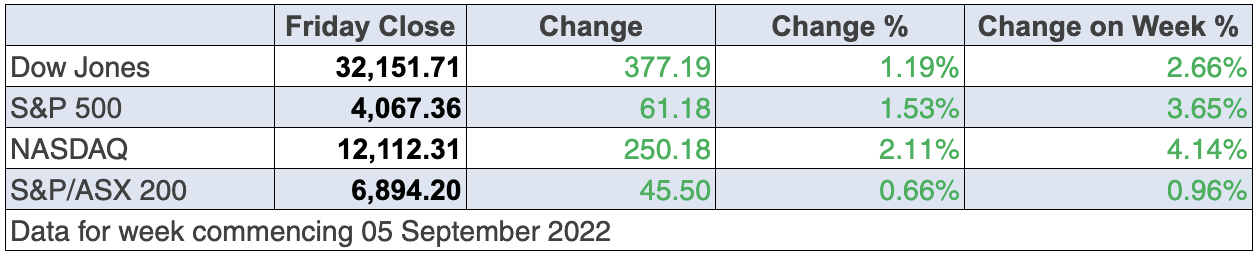

The battle between market optimists and pessimists continued this week, with the former staging a comeback just when it looked like the stocks sell off merchants had the upper hand, such that the June lows for Wall Street and the Nasdaq were under threat of being taken lower.

Typically, we played follow the leader, with a nice finish for the week being helped along by two central bankers. The first was the Vice-Chair of The Fed, Lael Brainard, who admitted that data could see the US central bank ease up on its aggressive rate rise program.

And then in a Sydney speech, our own Dr Phil Lowe gave out hints that jumbo 0.5% rate rises might be on the way out, once again, if the data drops give out favourable indicators that inflation is starting to fall.

On Wall Street overnight, the Dow started up, rising over 300 points with support for stocks also coming from economic data that’s saying a US recession isn’t a certainty. The positivity was sustained for the entire trading day with the Dow continuing to climb higher 377 points to 32,151.

“The case for the ongoing bear market is that the Fed will continue to tighten monetary policy, withdraw liquidity from the market and cause a tailspin for equities,” said David Donabedian chief investment officer of CIBC Private Wealth US. “But this week’s market recovery has shown there is continued resilience in the economy bolstered by favorable economic reports.”

In simple terms, the overall market consensus is virtually saying: ‘We’re not sure about inflation and the course of interest rate rises and we’re not sure about a possible recession, so we’re not selling off in a panic’.

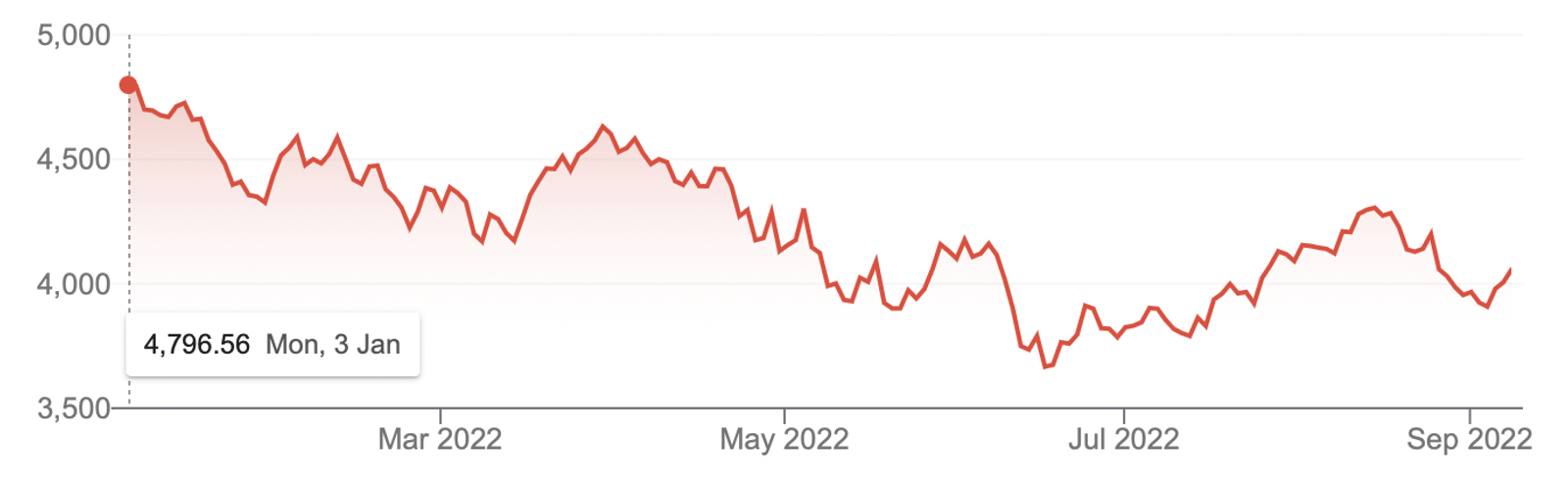

The chart of the S&P500 gives me hope that there’s a lot of market muscle not interested in taking stocks down to the mid-June lows, as this chart below shows.

S&P500

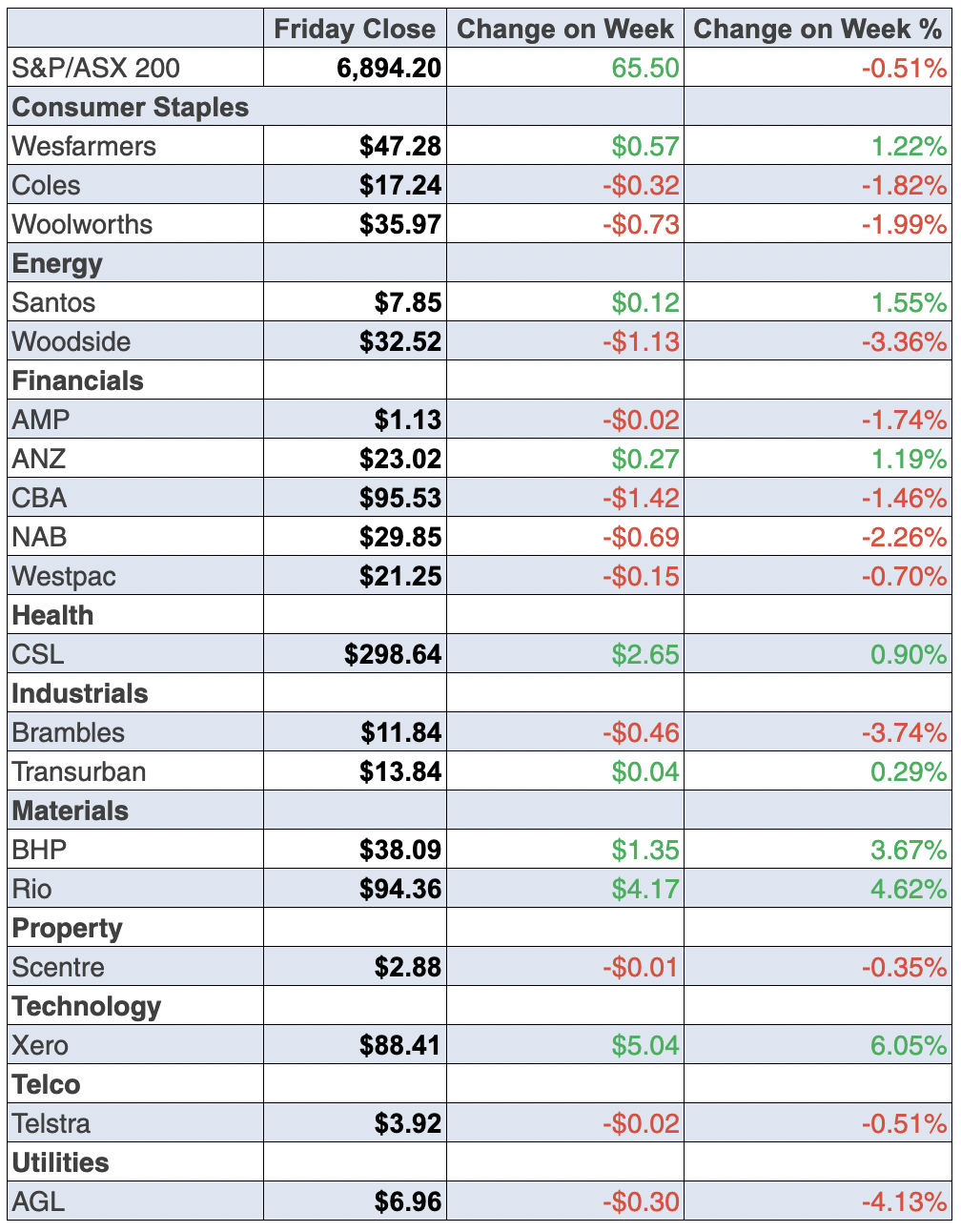

The same applies here, with the S&P/ASX 200 actually up 65.5 points for the week. That’s a nice effort considering how the Jackson Hole speech of the Fed’s Jerome Powell has hit stocks since August 26.

Interestingly, late in the week, Jerome kept us guessing about how he feels about future rates, but he did say that the US central bank is “strongly committed” to fighting inflation and won’t flinch in its efforts to curb price pressures “until the job is done”. Next Wednesday, he (and we) will see the latest US inflation number. This will be important for his tone and the market’s reaction.

(On Monday I’ll look at the growth stocks that are telling me that a lot of smarties are starting to look ahead for when rate rises are over. Some companies are showing they’re gaining a lot of fans.)

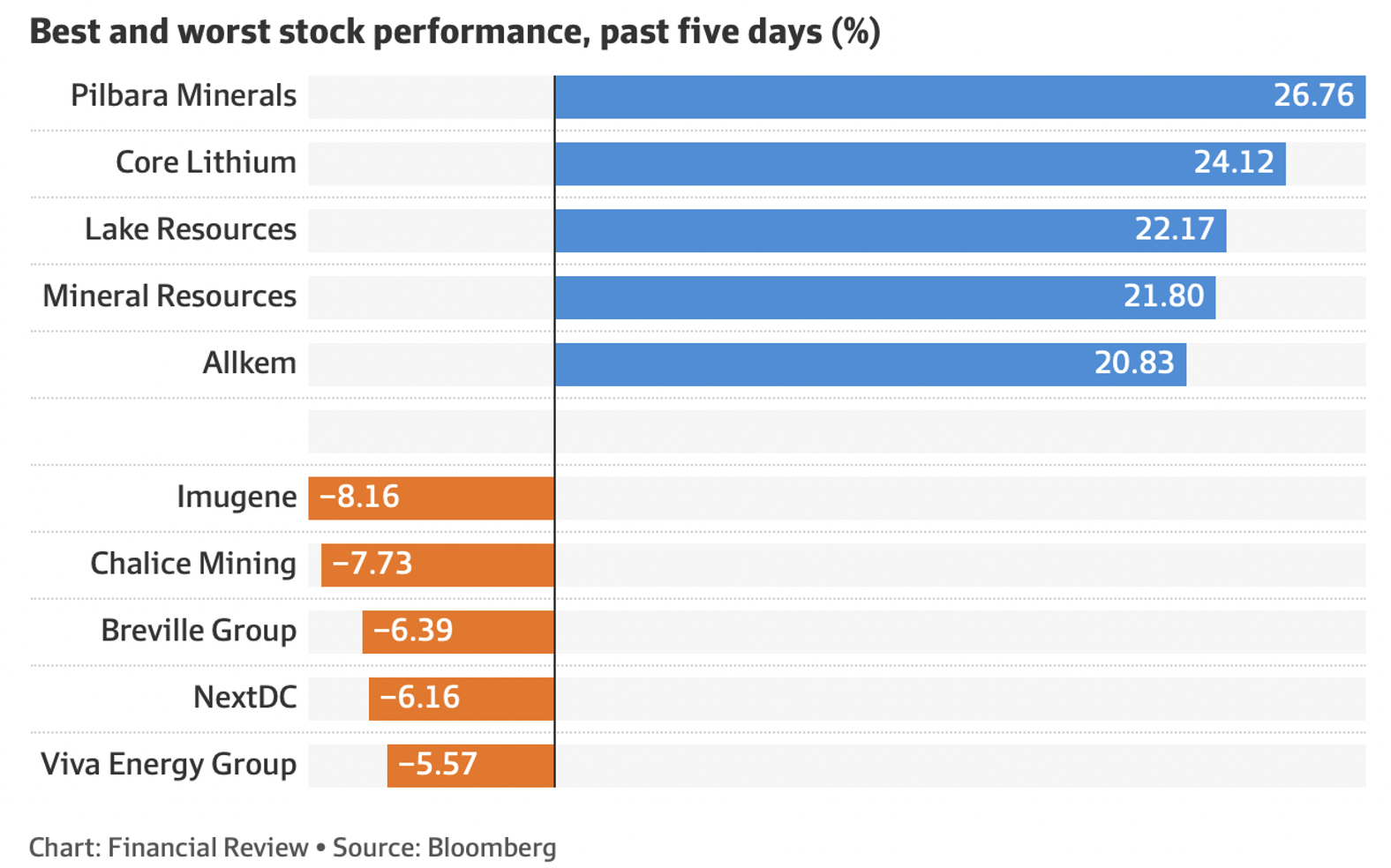

To the local story in more detail, and apart from the 65-point gain for the week, the miners were again in favour, especially the new age ones.

Mineral Resources had a boomer of a week and was up 21.78% for the week to finish at $71.51, after market talk that said it could spin off its lithium business.

This and other positive outlook forecasts for the product helped other lithium players, such as Pilbara Minerals, which was up 24.31% for the week.

This chase for the ‘modern’ minerals linked to electric vehicles, battery technology and other renewable endeavours, showed up in the weekly winners’ and losers’ chart.

One company the Bloomberg table missed was Tyro Payments. This is now a target for a takeover but its chairman David Thodey has declared the recent price offered was “opportunistic”. The offer on the table was $1.26. Tyro’s share price was up 39.59% this week and finished at $1.38.

For those wondering how the big miners did, here’s the summary from the AFR’s Emma Rapaport: “BHP gained 3.1 per cent to $38 and Fortescue Metals added 6.1 per cent to $17.8. Rio Tinto, South32 and Newcrest all gained between 2.7 per cent and 3.8 per cent, while De Gray mining jumped 11.9 per cent and Sandfire Resources rose 8 per cent”.

What I liked

- The Australian economy (as measured by gross domestic product or GDP) grew by 0.9% in the June quarter this year, to be up by 3.6% on the year. ‘Normal’ GDP growth is about 2.25%.

- The Reserve Bank (RBA) Board has lifted the cash rate for an unprecedented fifth straight month, hiking by 50 basis points (half a percent) to 2.35% – the highest level since February 2015. The fourth consecutive half-point rate hike also represents the most aggressive monetary policy action since 1994. While it has been the right policy, I hope the Bank starts to reduce the rises or even try a pause to watch the data.

- CommSec reported: “Governor Lowe signalled that the recent run of ‘jumbo’ rate hikes of 50 basis points could be nearing an end”. The Governor said, “And we recognise that, all else equal, the case for a slower pace of increase in interest rates becomes stronger as the level of the cash rate rises”.

- The weekly ANZ-Roy Morgan consumer confidence index rose by 1.3% to a 13-week high of 86.1 points but is a lot lower than the long-run average since 1990 of 112.2 points. We don’t want consumers to be so negative that it creates a recession.

- The Australian Bureau of Statistics (ABS) said the current account surplus rose from $15.6 billion to $18.3 billion in the June quarter 2022. It was the 13th consecutive surplus, the longest quarterly stretch on record. (Demand from overseas is not inflationary here.)

- The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) today released a report estimating that Aussie agricultural export earnings could climb to a record high of $70.3 billion in 2022/23.

- The Australian Industry Group (AiGroup) and Housing Industry Association’s (HIA) Australian Performance of Construction Index (PCI) rose by 2.6 points to 47.9 points in August, but activity contracted for a third straight month. And house building activity contracted for a fourth consecutive month to a 27-month low of 33.3 points. Readings below 50 denote a contraction in activity. (These contraction readings help lower inflation.)

- The final S&P Global services index dipped from 47.3 to 43.7 in August (survey: 44.2). Any reading under 50 means contraction, which is good for slowing down inflation.

- The European Central Bank (ECB) lifted its benchmark deposit facility rate by an unprecedented 75 basis points to 0.75% and promised further hikes to tackle soaring inflation. This is the medicine these guys need to beat inflation.

What I didn’t like

- According to the Federal Chamber of Automotive Industries (FCAI) a total of 95,256 vehicles were sold in August, bringing the year-to-date total to 717,575. The result represents a 17.3% increase on the same month in 2021. And it was the strongest August sales result in five years. (Usually, I’d like this but we need the consumer to help bring inflation down and big spending doesn’t help.)

- Ditto to this: “According to the Australian Bureau of Statistics (ABS), retail trade rose by 1.3% in July, the biggest increase in four months, to a record high of $34.7 billion. Retail spending was up 16.5% in July on a year ago, but total online retailing sales fell by 0.5% in July to be 1.7% lower on a year ago”. (Some of this jump compared to a year ago is comparing to a month where a lot of Australia was in lockdown, so it might be an exaggerated number.)

- The US Federal Reserve Beige Book, a periodic snapshot of the health of the US economy, indicated that price pressures are expected to persist at least through to the end of the year.

- In US economic data, the ISM services index rose from 56.7 to a 4-month high of 56.9 in August (survey: 55.3). This could suggest inflation is not being tamed quickly enough for the Fed’s inflation-fighting goal.

Watch the data

Next Tuesday, September 13, the Yanks get their CPI number, which brings the all-important US inflation reading. The last number was 8.5%. If the drop is bigger than expected, the stock market will like it and speculation about how many more US rate rises could be great for stocks. Our market will react on Wednesday — this could be a HUGE deal for stocks.

The week in review:

- I thought I would put the focus on small-caps this week in the Switzer Report given the potential upside many of them hold once we eventually pull out of this bear market. It’s always worth noting though, that picking the right one is easier said than done and nailing the timing is another beast altogether. With that aside, I listed 21 stocks the analysts like which are also in the Small Ords Index.

- The a2 Milk Company has had a tumultuous last couple of years, to say the least, but following its announcement of a $150 million on-market share buyback last week, Paul (Rickard) assesses whether this stock has finally turned a corner.

- In his article this week, Tony Featherstone says youth-focused retailers, Lovisa (LOV) and Universal Store Holdings (UNI) stand out amid predicted economic gloom.

- James Dunn shares his top 3 stocks from the FY22 reporting season.

- In our “HOT” stock column, Michael Gable, Managing Director of Fairmont Equities, asks if Pilbara Minerals (PLS) is a buy right now.

- In Buy, Hold, Sell, What the Brokers Say, there were 9 upgrades and 14 downgrades in the first edition, and 8 upgrades and 4 downgrades in the second edition.

- And finally, in Questions of the Week, Paul (Rickard) answers your queries about whether Wesfarmers is a buy; Is it too late to change my mind with CBA’s dividend re-investment plan – can I take the cash instead?; What’s happening with the takeover of Ramsay Health Care? And with uranium, what are your thoughts on the BetaShares Global Uranium ETF?

Our videos of the week:

- Dementia and the many forms it comes in | The Check Up

- 3 stars from reporting season! + Has inflation peaked? | Switzer Investing (Monday)

- The RBA lifts interest rates by 0.5%, just how high will they go? + Can lithium stocks go higher? | Mad about Money

- Are ALX & WES a buy? + Is the property market stronger than what doomsayers would have us believe? | Switzer Investing (Thursday)

- Boom! Doom! Zoom! | 8 September 2022

Top Stocks – how they fared:

The Week Ahead:

Food for thought: “You make most of your money in a bear market, you just don’t realize it at the time.” – Shelby Cullom Davis

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

In our chart of the week, Shane Oliver of AMP Capital points to the risk premium of equities over bonds, noting that investors should keep a close eye on bond yields.

“So far this year the continuing strength in company profits and a fall back in share prices has left share market valuations relative to bonds (as measured by the gap between earnings yields and bond yields – which is a proxy for shares’ risk premium) looking ok, despite the rise in bond yields,” writes Shane.

“However, the gap has narrowed to its lowest since the GFC in the US. Compared to the pre-GFC period shares still look cheap. It will be key to watch bond yields (where further rises will make shares less attractive) and earnings downgrades (which would also make shares less attractive).”

Top 5 most clicked:

- 21 stocks the analysts like – Peter Switzer

- 3 reporting season stars – James Dunn

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

- Has a2 Milk finally turned the corner? – Paul Rickard

- Questions of the Week – Paul Rickard

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.