What I’m about to put before you as a risky investment opportunity isn’t bitcoin but it could be potentially as rewarding, though it does come with a risk factor akin to cryptocurrencies. The irony is that you’d be putting your money into some of the best companies in the world!

Charlie Munger, the man Warren Buffett says taught him to invest for the long term, has surprised the investing world by doing what I’m going to look at here below.

But be aware — I’m not recommending this play of investing in some of China’s best companies. No, I’m just informing you what Buffett’s investing mentor has done!

That said, there might be a safer way to play this risky reliance on what the leadership in China might do in the future to hurt some of its best companies and their share prices.

A CNBC look at this very important investing buddy of Buffett’s revealed that “Munger taught Buffett to look for long-term investments – companies that would be successful for a long period of time, rather than those that might have ‘one puff left in the cigar’. This pivot in strategy was a key move toward the growth and tremendous success of Berkshire Hathaway.”

On Munger, this is what Buffett said: “It’s better to associate with people who are better than you are.”

Well, Charlie shocked a lot of people by adding to his big bet into China’s star but Beijing-battered Alibaba! Munger now holds 302,000 shares valued at $45 million.

“When something is outperforming, then you need to think about rebalancing to areas that have gone on sale. China has gone on sale,” said JPMorgan’s Asset & Wealth Management CEO, Mary Callahan Erdoes.

In contrast, Social Capital’s Chamath Palihapitiya is warier. “What I’ve seen over the last six months has really shaken my confidence in my ability to predict what happens next. And so from my perspective, it’s a place that…I will read about and not invest in”.

But Munger isn’t alone in backing China, with the chief investment strategist at Blackrock’s Investment Institute telling investors they should increase their exposure to China “threefold!” “China is under-represented in global investors’ portfolios but also, in our view, in global benchmarks,” Wei Li of Blackrock’s told businessinsider.com in August this year, adding that the allocation shift should include both stocks and debt.

In contrast, Goldman Sachs has gone public in stating that it has cut its exposure to Chinese companies by 20% in July, as the corporate crackdown intensified.

Wei Li actually sees Beijing’s big company witch hunt as part of a business cleansing programme that will be long-run positive! Aside from internet companies such as Tencent, Alibaba and Baidu, the private education tutoring businesses, along with online gaming operations, have been bought to book.

There have even been threats that Chinese companies on the US stock market would be banned and deregistered! Investing in China is very much looking like the investment Warren Buffett would not recommend for us. Why?

Well, he’s always advised: “Never invest in a business you cannot understand.” So, given Munger’s influence on Buffett, I guess Charlie thinks he understands China’s leaders and what their impact on Alibaba will be.

So what has happened to Alibaba and other online mega-companies from China?

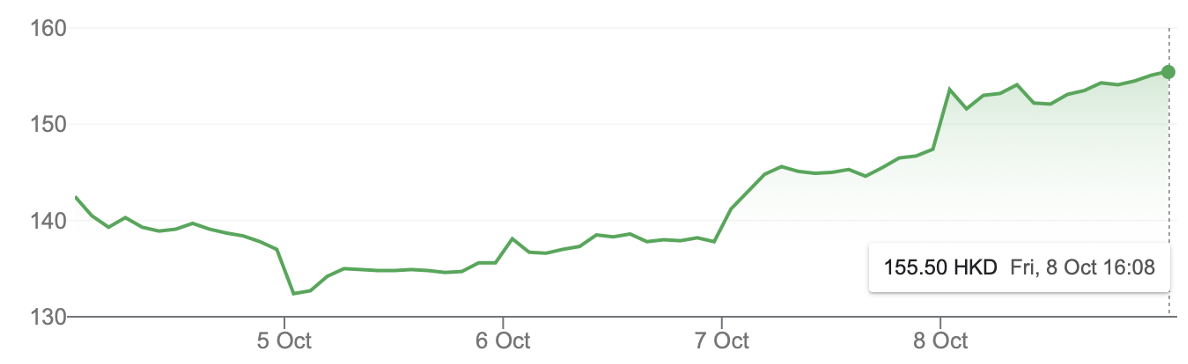

Over the year, the share price has gone from $HK292 to $HK155, or a slide of 46%.

Alibaba

But attitudes are changing, at least in some quarters of the investing community.

Alibaba 5 days

The stock has spiked 9.12% in five days. So there is smoke, but do you want to risk finding the fire?

By the way, over the same period, Tencent was down 13.5% for the year but has risen 3.61% over the past week. Meanwhile, Baidu was smashed 39.3% over the past year but has rebounded 2.48% over the past five trading days.

Going long, China’s great companies look potentially lucrative — but it is risky. Are there safer ways to dip your toe in the water?

When I saw the Munger play, I instantly thought of Hamish Douglas, one of our best fund managers, who’s copped some less-than-stellar results lately. Hamish held a lot of cash when the market rebounded out of the Coronavirus crash, but he has always liked big Chinese companies like Alibaba.

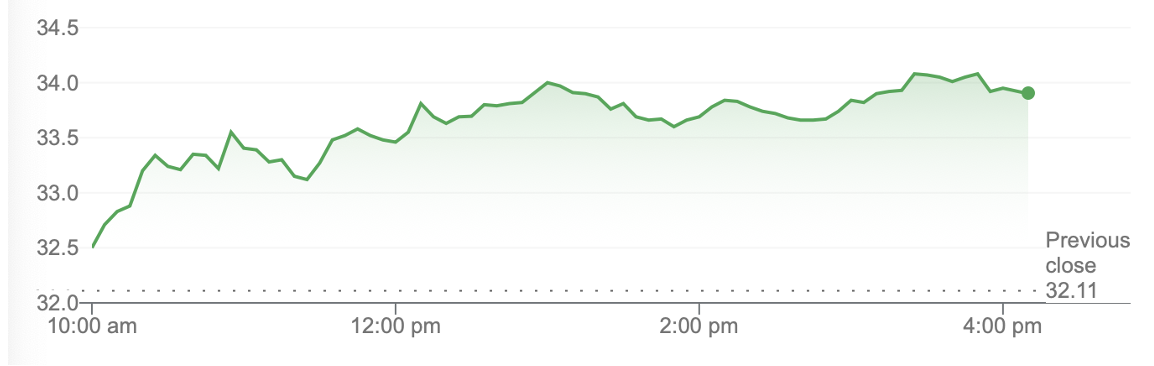

As a consequence, I thought believing in his ability to turn around a temporary challenging period might be a way to indirectly play the China investing theme. And I wasn’t alone, as this chart from Friday shows.

Magellan Financial Group (MFG)

MFG was up 5.57% in a day, which might be a positive sign for Hamish. And it’s worth remembering that before the Coronavirus crash, MFG was a $73 stock.

Right now, the consensus of analysts thinks the company has a 9.2% upside. But Morgans is a believer, with a $54.85 target out there for the company. If they’re right, that would be a 61.8% gain ahead!

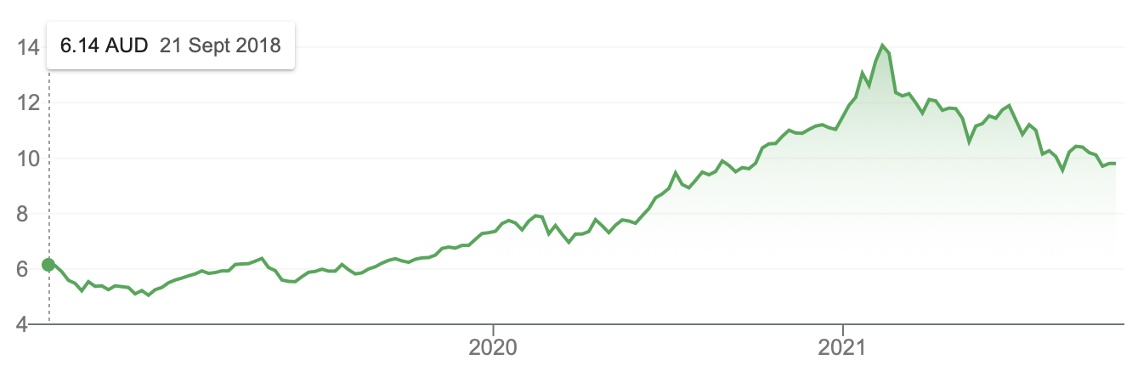

Another way to play the Munger tip is via an ETF like BetaShares Asia exchange traded fund. This has a 9.7% exposure to Tencent, 8.8% to Alibaba and 5.1% to JD.COM. In fact, it has 10 really big names in the Asia tech scene, including the Taiwan Semiconductor Manufacturing Company, which has the biggest weighting of 11.1%.

Year-to-date, this ETF is down 15.58%, but last week it lifted 1.45%. The best case for supporting this play is the 5-year chart that shows the price is up 59.77%.

BetaShares Asia Technology Tigers ETF

Maybe the 97-year old mentor of the 91-year old Warren Buffett is onto something. But remember, this is a risky play, especially if you’re get ruffled by losses in the short term.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.