Question 1: When looking at a stock, should I consider the ‘short’ position in the stock before deciding to buy it?

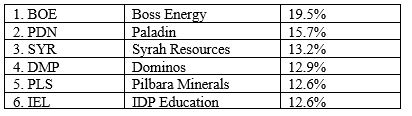

Answer: I think it’s one factor to consider, particularly where there’s a significant short position. By that, I mean when the short sellers have sold more than 5% of the ordinary shares. ASIC requires short sellers to report daily and then collates the information. We publish the top 20 shorted stocks each Saturday.

While the short sellers don’t always get it right, they are “professionals”, and they get it right more often than they get it wrong. Looking at the big short positions now, they clearly don’t like uranium and rare earth stocks and are still somewhat negative on lithium stocks. Dominos and IDP Education are also on the nose.

Here’s a list of the top 6 stocks currently shorted:

Question 2: We have shares in KTIG (KTG), a West Australian company with a modern welding method for fabrication. It has been suspended on the ASX for some time but has sent a proposal to shareholders to purchase another company and, of course, want shareholders to pay. That sends a ‘red flag’ to me, but the alternative is delisting and loss of any equity. Should we vote at the proposed meeting for the new venture?

Answer: While I would be very mindful of this type of corporate transaction, you are a shareholder in a company with only $345,000 cash on hand (at the end of December) and where the shares have been suspended from the ASX for more than a year. Arguably, your shares are worthless. I suggest you read carefully the Independent Expert’s Report and then decide how to vote. You don’t have to invest more monies. My guess is that you have no realistic option but to support.

Question 3: Aristocrat Leisure (ALL) seems to go from strength to strength. While I am a little wary of gambling stocks, I am interested to know whether the brokers see further upside.

Answer: While the brokers feel that Aristocrat Leisure is fully priced, they all have “buy” recommendations. The consensus target price is $72.75, about 1.2% lower than the last ASX price of $73.62. The range of target prices is a low of $63.50 through to a high of $80.

The brokers like recent contract wins, the lower AUD, and the cash generation, resulting in ongoing share buybacks. ALL holds its AGM on 20 February and should update the market on recent trading performance/outlook.

Question 4: When is the Commonwealth Bank (CBA) due to report its earnings?

Answer: CBA will report its half year earnings next Wednesday 12 February. This will be before the market opens.