Two things can be said about Trump’s new tariffs and trade war 2.0. The first is that the market underestimated Trump’s resolve to weaponise tariffs, judging by market falls after news of US tariffs on Mexican, Canadian and Chinese goods.

Markets should have known better, particularly after they underestimated the magnitude of Trump’s election victory in November. Many commentators saw Trump’s tough talk on tariffs as a bluff and unlikely to be implemented.

Wiser heads took Trump at his word. Like or loathe him, Trump has a stronger mandate for the US Presidency this term and is more prepared. He said he would impose tariffs and quickly implemented a version of that.

The second thing about the tariffs is the layer of geopolitical and market volatility they add. It’s one thing when the US berates China, Russia, Iran and North Korea, and another when the US attacks its nearest neighbours through trade.

In the medium term (3-5 years), Trump’s trade war will quicken ‘reshoring’ and ‘deglobalisation’ as more US companies bring back part of their global supply chain to the US, to reduce geopolitical risk and import costs.

For now, the new trade wars could see a period of heightened market volatility. Mexico and Canada have already flagged trade retaliation and Trump has previously warned that the US would aggressively respond to any such move. The one-month reprieve for Mexico and Canada if they do more on border protection and drug control reinforces the uncertainty and unpredictability of Trump’s tariff agenda.

What happens when more countries are inevitably drawn into a global trade war? Who’s next: Denmark, if it refuses to give up Greenland? Or Panama, if it won’t play ball with the Panama Canal?

My suggestion in this column last month to reduce US equities exposure looks timely. I felt US equities had become increasingly overvalued and that Trump’s Presidential inauguration last month could trigger heightened market volatility.

That has been the case so far this week, although it’s too soon to know how markets will react to a larger trade war. It won’t be good. Tariffs are ultimately inflationary, and trade wars destroy wealth. Watch markets pare back their expectations over the next few months for rate cuts after Trump’s tariff moves.

Nevertheless, short-term volatility creates opportunity for long-term investors. As I have noted many times in this column, the key to delivering ‘alpha’ (a return greater than the market return) is to capitalise on volatility when asset prices fall too far. That is, to buy when others are selling and value increases.

I’m still moderately bullish on equities this year. Interest rate cuts overseas and in Australia will be a tailwind for equities. Falling rates, strong employment and an economy not in recession is a good combination for equity markets.

I’d use any period of extended volatility to buy into market weakness, capitalise on lower asset prices, and add to portfolio exposures.

Here are two ways to do it:

- Direct shares

ASX-listed companies that could benefit from Trump’s tariffs include ResMed Inc, BlueScope Steel and, to a lesser extent, James Hardie Industries. Among mid-cap stocks, Reliance Worldwide Corporation is another to consider.

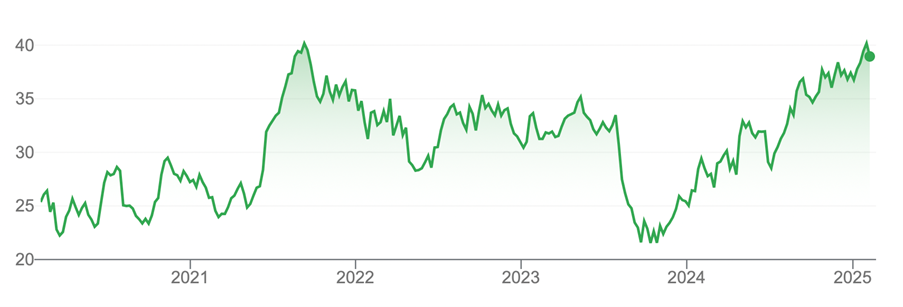

ResMed, a sleep apnea device maker, has manufacturing facilities in California and other parts of the US, Singapore and Australia. Unlike many medical device manufacturers. ResMed doesn’t rely on manufactured imports from China, which was slapped with a 10% tariff by the US and possibly more in time.

ResMed’s competitive position could improve as key competitors that rely on Chinese imports face a higher tariff. I’ve liked ResMed for a long time, having mentioned it several times in this column over the past few years. The stock still looks modestly undervalued, possibly more so if it benefits from Trump’s tariffs.

Chart 1: ResMed

Source: Google Finance

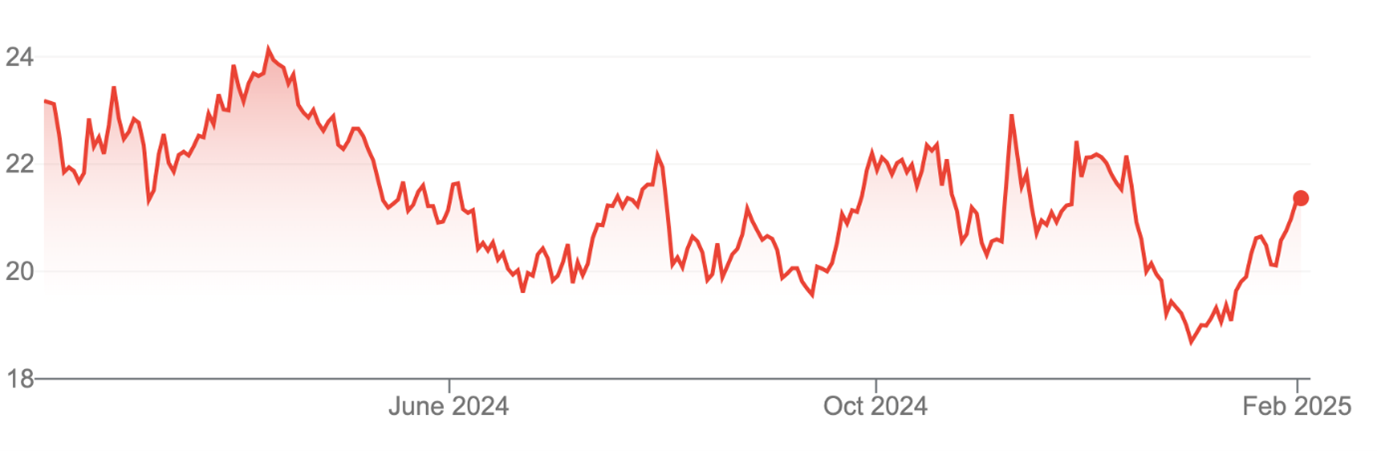

Among manufacturers, BlueScope could benefit from tariff changes due to its significant US steel-making operations. A trade war could reduce the number of cheaper steel imports entering the US, benefiting local manufacturers such as BlueScope. But the stock looks fully valued at its current price.

Chart 2: BlueScope Steel

Source: Google Finance

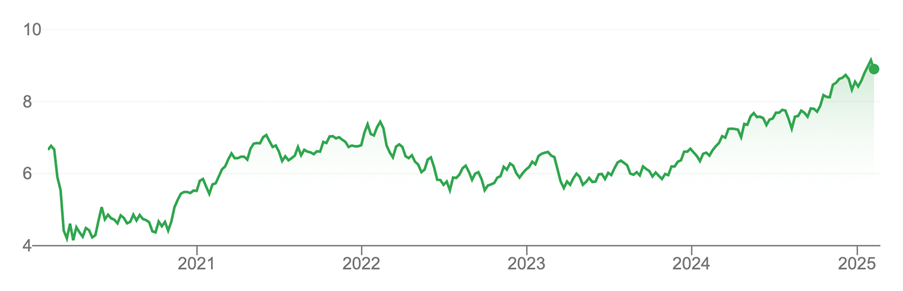

James Hardie Industries, a global manufacturer of cement fibre products, is another potential beneficiary. The company has multiple US manufacturing plants and a strong Australian manufacturing base. Again, if the tariffs encourage a shift towards more local building materials manufacturing, James Hardie could benefit. But, like BlueScope, James Hardie looks fully valued at its current price.

Chart 3: James Hardie Industries

Source: Google Finance

Of the three stocks, I favour ResMed for long-term investors, but caution that buying stocks on the basis of trade speculation is risky. It’s too soon to know how companies will adapt their global purchasing to respond to tariffs or unintended consequences of Trump’s trade war. Moreover, a potential tailwind from tariffs is one of many factors to consider for these companies and their valuations.

- Sector tilts

I prefer this approach to buying direct shares on trade speculation. With sector tilts, I’m using market volatility to add to exposures in sectors I already favour, such as global banks and Australian resource companies.

I have outlined the case for global banks several times in the column in the past 18 months, so will provide only a brief recap here. US and European banks are significantly cheaper than Australian banks, despite serving substantially larger markets and operating in broadly similar regulatory regimes.

My preferred exposure, the BetaShares Global Banks ETF – Currency Hedged – (ASX: BNKS), is up 32% over one year to end-December 2024.

By lifting the cost of goods, Trump’s tariffs could add to inflation and potentially force central banks to delay rate cuts – or at least consider delaying them until they see the effect of Trump’s policies.

On balance, higher rates support a higher net interest margin for banks (the difference between interest received and paid) and thus bank earnings growth, provided higher rates don’t lead to a spike in bad debts, which hasn’t been the case so far.

Gains might be tempered from here, but I still like the outlook for global banks and the BNKS ETF.

Chart 4: BetaShares Global Banks ETF – Currency Hedged

Source: Google Finance

Australian large-cap resource stocks also look interesting after a tough 2024. Being overweight Australian banks and underweight Australian resource stocks was a crucial trade in 2024, and one many asset managers got wrong.

I, too, have avoided Australian banks, particularly the Commonwealth Bank, believing it is overvalued by global standards. I continue to like commodity producers this decade, principally on expectations of supply constraints.

The SPDR S&P/ASX 200 Resources Fund (ASX: OZR) is a simple way to gain exposure to Australian resource stocks via an Exchange Traded Fund.

About 40% of OZR is held in BHP Group, my favoured local resource stock. Woodside Group, which also looks undervalued, Rio Tinto, Fortescue and Santos comprise another 30% or so of the ETF, which is unhedged for currency moves, so would benefit from further falls in the Australian dollar against the Greenback.

OZR returned -15.3% to end-December 2024, such has been the underperformance of large-cap resource stocks, amid fears of slowing Chinese economic growth and subdued global growth. Over three years, OZR’s annualised return is a paltry 5.4%. It’s been a tough few years for large-cap miners.

A recovery could take time, but OZR’s average Price Earnings (PE) ratio of 10.7 times seems undemanding for miners of this quality. The ETF has a trailing yield of 5.4% before franking, meaning investors can receive a decent yield while they wait for the market to re-rate valuations of large-cap Australian miners. A recovery will take time and won’t occur in a straight line. Expect setbacks along the way.

OZR fell 1.7% on Monday when the market reacted to the new US tariffs. Clearly, the market is concerned about the impact of the tariffs on global demand and commodity prices. That could be an over-reaction – and an opportunity to buy some of the world’s best miners during tariff-related market weakness.

Chart 5: SPDR S&P/ASX 200 Resources Fund

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 5 February 2025.