Boom believers got plenty of reason to keep the faith with great local jobs data being mirrored in the US, with both solid economic and earnings reports driving US share market indices to record highs, again!

This from CNBC sums it up neatly: “The Dow’s push through 34,000 is a signal that investor appetite for future growth prospects is spilling over into more value-oriented names,” said Peter Essele, head of portfolio management at Commonwealth Financial Network. “The demand for industrials and more cyclically-oriented areas should continue as the vaccines take hold and earnings potentially come in higher than originally expected.”

You will see below in my What I liked section that consumer, retail and job market data confirms a big boom is brewing. In fact, overnight, the University of Michigan’s consumer sentiment index was released and it rose to a one-year high of 86.5 in the first half of March.

US stocks have racked up four straight weeks of gain, putting on over 7%. And you can thank a good vaccination programme for that, after the Yanks had a shocker containing the Covid-19 challenge. We’re clearly the mirror opposite and somehow I prefer our experience compared to our US buddies.

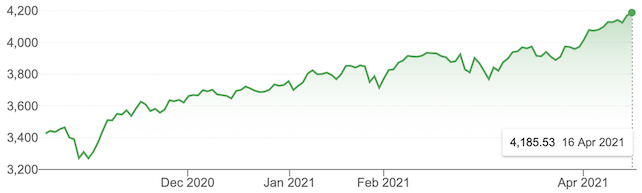

S&P 500 6 months

Interestingly, on Friday on Wall Street, tech stocks didn’t lead the way. Value stocks did. But given the gains, the market is buying just about all companies that will benefit from the boom.

And what a boom, with 95% of stocks in the S&P 500 Index now above their 200-day moving average, which says big cap stocks are in an uptrend.

CNBC’s Mike Santoli says this has only happened in recent times in 2004, 2010 and now. It happens early in multi-year bull markets and can be followed by a period of small pullbacks or sideways movements before the uptrend reasserts itself.

So what’s the takeaway message?

Well, first we could see a bit of “sell in May and go away” action by profit-takers, especially for some big cap cyclical stocks. But the ‘stocks going higher’ trend will eventually reassert itself, if a sell off happens.

That said, I don’t think any sell off will happen next week or in the very near term, with economic and earnings data so strong.

To the local story and tech stocks have continued their comeback, after a short rejection period. Why? It’s thought the even better-than-expected economic data and lower yields in the bond market has helped. And it has, but really if you believe that a big boom and more normal business conditions are happening, tech stocks will be winners.

Also, central banks restating their goal to keep interest rates low until unemployment is in the 4% region is giving investors confidence to stick with stocks. Afterall, we compare returns from investing stocks to saving in term deposits and the latter is a very good reason to invest in stocks. And while a lot of tech stocks are seemingly overvalued, other stocks are still way cheaper than they were before the Coronavirus crash of the stock market.

This week, my SWTZ Dividend & Growth fund climbed to $2.55 after hitting a crazy low of $1.67, when we all were locked down and scared out of our wits in March last year. That’s a 52% rebound, but before the pandemic it was a $2.70 stock and it tells me that stocks can easily go higher as normality eventually returns to business over 2021 and into 2022.

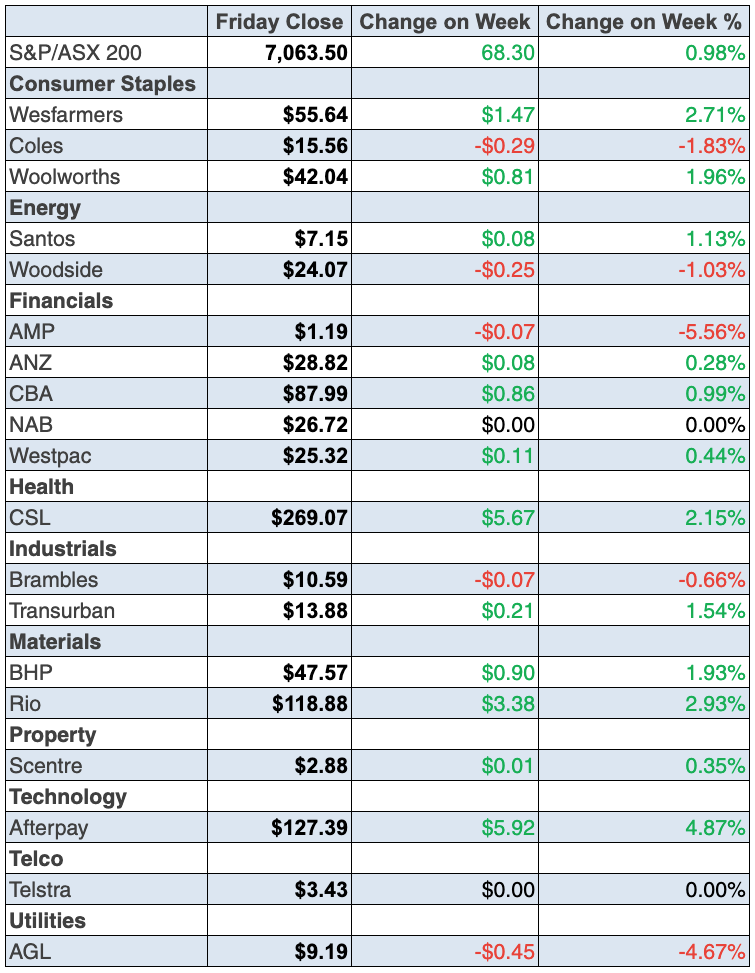

The S&P/ASX 200 Index rose 68.3 points (or 1%) to wind up at 7063.5. And as I said, tech stocks ‘starred’, as this shows:

- Zip up 12.9%

- Altium 8.4%

- Xero 5.9%

- Next DC 4.5%

- Appen 3.1%.

Losers included Whitehaven Coal, down 17.68% on mine problems, Origin Energy off 9.7% on lower guidance and AMP down 5.56%, with analysts not positive on the company.

Meanwhile, gold had a bounce-back week, with Resolute Mining up 7.3%, Perseus up 7.4% and Newcrest rising 3.8%. Kitco’s Jim Wyckoff explained gold’s good run this way: “A depreciating U.S. dollar on the foreign exchange market and this week’s surge in crude oil prices have also given the metals market bulls confidence.” And this got the technical traders positive and buying.

What I liked

- Employment rose by 70,700 in March (consensus: 35,000) after increasing by 88,700 jobs in February.

- Full-time jobs fell by 20,800 and part-time jobs rose by 91,500 positions.

- The number of people employed rose to a record high of 13.078 million.

- Unemployment fell from 5.8% to a 12-month low of 5.6% in March (consensus: 5.7%).

- The participation rate rose from 66.1% to a record high of 66.3% in March (consensus: 66.1%).

- In March, the underutilisation rate fell from 14.3% to a 15-month low of 13.5%.

- The underemployment rate fell from 8.5% to 7.9% – a 7-year low.

- The Westpac-Melbourne Institute Index of Consumer Sentiment lifted 6.2% in April to 118.8 – the highest reading since August 2010. Confidence rose by 10.5% in April to a record high (since records began in January 1996) of 131.1 for Aussies aged 25-44 years.

- The ‘mortgager’ confidence sub-index rose by 11.1% to an all-time high of 128.7. And confidence for ‘tradies’ jumped 18.5% in the month to a record 140.1.Readings above 100 points denote optimism.

- The weekly ANZ-Roy Morgan consumer confidence rating rose by 5.9% – the most in 43 weeks – to a 17-month high of 114.1 (long-run average since 1990 is 112.6). And confidence is up by 74.7% since hitting record lows of 65.3 on 29 March 2020 (lowest since 1973).

- In seasonally-adjusted terms, preliminary job vacancies increased by 19.1% (or 38,244 job advertisements) — the biggest lift in 9 months — in March to stand at a 12-year high of 238,747 available positions. Job ads are up 96.4% (or 117,184 advertisements) over the year.

- The total number of dwelling starts rose by 18.6% — the biggest quarterly lift in 19 years — to a 2-year high of 51,055 units in the December quarter. Starts are up 19.4% on the year. Total house starts rose by 27% to 20½-year highs of 34,313 units to be up by 36.4% from a year ago. Apartment starts rose by 4.6% to 16,553 units, but were down 4.9% from a year ago.

- The NAB business confidence index fell from an 11-year high of +17.8 points in February to +15.5 points in March, but it’s miles above the long-term average of +5.2 points).

- The business conditions index lifted to a record high of +25.2 points in March, up from +17.0 points in February (long-term average is +5.4 points). Trading, profitability and employment conditions all hit record highs.

- US initial jobless claims fell by 193,000 to 576,000 last week — the lowest level since March 2020.

- US retail sales jumped 9.8% — the second biggest advance ever — in March (survey: +5.8%).

- The NAHB housing market index in the US rose from 82 to 83 in April (survey: 83). The Philadelphia Fed manufacturing index rose from 44.5 to 50.2 — the highest level since 1973 — in April (survey: 41.5). The Empire State manufacturing index lifted from 17.4 to its third highest level in the past decade at 26.3 in April (survey: 20).

- The Chinese economy (GDP) grew at a record 18.3% annual rate in the March quarter from a year ago (consensus: +18.5%), up from a 6.5% annual growth rate in December.

- Chinese retail sales expanded at a 34.2% annual rate in March (consensus: +28%). Industrial production rose at a 14.1% annual rate (consensus: +18%). Fixed-asset investment expanded by 25.6% in the first three months of 2021 from the same period ayear earlier (consensus: +26%).

What I didn’t like

- Only the problems with our vaccination programme!

Sorry but I couldn’t find dislikes!

The lack of developments that genuinely worried me was highly unusual but I’m taking it as another good reason to believe in the boom and being long stocks. And while I said a post-May sell off can’t be ruled out, I would only use that to buy more of those stocks that will benefit from the reopening of economies, with vaccination programmes here and around the world helping economies and company profits grow.

So what should you buy?

Have a look below at the ideas from this week’s stocks stories.

The week in review:

- I’ve looked at 41 stocks in the last few months and I want you to take a look at my report card. Keep the faith when it comes to shares!

- Paul Rickard wrote that our model portfolios performed strongly in the March quarter, gaining up to 9% and comfortably outperforming the benchmark S&P/ASX 200 Index.

- James Dunn looked at five companies with a ‘Saas’ (or Software as a Service) business model: Open Learning Limited (OLL), ELMO Software (ELO), Whispir (WSP), Class (CL1) and Damstra Corporation (DTC).

- Tony Featherstone said that the resumption of treatments halted by COVID-19 boosts Virtus Health (VRT) and Monash IVF Group (MVF).

- Our “HOT” stock of the week selected by Michael Gable, managing director of Fairmont Equities, was Mineral Resources (MIN).

- 2 upgrades and 1 downgrade made up our first Buy, Hold, Sell – What the Brokers Say article of the week, while 9 upgrades and 4 downgrades made up the second edition.

- In Questions of the Week, Paul Rickard answered questions about Santos (STO), Bitcoin, Genex Power (GNX) and Nuix (NXL).

- Is Zip (Z1P) a sell? Make sure you watch the recording of this week’s Boom! Doom! Zoom! Q&A session to hear our thoughts, plus analysis of Galaxy Resources (GXY), EML Payments (EML), Bitcoin and more.

Our videos of the week:

- Boom! Doom! Zoom! | April 15, 2021

- Tantalising ASX tech stocks: OPY, FZ0 & More! Julia Lee has fallen in love again with EML | Switzer Investing

- Rudi’s red hot ASX stocks: CSL, IRE, HUB + CEO of EML – why is it up 12%? | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday April 20 – Weekly consumer sentiment (April 18)

Tuesday April 20 – Reserve Bank Board meeting minutes

Tuesday April 20 – CBA Household Spending Intentions (March)

Tuesday April 20 – Overseas travel statistics (March)

Wednesday April 21 – Preliminary retail trade (March)

Wednesday April 21 – Skilled job vacancies (March)

Wednesday April 21 – Household financial resources (September)

Thursday April 22 – Detailed labour force (March)

Friday April 23 – IHS-Markit purchasing managers’ indexes (April)

Overseas

Tuesday April 20 – China 1-year and 5-year loan prime rates

Tuesday April 20 – US Weekly Johnson Redbook index (April 17)

Wednesday April 21 – US Weekly MBA mortgage applications (April 16)

Thursday April 22 – US Chicago Fed national activity index (March)

Thursday April 22 – US Weekly initial jobless claims (April 17)

Thursday April 22 – US Existing home sales (March)

Thursday April 22 – US Kansas City Fed manufacturing index (April)

Thursday April 22 – US Conference Board leading index (March)

Friday April 23 – US New home sales (March)

Friday April 23 – IHS-Markit purchasing managers’ indexes (April)

Food for thought:

“We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten. Don’t let yourself be lulled into inaction.” – Bill Gates

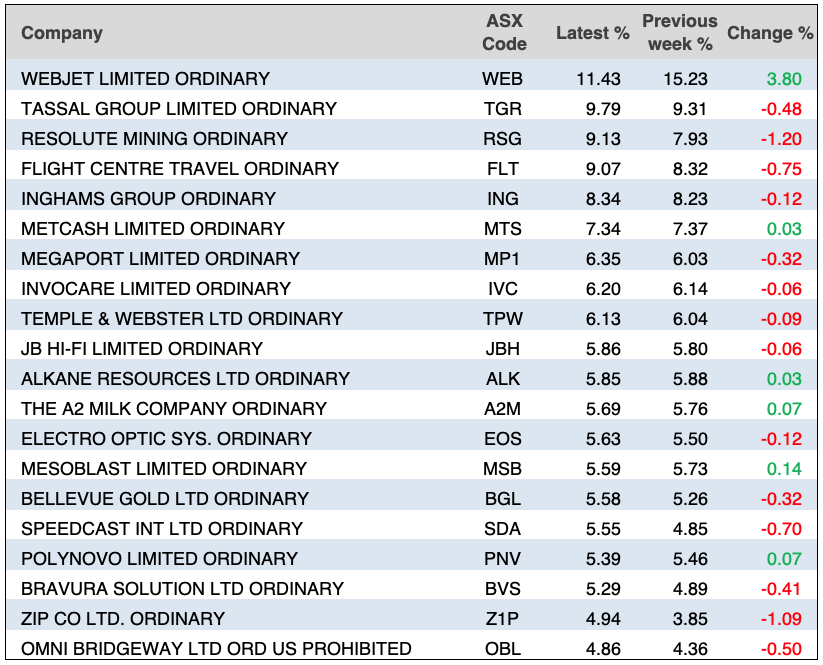

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

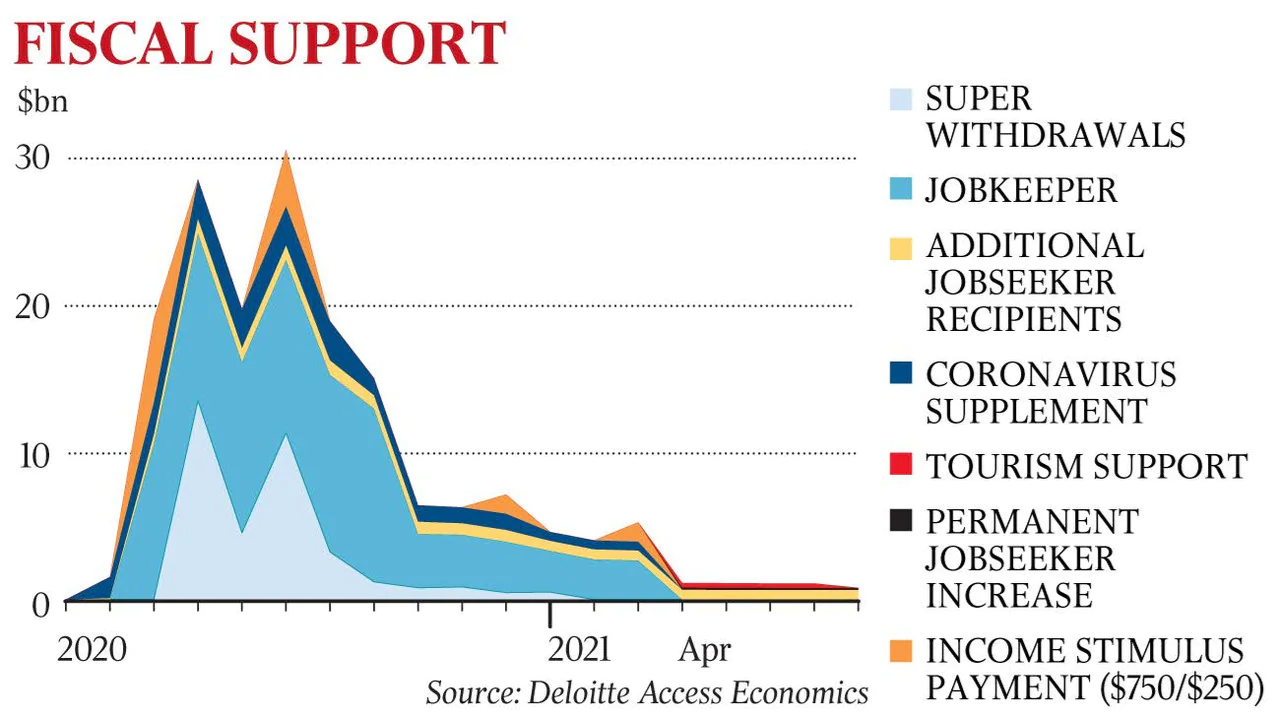

Chart of the week:

The following chart from Deloitte Access Economics published by The Australian shows the government’s fiscal support during the COVID-19 pandemic:

Top 5 most clicked:

- Switzer puts the acid test on his 41 calls – Peter Switzer

- 5 ‘SaaS’ tech stars – James Dunn

- Portfolios power ahead as the market hits fresh highs – Paul Rickard

- Questions of the Week – Paul Rickard

- “HOT” stock: MIN – Maureen Jordan

Recent Switzer Reports:

- Monday 12 April: 41 stocks put to the test

- Thursday 15 April: Are Virtus Health & Monash IVF buys?

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.