A recurring theme in this column is to buy high-quality stocks during bouts of market volatility. That is, pounce on value when other investors panic. That is the essence of active investing and the key to generating attractive risk-adjusted returns from portfolio equity allocations over the long term.

It’s not rocket science. You buy undervalued, quality companies and hold them until they become overvalued, a process that often takes years. Along the way, you take advantage of market corrections to buy more stock in these companies when markets fall or sell stocks when markets rally.

This column spends much time on the valuation side of that equation, finding stocks or Exchange Traded Funds (ETFs) that have fallen below their true value. Less time is spent on quality. That is, defining what ‘high-quality company’ means and how investors can gain exposure to the market’s best companies.

My preferred quality metric is Return on Equity (ROE). Yes, competitive advantage, pricing power, market position, management, and brand are all markers of company quality. So, too, are balance sheet, free cash flow and earnings stability.

ROE captures these quality markers. Simply, ROE shows how hard each dollar of shareholder equity is being worked. Companies with high and rising ROE (above 15%) over long periods typically have a valuable competitive advantage.

The rate of ROE varies by industry. A high-growth software company with fat profit margins will have a higher ROE than a company in a heavily regulated, mature industry. But the tech company’s valuation might already have priced in that ROE.

The general point remains: the best companies work every dollar of shareholder equity harder each year, then reinvest more earnings into the business rather than pay higher dividends. Why? Because they compound those earnings due to a high, rising ROE. REA Group is a great example.

Quality even more important

Owning high-quality companies with attractive ROE is always important, especially so now given rising macroeconomic and geopolitical risks.

I wrote last week that I am concerned by this latest market correction. It feels more like a damaging pothole than a speed bump in the road.

The equivalent of decades of change in US foreign policy has occurred in weeks. How this plays out is anybody’s guess. The only certainty is heightened market uncertainty and volatility. This is no time to own low-quality companies.

The good news is this volatility will create opportunities to buy more stocks trading below their intrinsic or true volatility. This should be a great time for active investors who can capitalise on volatility and value.

Investors who ‘buy this dip’ should stick to the highest-quality companies that can withstand whatever Trump throws at the global economy and geopolitical landscape. Companies that have the resources to withstand recession.

Factor-based ETFs

An expanding range of factor-based ETFs on the ASX provides more tools for investors to pinpoint the highest-quality global companies. Factor-based ETFs select, and weight stocks based on specific factors linked to higher returns or lower risk.

Factor-based ETFs are also known as smart-beta ETFs because they use rules to deviate from the composition of a benchmark index. For example, a factor-based ETF might use rules to identify companies based on factors such as value, momentum, quality, low volatility, size or dividend yield.

Smart-beta ETFs have pros and cons. In some ways, they fill a middle ground between active and passive investing. These ETFs pinpoint stocks with certain factors, rather than exactly replicate an underlying index.

Several smart-beta ETFs have disappointed investors over the years. But I still think ETFs that use rules to identify the highest-quality global companies have a role in portfolios and are a cheap, convenient way to get this exposure.

The VanEck Morningstar Wide Moat ETF (ASX: MOAT) is an example. MOAT provides exposure to a diversified portfolio of US companies that Morningstar believes are attractively priced and have sustainable competitive advantages.

Stock selections are based on Morningstar’s stock research rather than automated rules, meaning MOAT is arguably more of an active ETF than a smart-beta ETF (although it does rely on Morningstar’s rules around its moat ratings).

The ETF seeks companies with a wide economic moat. Like a castle with a moat, these companies have something special that defends their market position and helps them earn a higher ROE. Monopolies and duopolies fit the bill.

MOAT focuses on company quality and value. The ETF holds 52 stocks, including many of the world’s best-known companies.

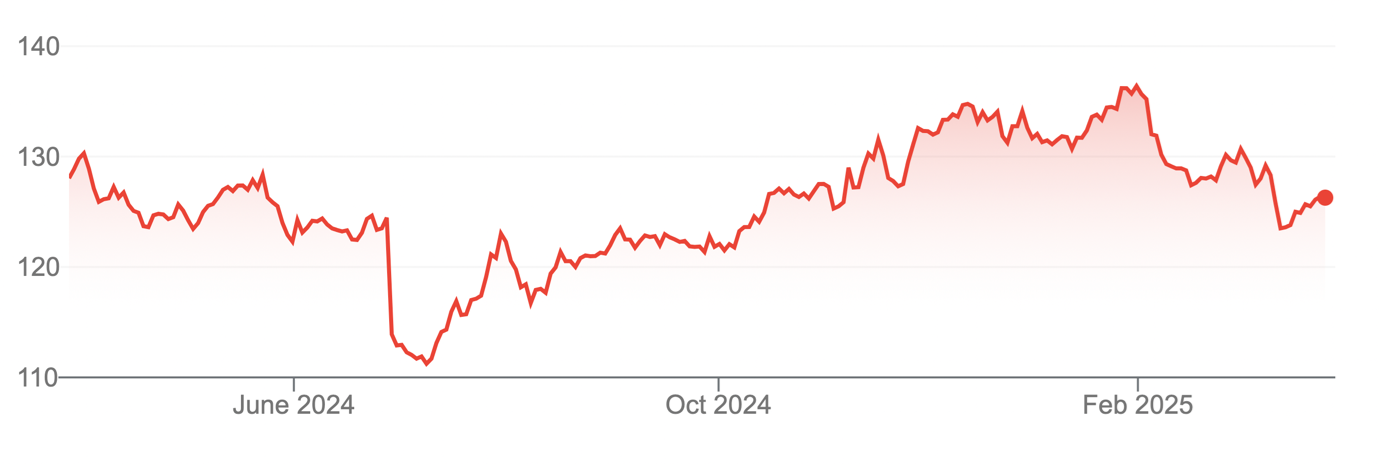

MOAT has had a relatively tough 12 months, returning 12% over one year to end-February 2024 compared to a 23.5% return in its benchmark S&P 500 index.

Since inception in 2015, MOAT has done a touch better than the S&P500 on an annualised basis.

For prospective investors, MOAT is well off its recent high. In late February, it trades on an average forward Price Earnings (PE) multiple of about 18 times, which is reasonable given the quality of companies in the ETF.

This could be an opportunity to gain exposure to high-quality companies after a period of short-term underperformance in MOAT.

MOAT invests almost entirely in US equities, albeit those it believes are attractively valued. Prospective investors should ensure this aligns with their view on US equities and does not replicate other portfolio exposures.

Chart 1: VanEck Morningstar Wide Moat ETF

Source: Google Finance

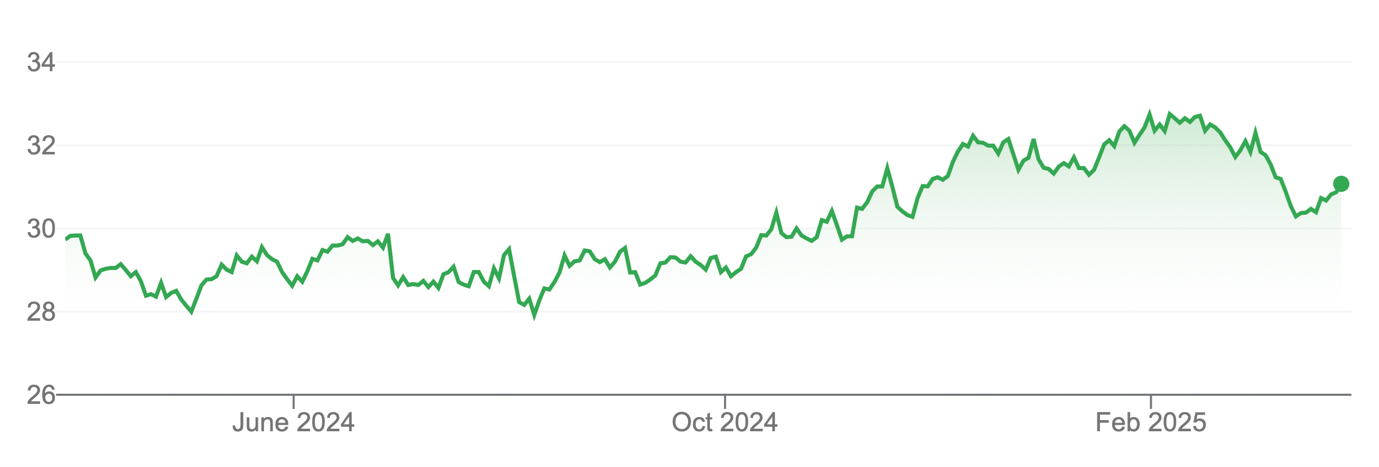

Another option is the Betashares Global Quality Leaders ETF (QLTY). This factor-based ETF invests in a portfolio of 150 global companies (excluding Australia). Almost 70% of the portfolio is invested in US equities.

The ETF’s quality ranking is based on a company’s ROE, debt-to-capital, cash-flow generation ability and earnings stability.

Like the MOAT ETF, QLTY has underperformed recently. Its 13.7% return over one year to end-February 2025 compares to 21.3% from its benchmark index.

Not holding or having low weightings in the ‘magnificent seven’ tech stocks has hurt the short-term performance of QLTY and MOAT relative to their indices.

Also, like MOAT, QLTY has done a touch better than its benchmark index since inception in 2018, again showing the value of holding high-quality companies.

ETF cynics might argue that MOAT and QLTY have delivered index-like returns over long periods while charging higher fees than broad-based indices.

That is fair. But it’s when markets tank that the value of owning a portfolio of high-quality companies rather than a mishmash of stocks comes to the fore.

With so much macroeconomic and geopolitical risk brewing, the need to focus on the market’s highest-quality companies has rarely been greater.

Of the two ETFs, I prefer MOAT because it has a valuation filter. QLTY has good methodology, and I like its portfolio, but it’s pointless owning high-quality companies if they are overvalued. Quality and valuation go hand in hand.

Chart 2: Betashares Global Quality Leaders ETF

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 26 March 2025