Donald Trump came good this week but the growth implications of his trade war have come back to bite him, Wall Street, the local stock market and our portfolios! A Santa Claus rally not only has to fight the snowstorm of the US President’s tariff tussle with China but its global growth implications.

That’s what the New York Stock Exchange and the Nasdaq on Times Square battled on Friday.

I’m hoping on a positive end to overnight US trade, which has been a pattern this week, that shows there are still plenty of buyers who think this current correction has created a buying opportunity but there’s not enough to change the numbers for a credible rebound.

A deal on trade should do that but that’s a few weeks off yet, if it’s to happen!

Local shares ended the week lower on Friday, weighed down by the major banks, as weaker-than-expected Chinese economic data didn’t bode well for Australia. When your best export customer is slowing down, with industrial production up 5.4% when 5.9% was tipped, your stock market can’t get excited.

The irony is that Donald said and did a couple of things this week to build up positivity about the trade war. And China agreed to take 500,000 tonnes of soybeans and talked about cutting tariffs on US cars from 40% to 15%. This is progress.

But now growth question marks in the EU, China and the UK, with its Brexit problems on top of an expected slowdown in the US, are all conspiring to hurt stock prices. Negative news is nearly always over-hyped and that’s why there’s a chance to make money out of the first overreaction. But at the moment, the trade war, with its many widespread implications, isn’t giving positivity a chance!

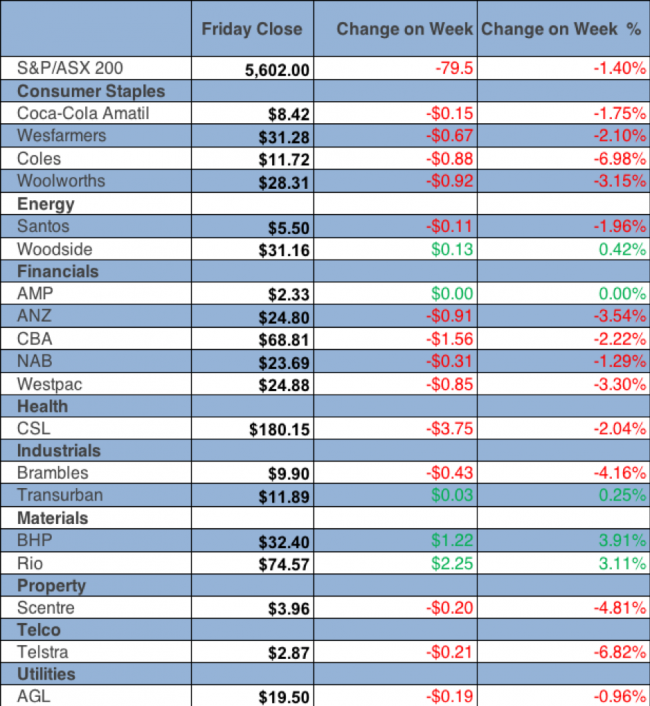

Our S&P/ASX 200 Index closed down 79.5 points (or 1.4%) for the week at 5602, which is an important support level.

The ACCC didn’t help stocks, casting doubt over the TPG-Vodafone merger, with Telstra losing nearly 7% over the week. That’s never great for the index. And when you throw in the banks that not only have Royal Commission challenges but probably a slower Aussie economy to deal with, if the China slowdown persists, you can see why we traded lower over the week.

The miners were up on better commodity prices, with BHP in its buyback week up 3.9% to $32.40, while Rio added 3.1% to $74.57. These were saviours for the overall index. For those worried about their Fortescue stocks, you’ll be happy to see “Morgan Stanley upgraded its rating for Fortescue Metals Group from an ‘underweight’ rating to ‘overweight’”, the AFR reported. Its price target goes from $3.30 to $5.05 and the stock finished the week at $4.12.

If the current market behaviour seems confusing to you, you’re not alone, as the following from AMP Capital’s Shane Oliver shows: “Share markets were mixed over the last week with nervousness around trade and global growth continuing, not helped by weak Chinese economic data. US, Eurozone and Chinese shares rose but Japanese and Australian shares fell.

Despite a rise in material stocks over the last week, the Australian share market was particularly dragged down by telcos, consumer staples, utilities and financials – seeing defensive sectors getting hit so hard (not helped by regulatory risks) makes this a rather confusing downswing! Bond yields rose in the US and Europe but were little changed in Australia and Japan.”

But on the important market-killing problem of the trade war, I liked Shane’s take: “Our view remains that there is a strong incentive for both sides to make a deal to resolve the issue before it weakens their economies (which won’t be good for Trump’s 2020 re-election). It may take more than 90 days, but we expect a deal to be reached in the next 6 months.”

And for Santa Rally hopefuls, this is what Shane’s research shows:

“The Santa rally normally kicks in around mid-December on the back of festive cheer and new year optimism, the investment of any bonuses, low volumes and no capital raisings. Over the last 10 years, the period from mid-December to year end has seen an average gain of 1% in US shares, with shares up in this two-week period 7 years out of 10, albeit it’s been less reliable in the last few years. In Australia, over the last ten years, the average gain over the last two weeks of December has been 2.2%, with shares up 8 years out of 10, including in all of the last six years. Which is why December is normally a strong month.”

By the way, despite growth fears, Shane’s view on US economic data was interesting: “US data releases over the last week were strong!”

For the week ahead, the Fed meeting mid-week will be huge and what the Fed boss, Jerome Powell, says and does will have a big impact on the stock market. If he talks confidence in the US economy but says he’s holding back on a rate rise to watch how the trade negotiations play out, it would be good for stocks. Fortunately, US central banks do care about the confidence implications for Wall Street of their policy decisions.

In Australia, the Mid-Year Economic and Fiscal Outlook to be released on Monday is likely to show that the Federal budget is running around $9bn per annum better than expected and a Budget Surplus is not too far away. But this isn’t likely to help our stocks or PM Morrison’s political stocks, with so many issues to sort out in what still looks like a divided party.

What I liked

- The Westpac/Melbourne Institute survey of consumer sentiment index rose by 0.1% to a reading of 104.4 in December. The sentiment index is above its long-term average of 101.3. A reading above 100 denotes optimism. Consumer confidence in Western Australia is the highest in five years.

- The NAB business conditions index eased from +13 points to +11 points in November.

- The NAB business conditions employment sub-index lifted from +7 to +9 points in November. And the 12-month moving average rose from +9.93 points to +10.04 points in November – a record high.

- The Bureau of Statistics reports that Australian home prices fell by 1.5% in the September quarter to stand 1.9% lower over the year, which is a lot less dramatic than housing headlines.

- The number of loans (commitments) by home owners (owner-occupiers) rose by 2.2% in October – the largest gain in 15 months but loans are down by 4.8% on the year, though this is not huge, considering the disastrous housing headlines.

- The proportion of first-time buyers in the home loan market rose from 18% in September to 6-year highs of 18.1% in October (decade-average 17.7%).

- Foreigners held a record $613.8 billion of Aussie shares in the September quarter, up from $605.5 billion in the June quarter.

- Chinese fixed-asset investment rose by 5.9% in the 11 months to November on a year earlier (forecast: +5.8%), up from 5.7% growth in the 10 months to October.

- The European Central Bank announced the conclusion of its €2.6 trillion bond purchase scheme on Thursday, which rescued the EU from the GFC recession. ECB President Mario Draghi said “the balance of risk is moving to the downside”. However, Eurozone growth projections in 2019 were cut from 1.8% to 1.7%.

- Shares of Deutsche Bank lifted by 5.8% on reports that Germany was holding high level talks to facilitate a possible merger with Commerzbank (+5.6%). Improving European banks solidity is a good thing.

What I didn’t like

- Total new lending commitments (housing, personal, commercial and lease finance) fell by 1.2% in October to $70.7 billion.

- The value of loans to buy new cars fell to 30-month lows of $8.14 billion in rolling annual terms in October, but this sector has had a boom run, with interest rates so low for so long!

- NAB’s business confidence reading fell from +5 points to +3 points.

- The OECD housing report that was misreported. The Paris-based think tank thinks we will have a soft landing for house prices but its worst case scenario became the headline!

- The NFIB business optimism in the US index fell from 107.4 to 104.8 in November (forecast 107.3).

- Chinese retail rose at an 8% annual rate in the year to November, (forecast: +8.8%), down from 8.6% in October. Real retail sales rose at a 5.8% annual rate in the year to November, up from 5.6% in October.

- Chinese industrial production rose at a 5.4% annual rate in November, below the forecast average (5.9%). Production had risen by 5.9% in the year to October.

Donald’s threat to Santa

Shane Oliver’s Santa rally research shows we have good reason to hope for an end of year spike in stocks but no Christmas has ever had a US president like Donald T, as this week again showed. This is how Craig James from CommSec saw his new antics this week: “While there was some optimism on US-China trade, the US President threatened to shut down the Government over a stoush with Democrats on funding for a US-Mexico border wall!”

This argument was on TV and demonstrates my contention that this guy, this US President, is unique.

The Week in Review:

- I’m starting to buy stocks, even though the bank black cloud and the Royal Commission hangs over financial stocks.

- Would you like to kick off some investments for your kids or grandkids but not sure how to go about it? In the first of a two-part series, Paul Rickard shows you how.

- Michael Gable wrote that benign inflation, an easing of long-term yields, and GDP growth coming back to sustainable levels should leave equities in a “sweet spot”.

- Tony Featherstone suggested 3 stocks to consider for 2019 and some to discard or prune in preparation for fresh opportunities.

- It’s time to do some Christmas buying and clearing according to James Dunn so your portfolio kicks off the New Year looking good.

- In the first Buy, Hold, Sell – what the brokers say of the week, South32 got an upgrade and BHP got a downgrade, and in the second edition, Adelaide Brighton, Inghams and QBE Insurance were in the good books.

- Michael J. Wayne, Managing Director of Medallion Financial Group, selected Aristocrat Leisure as this week’s Professional’s Pick.

- Our Hot Stocks this week were Coles and Northern Star Resources.

- Maureen Jordan shared a story of ‘the accidental investor’ who never thought they’d end up investing in anything apart from a house for their family to live in.

- And in Questions of the Week, we answered readers’ queries about gold, banks and Bill Shorten’s retiree tax.

Top Stocks – how they fared:

What moved the market?

- Ongoing discussions between the US and China, Donald Trump’s willingness to intervene in the Huawei executive case and China’s purchase of 500,000 tons of soybeans.

- Oil prices rose after reports indicated Saudi Arabia would cut shipments to the United States

Calls of the week:

- Michael Gable’s stock pick for right now is the Goodman Group.

- As Maureen Jordan wrote this week, ‘AC-2’ has shown there is truth to the old proverb, “Keep company with the wise and you will become wise. If you make friends with stupid people, you will be ruined.”

- Richard Branson’s Virgin Galactic has become the first commercial company to send humans successfully to the edge of space.

The Weeks Ahead:

Australia

Monday December 17 – Overseas arrivals & departures (October)

Monday December 17 – Mid-Year Economic & Fiscal Outlook

Tuesday December 18 – Reserve Bank Board minutes

Thursday December 20 – Population (June quarter)

Thursday December 20 – Employment/unemployment (November)

Thursday December 20 – CBA Business sales index (November)

Friday December 21 – Detailed job data (November)

Monday December 31 – Private sector credit (November)

Wednesday January 2 – CoreLogic Home Value Index (December)

Overseas

Tuesday December 18 – US Housing starts (November)

December 18-19 – US Federal Reserve decision

Thursday December 20 – US Existing home sales (November)

Friday December 21 – US Economic growth (September quarter, final)

Friday December 21 – US Personal income (November)

Friday December 21 – US Case Shiller home prices (October)

Thursday December 27 – US Consumer confidence (December)

Friday January 4 – US ISM manufacturing (December)

Friday January 4 – US Non-farm payrolls (December)

Switzer Stumper

Where does Frosty the Snowman keep his money?

Reply to this email with the correct answer for your chance to win an extra month on your subscription!

The answers to last week’s question was: Noel (No ‘L’)

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

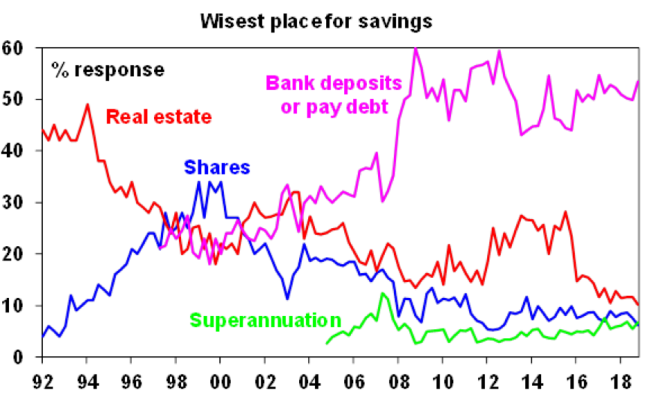

According to the latest Westpac/Melbourne Institute survey, consumers believe bank deposits and paying down debt are the wisest place for their savings, making up 31% and 23% of responses respectively, while only 6% chose shares:

Source: Westpac/Melbourne Institute, AMP Capital

Top 5 most clicked:

- Up for some Christmas buying? – Peter Switzer

- 3 stocks to pop in your stocking and 2 to take profits on – Tony Featherstone

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

- Sweet spot for stocks – Michael Gable

- Investing for your kids or grandchildren – part 1 – Paul Rickard

Recent Switzer Reports:

Monday 10 December: It’s Christmas time

Thursday 13 December: Countdown to Christmas

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.