Telstra’s share price retreat following its full year profit announcement has created a little bit of value in the stock. It closed on Friday at $4, down 26 cents or 6.1% for the week.

The main reason for the fall was the announcement by CEO Vicki Brady that it would retain for the medium term InfraCo Fixed. Following a group restructure, Telstra’s fixed infrastructure assets had been transferred into a new operating company, InfraCo Fixed, contributing about $1.6bn of EBITDA to the Group. The market’s expectation was this would be spun out or divested, creating an immediate return for shareholders.

Instead, Telstra came to the view that the greatest value would be created by maintaining the current ownership structure.

With no near term “sugar hit”, some investors took their profits and sold out. Analysts, who had been valuing Telstra on a “sum of the parts” basis, reverted to the more traditional “discounted cash flow” basis and reduced their target prices.

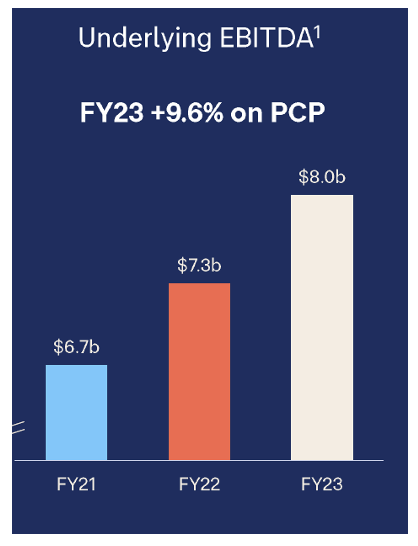

Overall, Telstra delivered a very credible result meeting guidance on all dimensions. Total income of $23.2bn was up 7.4% on FY22, and underlying EBITDA of $8bn was up 9.6% on FY22 or 5% when Digicel Pacific was excluded (the latter was acquired by Telstra in July 22).

The mobiles division starred, contributing $4.6bn of the $8.0bn EBITDA, up 15.1% on FY22. Net customer additions, increasing services revenue and increasing ARPU (average revenue per user) drove the increase. The international division also delivered an improved performance, as did the very low margin Fixed Consumer and Small Business product line, which derives most of its revenue from being a retailer of NBN services.

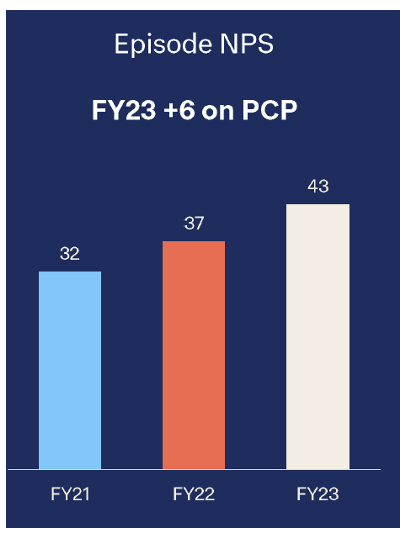

Underlying expense growth of 6.3% led to positive jaws (revenue growing faster than expenses), following strong cost discipline. Another highlight was the improvement in customer NPS (net promoter score) by 6% (more satisfied customers and fewer complaints).

On the negative side, earnings in the Fixed Enterprise product line fell by 38% to $0.4bn.

For shareholders, a final dividend of 8.5c meant a full year payout of 17c (fully franked), up 0.5c on FY22. With earnings per share of 16.7c, this represents a payout ratio of 102% (but only 95% of free cash flow).

Looking ahead, Telstra provided the following guidance for FY24:

- Total income of $22.8bn to $24.8bn ($23.2bn in FY23)

- Underlying EBITDA of $8.2bn to $8.4bn ($8.0bn in FY23)

- Capex of $3.6bn to $3.7bn ($3.6bn in FY23)

- Free cashflow of $2.8bn to $3.2bn ($2.8bn in FY23)

What do the brokers say?

The brokers are generally positive on Telstra. According to FN Arena, of the five major brokers who cover the stock, there are three ‘buy’ recommendations and two ‘neutral’ recommendations. The consensus target price is $4.50, 12.5% higher than Friday’s closing ASX price of $4. Target prices range from a low of $4.20 from Morgans through to a high of $4.75 (from Morgan Stanley).

Following the result, the brokers marginally downgraded their target price, from a consensus of $4.67 to $4.50. This was largely due to the “delay in releasing value” by not selling Telstra InfraCo, and a change in the valuation method from a “sum of the parts” to the more traditional “discounted cash flow” basis.

Overall, the result was assessed as meeting expectations both in terms of the outcomes for FY23 and forward guidance for FY24.

FN Arena’s precis of the post results broker research shows positive sentiment to the stock (including being one of Morgan Stanley’s “top picks”) but also some weariness about how defensive stocks might perform. Here are Macquarie, Morgans and Morgan Stanley’s views.

“Telstra’s earnings were ahead of Macquarie and at the top of the guidance range. FY24 earnings guidance is slightly below the broker at the midpoint, reflecting enterprise/wholesale headwinds.

Telstra indicated monetisation of InfraCo is on hold. Macquarie views this as a positive for the group’s competitive advantage as an asset owner although negative from a capital return perspective.

Contracted annual mobile price increases are the next step up for the stock. Outperform retained. Target falls to $4.39 from $4.64, reflecting a shift to a discounted cash flow valuation from sum-of-the-parts now the InfraCo sales is off.”

“Morgans believes this decision (InfraCo will remain for at least the medium term) removes the short-term appeal of the stock and downgrades to Hold form Add.

As the stock market generally looks forward by around nine months, the analyst believes investors may rotate away from the defensive Telstra to cyclical growth stocks.

FY23 revenue, underlying earnings and capex were all broadly in-line with guidance and consensus expectations. FY24 guidance also met the consensus estimate.

While the broker’s EPS forecast for FY24 falls by -3.5%, the sum-of-the-parts valuation also falls on management’s delay in releasing value and the target reduces to $4.20 from $4.70.”

“Morgan Stanley comments Telstra Group’s FY23 has met expectations, vindicating the broker’s positive thesis beforehand. The Mobile division outperformed by some 4%.

Mobile is considered the key driver of shareholder value. The Enterprise Fixed division underperformed and the sale of InfraCo has been put on the backburner, for now.

FY24 guidance remains in line with market expectations, including for free cash flow. Telstra remains one of the broker’s Top Picks.”

Bottom line

Telstra is certainly more attractive than it was a few weeks ago. On a multiple of 22.2x forecast FY24 earnings and 20.5x forecast FY25 earnings, and a prospective dividend yield of 4.4% for FY24 and 4.6% for FY25, it is no bargain.

But it has all the hallmarks of a classic defensive stock, and because of the predictability of revenue, earnings and fully franked dividends, investors pay a premium.

There remains the possibility of a small “sugar hit” if Telstra was to sell down its part ownership of the mobile towers business, Amplitel.

My sense is that Telstra might drift a little lower (particularly if bond yields rise further), but we are not too far off a major support area around $3.75 to $3.80. A “hold” for investors, potentially with a view to increasing their exposure.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.