Exchange Traded Funds that track the latest technology trend or green metal usually attract attention, even though thematic ETFs collectively have a mixed long-term record.

Less considered are income-focused ETFs designed to enhance yield and reduce volatility through options strategies. A 5% yield feels like chicken feed when equity markets rally and investors obsess over capital growth. But reliable income is the key to great investing.

ETF issuers and active fund managers have launched more funds recently that use options strategies to enhance yield and protect portfolios against market volatility. They won’t get as much coverage as the latest lithium-related ETF but are well worth a look.

Options can be a great tool to enhance yield through covered-call and other strategies. Investors can also use options for leveraged exposure to stocks or indices, trade different market conditions or as a form of portfolio insurance through put options.

The problem, however, is that options strategies are complex for most retail investors. Options pricing is influenced by time, market volatility, dividends and other factors, meaning options typically suit experienced traders or active investors. Some strategies work best in flat or gradually falling or rising markets and can underperform in strongly rising markets, such as Australian equities so far this year.

Options can be complicated. In the late ‘90s, I conceived and launched the Leverage magazine within the old Shares magazine to provide more investor education and awareness on options, warrants and other markets. Leverage no longer exists, but I recall at the time wondering why there weren’t more funds that did the hard work with options for retail investors.

The latest batch of ETFs and active funds that use options is timely. Heightened volatility in global equity and bond markets is creating more opportunities for options strategies. At the same time, risks are rising amid the threat of recession in the US and Europe and the impact that would have on lower-quality bonds.

Moreover, as the population ages, the need to smooth volatility and better protect portfolios is rising. Using options is one way to do that and for many investors. The easiest way to do so is through a fund that uses technology or has a manager to utilise options strategies.

Here are three options-related funds to consider:

1. Global X S&P/ASX 200 Covered Call ETF (ASX AYLD)

Launched this month, AYLD is Australia’s first S&P/ASX 200 Covered Call ETF and is a significant development for the Australian options market. Some options-related ETFs in the US have huge assets under management and have become a channel for retail investors to gain simple, lower-cost exposure to options markets here and overseas.

AYLD is designed to track the S&P/ASX Buy-Write Index. A buy-write strategy (covered call) involves selling call options over stocks an investor owns. That generates income in the form of a premium, in addition to dividends and franking credits from those stocks. Simply put, the premium can be a source of alternative equity income.

In a release accompanying the launch of AYLD, Global X said the ETF can be used to generate potential extra income or protect portfolios by smoothing against market falls. And that accessing covered-call strategies through an ETF is cost-effective and less complex and time-consuming for retail investors (compared to using options directly).

It’s hard to argue with that: sophisticated investors have long used covered-call options strategy to enhance portfolio income and as a downside protection strategy. Like all securities, options have pros and cons, but can aid portfolio construction or trading when used well.

The S&P/ASX Buy-Write index has returned 13.6% over one year to end-Jan 2023, S&P data shows. However, the index’s five-year annualised return is 5.5% in that period and its yearly performance can be volatile.

In February, Global X also launched the Global X Nasdaq 100 Covered Call ETF (QYLD), which will track the Cboe Nasdaq-100 BuyWrite V2 Index; and the Global X S&P 500 Covered Call ETF (UYLD), which tracks the Cboe S&P 500 BuyWrite Index.

Both funds are already listed in the US and represent the two largest covered-call ETFs in the world by assets, says Global X. They look a useful tool for experienced Australian investors who want exposure to covered-call options strategies over the largest US stocks.

As with any ETF, take time to understand the index over which the fund is based, its methodology, fees and other issues, such as currency risks in the case of ETFs that invest offshore.

Chart 1. S&P/ASX Buy-Write Index

Source: S&P

2. JPMorgan Equity Premium Income Active ETF (Managed Fund) (ASX: JEPI)

Launched on ASX in November 2022, JEPI also uses call-option strategies to generate distributable monthly income. Unlike a passive ETF, JEPI is an active managed fund that uses bottom-up research to identify defensive equity exposure and income ideas.

JEPI aims to provide the majority of returns from S&P 500 Total Return Index in the US (in Australian dollars) while reducing risk through lower volatility and offering incremental income through options strategies.

JEPI is tiny in Australia, but the fund overseas is worth US$20 billion and comes from one of the world’s leading investment banks.

The ASX-listed JEPI has currency risk (it’s quoted in Australian dollars), so investors need a view on the direction of our dollar versus the Greenback. The annual fee is 0.4%.

Chart 2: JEPI

Source: Google Finance. Note US-listed JEPI shown. Prices in US dollars

3. BetaShares Australian Top 20 Equity Yield Maximiser Fund (managed fund) (YMAX)

YMAX has been listed for more than a decade on ASX. YMAX uses a covered-call strategy over the top 20 shares on ASX (by market capitalisation) to deliver quarterly income and reduce portfolio volatility. Unlike the other ETFs mentioned earlier, YMAX does not track an index and is an actively managed fund.

YMAX’s attraction is its exposure to the market’s top-20 shares in one trade and a grossed-up distribution yield of 11.6% over the last 12 months.

The downside is performance volatility. YMAX has oscillated between attractive double-digit returns and low single-digit annual returns. The annual return since inception is 5.8% to end-December 2022. YMAX’s five-year annualised 5% return compares to 8.45% for the S&P/ASX Index (on a total-return basis).

As BetaShares notes, YMAX is expected to outperform a strategy of holding the top-20 stocks alone in a falling, flat or gradually rising market. YMAX’s strategy is expected to underperform in a strongly rising market as YMAX’s equity prices move above the strike prices of the call options, moderating capital growth and limiting dividend enhancement.

The effect of market conditions on options strategies is the main reason I prefer using active over index funds. Having professional managers who can determine the right options strategy for current and expected equity market conditions is beneficial (for those prepared to pay higher fees for active funds). Some quality Listed Investment Companies also use options in their investment strategies to enhance income.

For long-term investors happy with the index return, ETFs that use covered-call strategies over Australian and US shares are a useful new tool for this market.

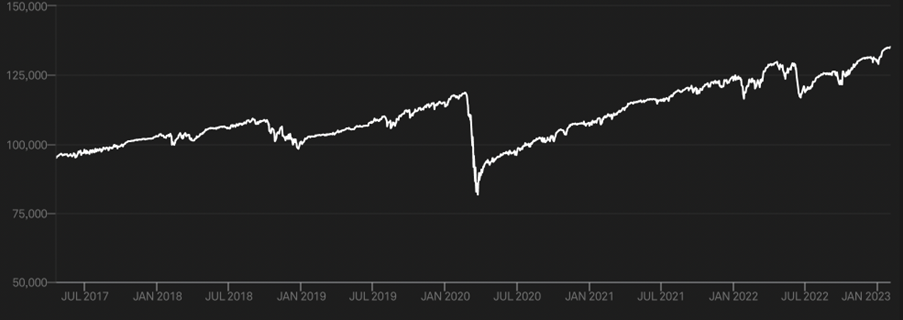

Chart 3: YMAX

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 8 February 2023.