Savers have something to celebrate at long last. Term deposit rates have cracked 3%!

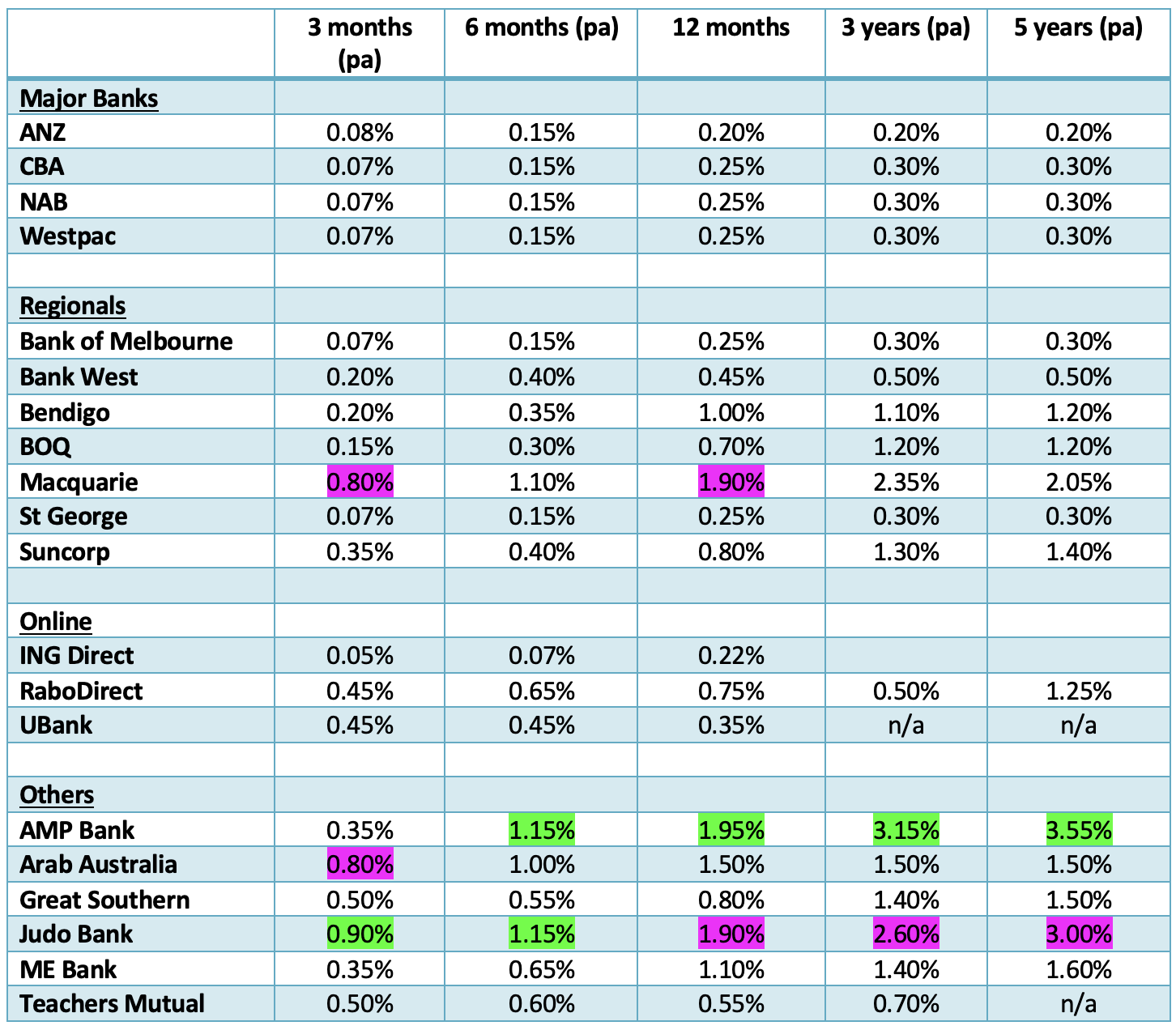

But a warning – you will need to shop around to get the best rates because there is a huge difference between what individual banks are offering. AMP Bank is paying 3.55% pa (interest paid annually) for a 5-year term while ANZ is only offering 0.20% pa for the same period. For a 12 month term, Macquarie is paying 1.90%. Go to one of the majors and the top rate on offer for 12 months is just 0.25%.

Whereas the Reserve Bank of Australia has yet to increase the official cash rate of 0.10%, the market has started to price in significant increases and driven government bond rates higher. The two-year government bond rate has jumped from (an artificial) 0.10% at the start of the year to over 2.0%. Longer-term deposit rates are ultimately related to the bond rate, so some banks have moved faster in raising their rates to attract new funds.

The increase in interest rates is chiefly being driven by concerns over higher inflation. Australia is following the United States, where consumer inflation accelerated to 8.5% in March, the highest rate since December 1981. US interest rates have soared, with the benchmark US 10 year government bond climbing to almost 3%.

US 10 year Government Bond Yield

Most economists expect our Reserve Bank to start raising rates in June. It confirmed that it wants to see “important additional evidence … on both inflation and the evolution of labour costs” before it bites the bullet and follows the lead of the US Federal Reserve, the Bank of England and Reserve Bank of New Zealand in raising rates. The first increase in June may only be 0.15%, so it could be some months before the major banks raise their shorter-term interest rates for depositors.

National Australia Bank forecasts the cash rate to climb to 1% by the end of 2022, with a 0.15% increase in June followed by three further increases of 0.25% in July, August and November. Westpac forecasts it will hit 1.25% by year’s end, while some other banks are more hawkish and are tipping 1.5%.

For interest rate watchers, the next major data point is the release of the March quarter inflation data (CPI or consumer price index), which is due out next Wednesday. The Reserve Bank Board meets again on Tuesday 3 May, and on 18 May, data on wages growth (wage price index) is due to be released by the Australian Bureau of Statistics.

The best term deposit rates

With more than 140 ADIs (Authorised Deposit-taking Institutions) covered by the Government Guarantee on depositors’ funds, it pays to shop around to secure the best rate. Don’t be put off by security concerns because with the effective Commonwealth Government guarantee on deposits of $250,000 on a per client per financial institution basis through the Financial Claims Scheme, Bank A is as good as Bank B up to $250,000.

Listed below are rates on offer for the popular terms of 3 months, 6 months, 1 year, 3 years and 5 years. Rates are current as of 20 April and are based on a deposit of $50,000 with interest paid on maturity or annually for terms of 3 or 5 years.

Rates are shown for the four major banks and 16 regional/significant/online/other banks. The major banks typically pay lower rates than the online banks and the regional banks.

AMP Bank is offering the best rates from terms of 6 months or more (highlighted in green). Judo Bank has the best rate for a 3-month term deposit of 0.90% and matches AMP Bank for 6 months at 1.15%. For 12 months, Macquarie’s rate of 1.90% stands out (highlighted in pink).

Some banks, such as UBank, reward loyalty by paying an additional 0.10% pa when an investor rolls over the full amount of a term deposit to a new deposit term.

Rates as of 20 April 2022 for deposits of $50,000 and upwards. Interest paid on maturity, or annually for 3 and 5 year terms. Advance notice (31 day) products selected when offered. Teachers Mutual is “customer” rate, members get an extra 0.05%.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.