Last week, Peter Switzer went “dovish” and called on RBA Governor Dr Phil for an immediate cut to the benchmark cash rate. In case you missed it, here’s his article from Switzer Daily.

He joined a growing group of economists, including the Chief Economists from Westpac and the NAB, Bill Evans and Alan Oster respectively, who now forecast the RBA to cut the benchmark cash rate by 0.5% to just 1.0% by year’s end.

According to the NAB, “growth appears to have lost significant momentum, placing at risk further improvement in the labour market at a time when inflation poses little constraint on policy and financial stability risks have abated. We have pencilled in one 25bp cut to 1.25% in July and a further 25bp cut to 1% in November”.

While I am not yet a “card carrying member” of the rate cut camp, market sentiment has certainly shifted over the last few weeks. Wholesale rates have started to fall in anticipation of the possibility of a rate cut, and retail rates are starting to follow.

On that basis, here is our regular review of the best term deposit and cash rates. If you are looking to lock in a term rate (up to 18 months), you might want to act quickly.

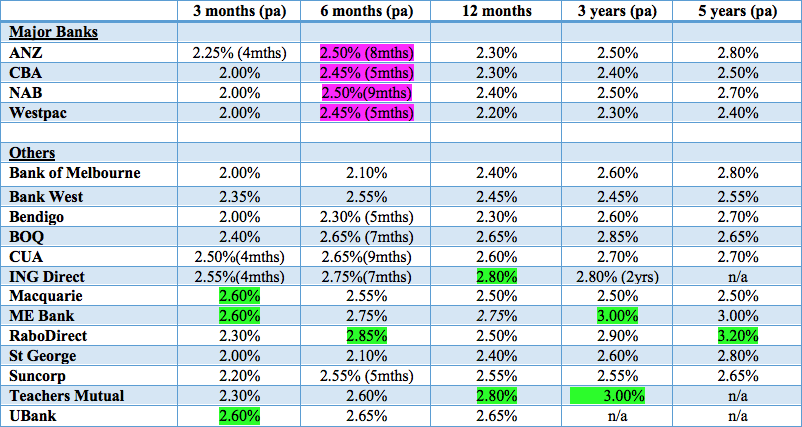

The best term deposit rates

Listed below are the latest term deposit rates on offer for the popular terms of 3 months, 6 months, 1 year, 3 years and 5 years. Rates are current as at 18 March and are based on a deposit of $50,000 with interest paid on maturity or annually for terms of 3 or 5 years.

Rates are shown for the 4 major banks and 13 regional/significant/on-line other banks. The major banks typically pay lower rates than the online banks and the regional banks.

Each of the major banks has a “special” or “headline” rate (highlighted in purple). Sometimes, these are only available for a few days, so check online to see what is available. The pick of these today (Monday) was ANZ’s 2.50% for 8 months.

RaboDirect has the best rate for 6 months at 2.85% and is the clear winner (by a material 0.2%) if you want to invest long term for 5 years. Teachers Mutual and ME Bank are both offering 3.0% for 3 years. “Best” rates are highlighted in green.

ING Direct, RaboDirect and UBank also reward loyalty by paying an additional 0.10% pa when an investor rolls over the full amount of a term deposit to a new deposit term.

And while it can be a hassle to change banks or open a new bank account, if you want that extra 0.25%, be prepared to shop around. Don’t be put off by security concerns because with the effective Commonwealth Government guarantee on deposits of $250,000 on a per client per financial institution basis through the Financial Claims Scheme, Bank A is as good as Bank B up to $250,000.

Rates as at 18 March 2019 for deposits of $50,000 and upwards. Interest paid on maturity, or annually for 3 and 5 year terms. Advance notice (31 day) products selected when offered. Teachers Mutual is “customer” rate. Westpac offer existing customers an additional 0.05% on short term rates.

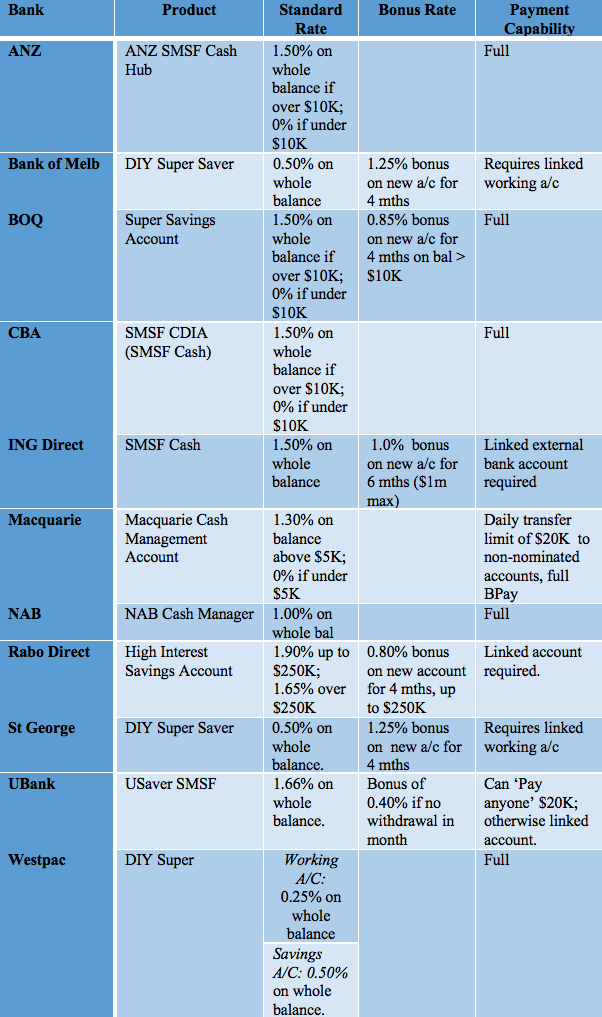

Bank accounts for SMSFs

Most banks offer tailored accounts for SMSFs (see below), which are fee free and can be used to make payments online. Some accounts require a linked working account to access full payments capability (for example, with another bank in the case of Rabo or ING, or within the same bank by St George/Bank of Melbourne).

Rates as at 15 March 2019

If the interest rate is the key determinant, then RaboDirect and UBank are the leaders. UBank pays bonus interest of 0.40% if no withdrawal is made in the month. However, if your SMSF has more than 2 trustees or 2 directors – you can’t open an account with UBank!

If transactional ability is important, then it is hard to go past the major banks. For SMSFs, Commonwealth Bank offers the Commonwealth Direct Investment Account (CDIA) which can be accessed through NetBank, while ANZ has the SMSF Cash Hub. Westpac used to have a very compelling offer, however now that it is actively promoting a SMSF solution with BT, the rates on its pure cash account have been pulled back to an “uncompetitive” 0.50%.

For the CBA’s CDIA and ANZ’s SMSF Cash Hub, no interest is paid if the balance is under $10,000. However, the advertised rate is paid on the whole balance if it is over $10,000 – so it will usually make sense to keep a minimum balance of at least $10,000 in these accounts.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.