Markets are caught between two negatives — too many interest rate rises because of too much inflation and the fear that too many interest rates might cause a recession. And the latter fear wasn’t helped by international transport business Fed Ex, which withdrew guidance for next year because of the volatile environment. Its share price tumbled over 20%!

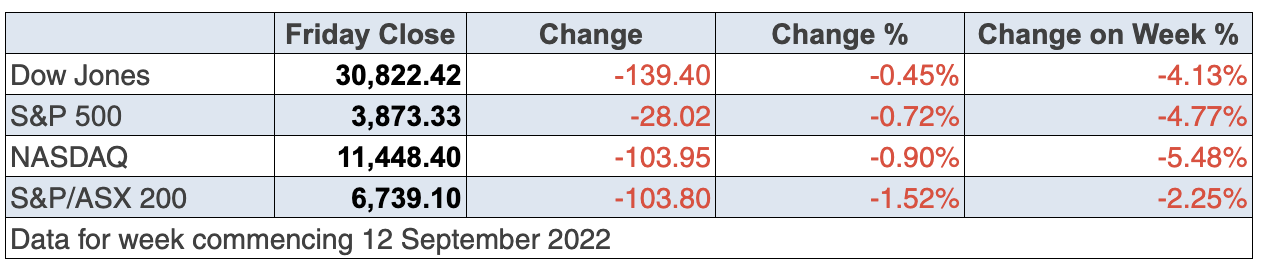

Just to recap, US share markets were smashed on Tuesday, following a higher-than-expected US inflation data reading. At the close of trade, the Dow Jones index fell by 1,276 points (or 3.9%), while the S&P 500 slumped 178 points (or 4.3%). The Nasdaq index, with its tech bias, gave up a huge 633 points (or 5.2%). It was the indexes’ biggest one-day percentage drop since June 2020, after a four-day winning streak, which teaches us something that’s really important.

Well, when the market thinks inflation is set to fall, stock prices rise, on the basis that rate rises are going to ease and eventually stop. And as Tuesday on Wall Street proved, if the opposite happens and inflation is still a pest, then stock prices will slide.

Until the next US inflation read on October 13, the market will be looking for data that will give us a clue on what lies ahead and stocks will react to each number.

Lots of experts think US inflation has peaked but that could’ve been a September thing, but the latest number was for August. Meanwhile, we all know that official stats on indicators such as inflation and unemployment can come with a lag.

This might shock you but our RBA says “More generally, estimates suggest that it takes between one and two years for changes in the cash rate to have their maximum effect on economic activity and inflation”.

The so-called transmission mechanism of rate rises and how it affects the economy over time means central banks have to be careful that in trying to kill inflation they don’t overcook the economy into a burnt-out recession.

That’s why the Fed Ex announcement adds more concerns about future rate rises, but it would be something that the Fed’s Jerome Powell wouldn’t ignore. He has to be watching all data, and he said exactly that, and so will the market!

Yep, data is going to be crucial and the double drama of inflation causing too many interest rate rises that then lead to a recession will be a fixation that the market will wrestle with until October 13. So brace yourself for volatility in coming weeks.

Some investors will buy the dip, while others will sell the rip, meaning any good days for stocks on better data could see those with a negative view cash in on others’ optimism, which all say it’s going to be volatile and worrying on some trading days ahead.

I think this sums up where the market mindset is now, following that disappointing inflation result: “This year has been riddled with technical false starts. Few times in history have the Advances/Declines been so positive leading into a day with such overwhelming selling pressure,” Frank Gretz, technical analyst at Wellington Shields, wrote in a note to clients. “There’s always a risk in reading too much into one-day knee-jerk sort of reactions. Then too, the numbers say the report may have shifted investors’ mindset. They now suddenly believe what the Fed has been screaming.” (CNBC)

As with most experiences with stocks, we’re in a waiting game and data analysis will be really market-impactful.

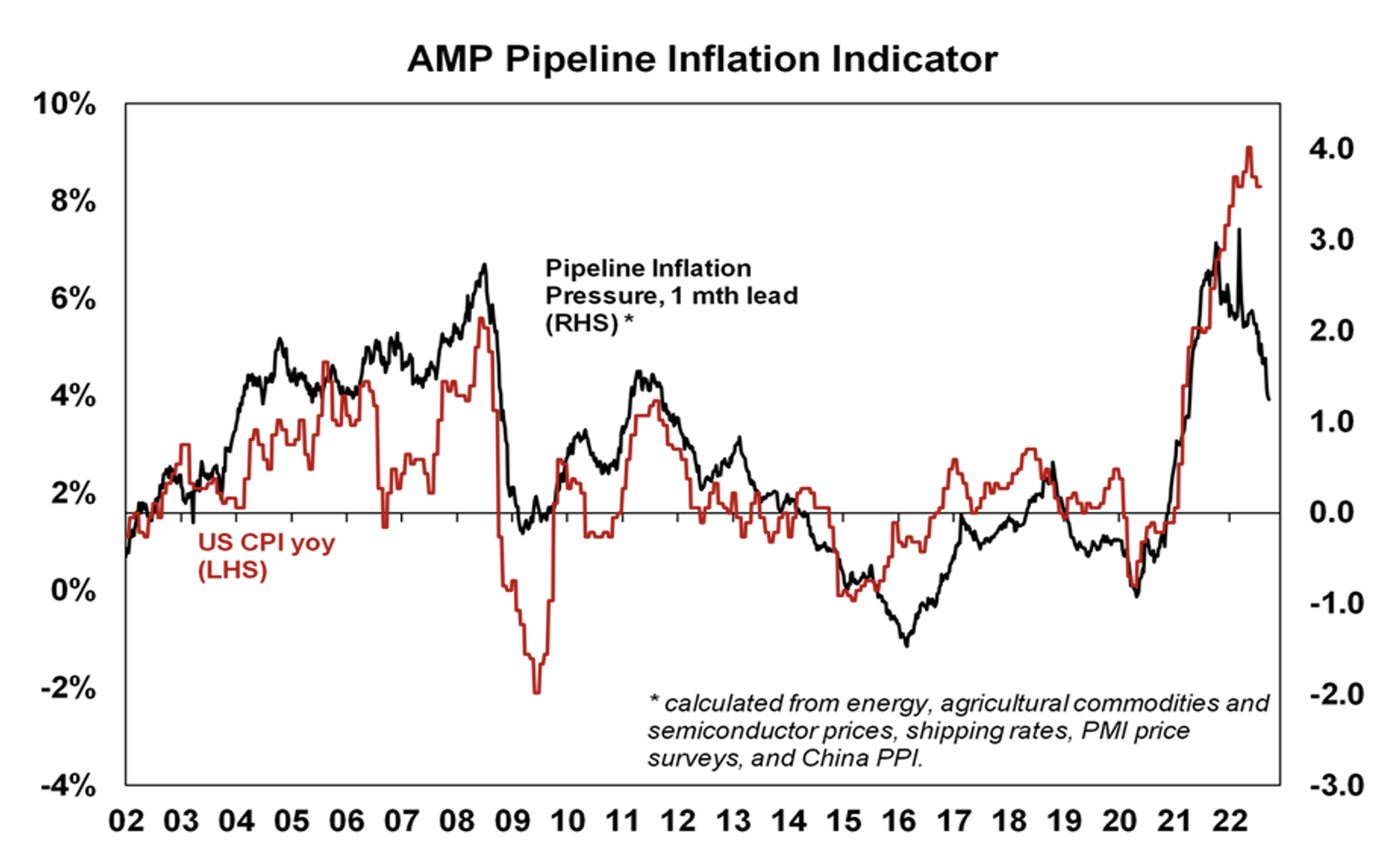

But I can’t leave you there, given what I said about lags. The AMP Pipeline Inflation Indicator from Shane Oliver is something optimists have to take on board.

Here you can see that the red line for official US inflation is starting to fall but the black line, showing the pipeline view on key inflation movers, has been falling ahead of the official readings.

Shane noted that “while short term risks remain high, there are several reasons for optimism.” And here they are:

- Producer price inflation is slowing and looks to have peaked in the US, UK, China and Japan.

- This is consistent with AMP’s Pipeline Inflation Indicator, which is continuing to trend down, given falling price and cost components in business surveys, falling freight rates and lower commodity prices (outside of gas and coal).

If the fall in inflation shows up more significantly on October 13, then this sell-off of stocks could easily be replaced by a boom in buying.

As I’ve said already — data watching and the central banks’ interest rate plays are everything.

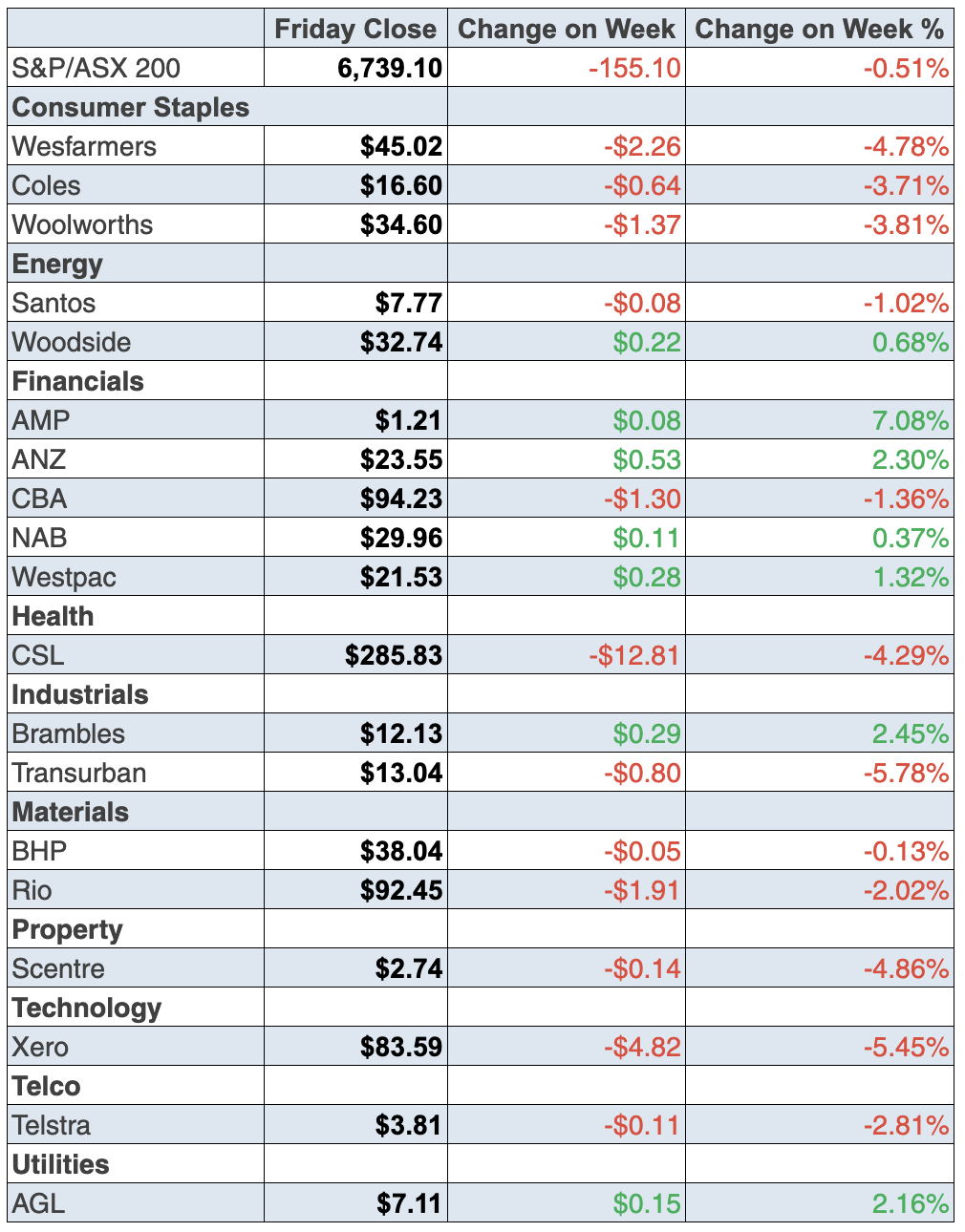

To the local story and the US inflation number was awful for the S&P/ASX 200 Index that dropped 2.1% for the week to finish at 6747.

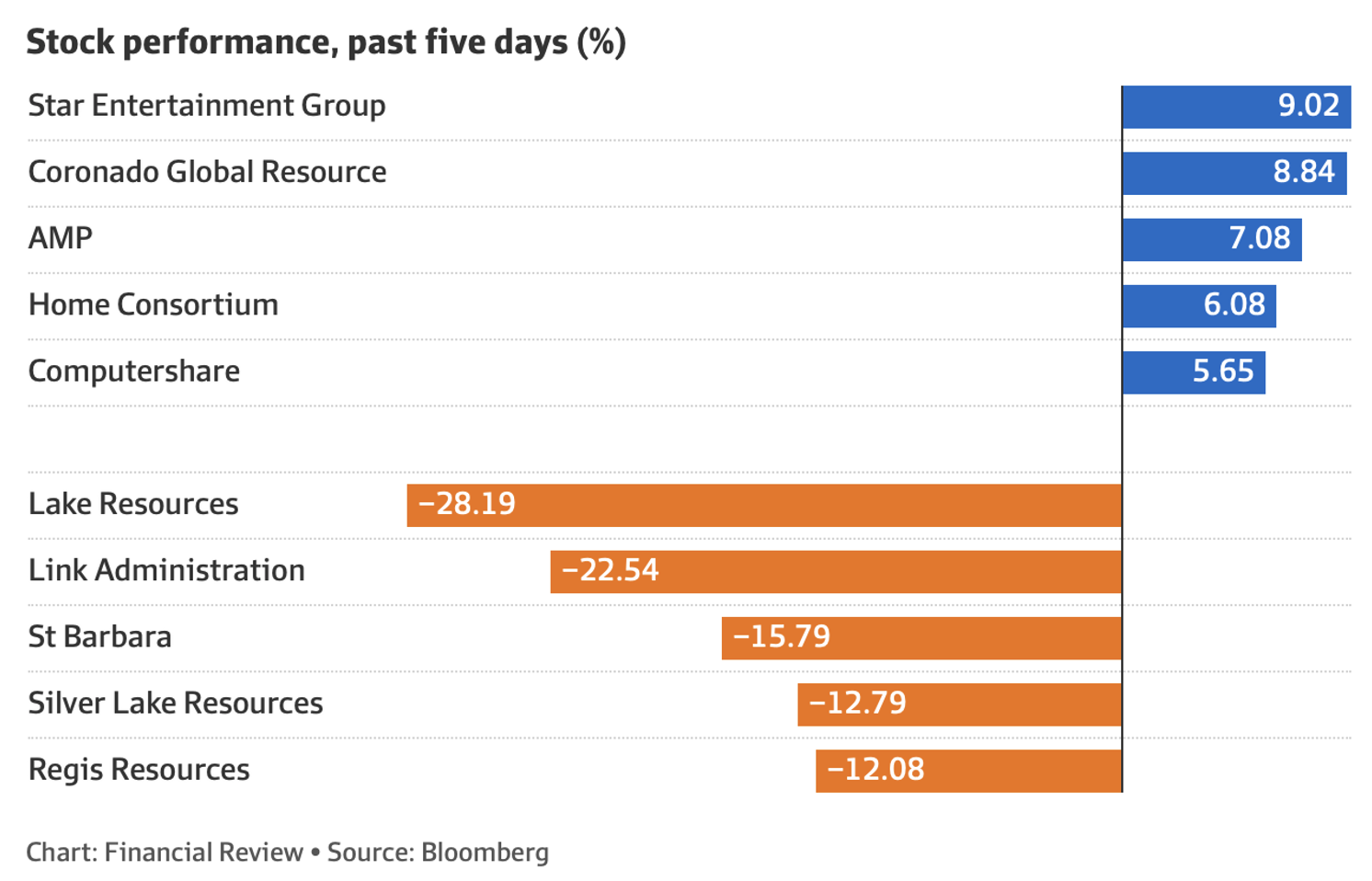

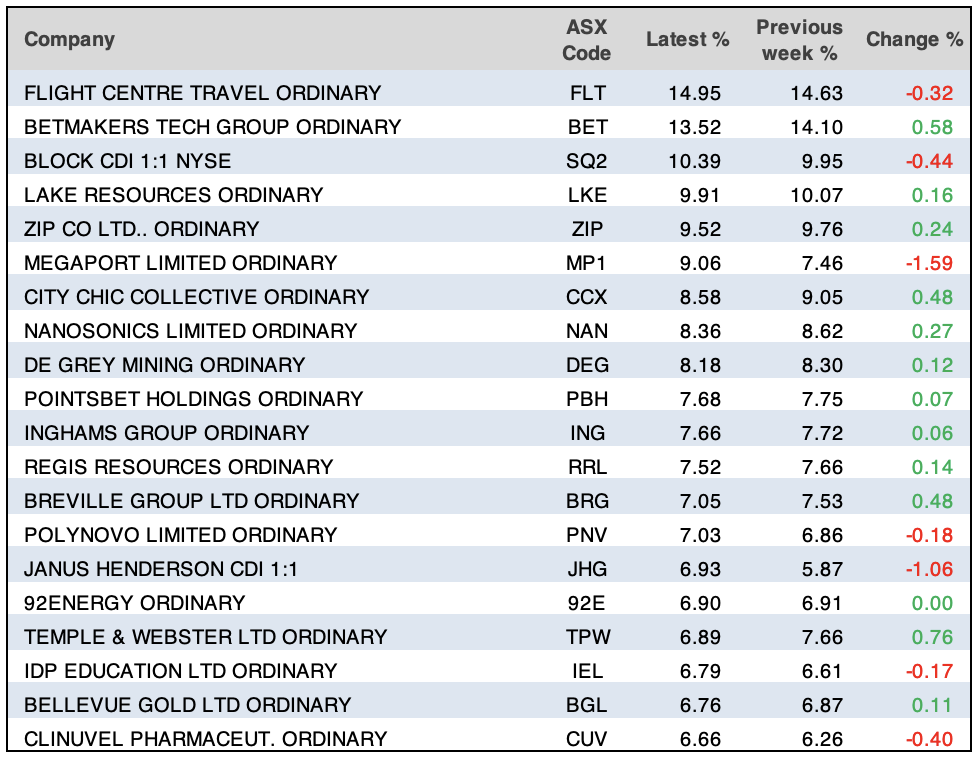

Here were the big winners and losers of the week:

Not shown in the above table was Atlas Arteria (ALX), which dropped nearly 12% for the week after raising $2.5 billion to win control of the Chicago Skyway at $6.30 a share.

Coal stocks lost a few friends over the week, despite new analysis suggesting its newfound popularity, thanks to the higher oil prices because of the Ukraine war, will keep helping their share prices. Whitehaven, tipped by a US coal watcher as a good buy, lost 1.7% this week to finish at $8.63.

Lake Resources has a battle with a key partner Lilac Solutions, which smashed its share price as the table above shows.

What I liked

- The Reserve Bank Governor has indicated that more rate hikes are on the way but smaller increases are now possible – the next decision by the RBA Board is whether rates rise 25 or 50 basis points.

- The unemployment rate rose from a 48-year low of 3.4% to 3.5%, the first increase in 10 months. The jobless rate has to rise or the RBA will go harder on rate rises.

- The weekly ANZ-Roy Morgan consumer confidence index fell by 0.5% to 85.7 (long-run average 112.2), which helps lower inflation and might make the RBA back off big rate rises.

- The Australian Bureau of Statistics (ABS) reported that the mean price of residential dwellings fell $18,900 to $921,500 in the June quarter – the first fall in two years. This is a plus for fighting inflation.

- In US economic data, consumer inflation expectations for the year ahead fell from 6.2% to 5.7% in August (survey: 6.1%).

- US economic data softened, which is good for inflation with industrial production down 0.2% and the Philadelphia Federal Reserve manufacturing index falling from 6.2 points to -9.9 points in September (survey: 2.8 points).

- The US producer price index (PPI) fell by 0.1% in August after a 0.4% fall in July (survey: -0.1%) but was up by 8.7% on the year (survey: 8.8%). I’m looking for indicators that will tip inflation has peaked in the US and this might show up in the September CPI out on October 13.

- Market reported rents as measured by Zillow in the US point to a slowing in US “shelter” inflation ahead. As this reflects new leases, it impacts with a lag. This is significant because the shelter component is 33% of the US CPI and is dominated by rent and owners’ equivalent rent.

- Chinese retail sales rose by 5.4% over the year to August; production rose by 4.2%; fixed asset investment rose by 5.8%. The results were stronger than the July outcomes and stronger than forecasted.

What I didn’t like

- The headline US Consumer Price Index (CPI) unexpectedly rose by 0.1% in August, defying market expectations for an easing in price pressures (survey: -0.1%). The core US CPI, excluding volatile food and energy prices, lifted 0.6% in August, above market expectations for a 0.3% lift.

- The US inflation number, which I was always wary of but was hopeful that the fall in inflation would show up in the stats. It will happen but it’s always a waiting game when it comes to stats that show what’s happening in the real world.

- The Westpac-Melbourne Institute monthly index of consumer sentiment rose by 3.9% in September, which isn’t great for lower local inflation hopes.

- The NAB business confidence index rose 3 points to a 4-month high of 10 index points, while conditions rose 1 point to 20 index points – a 14-month high (long-term averages near 5 points). This is another positive reading that doesn’t help beat down inflation!

The score

You know I keep a weekly score of what I liked versus what I disliked. Despite the dramatic sell-off this week, the latest score above is 9-4 for the likes. I think we are in the end-plays for rate rises but it could take a couple of months before the sentiment will confidently change from guarded pessimism to guarded optimism. The “guarded” bit could take until 2023 for it to be replaced with a much stronger sense of confidence.

The week in review:

- While tech stocks are by no means a darling sector for investors in the current market, I think there is value in keeping your eye on some of the quality options in this country. So, this week in the Switzer Report, I list a number of quality tech stocks that have defied the market sell-off, which tells us a lot about these companies.

- Paul (Rickard) assesses whether it is worthwhile investing in regional banks, specifically Bank of Queensland (BOQ) and Bendigo & Adelaide Bank (BEN).

- In his article this week, Tony Featherstone says it takes courage to buy sectors deeply out of favour and it takes high conviction to stick to that view. Tony says the key is identifying sectors that have good long-term prospects but have been oversold largely on short-term market fears, and buying through an ETF.

- James Dunn follows on from his article last week about this year’s reporting season stars by going to the other end of the spectrum and outlining 4 reporting season shockers for FY22.

- In our “HOT” stock column this week, Michael Gable, Managing Director of Fairmont Equities, says it looks like CSL Limited (CSL) is getting its mojo back and is a buying opportunity.

- In Buy, Hold, Sell – What the Brokers Say, there were 10 upgrades and 5 downgrades in the first edition, and just 3 downgrades with zero upgrades in the second edition.

- And finally, in Questions of the Week, Paul answers your queries about whether IGO is a buy; Would the listed investment company MFF Capital Investments be a good buy for your super fund?; Why the market has gone cold on Domino’s Pizza; Is there an easy way to work out how long your super will last to pay you a pension?

Our videos of the week:

- Can a high dose of vitamin E really cause death? | The Check Up

- Why are copper, nickel and lithium stocks on the rise? + 3 growth companies; DGL, PPE & SMP | Switzer Investing (Monday)

- US inflation disappoints & Wall Street tanks + Star Entertainment: ‘Unfit to hold casino license’ | Mad about Money

- 4 mid-cap stocks for your portfolio + How do you renovate or build and stay within your budget? | Switzer Investing (Thursday)

- Boom! Doom! Zoom! | 15 September 2022

Top Stocks – how they fared:

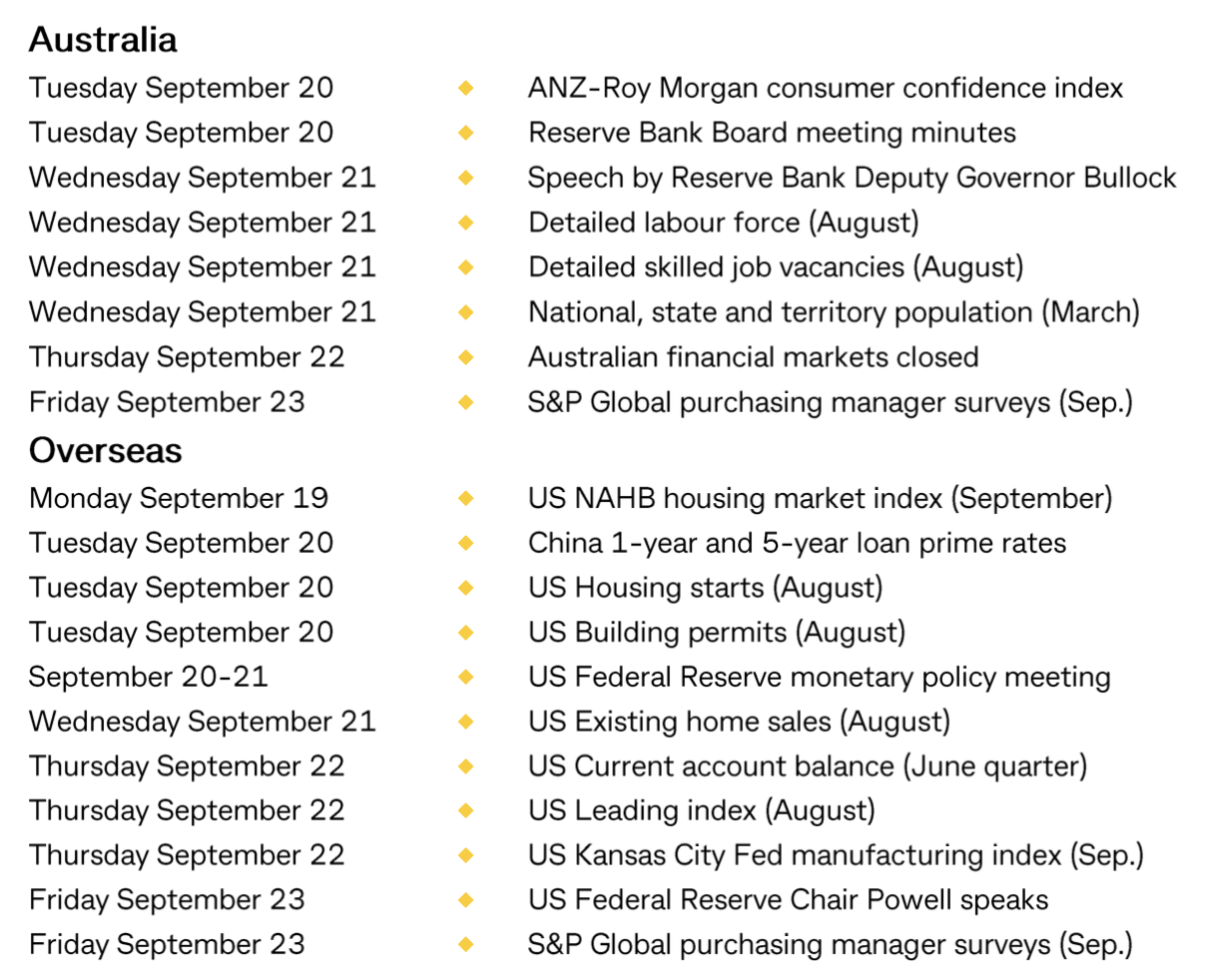

The Week Ahead:

Food for thought: “Fame and wealth without wisdom are unsafe possessions.” – Democritus

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

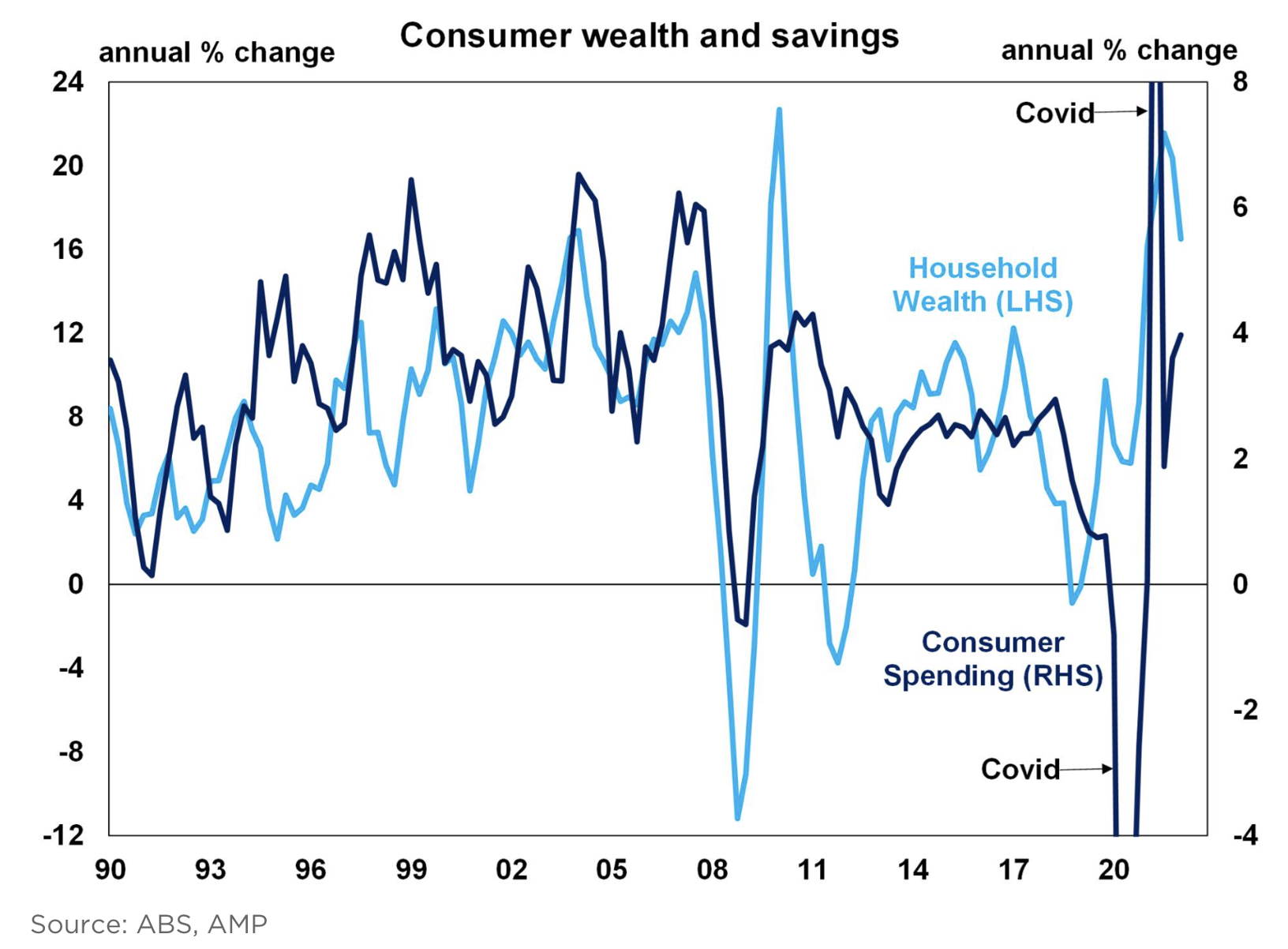

In our chart of the week, Diana Mousina of AMP Capital explains how consumer spending is projected to slow using a concept known as the “wealth effect”.

“The ‘wealth effect’ is an economic concept referring to a change in consumer spending following an adjustment to household wealth,” Diana said.

“The historical relationship between wealth and consumer spending shows that rising wealth coincides with rising consumer spending and vice versa (see the chart below) and intuitively this makes sense – when you feel like your assets are worth more, you feel more confident to spend.

“Our expectations for declining home prices in 2022/23 and, as a result, household wealth, means that consumer spending growth will also slow. We expect a weakening in consumer spending to just under 1% (year on year) by December 2023 which will weigh on GDP taking it well below normal levels of around 3% growth in consumer spending,” Diana notes.

Top 5 most clicked:

- 4 reporting season shockers – James Dunn

- How to pick a quality tech stock – Peter Switzer

- Is it time to look at the regional banks? – Paul Rickard

- 3 ETFs in 3 out-of-favour sectors – Tony Featherstone

- Questions of the Week – Paul Rickard

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.