In last week’s Switzer Report ( , https://switzerreport.com.au/the-big-5-reportwhere-to-from-here/) I looked at how five of our major companies had reported: CSL, CBA, Wesfarmers, Macquarie and Telstra. Today, I look at the other big 5 who have reported: Woolworths, BHP, RIO, NAB and Westpac. What did the market make of the results, and where do these stocks head now? Here’s my take.

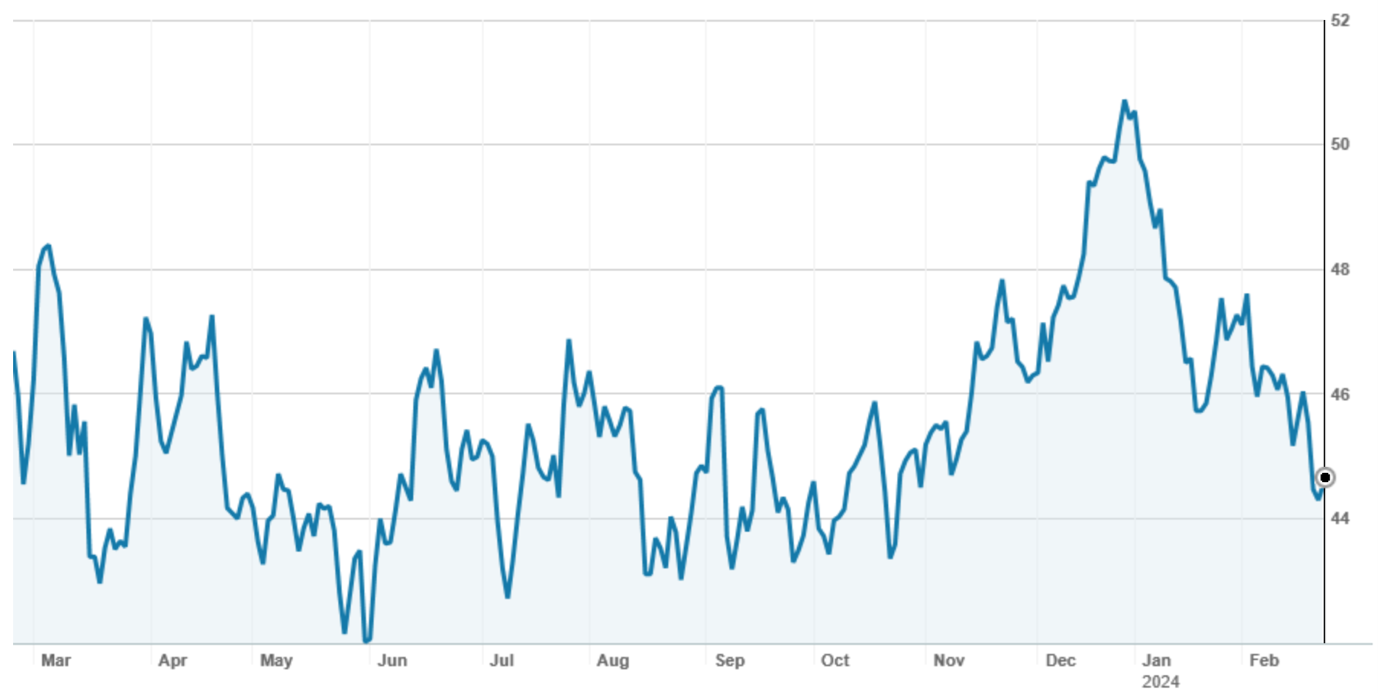

1. Woolworths (WOW)

Woolworths was hit with a double whammy: the retirement of CEO Brad Banducci and a fairly tepid profit report. Net profit rose by 2.5% to $929m for the half year, weighed down by a weak performance from discount retailer Big W and its New Zealand Food business. Woolworths’ interim dividend increased by 1c to 47c per share.

The highlight was Australian Food, where an improvement in margin of 0.24% led to an increase in EBIT of 9.9% to $1,570m. But EBIT for Big W crashed to just $54m and NZ fell by 40% to $71m.

A soft start means that Australian food sales are only up 1.5% for the first 7 weeks of 2024 (compared to the same period in 2023). With cost pressures, EBIT growth for Australian Food in the second half is expected to be lower than the first half. Woolworths warned that Big W is expected to deliver a “break-even” result in the second half, while the contribution from NZ Food would again be under pressure.

Source: nabtrade

Market & analysts

Woolworths finished at $32.78 on Friday, down 8.9% for the week. (ASX 200 down 0.2%).

Most analysts cut their target price by $2 to $3, with UBS electing to downgrade. The consensus target price sits at $34.10, about 4.0% higher than Friday’s closing ASX price of $32.78. The range of targets is quite wide: from a low of $27.50 from Ord Minnett through to a high of $39.00 from Citi.

My take

The numerous enquiries being held will keep the pressure on Woolworths and Coles. Despite last week’s fall in price, I expect further underperformance. Moreso in a bull market.

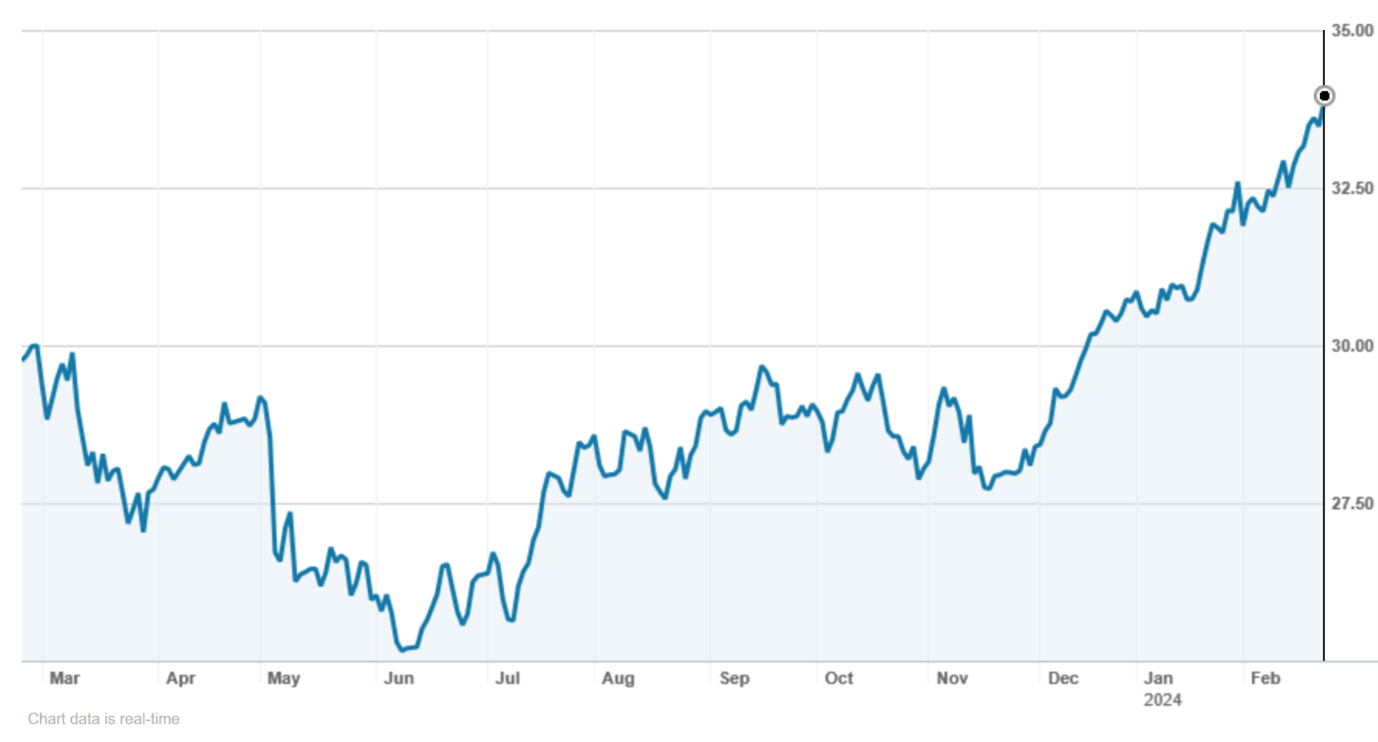

2. BHP

Higher iron ore and copper prices helped BHP record an underlying EBITDA of US$13.9bn for the half year, up 5%. Two material impairments, the first of US$2.5bn for Nickel West, and the second of US$3.2bn to cover BHP’s estimated share of the Samarco dam failure in Brazil, meant that the attributable profit was only US$0.9bn, down from US$6.5bn for the same half in 2023. BHP is set to pay an interim dividend of US$0.72 per share (approx. A$1.10), down from US$0.90.

The result was generally in line with expectations, although the medium-term production guidance for Escondida (copper) was below the consensus. The dividend was around 2c higher.

BHP indicated that capital expenditure would rise in the medium term from around US$7.5bn in FY23 to S11.0bn. Most of the increase is being deployed into what BHP describes as its “future facing projects”, potash at Jansen in Canada and copper in Chile and Australia.

Source: nabtrade

Market & analysts

BHP finished at $44.55 on Friday, down 2.3% on the week (ASX 200 down 0.2%).

Most brokers lowered their target price by around $1, with the consensus now at $45.61. According to FN Arena, there is 1 “buy” recommendation and 5 “neutral” recommendations.

My take

Although BHP has a tier one portfolio of assets, short and medium term performance will be dictated by commodity prices. Most is the market see downward pressure on the iron ore price due to the slump in the Chinese economy. Like BHP, I remain a little more optimistic about this and there is a point where the cost curve comes into play. I am in the market outperform camp.

3. Rio Tinto (RIO)

Rio announced its full year results (it balances on 31 December). For the FY23 year, EBITDA of US$23.9bn was down 9% on FY22. Lower prices and higher costs, offset by small volume increases, led to the reduction. Underlying earnings (after tax) of US$11.8bn were down 12% on FY22.

A highlight was the second half dividend of US$2.58, which was better than forecasts of US$2.47 per share. The former in Australian dollars is A$3.93 per share.

Similar to BHP, Rio is facing an increase in capital expenditure. In Rio’s case, most of this is in growth capex which will be used to fund Rio’s share of the Simandou iron ore mine in Guinea, which Rio says is the “largest untapped high grade iron ore deposit”.

Source: nabtrade

Market & analysts

Rio finished at $124.40 on Friday, down 3.5% on the week (ASX 200 down 0.2%).

Brokers largely saw the result as expected, with only minor changes to target prices. The consensus price is $128.67, about 3.4% higher than Friday’s close. There are two “buy” recommendations, 3 “neutral” recommendations and 1 “sell” recommendation.

My take

Similar to BHP, market outperformance. Rio is spinning off a lot of cash, and with net debt of only US$4.2bn, I think investors will continue to find the cash dividends very attractive.

4. National Australia Bank (NAB)

NAB provided a first quarter trading update. The unaudited cash profit for the first quarter was $1.8bn, which was broadly stable with the average of the second half of FY23. Income was 1% higher (small volume increases in home and business loans), a slightly higher net interest margin, offset by cost growth of 3%.

NAB has approximately $0.9bn of an on-market share buyback to complete. When this is done, its pro-forma capital ratio will be 11.7%.

Source: nabtrade

Market & analysts

NAB finished at $33.86 on Friday, up 2.4% on the week (ASX 200 down by 0.2%).

In the main, NAB’s result was a small “beat” with the net interest margin holding up better than expected. Only Morgans adjusted its target price, up modestly to $30.91. Overall, the brokers see NAB and the banking sector as expensive. The consensus target price is $28.99, 14.4% lower than Friday’s closing price. According to FN Arena, there are no “buy” recommendations, four “‘neutral” recommendations and two “sell” recommendations.

My take

Not my number “1” bank pick, I am a little non-plussed about both NAB and the sector. With its exposure to the business market, NAB will be a winner if the economy rebounds quickly, but in a sluggish environment, will be more challenged. Market underperformance.

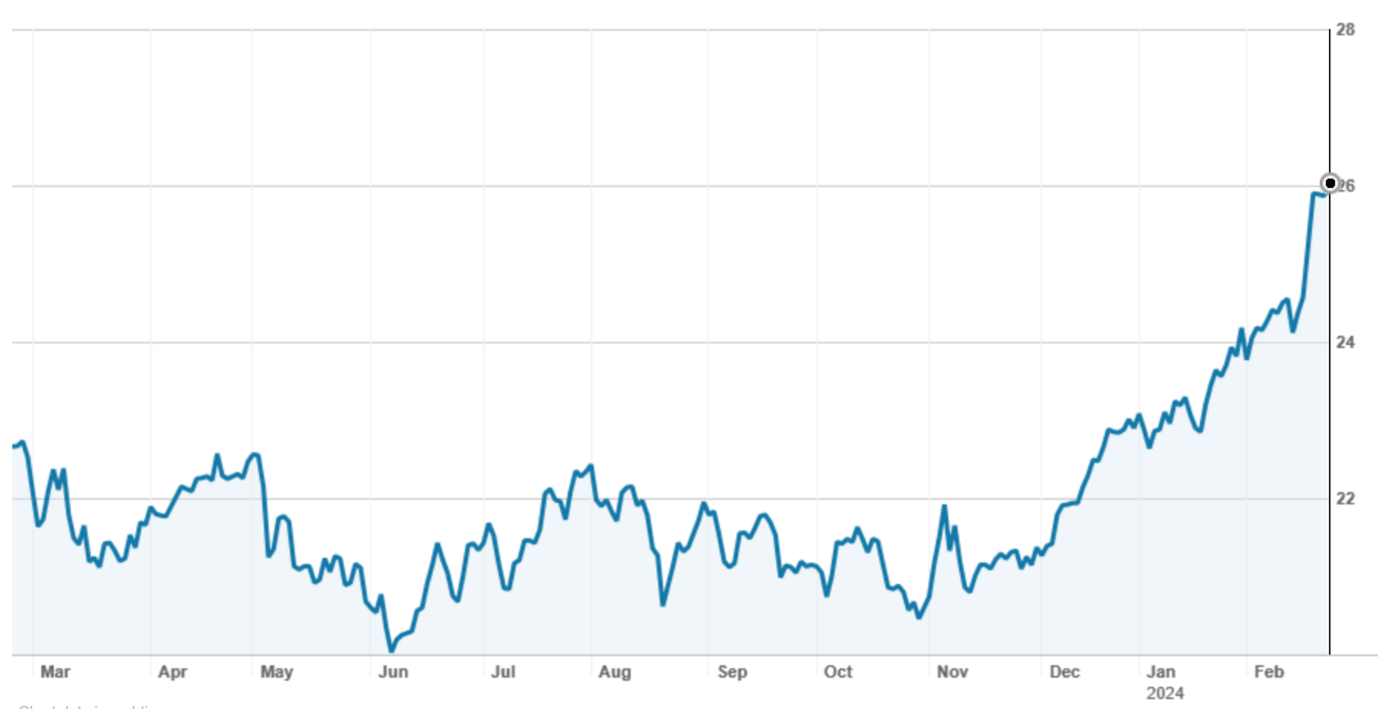

5. Westpac (WBC)

A 2% increase in income and 2% increase in expenses saw Westpac deliver a 1st quarter profit (excluding notable items) of $1.8bn. This was broadly in line with the second half and better than expected.

Westpac achieved system growth in home loans. Net interest margin appears to have been well managed, with overall NIM declining by 1bp and core NIM down by 4bp.

The Bank has approximately $1.0bn of an on-market share buyback to complete. When this is done, its pro-forma capital ratio will be 12.0%.

Source: nabtrade

Market & analysts

Westpac finished at $25.94 on Friday, up 5.6% on the week (ASX 200 down 0.2%).

A couple of brokers modestly upgraded their target price, but otherwise, most left unchanged. The consensus target price is $23.42, 9.7% below Friday’s closing ASX price of $25.94. There are 2 “buy” recommendations, 2 “neutral” recommendations and 2 “sell” recommendations.

Overall, the brokers see the sector as “expensive”. Westpac is also viewed this way but is arguably the least expensive of the four majors.

My take

I also think the sector is very expensive but am wary of the possibility of a “consensus” upgrade for Westpac. Market performance.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.