I’ve always learnt a lot from the greats of sport. Let’s face it, most of us would’ve loved to be great at sport and because of that, the people who really make it have something special we can learn from, just as we can learn from the likes of Warren Buffett, Ray Dalio and others who are stars of the money world.

I don’t know much about ice hockey but Americans tell me that the Canadian Wayne Gretsky was one of the all-time greats. And he’s famous for this outstanding observation captured in his advice to “skate to where the puck is going to be, not where it has been.”

The same applies to many quality companies out of favour. In May last year, Tony Featherstone told you that banks were a good buy. And I wrote a piece in Switzer Daily with the headline: “Is it time to buy CBA?”

The answer was “yes”.

It was a $58 stock then and is now $88, which is a 51% gain in 10 months for one of the best banks in the world!

When I see a quality company such as CSL at $248, I can’t help thinking about Warren Buffett’s famous piece of advice: “…be greedy when others are fearful.” That advice is a rule of thumb and does leave out other rules and qualifications, such as be greedy about quality companies!

So I want to look at quality companies on the outer right now. But before that, I want to make the point that “timing” and “time in the market” are both really important matters for investors to never forget.

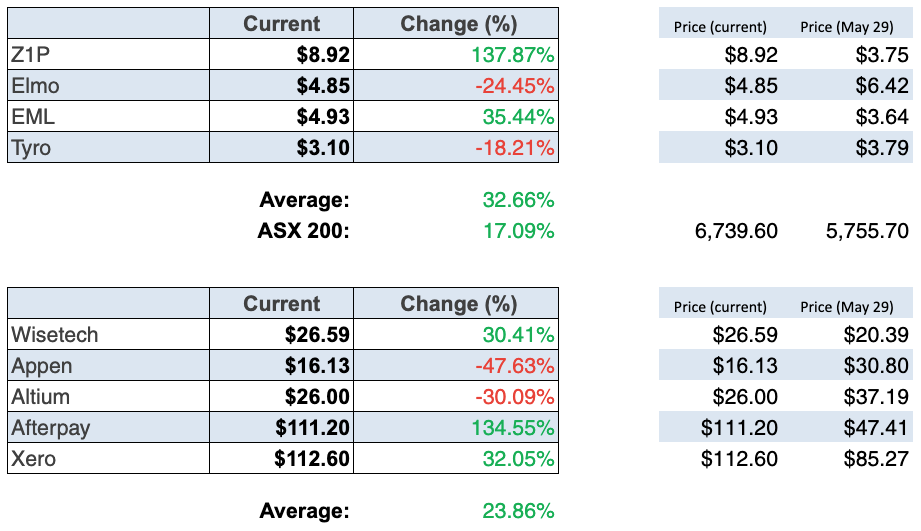

My colleague Paul Rickard fielded a question from a subscriber a month or so ago, who was concerned about the performance of my ZEET collection of stocks. I’m not sure if she bought all four. But another colleague, Jon Bragg, put the four stocks on a website that can track your stocks and this is what it told me today when I went to https://docs.google.com/spreadsheets/d/15KWP-OoBvNxc3xN2pobXOcijfFQDvhmbC9yTLypTza8/edit?usp=sharing .

This says that since May 29 when I wrote about my ZEET group of stocks, they had a return of 32.66% compared to the WAAAX group, which delivered 23.86% compared to the ASX 200, which came in at 17.09%.

That was pretty good considering that:

- Tech stocks have been creamed lately.

- Tyro copped an unfair, biased report from a hedge fund short seller and it copped a technological gremlin not caused by the company itself but by the manufacturer of their terminals.

- EML has been held back by the bad virus-fighting programmes in Victoria, Europe and the US.

- And ELO, like Xero, will do better when normal business conditions return and CFOs aren’t trying to continually cut costs.

Of course, if my subscriber bought in late, her returns might not be so good. But a 10% return for 10 months seems highly likely for anyone who read my piece on the ZEET stocks, and 10% is still a pretty good result.

However, it underlines the importance of “timing” and being diversified. I selected four ZEET stocks but I would’ve preferred six, or even more. If someone only selected Tyro and ELO, they would’ve lost about 20%. And while that would be bad luck, I bet in six months’ time these two stocks will be back in the black as the reopening of the economy improves the business environment that these companies work in.

In Friday’s Switzer Report webinar, I noted with interest how FNArena’s Rudi Filapek-Vandyck said he liked EML the most among that group.

But now for the group of quality companies that I think look well-priced but you will have to be a patient investor and not someone who wants big, quick returns ASAP. Have a look at these businesses that are also in the top 100 ASX list:

So here goes:

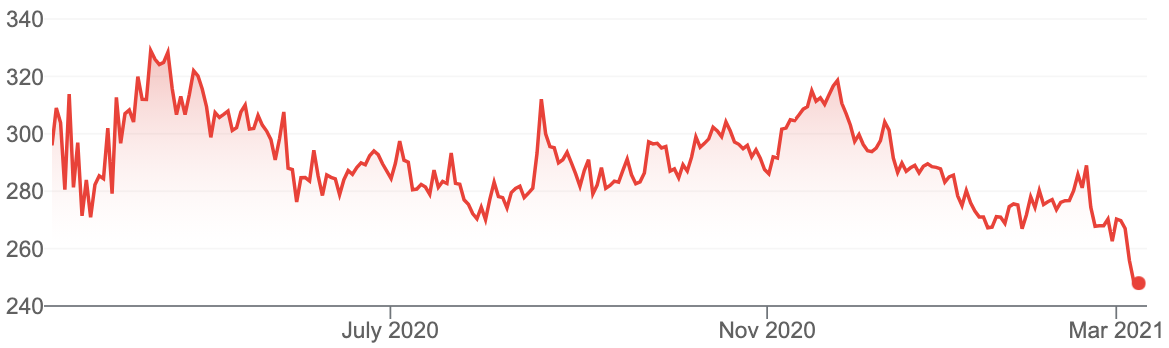

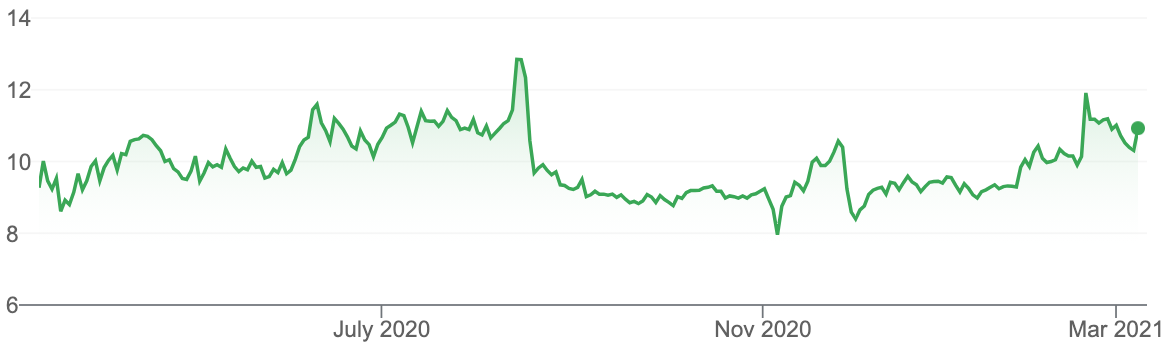

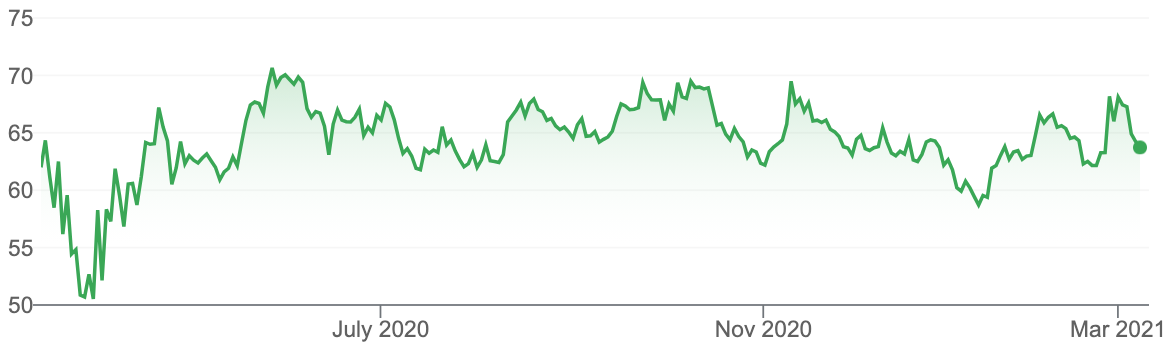

1. CSL

The analysts say there’s 21.5% upside and that this is a company that will get back to normal with plasma collections as America gets fully vaccinated. And, eventually, our currency will stop rising and that will help.

CSL

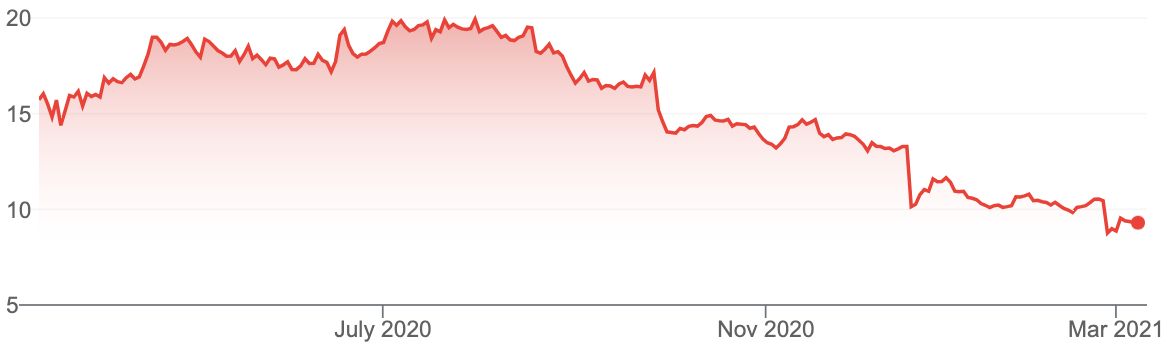

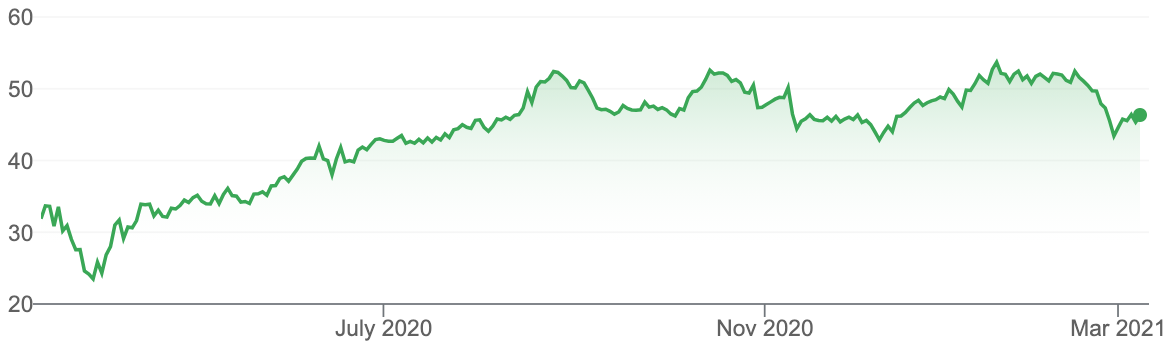

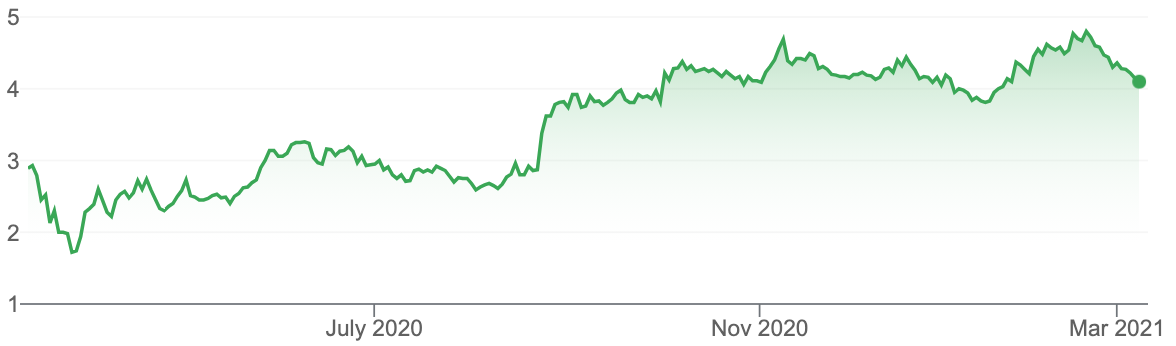

2. A2Milk

Here the analysts say 1.2% downside but I think inside a year they’ll prove these guys wrong. We might have to wait until Chinese tourists are back in force but I think the gains will come sooner. With the analysts, there was a diverse view. Out of seven, four were buyers, one was neutral and two were sellers and the highest target price was $11, so there are believers out there in A2M.

A2Milk (A2M)

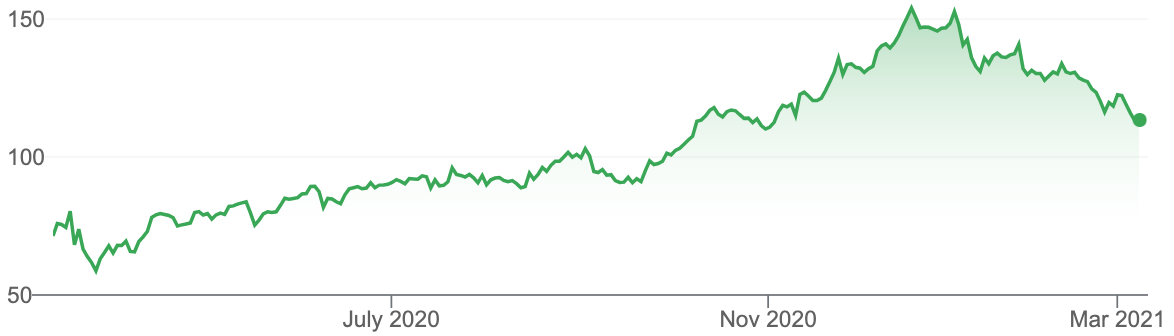

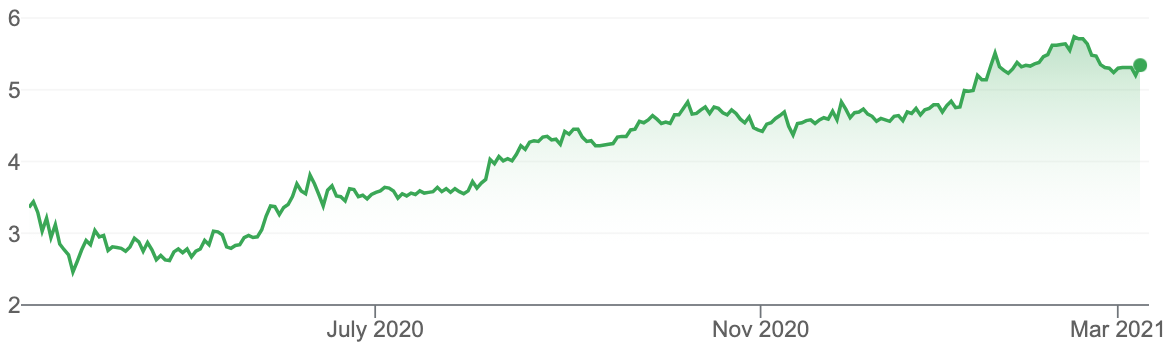

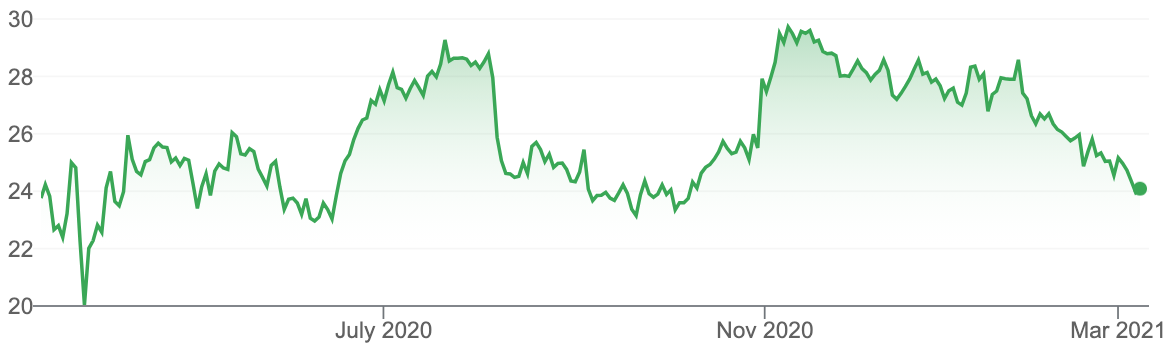

3. Xero

Here the analysts say 7.4% downside but again I’m betting against them. This is a great company that will strive as the US and UK economies improve over 2021 into 2022. Out of six analysts, two were sellers, three were neutral and there was an “overweight” recommendation. Interestingly, Macquarie was “neutral” on the stock but had a target of $120!

Xero (XRO)

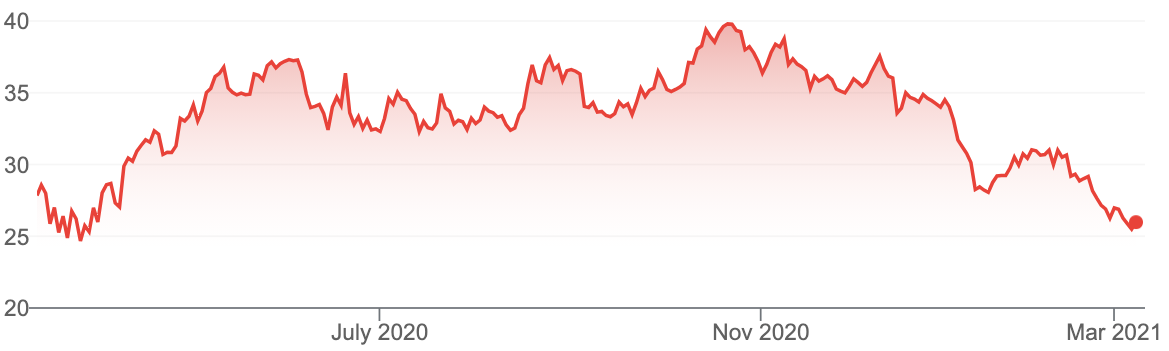

4. Treasury Wine Estates

0.9% upside is predicted but over a year that number will be bigger. There was only one seller out of seven analysts who look at the company.

Treasury Wine Estates (TWE)

5. JB Hi-Fi

The analysts see a 13.4% upside. These guys always impress at reporting time and we will be buying stuff for at least another year. Also these guys have improved their online offering. No analyst was a seller of the stock and the best target price was $57.03 versus the current price of $52.70.

JB Hi-Fi (JBH)

6. Harvey Norman

There’s 7.7% upside and I think the company will benefit from the economic boom ahead. Six analyst cover the company and there were no sellers and four were saying “buy” or “outperform”.

Harvey Norman (HVN)

7. Altium (ALU)

The analysts say there’s 28.5% upside. Tech is out of favour now but it won’t be for always. Six analysts looked at this stock and they were all buyers with different levels of enthusiasm. The highest target price was $37 versus a current price of $29.15.

Altium (ALU)

8. Ramsay Healthcare

Experts say there’s 8.1% upside. I had to include a healthcare business, with the sector being slugged now. As the UK and Europe become normalised via vaccinations, RHC will be a beneficiary. The company had two sellers, three holders/neutral ratings but Ord Minnett recommended “accumulate” with a target price of $70!

Ramsay Healthcare (RHC)

9. Reliance Worldwide

This is a great company in the building and renovation space and booms and building go hand-in-hand. Six analysts look at this company and not one is a seller and two say it outperforms, one says “buy”, one says “hold” and the final one says make it “equal weight”. The consensus is that this is 14.4% under-priced.

Reliance Worldwide (RWC)

10. Resmed (RMD)

The analysts think there is 16.3% upside. Every time this company is on the outer, it proves its critics wrong. Out of seven analysts, only one was a seller. And the best target price was Morgans with $30.09 compared to a current price of 28.08.

Resmed (RMD)

Clearly, not all these will spike at the same rate in the same time range, but they are quality companies, currently caught in a “let’s reject tech” phase and a rotation into stocks that the market will do well out of the reopening phase.

But for my long-term holds, I want to invest in companies where I think I can see their prices rising over time.

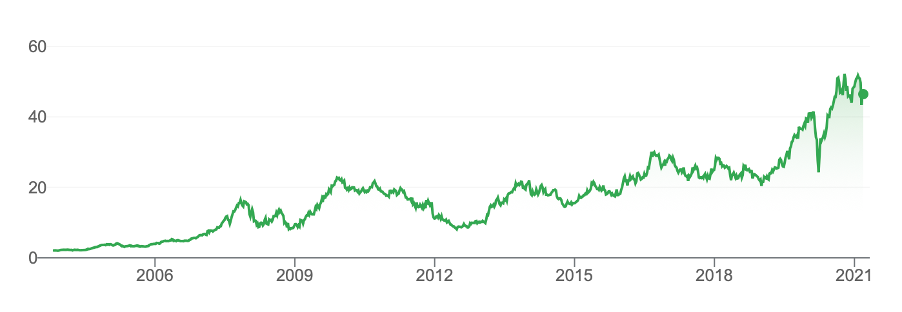

JB Hi-Fi’s chart (over time) makes my point graphically.

JB Hi-Fi

Imagine if your portfolio was made up of stocks whose charts all looked like this?

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.