After a volatile 2018, which ended in an aggressive global equity market sell off, it’s nice to turn a new leaf in 2019 and search for stocks that have the potential to generate us double-digit returns from current depressed prices.

The most interesting aspect of the December 2018 sell off was it became indiscriminate by stock and sector. Virtually nothing was immune to selling pressure in the last few weeks of 2018, a market phenomenon that’s often associated with a sentiment capitulation bottom.

As we have seen, markets have bounced solidly from those December lows, but I’d have to say you generally don’t get a true market bottom until the market itself “returns to the scene of the crime”. I believe we could see a retest of the December lows over the next few months and that would be a tremendous buying opportunity in high quality long duration companies that are rarely on sale.

On that basis, I am holding some cash, waiting to deploy at lower prices with what I would call a “shopping list” of great companies I hope to buy with a “margin of safety”. It will pay to be a little patient I suspect, but when the moment comes at the right risk adjusted price, you must act and put cash to work.

One of the stocks on my “shopping list” is Aristocrat Leisure (ALL.ASX). ALL is one of my core portfolio holdings and its underperformance was a detractor from our portfolio performance in the second-half or 2H of 2018.

The 2H de-rating on ALL was driven mainly by small earnings downgrades in a stock that was heavily owned by momentum investors. The chart below confirms that consensus FY19 EPS estimates have fallen by -4.31% over the last six months, yet the stock fell -36% from its peak.

That is a clear P/E de-rating back to 17.8x FY19 consensus estimates, the same estimates that forecast 19% EPS growth. ALL is now trading back on a price to growth ratio of less than 1x, which I believe will prove an attractive entry point.

The P/E de-rating was really about the uncertainty of ALL’s large scale digital investments. Markets hate uncertainty, but particularly so when they see back-to-back large scale acquisitions, albeit in an area of competence from the given company. This combined with a “momentum” investor register led to an overly-aggressive de-rating.

However, we are now starting to get a little clarity on ALL’s digital investments. The news is incrementally positive and that is all you need in a stock that has been heavily over-sold. A little clarity helps.

The Eilers social casino tracker for the December 2018 quarter (Aristocrat’s 1Q19) was released in the US last week. I am going to quote directly from Evans & Partners research that succinctly summarised the event.

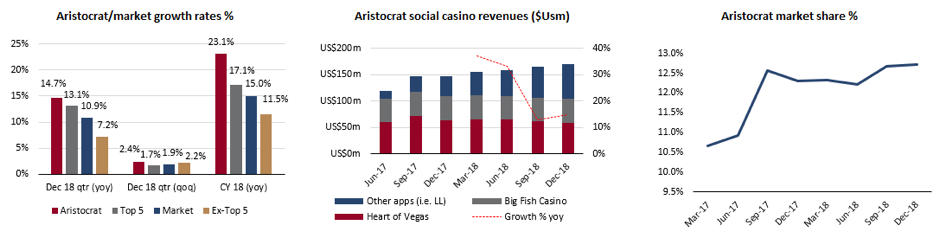

Aristocrat social casino pro-forma revenues (Product Madness & Big Fish) were estimated to have grown:

- 7% year-on-year (PM 12.3% and BF 21.3%) vs. 12.9% year-on-year in the September 2018 quarter.

- 4% quarter-on-quarter (PM 0.8% and BF 6.2%) vs. 4.4% quarter-on-quarter in the September 2018 quarter.

- Aristocrat’s market share was 12.73% vs. 12.67% in the September 2018 quarter.

- Aristocrat remains the clear number 2 in the market.

The overall social casino market grew:

- 9% year-on-year vs. 12.1% year-on-year in the September 2018 quarter.

- 9% quarter-on-quarter vs. 0.7% quarter-on-quarter in the September 2018 quarter

- The top 5 operators comprised 63.8% of revenues in the December quarter, up 120bps , but down 10bps quarter-on-quarter.

- CY2018 revenues of US$5.193 billion were largely in line with expectations; Eilers market growth estimates are largely unchanged (CY2018-22 CAGR of 7.5%).

Industry trends:

- Active users declined in 2018 (DAUs declined 4% in CY18)

- However, this was more than offset by strong yields (ARPDAU up 18% in CY18)

- Acquisition costs were surprisingly down in the Dec quarter (Cost per install or CPI)

NOTE: The Eilers social casino tracker revenue data is derived from average gross ranking position on the iOS and Google Playstore, 3rd party data, and proprietary estimates. The report’s estimates have historically been highly correlated with company reported social casino revenues.

Source: Evans & Partners

This is a positive result for Aristocrat for 5 reasons:

- Aristocrat social casino revenue growth improved in the Dec quarter and is on track to comfortably meet FY19 growth forecast of 8% year-on-year.

- Aristocrat social casino revenues continue to grow above market.

- Aristocrat’s multi-app strategy is proving successful with new apps (Lightning Link from Product Madness, Jackpot Magic from Big Fish) more than offsetting softer numbers from flagship apps (i.e. Heart of Vegas).

- The overall market continues to grow strongly.

- The top 5 operators continue to maintain dominant market shares, controlling 64% of the market.

Source: Evans & Partners

Most of the industry analysts have seen the data now and have made constructive comments about it. Some suggest the run rate is ahead of their expectations and may lead to small earnings upgrades. This is important as it suggests the small ALL earnings downgrade cycle, that triggered the heavy sell off, is over. ALL stock rose +3.1% on the first day after the US social casino data was released.

ALL shares hit a low of $20.66 on Christmas Eve 2018. The technical relative strength index (RSI) bottomed that day at 25, an oversold reading.

Since then, the stock has regained the 50-day moving average at $23.68, and through time should regain the 100-day moving average at $26.11 and eventually the 200-day moving average at $27.87. This recovery won’t be without volatility but I will be looking to use weak days to accumulate ALL stock, as I genuinely believe the worst is behind it now both fundamentally and technically. It’s also worth noting around 30% of the register has changed hands in the last six months, which suggests weak holders have exited the stock.

Interestingly, the analysts community remain bullish on ALL. There are 11 buys, 2 holds and 0 sell recommendations and the median 12-month price target is $31.19. That would be a +28.3% gain if proved accurate.

I realise some people have ethical issues with owning gaming stocks or those who manufacture gaming software. I do have sympathy for those views as the social cost of problem gambling is enormous. However, the company operates in a highly regulated market and my job as a fund manager is to invest in the best-of-breed companies in structurally growing industries. ALL fits that description.

As I said earlier in this note, I do believe a broader better buying opportunity will emerge again in equity markets over the next few months. I feel ALL trading on a PEG ratio less than 1x will be a good place to put some cash to work into a broader market pullback.

That’s my final point today: this is going to remain volatile. I don’t believe there’s any great rush to do anything and that patience in times of volatility will be rewarded. Wait for your moments to act: they will come.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.