Like many parents, I was relieved when kids returned to school this week. After an uncertain summer, the structure of school routine is needed.

I’m also nervous about the prospect of another disrupted year of learning. A jump in Covid infections at schools and occasional remote learning seems inevitable. Having had two years of Covid turmoil, kids badly need education continuity. Yet here we are in year three of disruption. Sadly, more kids will fall behind on learning.

In July 2021, a McKinsey study found US school kids (kindergarten to year 12) were on average five months behind in mathematics and four months behind in reading due to the pandemic. Students from disadvantaged backgrounds were hardest hit.

The result will be higher demand for private tutoring. Some parents will pay to have their kids tutored after school to help them catch up on learning. Others will subscribe to online mathematics and reading programs to supplement their child’s learning.

That’s good for ASX-listed education stocks like Kip McGrath Education Centres and 3P Learning. If these companies can’t grow faster during a pandemic – when demand for supplemental school learning is rising – they never will. This is their time.

My sense is more parents in 2022 will decide that two, possibly three years of disrupted learning is too much, at least for some kids. They will invest in extra learning support, fearful that their child might never catch up or fall too far behind.

Yes, it’s dangerous generalising about education. Every kid is different. For some, remote learning was fine. Perhaps they go to a well-resourced school that has invested in additional teaching support independently (or via government support).

Perhaps we’re past the Omicron peak and the school year might be more settled than expected as case numbers decline before winter. Let’s hope so.

My sense is that 2022 will be immensely disruptive for schools as more kids and teachers get Covid. In turn, that should mean a good year for tutoring companies that have strong online offerings. I noticed a couple of tutoring companies advertising on TV during the Australian Open. Clearly, they see an opportunity.

The two stocks below are micro-caps that suit experienced investors who understand the features, benefits and risks of investing in this part of the market.

1. Kip McGrath Education Centres (KME)

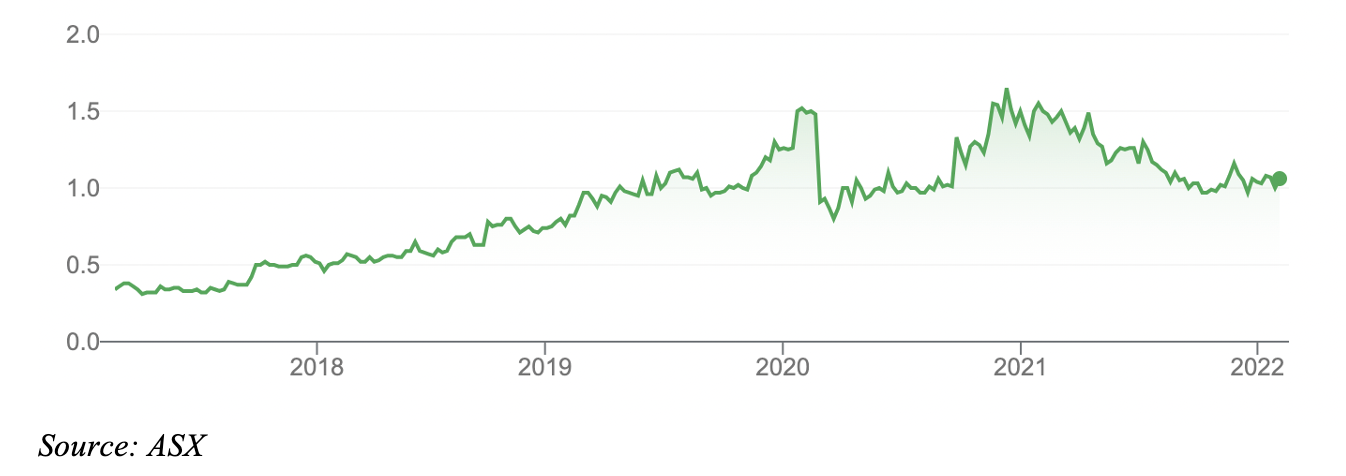

I covered the franchisor of after-school tuition in this report in October 2020. (“Two winners from the pandemic fallout”). Kip McGrath rallied from $1.20 then to a peak of $1.60, but now trades at $1.05, on low volume. KME drifted lower for most of 2021.

The market expected faster growth from Kip McGrath. Its FY21 revenue rose almost 13% to $19.27 million. Underlying profit (EBITDA) eased 3.1% to $5.1 million.

The earnings headwind was a drop in face-to-face lessons because of lockdowns during the pandemic. Growth in online tutoring was a highlight, but not enough to offset the fall in personal tutorials from Covid.

My interest in Kip McGrath is fourfold. First, Covid has quickened the move to online learning. At its AGM in November, Kip McGrath said online lessons increased by 121% (654,000 in FY21). Total lessons remained constant.

Online lessons have higher margins and potentially much higher volumes. The opportunity is to transition the lesson mix towards online learning and target global markets. E-learning takes Kip McGrath into new, larger markets.

Second, Kip McGrath is getting much-needed scale. In FY21, it bought learning centres in Brisbane, Melbourne and Perth, and Gloucester in the UK.

In September 2021, Kip McGrath announced it had acquired a 70% stake in Tutorfly, an incubator tutoring business in the US (it has an option to buy 100% if certain revenue milestones are met). Tutorfly is a platform that connects students to tutors. It looks like a clever platform to connect students with online tutoring by the hour.

Kip McGrath has bolstered its management resources with a few key executive hires last year. The company is also investing more in marketing and brand awareness.

Having followed Kip McGrath for years, I always thought it felt more like a family-owned business that should have stayed private. Kip McGrath seems to be finally building the infrastructure required to scale its online tutoring opportunity in a global market.

The fourth reason is valuation. If Kip McGrath can maintain high growth in online tutorials, it will be worth a lot more in the next five years than it is today.

Strangely, the pandemic could be the making of Kip McGrath as more kids require after-school tuition, and as blended online learning becomes the norm in tutoring. Kip McGrath has plenty of competition but also a solid base to build on.

Kip McGrath is due to report its FY22 interim result later this month.

Kip McGrath Education Centres (KME)

2. 3P Learning (3PL)

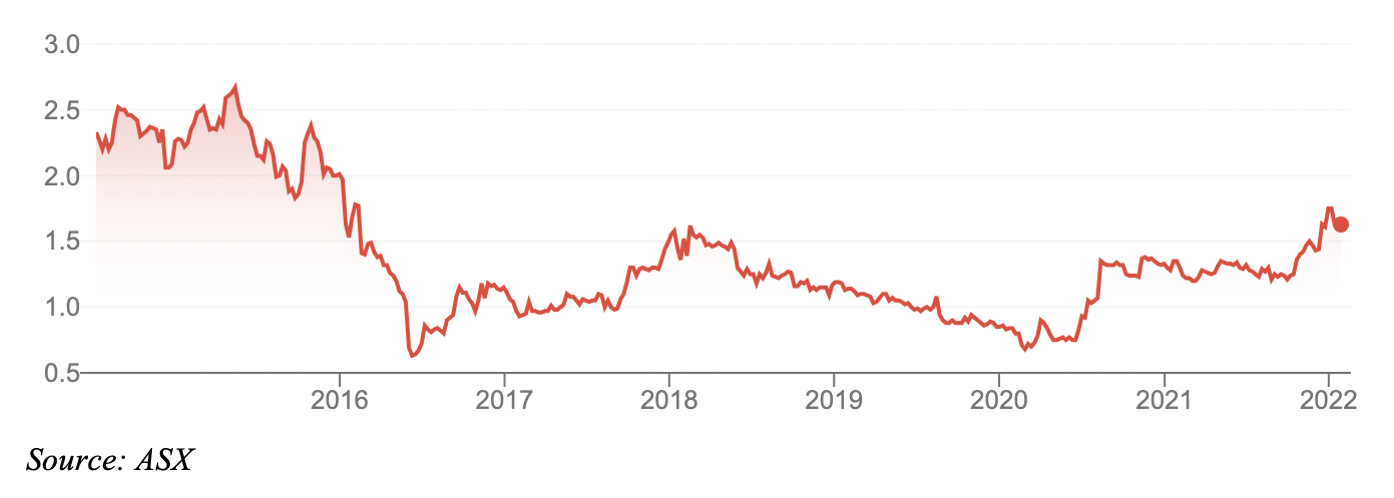

I covered 3PL for this report in August 2020, along with Janison Education Group and ReadyTech Holdings (3 Education Stocks the Coronavirus is Helping). 3PL was $1.06 then and now trades at $1.63, having peaked at $1.85 in early January.

To recap, 3PL provides popular online learning programs, such as Mathletics and Reading Eggs. The stock disappointed for years after its Initial Public Offering in 2014. It floated at $2.50 a share and hit 60 cents during the sharemarket crash in March 2020.

Management changes, complications in trying to sell in the US and disappointing earnings hammered 3PL. Its literacy and numeracy products were world-class, but like many tech companies, 3PL struggled to commercialise its technology fast enough.

Institutional investors have seen value in 3PL. There have been a few unsuccessful takeover bids in the past few years, notably from private equity. Other firms have wanted to get their hands on 3PL’s intellectual property.

In April 2021, 3PL merged with Blake eLearning. The deal made sense: 3PL’s strength in numeracy (through Mathletics and Mathseeds) and Blake’s strength in literacy education.

The merger adds scale to 3PL, helps it cross-promote its products to school customers and should deliver significant annual cost savings.

As part of the merger, 3PL has sharpened its focus to concentrate on the 3 Rs (reading, writing and arithmetic) in the school and direct-to-consumer markets. That’s a smart move: 3PL strayed too far when it moved into science and other areas.

I can imagine more schools and parents buying subscriptions to 3PL products during the pandemic. Nobody wants children to fall behind in foundational learning skills. Developing countries should be a stronger source of growth for 3PL.

Granted, 3PL has had its share of false starts over the years. I remember visiting the company at its North Sydney offices soon after it floated and being blown away by its creativity and innovation. I thought at the time that 3PL could become one of Australia’s great small-cap companies with a global footprint. That never happened.

For all the hiccups, 3PL has excellent products. The company is ideally positioned for the boom in online learning – and for the catch-up in after-school learning that is coming as more parents worry about the effect of Covid on their children’s education.

More will be known when 3P Learning reports its half-year results on 24 February.

3P Learning Limited (3PL)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 3 February 2022.