forecasts. Underlying inflation is forecast to be 4.3% a year in the fourth quarter of this year and 3.1% a year in the fourth quarter of next year.

- RBA forward guidance has shifted in a hawkish direction and the reference to not being on a pre‑set path was dropped.

- CBA thinks two more rate rises are coming. Two further 25 basis points interest rate hikes mean the probability of a soft landing for the economy is lowered significantly. It means the chance of a recession has been jacked up.

- Annual German consumer prices, harmonised to compare with other EU countries, rose by a less-than-expected 9.2% in January (survey: 10%). It’s still a very big number!

- European Central Bank policymaker Klaas Knot said the central bank may extend its streak of large interest rate hikes into May if core inflation doesn’t ease.

Oliver remains positive

AMP’s Shane Oliver didn’t think the RBA needed to raise interest rates but he remains positive for stocks. I interviewed him this week and here are some of his points:

- He’s upbeat on the outlook for investment markets this year as inflation falls and central banks get off the brake, but it won’t be smooth sailing.

- He expects a short-term pullback with central banks still playing a hard-talk game, recession risks being high overseas, the upcoming US debt ceiling problems later this year and geopolitical risks around Ukraine, China (as highlighted by the balloon over the US) and Iran.

- Also, profit-taking is to be expected after a big rise since October,

You can see the full interview here: https://switzer.com.au/the-experts/switzer-tv/best-stock-of-2023-will-stocks-surge-this-year/

The week in review:

- In this week’s Switzer Report, I share my thoughts about Megaport and what the ‘experts’ really think about it. While I’m comfortable investing in the tech sector for the long term, what about MP1? Here are my thoughts along with those of the ‘experts’.

- Paul Rickard shows us how well the Switzer portfolios are already doing in the new year with a solid start! The year has started with a rush with the stock market adding over 6% in January. Our model portfolios have also enjoyed solid gains.

- Tony Featherstone goes into 3 options-related funds he has found to help boost your income, Retail investors can cut through the complexity of options-market by using ETFs and active funds.

- James Dunn tells us about 3 quality Kiwi stocks he found that he thinks are top of their class! There’s no shortage of world-class innovation coming out of our neighbour across the ditch. Here are three Kiwi stocks that James thinks are global standouts in their fields — and each of these, for various reasons, looks to be alluringly cheap right now.

- In our “HOT” stock column, Michael Gable, Managing Director of Fairmont Equities, says that based on its attractive valuation, there may be further upside in Altium (ALU) shares over the near term. Plus Raymond Chan, Head of Asian Desk at Morgans explains why he says to add PEXA Group (PXA) to your portfolio.

- In Buy, Hold, Sell – Brokers Say, there were 7 upgrades and 3 downgrades in the first edition and 10 upgrades and 14 downgrades in the second edition.

- And finally, In Paul’s (Rickard) Questions of the Week, What is the smallest number of shares I can buy? What are the best ETFs for income from Australian shares? Are the brokers bullish on CSL and when is it scheduled to report? Why does the RBA announce interest rate changes on a Tuesday?

Our videos of the week:

- Will the RBA double down on a big interest rate rise? | Switzer Daily

- Best stock of 2023! Will stocks surge this year?! | SwitzerTV Investing

- Will Dr Phil hike interest rates by a big half-a-percent? | Switzer Daily

- Is Dr Phil pushing us into recession? | Switzer Daily

- Boom! Doom! Zoom! | 9th February 2023

- John Symond predicts rate cuts and house price rises | Switzer Daily

- Job losses at Fortescue are signs of things to come! | Switzer Daily

Top Stocks – how they fared:

The Week Ahead:

Food for thought: “An investor without investment objectives is like a traveler without a destination.” – Ralph Seger

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week

RBA has signalled more rate hikes ahead

The RBA’s February Statement on Monetary (SMP) comes in the wake of the 25bp rate hike at the February Board meeting, which took the cash rate to 3.35%. The decision to raise the cash rate by 25bp in February was widely anticipated by us and most analysts. But the RBA delivered a surprisingly hawkish message. More specifically, there was a clear shift in tone and forward guidance in the Governor’s Statement accompanying the decision. That hawkish tilt was apparent again in the February SMP, albeit a little less pronounced.

In the Governor’s Statement accompanying the Board decision on Tuesday it was stated that, “the Board expects that further increases in interest rates will be needed over the months ahead”. Today that equivalent forward guidance stated, “the Board expects that further increases in interest rates will be needed”. We are not drawing too much into this slight tweak today. We believe the changes the Governor made to his Statement this week imply that the RBA Board has essentially made up their mind and intend to raise the cash rate further over coming months. Indeed it would be a big shock now if the RBA did not tighten policy further.

We modified our central scenario for the cash rate on Tuesday due to the change in language in the Governor’s Statement. Despite that, we maintain that there is a strong case to pause. Monetary policy works with a lag and the RBA is flying blind given they have put through an incredible amount of tightening that is yet to fully impact home borrower cash flow and by

– Craig James, Commsec Research

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances