Australia’s largest infrastructure company, Transurban, has launched a $3.9 billion capital raising to fund the purchase of Sydney’s WestConnex toll road project. Transurban shareholders will have the opportunity to purchase additional shares in the company at $13 per share.

But should you participate? What are the options? And, given the enormous interest being demonstrated by big super and others for infrastructure assets including Sydney Airport, Spark Infrastructure and AusNet, should you follow their lead and perhaps increase your exposure?

We will explore these issues and others. But first, the background on the project and the purchase arrangements.

The WestConnex Project

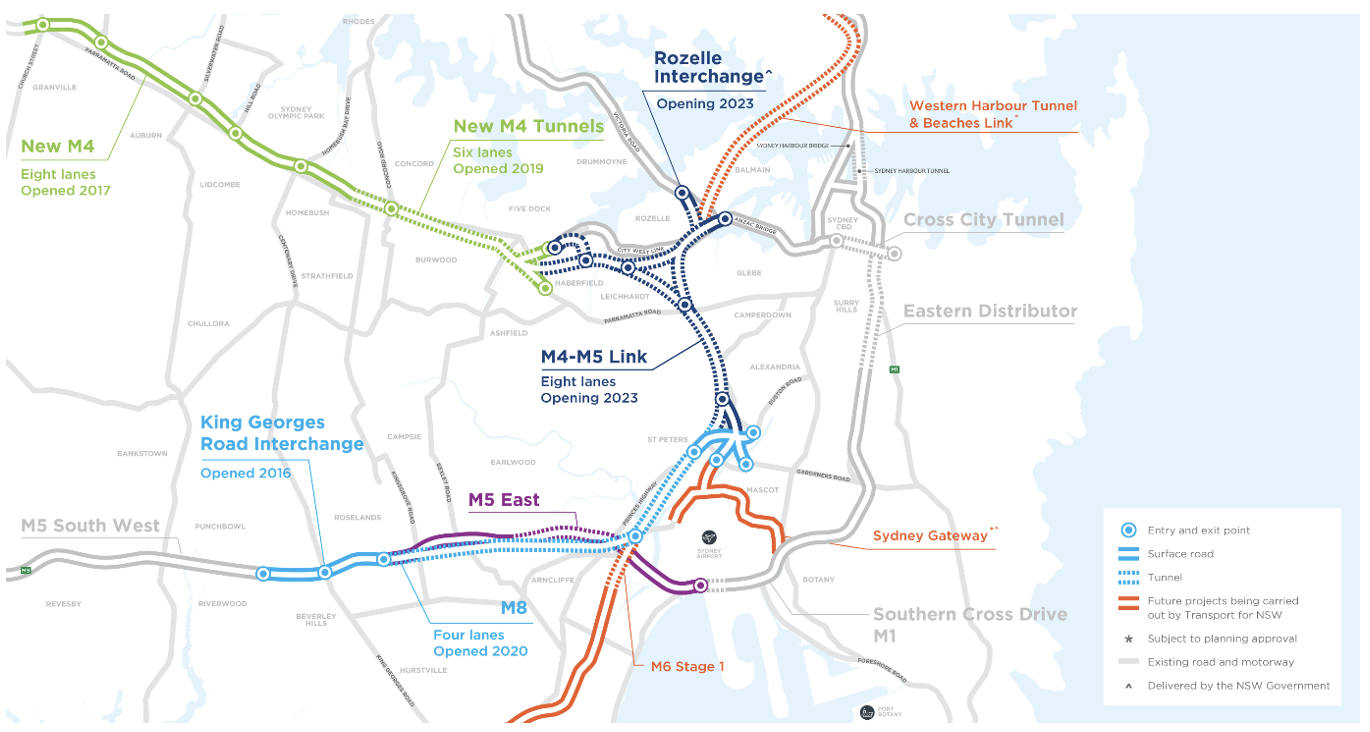

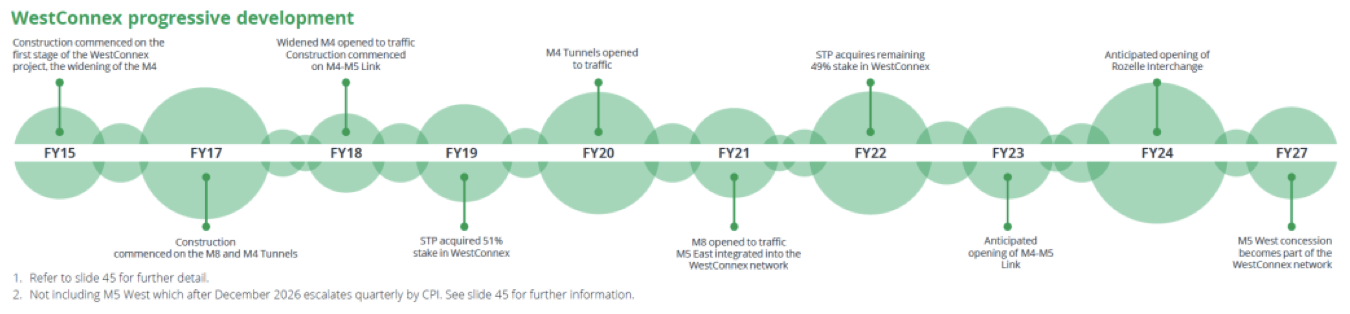

WestConnex consists of six separate assets that will form a 70km network of toll roads linking Sydney’s west with the Sydney CBD, Sydney Airport and Port Botany. Four of the six assets are operational and two construction projects are ongoing.

The project commenced in 2015 with the widening of the M4 to four lanes in each direction from Parramatta to Homebush. The M4 was extended further east via a 5.5km twin tunnel, which was opened to traffic in July 2019. The second phase of the project saw the development of the M8, a new 11km motorway in Sydney’s south-west that includes twin 9km tunnels from Kingsgrove to St Peters.

The final stage of the project includes the M4-M5 link tunnels, new 7.5km tunnels of four lanes in each direction connecting the M4 tunnels at Habberfield to the M8 at St Peters. This is due to open in 2023. The Rozelle Interchange and Iron Cove link will provide connections to Anzac Bridge and should open in the early part of 2024.

The $16.8bn project is on budget, with approximately 82% of capex already expended.

Once completed, WestConnex will comprise six assets owned across three separate concession agreements with each expiring in 2060. Tolls for each vehicle class are based on distance travelled and flag fall up to a cap, and escalate at the greater of 4% or CPI until 2040, and thereafter at the greater of 0% or CPI to concession expiry in 2026.

Purchase from the NSW Government

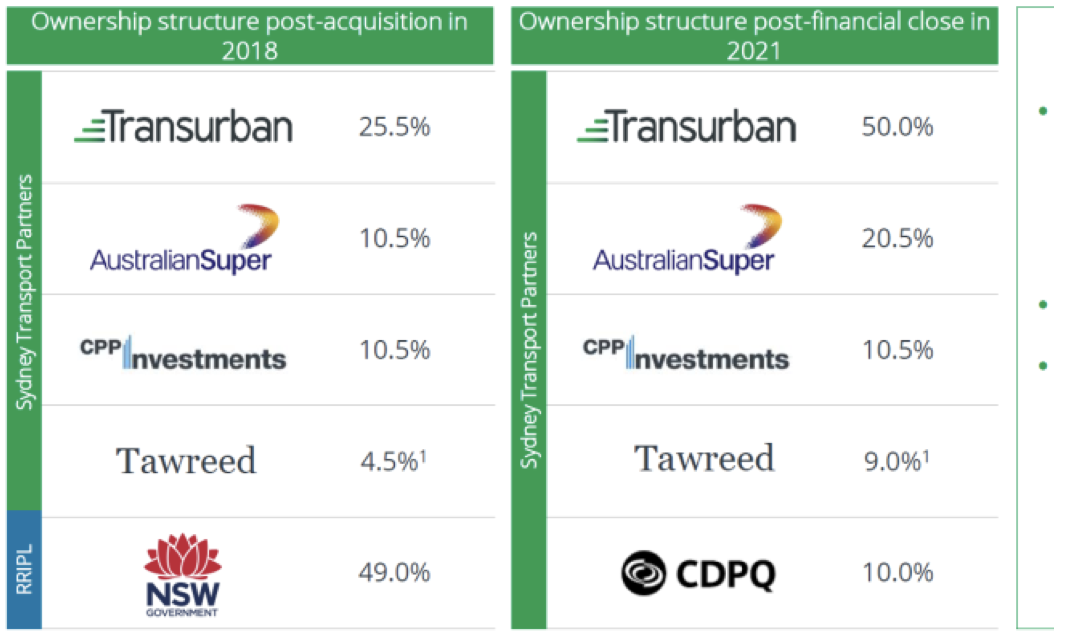

Sydney Transport Partners, of which Transurban will own 50%, is buying the remaining 49% of WestConnex from the NSW Government for $11.1bn. The original 51% was purchased in August 2018 for $9.7bn.

The ownership structure of Sydney Transport Partners, which will own 100% of WestConnex, will be Transurban with 50%, Australian Super with 20.5%, The Canadian Pension Plan Investment Board with 10.5%, CDPQ (a global investment group managing funds for public retirement and insurance plans) with 10% and Tawreed (a subsidiary of the Abu Dhabi Investment Authority) with 9%.

To fund its share of the purchase price (50% of $11.1bn or $5.56bn), Transurban is raising $3.9bn through an entitlement offer, a further $0.25bn through a special placement to Australian Super at $13.07 per share, and using $1.41bn from available cash facilities.

The Entitlement offer

Shareholders will receive entitlements on the basis of 1 new share for every 9 existing shares, with fractions rounded up. For example, if you hold 1,000 Transurban shares, you will receive 112 entitlements. Each entitlement allows you to buy 1 new Transurban share at $13 per share.

The entitlement price of $13 is an 8.3% discount to Transurban’s closing price on 17 September of $14.18, and a 7.5% discount to the theoretical ex-rights price of $14.06.

The offer to institutional investors has already been completed with $2.9bn raised. Approximately 93% of entitlements were taken up, with the shortfall being cleared in an institutional auction at $13.90, 90 cents higher than the entitlement price.

The retail offer of approximately $1 billion opens today (27 September). Shareholders have three choices:

- To take up their entitlements by paying $13 for each new share. Payment is due by Friday 8 October;

- To sell their entitlements on the ASX. These trade under the ticker TCLR, with trading due to cease on Friday 1 October; or

- Do nothing. In this scenario, your entitlements will be auctioned to institutional investors through a retail shortfall bookbuild on 12 October. If there is an excess of the bookbuild price over the entitlement price, that will be paid on 20 October.

Forecasts and risks

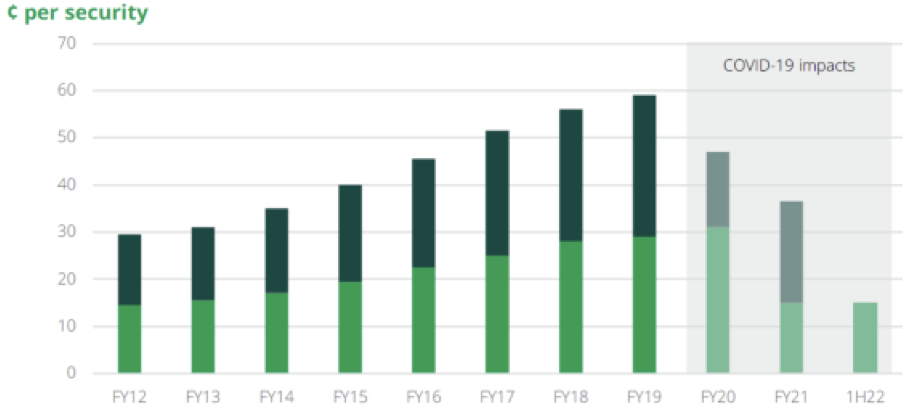

Transurban has provided distribution guidance for the first half of FY22 (1H22) of 15 cents per share. This will also be paid on the new shares issued as part of the capital raising.

Due to Covid-19 and lockdowns, they are not prepared to go any further except to say that the “total FY22 distribution is expected to be in line with FY22 free cash, excluding capital releases’’. Commenting on the acquisition, Transurban says that the acquisition is expected to be free cash accretive over the near, medium and long term when including capital releases, and slightly dilutive near term excluding capital releases.

Distribution History (1H light green, 2H dark green)

Due to Transurban’s increased stake and the project’s capacity to take on additional debt over time, the company says that it expects around $600m of capital releases until FY25. This is in addition of over $2.6bn of potential capital releases across the whole Transurban portfolio from FY21 to FY25. Some of these releases will be used to support higher distributions.

Ultimately, traffic flow remains the major risk. The impact of Covid-19 through lockdowns and people choosing to work from home is demonstrated in the chart of Transurban’s distributions. Compared to the same week in 2019, traffic in Sydney is currently down about 40%, Melbourne is down 50%, Brisbane is flat and north America is down around 10%.

Lockdowns will end and ‘normalcy’ will return – the unanswered question is whether “working from home” becomes a permanent feature and impacts traffic volumes over the long term.

Another risk for Transurban is the dispute over the construction of the West Gate Tunnel project in Melbourne. Work on the project has largely stopped with the construction costs blowing out by more than $3.3bn, plus another $600m for revenue delays and Transurban’s direct costs. Transurban expects that it will wear some of the construction cost blowout, along with the tunnel contractor and the Victorian Government.

Transurban carries around $15bn of net debt, and the WestConnex project has another $10bn. While Transurban says that over 99% of its existing debt book is interest rate hedged with an average tenor of close to 8 years, if interest rates rise, then Transurban faces a re-financing risk. The market also tend to look at Transurban as a “bond proxy” stock, so if bond yields rise, this may put pressure on Transurban’s share price.

What do the brokers say?

Several of the major brokers are involved in the fund raising. Certainly, no-one was surprised that Sydney Transport Partners was the successful acquiring party of WestConnex and that Transurban would need to raise capital to fund its share. A $4bn capital raise had been speculated about for several months.

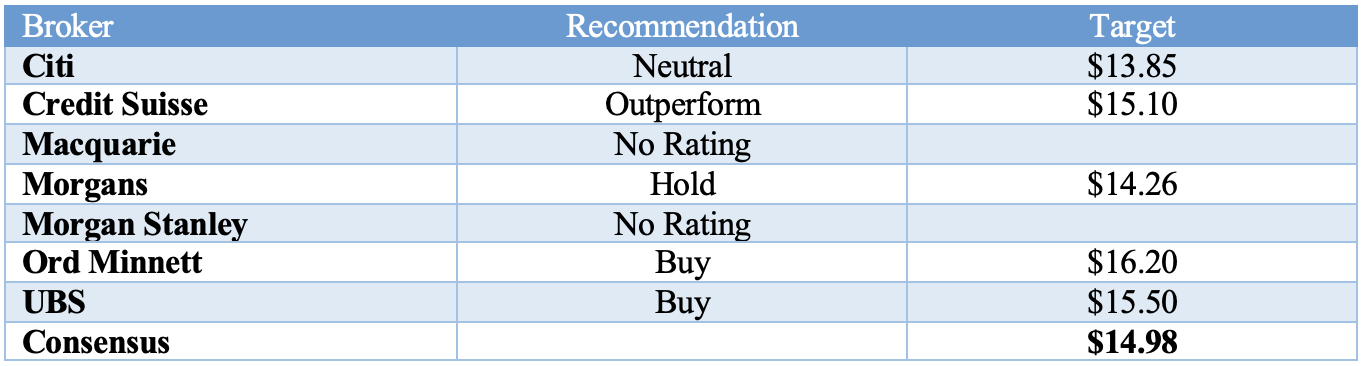

Overall, the major brokers are positive about the deal and Transurban. According to FN Arena, the consensus target price is $14.98, about 6.6% higher than Friday’s closing ASX price of $14.05.

On consensus, they forecast a total distribution of 45c for FY22 rising to 62.8c in FY23. This puts Transurban on a prospective yield of 3.2% (unfranked) for FY22 and 4.5% (unfranked) for FY23.

Here’s my view

Until recently, I was feeling a little “non-plussed’ about Transurban. A moderate yield, the likelihood that working from home will become a permanent change for many post the pandemic, development risk with the West Gate Tunnel and bond yields moving higher suggested that it was time to ease back on exposure to Transurban.

But the recent flood of institutional monies into infrastructure assets has swayed my thinking. In the space of a few week, we have seen bids for Sydney Airport, Spark Infrastructure and AusNet Services. Big super and others are aggressively pursuing these assets.

The remaining ASX listed infrastructure assets include Transurban (now clearly the biggest), Atlas Arteria, Auckland International Airport and possibly AGL. For retail investors, there aren’t many alternatives.

For me, it is a case of “follow the money”. So, I plan to take up the entitlements and maintain exposure. I don’t plan to buy more, but on a good correction that took Transurban back into the realm of yielding closer to 5% (unfranked), I would look to increase exposure.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.