Until April 2 brings news on the reciprocal tariffs the US President Donald Trump will impose on its trading partners, it’s unlikely we’ll see the uptrend I’m expecting for 2025 to resume. Of course, the President’s actions could frustrate what you’d expect from history’s impact on stocks but that’s the punt we have to cope with this year. And it’s bound to persist until 2028, when the next US election takes place.

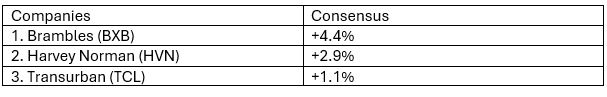

So, I want to be a buyer of companies or investment products that will participate in or even drive rising stock market indexes once we get clarity over tariffs. Last week, I suggested the likes of VAS to capture the top 300 stocks on the local stock exchange, but this index could be sluggish because the banks could still have some falling to do.

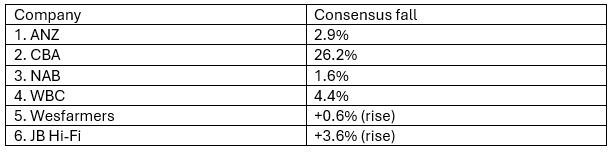

This is what the analysts on FNArena say about some of our top 20 stocks.

I think they’re too hard on CBA. As for the others, they have less to fall or might rise a little and won’t significantly work against the returns from VAS.

I like IHVV for a hedge play on the S&P 500 that has fallen because the Magnificent 7 stocks have pulled back. This is how getycharts.com saw the fall: “The Magnificent Seven stocks–Alphabet, Apple, Amazon, Microsoft, Meta Platforms, NVIDIA, and Tesla–have carried U.S. indices higher. Between 2023 and 2024, these seven names rose 156.1% as a collective, compared to 25.16% for the remaining 493 names and 57.88% for the S&P 500 index overall. However, this cohort has fallen from grace to start the year, tumbling as much as 14.23% in 2025 and dragging the S&P 500 lower.”

One US commentator argued on CNBC last week that the other 493 stocks (with the M7) haven’t fallen much or have risen, indicating that “breadth” is coming to the index. This means other stocks can take the S&P 500 higher, provided Trump’s tariffs don’t undermine the US economy and market confidence. This group of stocks were up 5.12% over the first two months of the year, while the S&P 500 was down 5.7%, thanks in large part to the M7’s slide.

If we assume the M7’s fall might be over and other stocks should do well, IHVV should be back in play. Backing the S&P 500 is also ‘betting’ Donald Trump will want Wall Street to rise on his watch.

Given there are 100 stocks in HNDQ, which captures the top 100 stocks in the Nasdaq Composite index, then those other 93 companies could still have some rise in them, given many of these will be tapping into artificial intelligence innovations.

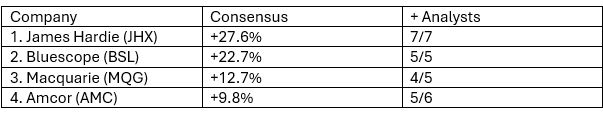

If you don’t want to invest in ETFs and you worry about hedging, you could invest in Aussie stocks with a big exposure to the US economy. Here are some companies that the analysts like that make a lot of their money in the US.

But what if I don’t have any cash to be a buyer now? Well, it might mean selling stocks likely to lose or not gain much over time. Here are some good companies that the analysts think have little upside.

Or you could reduce your exposure to some of the top 20 stocks I listed above, though you wouldn’t do that if you have them for income and bought them at much lower prices.

This is one reason why I think the analysts very negative view on CBA is excessive. I think it falls as the market chases stocks that will do well with falling interest rates, or stocks such as BHP and Rio Tinto as China grows stronger. But I can’t see the CBA slumping 26.2%, let alone the 37.67% slump Citi is predicting. That said, six out of six tip double-digit falls for the country’s best bank and the world’s 22nd safest bank, according to gfmag.com.

Note, no US or UK bank was seen as safer than CBA. That’s why I’ll be buying CBA if the market is silly enough to take its share price down from the current $145.60 to the analyst’s tipped price of $107.45.