The US central bank — the Fed — has had a less than stellar week while Europeans continue to struggle with the Coronavirus, with Germany considering a longer lockdown as infections rise. News like this holds back the strength of the global recovery and is in contrast to what we’re seeing here, with the latest jobs report underlining the value of beating COVID-19 convincingly.

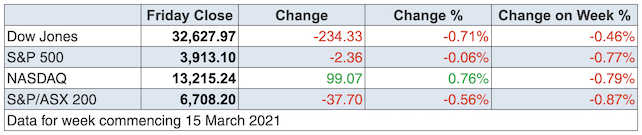

After an unconvincing showing by the Federal Reserve Chairman Jerome Powell earlier in the week (when he did say interest rates would be held where they are through to 2023), he decided it was time to take away the pandemic-era capital break for banks. This explains why the Dow is down overnight, while the S&P 500 and Nasdaq indexes were up for most of the trading session.

“This is a disappointment to investors that the Fed decided not to extend it,” said Jimmy Chang, chief investment officer at Rockefeller Global Family Office. “There was a lot of expectation, at least a few weeks ago, that the Fed would extend to relieve SLR for the big banks, given the need to absorb so much Treasury issuance.”

Big banks (like Bank of America and JPMorgan) were down around 3%, and while the decision won’t have huge impact, the timing with the bond market hurting confidence wasn’t a good look, when banks having money to lend looks like a good idea for a US economy just starting to beat the virus.

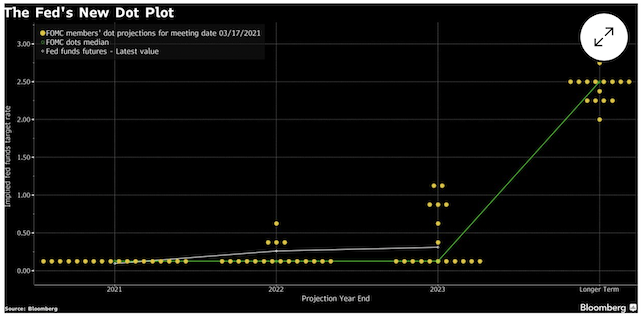

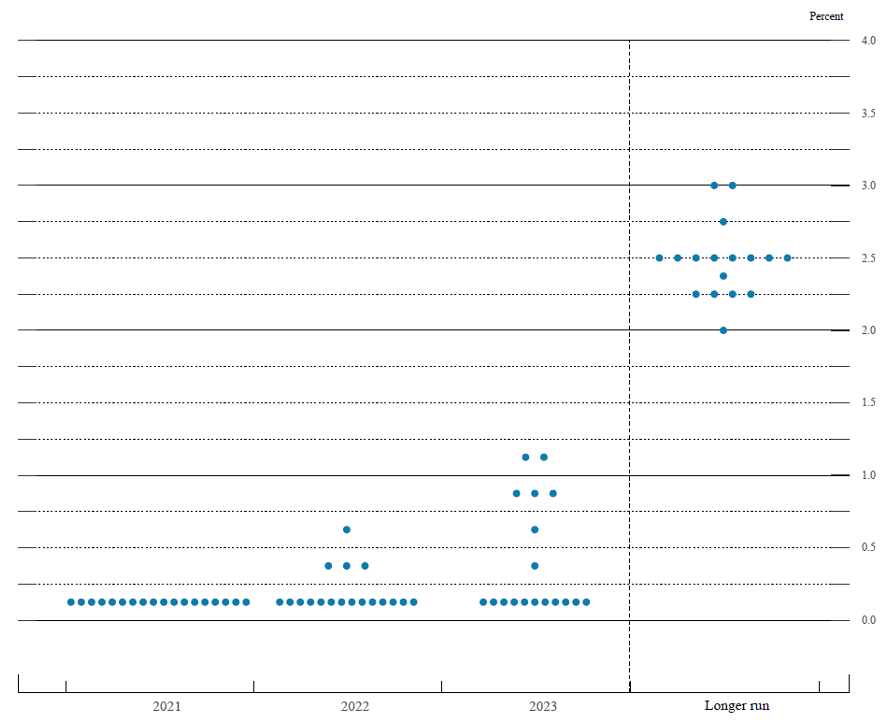

In contrast, the Fed and Jerome got it right earlier in the week with no change to interest rates and no Fed members seeing rate rises in 2021, while four out of 18 see it possible in 2022. The chart below says seven expect rates to rise in 2023, which is at odds with their boss, Mr Powell. All this explains why the bond market sees higher rates in 10 years’ time. That said, you can see why I think the bond market concerns are coming a little too soon for the stock market that’s a lot less long term in its thinking about share prices!

I loved the Fed’s call that GDP is expected to increase 6.5% in 2021 (which is much bigger than its previous 4.5% call) and the jobless rate is tipped to get close to 4.5% this year!

In the fullness of time, I think the bond market concerns will be trumped by the big economic rebound, which we saw here this week with those job numbers.

The enthusiasm for our jobs report was nicely captured by CommSec economist Ryan Felsman.

“The Aussie labour market exhibited extraordinary resilience in February with a massive 88,700 jobs added in the month – smashing consensus expectations for the addition of 30,000 – despite snap Covid-19 lockdowns in both Melbourne and Perth,” he wrote. “Encouragingly, full-time jobs surged by 89,100 in February with job gains across all states and territories — the ‘V’-shaped recovery in the labour market has been remarkable…”

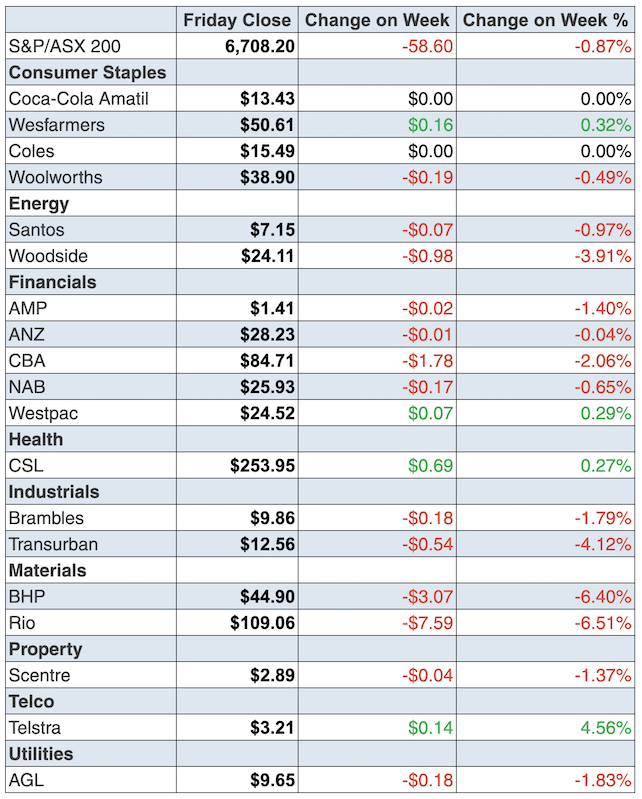

To the local story and it was a loser of a week with the S&P/ASX 200 index down 0.9% to finish at 6708.2. And while energy and iron ore miners were no help, it was the concern over the bond market that was the main reason for stocks heading south. But why? Blame the nincompoops in Europe!

Global oil prices fell by 7% on Thursday, which was the biggest fall since September last year. There were concerns about short-term demand for crude, which fell due to rising Covid-19 cases in Europe and stalling vaccine rollouts. The lift in the US dollar also was no help to crude oil prices.

Why our market struggled with such a hugely positive jobs report (that told us unemployment had dropped 0.5% to 5.8%) when the bullish RBA had the jobless rate at 6% by year’s end just shows how Wall Street dependent our market is.

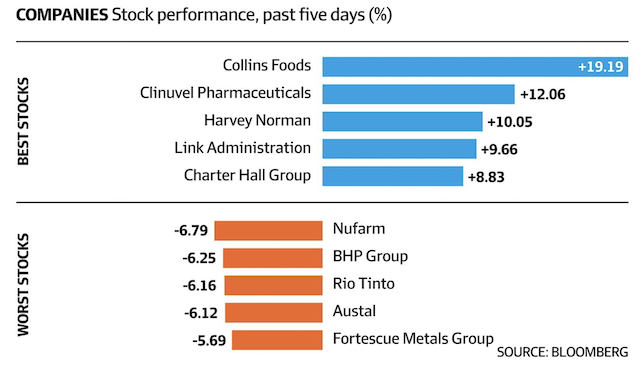

At least our retailers saw the benefit of more Aussies in jobs, with JB Hi-Fi up 7.3% to $52.20 and Harvey Norman surging 10.1% to $6.02. And here’s the Bloomberg/AFR summary of winners and losers.

What I liked

- Employment rose by 88,700 in February (consensus: 30,000) after increasing by 29,500 jobs in January. Full-time jobs rose by 89,100 and part-time jobs fell by just 500 positions.

- Unemployment fell from 6.3% to an 11-month low of 5.8% in February (consensus: 6.3%). It looked even better with the participation rate steady at a record-high 66.1% in February.

- The ABS reported that national payroll jobs rose by 0.4% and wages were steady over the fortnight to 27 February 2021. Payroll jobs were just 0.2% below levels at the start of the pandemic (since Australia recorded its 100th confirmed case of Covid-19 on 14 March 2020). And wages were 1% higher over the period.

- “The Commonwealth Bank Household Spending Intentions series for February 2021 showed mixed results across the seven spending categories, but overall continued to point to ongoing improvement in household spending in the Australian economy.”

- The total value of Australia’s 10.6 million dwellings was a record $7,724.4 billion in the December quarter, with the average (mean) dwelling price at $728,500. Home prices rose in all capital cities in the quarter and over the year.

- At its 2nd March 2021 Board meeting, Reserve Bank policymakers reiterated that the cash rate will remain at 0.10% (10 basis points) “for as long as necessary”.

- Chinese economic data was positive for the global economy, with retail sales expanding at a 33.8% annual rate in January-February (consensus: 32%). Industrial production rose at a 35.1% annual rate (consensus: 32.2%). Fixed-asset investment expanded by 35% in the first two months of 2021 from the same period a year earlier (consensus: 40.9%) but it still was a positive number.

- The Philadelphia Fed manufacturing index rose from 23.1 to 51.8 in March – its highest level since April 1973 (survey: 23.3).

- The US Conference Board leading index rose by 0.2% in February (survey: 0.3%).

- The Bank of England said Britain’s economic recovery was gathering pace and left policy rates unchanged.

What I didn’t like

- ‘Preliminary’ retail trade fell by 1.1% in February (consensus: 0.6%) to stand 8.7% higher than a year ago but mini-lockdowns were blamed.

- The weekly ANZ-Roy Morgan consumer confidence rating fell by 0.9% to 110.9 (long-run average since 1990 is 112.6) but confidence is still up by 69.8% since hitting record lows of 65.3 on 29 March 2020.

- Over the year to September, Australia’s population grew by 220,500 people – the fewest in 15½ years. Overall, the annual population growth rate eased from 1.31% to 0.87% – the slowest annual growth rate since at least 1981 when Bureau of Statistics records began.

- US housing starts slid 10.3% in February (survey: minus 1.3%).

Don’t give up on stocks

The virus challenges in Europe aren’t helping the stock market but neither is the rotation out of tech stocks into businesses that will cash in on fast-growing economies. A lot of fund managers are momentum players and CNBC’s Jim Cramer summed it up neatly: “Problem is, if they want to buy the banks or the smokestack stocks … they need to sell something else … such as the high-growth tech stocks that they always dump, and that’s called the hedge fund playbook.”

And one day when tech stocks prices are lower and the stocks they’re buying now will be too high, they’ll remember that the tech stocks are fast-growers – doh!

These people create buying opportunities for the patient long-term investor.

The week in review:

- For the last month, tech stocks have been in the twilight zone. But not all tech stocks are tarnished with the same brush. Xero (XRO) has dropped from its highs. Does this mean it’s passed over into the buy zone?

- In an environment where the market for ‘ethical’ or ‘ESG’ investment products is booming, it’s important to “look under the bonnet” before deciding where to invest. In his article this week, Paul Rickard looked at the four major Aussie share ESG focussed ETFs: BetaShares Australian Sustainability Leaders ETF (FAIR), Russell Investments Australian Responsible Investment ETF (RARI), VanEck Vectors MSCI Australian Sustainable Equity ETF (GRNV) and Vanguard Ethically Conscious Australian Shares ETF (VETH).

- James Dunn shared his analysis of two ASX-listed companies at the forefront of the hydrogen push – Fortescue Metals Group (FMG) and Hazer Group (HZR) – and three other smaller players – Leigh Creek Energy (LCK), Hexagon Energy Materials (HXG) and Pure Hydrogen Corporation Limited (PH2).

- Tony Featherstone wrote about 3 pub stocks to watch as valuations recover: Redcape Hotel Group (RDC), Hotel Property Investments (HPI) and ALE Property Group (LEP).

- Our “HOT” stock of the week from Burman Invest’s Julia Lee was Qantas (QAN).

- In this week’s Buy, Hold, Sell – What the Brokers Say, there were 12 upgrades and 5 downgrades in the first edition, and 7 upgrades and 3 downgrades in the second edition.

- And in Questions of the Week, Paul Rickard answered questions about IAG’s exposure to Greensill, the transfer balance cap for super, James Hardie and the US Federal Reserve’s “dot plot”.

Our videos of the week:

- Boom! Doom! Zoom! | March 18, 2021

- We shine the spotlight on these quality ASX stocks: ALU, BHP, MQG, CSL, TLS & more! | Switzer Investing

- Hot tech stocks – MP1, NXL + could stocks fall 10%? & CEO of Aussie Home Loan | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday March 23 – Weekly consumer sentiment (March 21)

Tuesday March 23 – Weekly CBA credit/debit cards (March 18)

Wednesday March 24 – Preliminary international trade (February)

Wednesday March 24 – ‘Flash’ purchasing manager index (March)

Wednesday March 24 – Skilled internet job vacancies (February)

Thursday March 25 – Finance & wealth (December quarter)

Thursday March 25 – Labour force (February)

Thursday March 25 – Business conditions & sentiments (March)

Overseas

Monday March 22 – US Existing home sales (February)

Monday March 22 – China Loan prime rate fixing

Monday March 22 – US National activity index (February)

Tuesday March 23 – US Current account (December quarter)

Tuesday March 23 – US New home sales (February)

Tuesday March 23 – US Richmond Federal Reserve index (March)

Wednesday March 24 – US Durable goods orders (February)

Wednesday March 24 – ‘Flash’ purchasing manager indexes

Thursday March 25 – US Economic growth (GDP)

Friday March 26 – US Personal income/spending (February)

Friday March 26 – US Trade in goods (February)

Friday March 26 – US Consumer sentiment (March)

Saturday March 27 – China Industrial profits (February)

Food for thought:

“Now, there’s just so much money injected into the markets and the economy that the markets are like a casino with people playing with funny money. They’re buying all sorts of things and pushing yields on everything down. Now you have stocks that have gone up, and you have classic bubble dynamics in so many different assets,” – Ray Dalio, writing in a LinkedIn article this week.

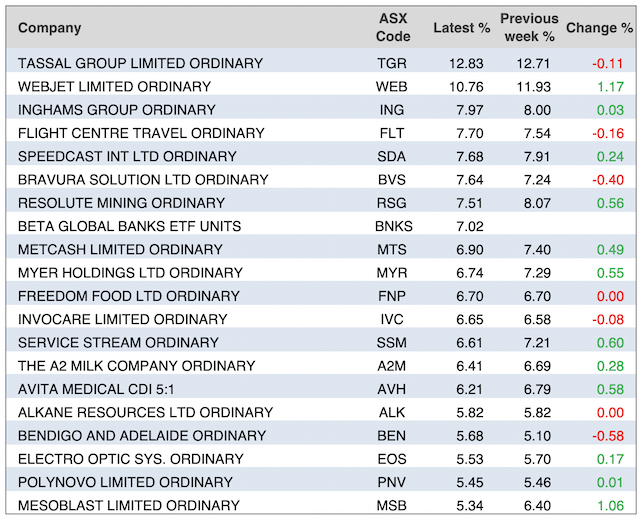

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

Paul Rickard went into detail about the US Federal Reserve’s most recent dot plot in the latest Questions of the Week. As Paul explained:

“At each meeting of the US Federal Reserve Open Market Committee (FOMC) (the rate setting Committee of the US Federal Reserve Board), the 18 members submit their projections on the most likely outcomes for economic growth, unemployment and inflation for the next 3 years and over the long run. They also give their projections of “appropriate monetary policy” for the next 3 years and long term – as expressed by the key short term interest rate. The “dot plot” shows these rates – with each dot representing where a Member sees the rate. The significance is obvious – it tells you where the Members think interest rates will move and over what time. Changes from one meeting to the next are closely watched. At Wednesday’s meeting, although 11 members expect no change in interest rates in 2021, 2022 and 2023, 7 members now expect rates to go up in 2023 – up from 5 at the last meeting.”

Top 5 most clicked:

- Is Xero in the buy zone? – Peter Switzer

- 5 companies at the forefront of the hydrogen push – James Dunn

- Does environmental, social and corporate governance (ESG) investing stack up? And what’s the best ETF? – Paul Rickard

- 3 pub stocks to watch as valuations recover – Tony Featherstone

- My “HOT” stock: QAN – Maureen Jordan

Recent Switzer Reports:

- Monday 15 March: Is Xero in the BUY zone?

- Thursday 18 March: 3 pub stocks to watch as valuations recover

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.