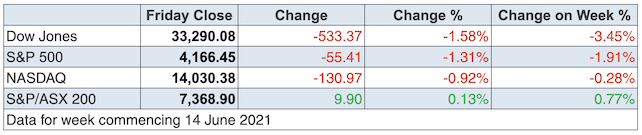

Before the close, the Dow Jones was heading for the worst week this year, losing about 3.4% yet the Nasdaq ended up down only 0.37%! Welcome to a re-rotation with tech stocks back in favour and value stocks losing friends.

Who’s to blame? In simple terms it’s the Federal Reserve that met this week and the members of the Federal Open Market Committee (FOMC) with their interest rate predictions that led to the conclusion that rates could rise in 2023 rather than 2024.

This has created a typical overreaction by short-term players, who were keen to book their profits before reloading up on tech stocks. It happened here too but financials didn’t cop it like they did in the US over the week. Recall our bank stocks were some of the biggest gainers of the rotation out of tech/growth stocks into value stocks.

Tech stocks copped it in February and you might remember I suggested it was a buying opportunity for the long-term investor. But I never expected the long term to show up in the short term! Over that time, CBA has risen around 25%, with other financials surging and I won’t be surprised if we see a bit of profit-taking selling in this and other sectors that have been described as value stocks.

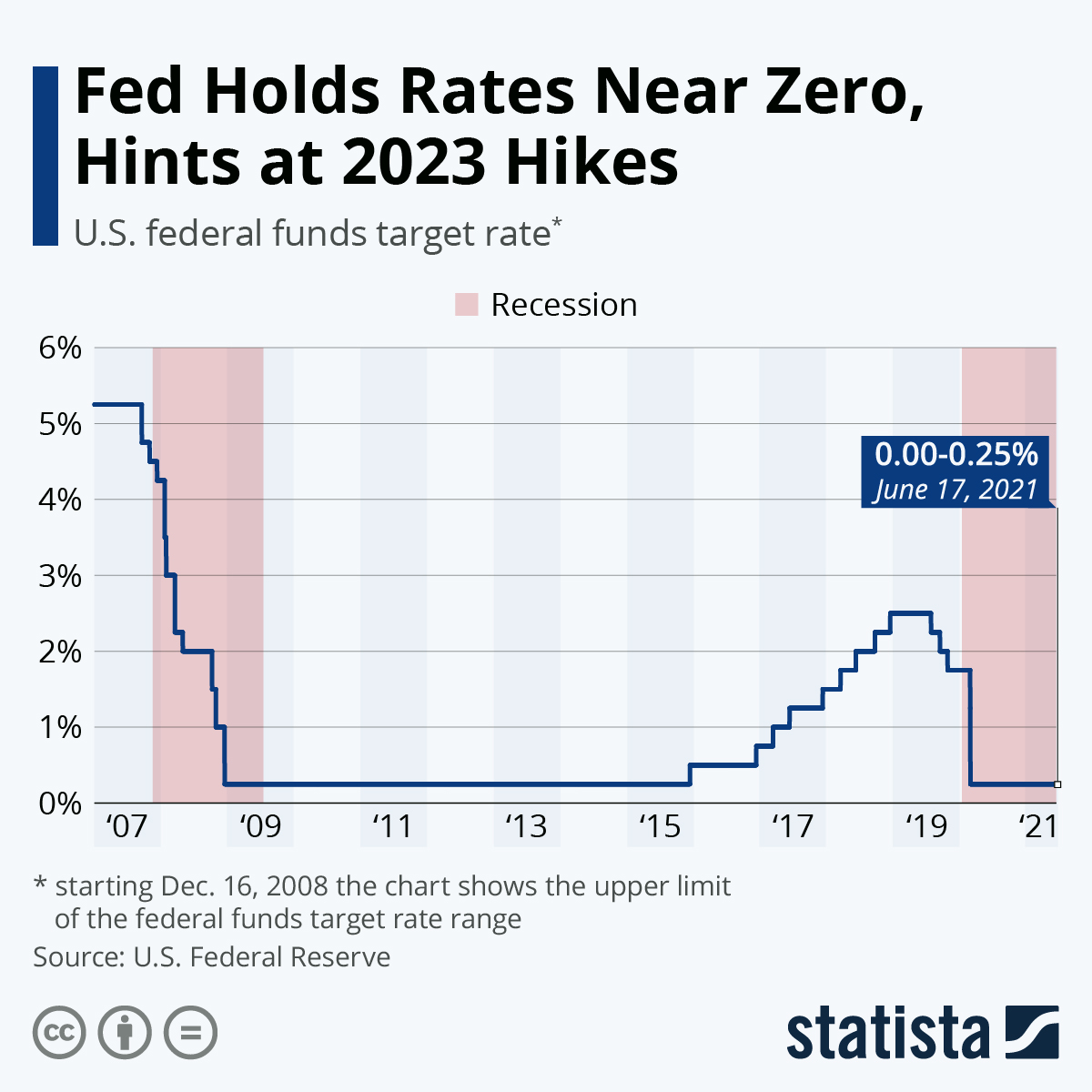

The trouble for stocks started when the Federal Reserve left its target range for the federal funds rate unchanged at 0-0.25%. However, in the attached forecasts, 11 of 18 policymakers signalled two rate increases by the end of 2023.

And even though Chairman Jerome Powell said that it was still way too premature to talk of a ‘lift-off’ phase for interest rates, also saying that bond purchases will remain at a rate of US$120 billion per month, Wall Street got jumpy and started chasing tech stocks at the expense of value plays.

It pushed the US dollar up and our dollar down, so on Monday’s Switzer Investing TV programme I’ll interview Morgans’ chief economist, Michael Knox, who not only tipped this roaring 20s-like economic growth, he also predicted a rising Aussie dollar over the 80 US cents level back in July last year. Does he still think this will happen? I bet the answer is yes!

By the way, the Oz dollar was 69 US cents then, so it’s still up over 8% since that call. In February, the gain was 14.4%!

Fears around higher interest rates drove the US dollar higher and as commodity prices are priced in the greenback, they fell. But they weren’t helped by Beijing, as Bloomberg explained this week. “China has stepped up its campaign to rein in commodity prices and reduce speculation in a bid to ease the threat to its pandemic rebound from soaring raw material costs,” its team wrote. “State-owned enterprises were ordered to control risks and limit their exposure to overseas commodities markets by the State-owned Assets Supervision and Administration Commission, according to people with knowledge of the matter.”

China might have short-term success but eventually market demand and supply will determine what happens. This could be Beijing trying to buy time awaiting Brazil and Vale to get back to normal, which would bring down iron ore prices. But this is purely speculation, as the leadership of China doesn’t share secrets!

Undoubtedly, central banks are noting how strong economies are and even our Reserve Bank Governor Dr Phil Lowe delivered a speech this week where he pointed out that a material lift in wages (necessary to push inflation to the 2-3% target range) was “some way off”. But economists also noted he wasn’t throwing around his “rates won’t rise until 2024” line, like he has in the past.

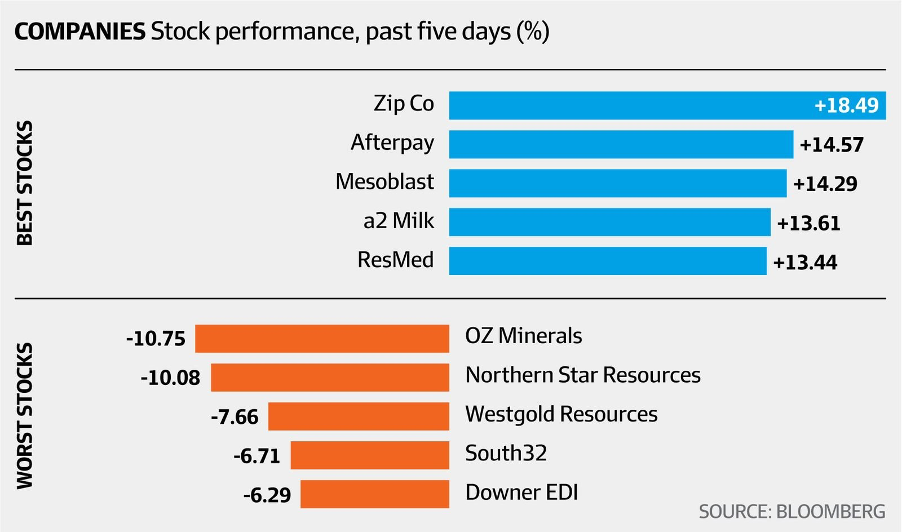

To the local story and as I’ve been tipping, tech stocks weren’t going to be out of favour for long (especially if they’re called growth stocks). And economic growth forecasts have been on the rise here and all around the world.

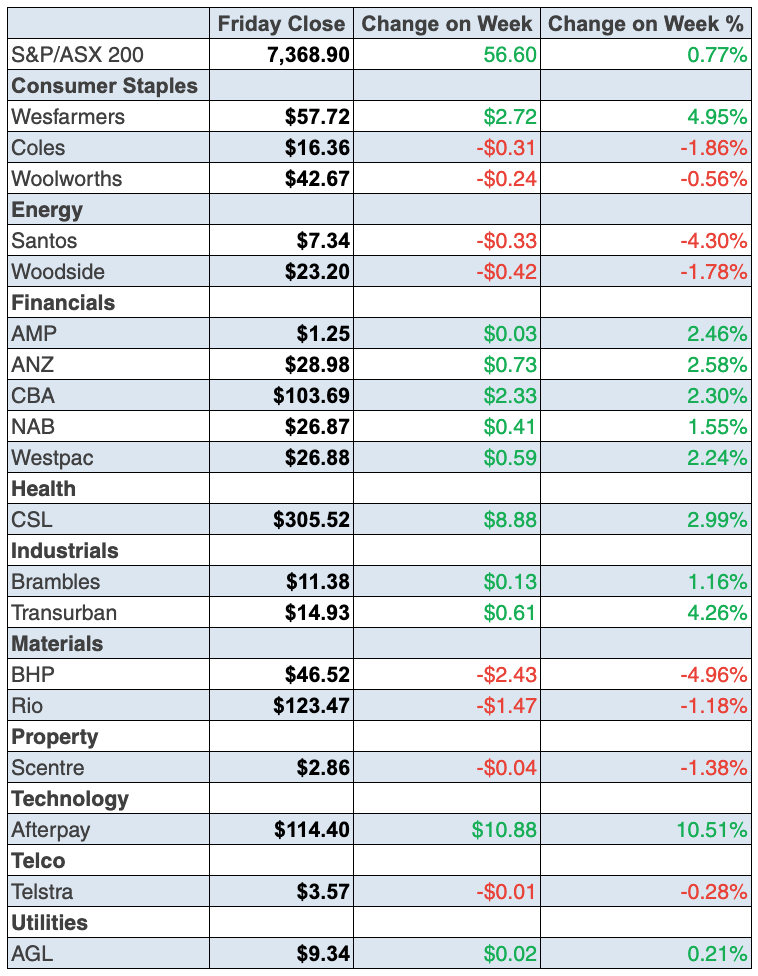

The S&P/ASX 200 put on 56.6 points (or 0.8%) for the week and the banks were big drivers of the index. The CBA was up 2.3% to $103.69, NAB rose 1.5% to $26.97, Westpac 2.2% to $26.88, while ANZ jumped 2.6% to $28.98.

Happily, some of my favourite tech stocks put in a big week, with Zip Co. up 13.8% to $8.14, while Megaport is confirming my belief that it has a good future, rising 9.1% to $17.60. Predictably, if tech had a good week, so would Afterpay, which was up 10.5% to $114.40. And the very reliable Xero put on 6.1% and is now at $142.25. This is a top company of the future (as I’ve said many times) and is a classic buy-the-dip stock. Back in March, it was a $108 stock so the rise has been a whopping 31% in just over three months!

Another great buy-the-dip sector has been healthcare. I’ll let the AFR’s William McInness sum up this week’s action. “Health care stocks were also among the top performers. CSL climbed 3 per cent to $305.52, ResMed added 12.5 per cent to $31.91, Sonic Healthcare advanced 6.2 per cent to $37.81, Cochlear firmed 4.8 per cent to $246.72, Pro Medicus rose 10.9 per cent to $55.81 and Mesoblast closed 7.9 per cent higher at $2.32.” I don’t know what’s going on with Mesoblast. I’ve contacted the CEO, who dodged my inquiry, but it seems to be on a rise for who knows what reasons!

Mining stocks had a tough week, with China trying to bring commodity prices down by releasing stockpiles. Market interference can work short term but it’s seldom a long-run solution. BHP Group lost 5% to $123.47, Rio 1.2% to $123.47, while Fortescue slipped 3.4% to $22.42.

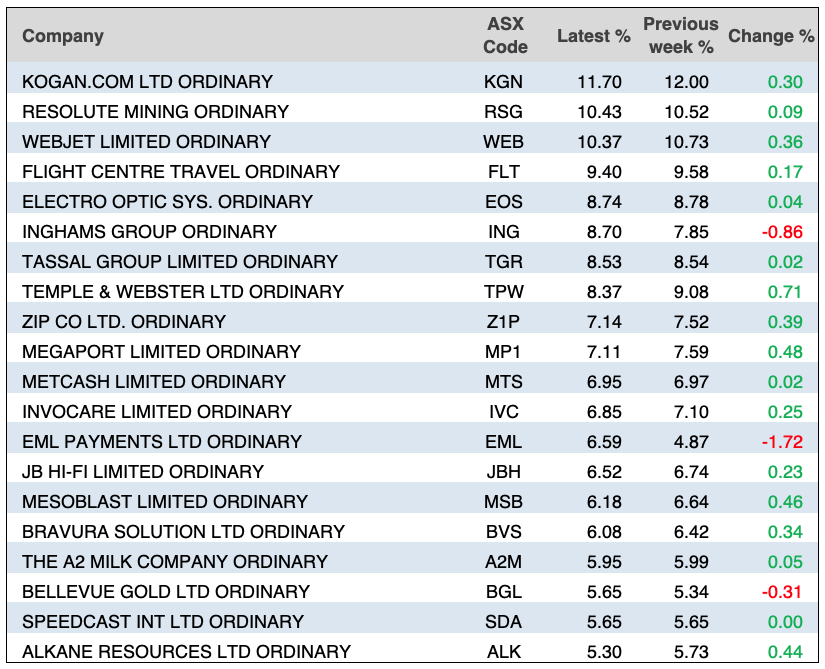

The Bloomberg chart below shows how a lot of stocks that I had faith in have regained fans. The re-rotation in such a quick timeframe has even surprised me, but that’s what stock markets can do!

What I liked

- Employment soared by 115,200 in May after falling by 30,700 in April.

- The unemployment rate fell from 5.5% to a 17-month low of 5.1%.

- The weekly ANZ-Roy Morgan consumer confidence rating rose by 0.3% to 111 (long-run average since 1990 is 112.6). Consumer views on whether it’s a ‘good time to buy a major household item’ jumped by 3.3% in a positive sign for retailers.

- Industrial production in the US lifted 0.8% in May (survey: 0.7%).

What I didn’t like

- China is trying to manipulate supply of commodities to drive prices down.

- US retail sales fell by 1.3% in May (survey: -0.8%).

- The NAHB housing market index fell from 83 to 81 in June (survey: 83). The Empire State manufacturing index eased from 24.3 to 17.4 in June (survey: 22.7) but these are low grade indicators.

- New claims for unemployment insurance in the US rose from 375,000 to 412,000 in the past week (survey: 359,000).

Lesson of the week

I wrote this week that the foundation rules for investing were “buy the dips” with quality companies and “the trend is your friend until it bends”. I wrote this on the plane last Friday (a week ago) forgetting that we didn’t publish on Monday because of the public holiday, so my piece came out a few days later on Thursday. We saw in action exactly what I was talking about.

Of course, there are a lot more rules for successful investing, but being a long-term investor creates buying opportunities and the whole experience shows the pay-off from being diversified. Sure, it reduces the big returns from exclusively going long a sector that roars but it averages out nice returns over time.

This is the difference between speculators and investors.

If you missed my story and others this week, check them out below.

The week in review:

- Buy the dips on quality businesses like these four – Commonwealth Bank (CBA), Macquarie (MQG), CSL (CSL) and Wesfarmers (WES) – and remember that the trend is your friend until it bends.

- Tony Featherstone looked at two coal-related stocks that offer value: Aurizon Holdings (AZJ) and New Hope Corporation (NHC).

- There were 6 upgrades and 10 downgrades in Buy, Hold, Sell – What the Brokers Say this week.

- In Questions of the Week, Paul Rickard answered your questions about ESG concerns surrounding Woodside (WPL) and other oil companies, ANZ Capital Notes 6, stock option prices and the SPP Harvester.

- And in Boom! Doom! Zoom!, we discuss regional banks, copper stocks, Coles (COL), CSL (CSL) and more.

Our videos of the week:

- Boom! Doom! Zoom! | June 17, 2021

- ASX share prices of ALU, APX, A2M & NXL have taken off! + The best income-paying stocks you need! | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday June 21 – Preliminary retail trade (May)

Tuesday June 22 – Weekly consumer sentiment (June 20)

Tuesday June 22 – Weekly payroll jobs and wages (June 5)

Wednesday June 23 – Markit purchasing managers’ indexes (June)

Wednesday June 23 – Reserve Bank Assistant Governor speech

Wednesday June 23 – Skilled job vacancies (May)

Wednesday June 23 – Preliminary international trade (May)

Thursday June 24 – Finance & Wealth (March quarter)

Thursday June 24 – Business conditions & sentiments (June)

Thursday June 24 – Detailed labour force (May)

Overseas

Monday June 21 – China loan prime rates (June)

Monday June 21 – US Chicago Fed National activity index (May)

Tuesday June 22 – US Existing home sales (May)

Tuesday June 22 – US Richmond Fed manufacturing index (June)

Wednesday June 23 – US Current account (March quarter)

Wednesday June 23 – Markit Purchasing managers’ indexes (June)

Wednesday June 23 – US New home sales (May)

Thursday June 24 – US Advance goods trade balance (May)

Thursday June 24 – US Wholesale inventories (May)

Thursday June 24 – US Durable goods orders (May)

Thursday June 24 – US Economic (GDP) growth (March quarter)

Thursday June 24 – US Kansas City Fed factory index (June)

Friday June 25 – US Personal income & spending (June)

Food for thought:

“Our favourite holding period is forever.” – Warren Buffett

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

After 13 members of the Federal Open Market Committee on Wednesday said they expect interest rates will rise in 2023, Statista’s Felix Richter published the following chart looking at the history of the Fed’s target rate since 2007:

Top 4 most clicked:

- Buy the dips on these 4 “quality” businesses – Peter Switzer

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

- Questions of the Week – Paul Rickard

- Two opportunities in coal-related stocks – Tony Featherstone

Recent Switzer Reports:

- Thursday 17 June: Buy the dips on these 4 quality businesses

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.