Stories about rising interest rates mostly focus on homeowners. Spare a thought for small businesses that will be crushed by rising interest costs and slowing demand.

One small business owner told me his energy bill had soared over 12 months. Raw material costs were up, wage pressures were growing and staff were harder to find.

I see signs of small-business pressure everywhere. Some firms have closed because their costs are now too high. Others have temporarily shut because of labour shortages.

This is before the real pain from higher interest rates hits consumers. Make no mistake: a world of pain is ahead in 2023. We have only scratched the surface.

If more small businesses are struggling to survive because of rising costs, what happens when consumer demand starts to crater? For all the cost pain, small businesses have had the tailwind of a buoyant economy and retail spending. Until now.

Sadly, it’s going to get ugly for many small businesses. I’d hate to own a business right now that relies on discretionary retail spending and has a high fixed cost base. Expect to see more vacant cafes and fashion outlets in the next 12 months.

But it’s also worth thinking about business-to-business firms that can withstand a slowing economy – and maybe even do a little better.

As always, the key is finding companies that provide “sticky” products that have high switching costs and genuine pricing power. And buying them when they trade below their true value because the market overreacts to the conditions.

Here are two small-business-related stocks to consider. One is starring; the other has been out of favour. Both stocks suit long-term investors.

1. AUB Group (ASX: AUB)

The business insurance group has been a mid-cap favourite of mine for many years. I have written on it, and, to a lesser extent, Steadfast Group, for this report several times.

To recap, AUB has a network of insurance agencies and underwriting groups in 520 locations in Australia and New Zealand. The company provides billions of dollars in insurance policies to more than 900,000 clients.

Business insurance has defensive qualities. Like many small business owners, I detest paying insurance premiums each month. But I also know that my business cannot operate with insurance. So, I maintain the policy in good and bad markets.

AUB this week reported a good result for the first half of FY23. Revenue grew 42% and after-tax net profit rose 52% on the same half a year ago. AUB’s Tysers acquisition in the UK exceeded the company’s expectations. Tysers looks like a cracking deal.

Despite upgrading its FY23 guidance, AUB fell after the result, albeit in a weak share market that was buffeted by heavy overnight falls on Wall Street. AUB says it expects “strong progress across all parts of AUB” [in FY23].

AUB’s three-year annualised return (assuming dividend reinvestment) is still a whopping 29%. Over 10 years, AUB has delivered an almost 14% return, making it one of the market’s best mid-caps.

AUB is getting closer to fair value. A consensus target of $27.28 among brokers suggests modest upside in the stock from the current $25.97. Moreover, the earnings tailwind from increasing policy premiums should begin to slow in the next few years.

But there’s still a lot to like about AUB’s long-term growth strategy and its potential for acquisitions overseas. The acquisition of Tysers, a UK firm, looks like a long-term winner and AUB Group has the balance-sheet firepower to buy more businesses.

Chart 1: AUB Group

Source: Google Finance

2. Judo Capital Holdings (ASX: JDO)

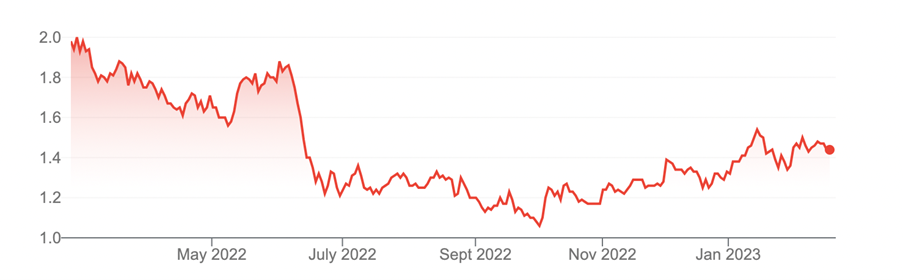

Judo has frustrated investors since its Initial Public Offering (IPO) in November 2021. From a $2.10 issue price, Judo now trades at $1.44, even though it has so far achieved or beaten prospectus targets and has barely missed a beat since its 2016 launch.

Judo targets small and medium-sized (SMEs) businesses. Judo was born from a view that Australia’s banking industry poorly serves SMEs – a proposition that remains alive and well today.

Judo delivered a solid interim result this week but was still hammered when the market sold off on Wednesday. Judo’s Gross Loan and Advances (GLAs) were $7.5 billion in the first half of FY23, up 23% on the second half of FY22. The underlying net interest margin rose 72 basis points to 3.56% – an excellent result.

Judo’s profit before tax leapt from $12.6 million in the second half of FY22 to $53.2 million in the first half of FY23. Judo also confirmed its FY23 guidance.

Judo’s loan book at $7.5 billion at end-December 2022 has almost tripled in size since December 2020. As Judo rapidly scales its operations, it will become more efficient and profitable. For a bank, it’s made great gains in a short period.

The big question is what happens with Judo in the next 12 months as demand for business credit slows and credit quality deteriorates. The risk is a spike in bad and doubtful debts as more SMEs go to the wall and cannot repay their loans.

Judo has always promoted its use of technology and human bankers. Its model is based on relationship brokers maintaining a small portfolio of customers, which means they can identify potential problem loans and act quickly to avert problems.

That model will be tested like never before this year, but Judo has a conservative lending policy and said in its latest result that its credit quality remained strong.

I doubt Judo will run into the same problems other SME lenders have faced over the years in their quest to build a bigger loan book at all costs.

As to slowing credit demand, Judo, like all banks, will be affected. But its long-term growth prospects are about building market share in SME lending, off a low base. Judo’s target of a $9 billion loan book is still a blip in the overall SME loan market.

A price target of $1.76, based on the consensus of eight broking analysts, suggests Judo is undervalued at the current $1.44.

Judo is no screaming buy and there are rising risks in SME lending. But the stock is down a third from its IPO price in late 2021, despite making strong operational progress during that time and, if anything, doing a little better than it said it would.

The market fretted about the effect of COVID-19 on SME credit demand and loan quality. Then, general equity market weakness weighed on Judo. Now, investors are concerned about the risk of recession and what that would mean for SME lending. Judging by its latest result, Judo is navigating these conditions well.

I believe Australia will avoid recession this year and that rates are getting close to their peak. As painful as will feel in the next 12 months, rate relief is getting closer. Buying a well-run SME lender near the peak of negativity has appeal.

Chart 2: Judo Capital Holdings

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 22 February 2023.