It seems like there’s a different megatrend every few weeks (and a new thematic Exchange Traded Fund (ETF)) for investors to back. In the past few months, there have been thematic ETFs on hydrogen companies, cryptocurrency innovators, blockchain and semiconductors.

Thematic ETFs are a good investment tool, provided they’re based on long-term structural trends rather than fads, are true-to-label, and are used sparingly in portfolios. The risk is that inexperienced investors are seduced by the appeal of “megatrend” investing.

Most megatrends look compelling, on paper. But how many genuine megatrends exist, and has the market already priced the trend’s potential into company valuations? A fund manager recently warned that investors are becoming “theme junkies” – a sentiment I agree with.

I follow trends closely and often combine top-down industry analysis with bottom-up company selection. Over the years, I’ve realised two things with megatrend investing: the best trends are usually the most obvious, and megatrends take longer to play out than investors realise.

Ageing is an example. It’s a no-brainer that developed nations will have larger, older populations in the coming decades. About a third of Australia’s population will be 55 years or older by 2050, from just over 25% now, Australian Bureau of Statistics data shows.

Life expectancy at birth will rise from 80.9 years for men and 85 years for women in 2018, to 86.8 years for men and 89.3 years for women by 2061, the latest Federal Government Intergenerational Report shows. Imagine what society will look like over the next four decades when people are living well into their ‘80s, on average.

Now, consider what rising life expectancy means for the healthcare sector. Across developed nations, people are spending more on healthcare services that help them live longer, pain-free lives. It’s a safe bet that healthcare will become Australia’s fastest-growing industry over the next decade, and that its share of GDP (currently 10%) will grow substantially.

The ageing population and healthcare megatrends are hardly new. Nor nearly as exciting as investing in artificial intelligence, crypto firms, hydrogen or fintech technology/blockchain companies. But I’d argue the ageing population and healthcare megatrends will last much longer and provide stronger risk-adjusted returns.

The ageing population megatrend is particularly interesting. Australia has an estimated 5.9 million Baby Boomers (born between 1946 and 1964). By 2030, the youngest of the Boomers will be 66. The signs point to a mass exodus from the workforce (at least from full-time work) for many Baby Boomers by the end of this decade.

In the US, Forbes magazine recently dubbed the Baby Boomer workforce exodus as the “Great Retirement”. US surveys have shown a sharp increase in the number of Baby Boomers planning to bring their retirement forward. Covid has had an impact. Just as many younger people are considering quitting their job (the “Great Resignation”), many older people are considering retiring earlier. Some, no doubt, are encouraged by rising wealth from shares and property.

Who knows if the survey findings will match reality? I’m sceptical. Livings costs will eventually catch up with younger people who have changed priorities after Covid. And many older people I know (myself included!) like working and dread the thought of semi- or full-time retirement.

But the broad trend is clear: many more Australians retiring between now and 2030.

Playing the ageing trend

It’s ironic that the best megatrend of them all – an ageing population – is not represented by thematic ETFs on the ASX. The closest way to play the trend is through a few global healthcare ETFs (that benefit from older people spending more on medical services). Investors who want exposure to the trend need to pick stocks that cater to an ageing demographic.

My preference in the past few years has been property developers involved in lifestyle communities. These developments, aimed at seniors who want to live independently, look a lot less complicated than aged-care providers.

With interest rates at record lows and unlikely to rise by much anytime soon, downsizing is becoming a more attractive option for many retirees. They sell the family home and either buy or rent a smaller, more maintainable property in a lifestyle community. In turn, that frees up capital for retirees to supplement low investment returns and have a better lifestyle.

In May, I covered this downsizing trend, nominating Lifestyle Communities (LIC) and Ingenia Communities Group (INA) as two preferred ideas.

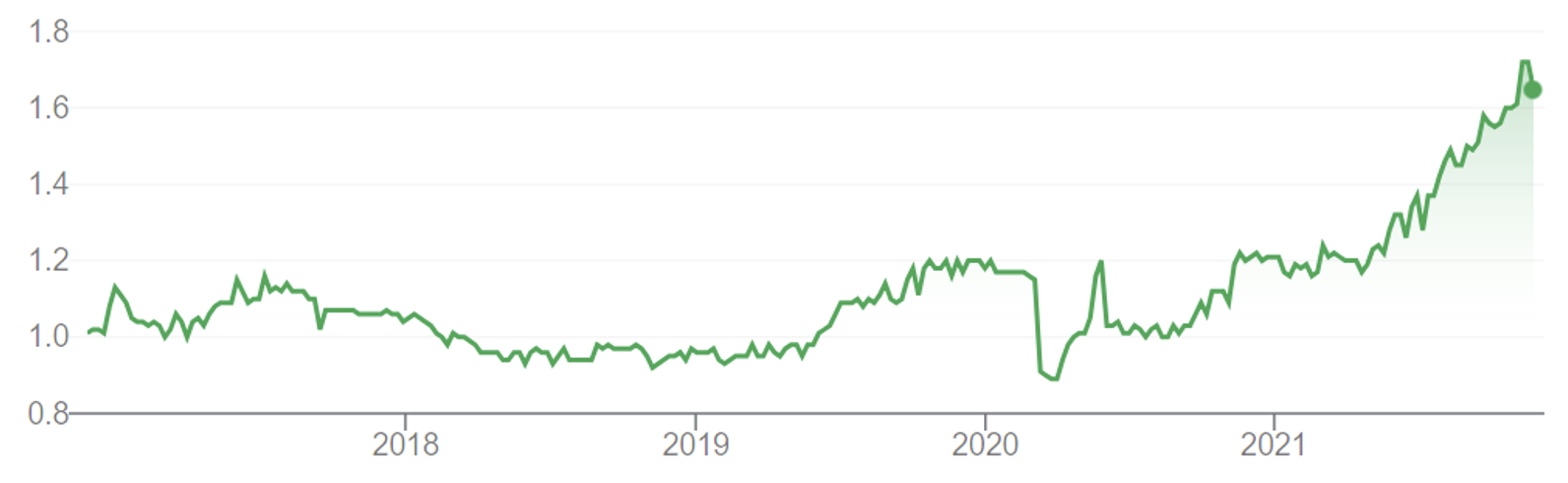

I expected Lifestyle Communities, a provider of independent-living properties in Melbourne, to have a short period of price consolidation, and that happened between May and July. The stock has rallied from $13.75 since that story to $20.27, having hit a 52-week high of $23.85.

Lifestyle Communities (LIC)

Source: ASX

With Ingenia, I wrote that the stock has “broken through points of key resistance, suggesting a new upper level in its price trend could be forming”. Ingenia, a provider of holiday parks and retirement villages, has rallied from $5.44 in May to $6.12, having peaked at $7.08.

Ingenia Communities Group (INA)

Source: ASX

I like both stocks and rate Lifestyle Communities as one of this market’s best-run small-cap companies. It has an excellent, repeatable business model and strong management.

That said, I wouldn’t put new money to work in either stock for now, given the extent of their rally this year. Current investors in both stocks could maintain their holding. Prospective investors should watch and wait for better value to emerge in the next few months.

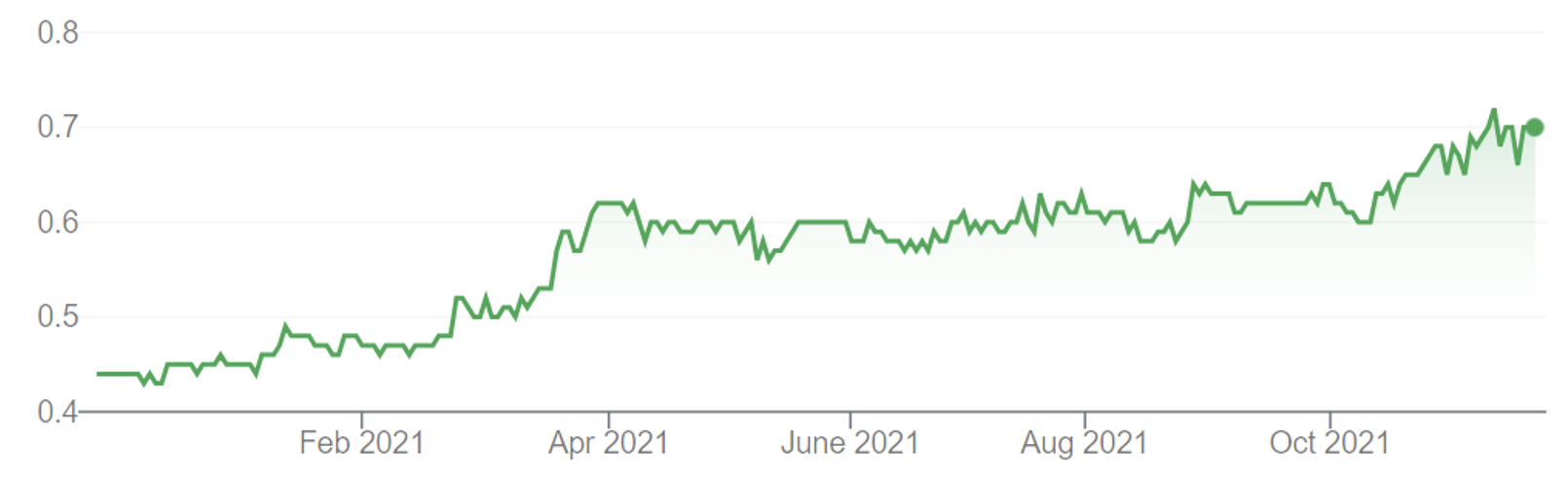

Aspen Group (APZ), another provider of affordable housing, also caught my eye this year. I covered Aspen in July for this report. Aspen has rallied from $1.37 at the time of that report to $1.65.

Aspen Group (APZ)

Source: ASX

Aspen is much smaller than Ingenia Communities Group but is in a similar market space. The Sydney-based company owns dwelling rentals, leases land sites to customers, and sells dwellings and land. Its properties include houses, apartments, mixed-use parks, land-lease communities and co-living facilities.

As I wrote in July, Aspen has mostly traded at a discount to its net asset value (NAV), restricting its ability to raise capital (without diluting unitholders). At its current price, Aspen trades at a 23% premium to its latest NTA ($1.34 a unit). Aspen looks better positioned to raise capital, quicken its growth strategy and attract small-cap fund managers to its register.

Aspen needs to grow faster to justify the valuation premium. However, a price pullback or consolidation in the next few months would not surprise, given Aspen’s rally. That would create a buying opportunity for experienced investors who are comfortable with microcap trusts.

There’s much to like about Aspen’s long-term prospects. As I’ve said before, the market will pay more attention to providers of affordable housing and build-to-rent projects this decade. Demand for affordable housing – cheap home-and-land packages, and caravan rentals – is rising as a generation of Australians is priced out of the property market. Or needs to free up equity from existing properties to provide income to live on.

This week, I add Eureka Group Holdings (EGH), another microcap, to my list of preferred lifestyle-community providers. Eureka has 41 villages in its portfolio (33 owned villages, and eight managed villages).

Eureka had a challenging FY21 with after-tax net profit of $6.28 million, from $8.1 million a year earlier. Provisions against legacy assets and a higher tax rate hurt its earnings.

Eureka has had a good start to FY22. At its Annual General Meeting in November, Eureka said results in the first quarter of FY22 were “encouraging” due to high occupancy rates.

On guidance, Eureka said it expects underlying earnings of $11.5-$11.8 million in FY22 (from $10.57 million in FY21). That looks conservative given Eureka has invested in its management team, relocated its head office to Brisbane and has several projects in advanced negotiations.

Eureka is building the internal infrastructure to run a larger operation. In FY21, Eureka acquired two retirement villages in Cairns and Hervey Bay, adding 123 units. It also acquired a rental village at Ipswich, is expanding its Wynnum village and has other greenfield developments. It looks like Eureka’s growth strategy is going up a notch.

At 68 cents, Eureka is capitalised at $160 million. Like Aspen, Eureka suits experienced investors who understand the nature, benefits and risks of microcap investing.

For those who have sufficient risk tolerance, Eureka offers interesting exposure to affordable housing for seniors in Southeast Queensland – a clear growth market this decade and beyond.

Eureka Group Holdings (EGH)

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 23 November 2021.