If there’s one important thing I’ve learnt about investing in stocks it’s to be objective about what you’re investing in. I know we all find it hard to dump poor performers because we believe in the company, even if the market doesn’t. It’s why I liked CBA at around $58 in May last year and $63 in September.

But so far my faith in Mesoblast hasn’t given me rewards but I expected I had to wait a year or so for a pay-off with this speculative play. And frankly, my play was small so I can live with this one, even if it never comes good.

The opposite was the case with Tyro, which is a big play in my super fund and it’s why I gave 5 reasons to buy Tyro shares on January 18.

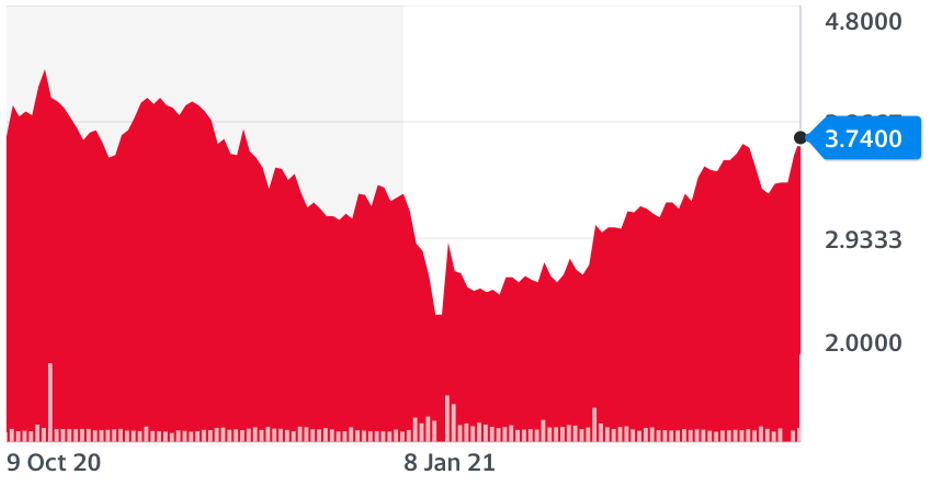

Tyro (TYR)

After the Viceroy report from a US-based hedge fund, Tyro’s stock price fell to $2.32, so the gain there has been 61%, which makes me a proud stock tipster.

So to be objective, let’s see what I suggested this year and how each one performed.

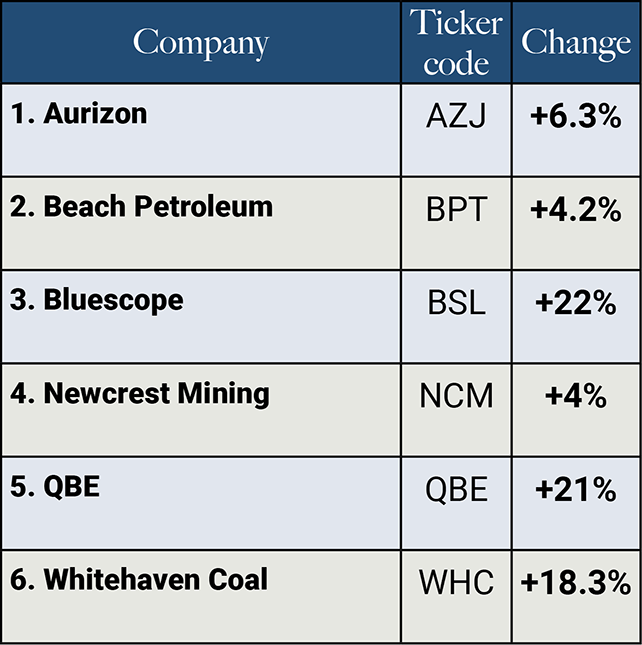

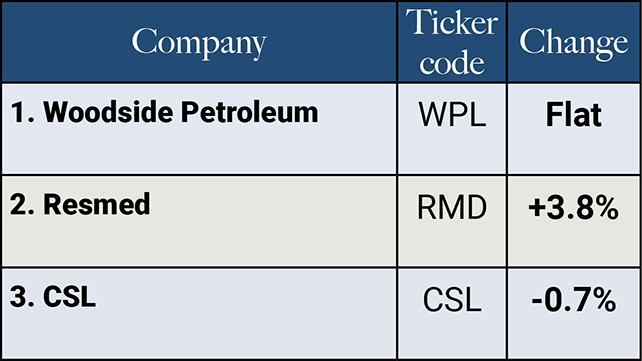

On February 1, I looked at 6 top 100 stocks with 20% upside. Here’s how they’ve performed since then:

At the time I wrote: “So there are 6 top 100 stocks with potentially a 20% plus upside that are worth having a long hard think about.” I guess I got that one right!

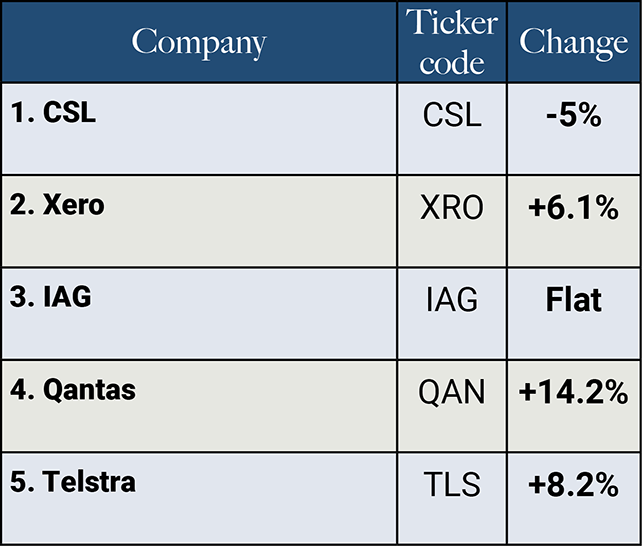

On 8 February, I looked at 5 quality companies mistreated by the market, so let’s see how they fared:

On February 15, I looked at 50 micro and small cap companies that presented at our small cap conferences. There were 50 and only five had negative performances, stock price wise, after the events, which is something we’re all pretty happy about.

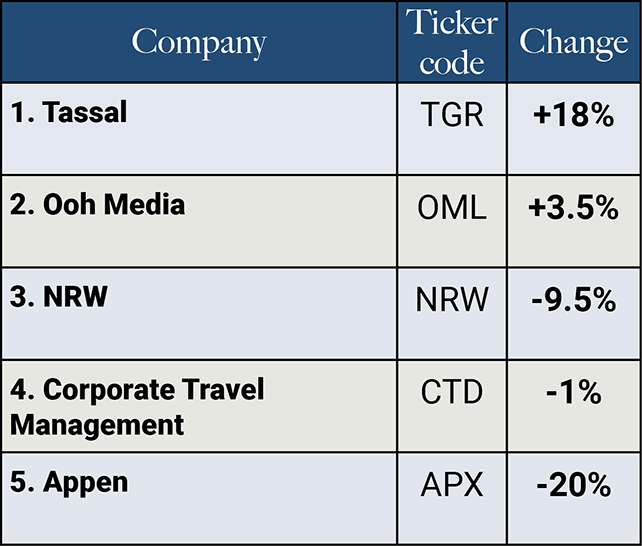

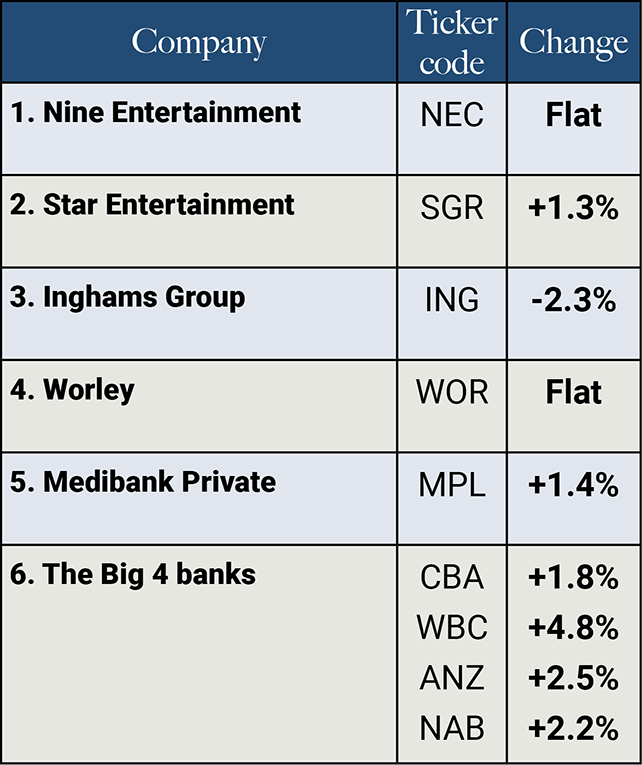

On February 22, I pinpointed 5 top 200 stocks to benefit from the reopening trade. So how did they do?

Re-reading this story, I was hardly glowing on any of these companies in the short term but I liked them longer term. Also our vaccination problems have slowed down the positives from the reopening trade.

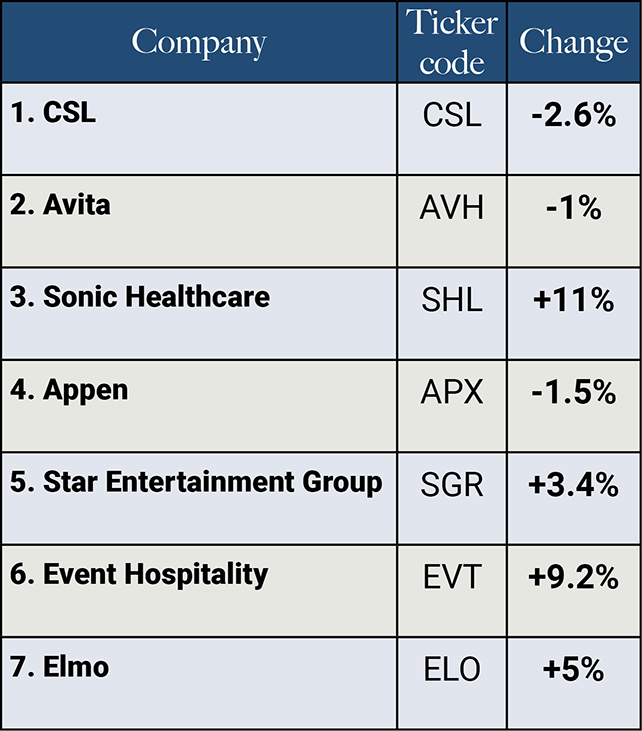

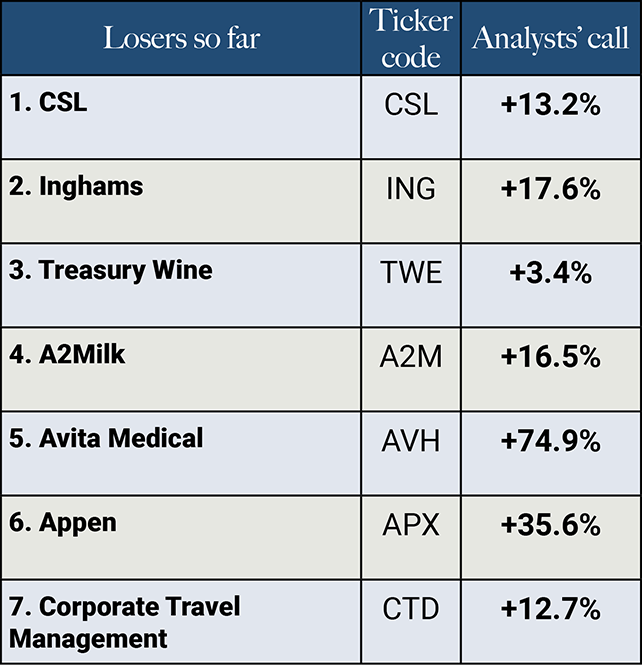

On March 1, I looked for 7 stocks I liked based on a vaccination uplift. So how did I do?

I reckon these would’ve done better if our vaccination program was a tad better!

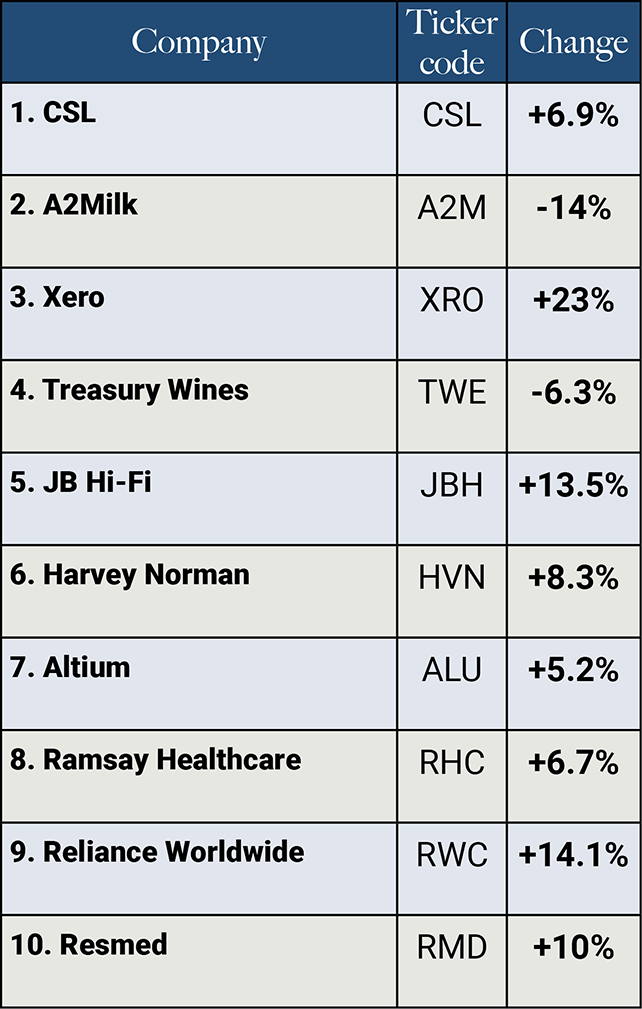

On March 8, I said I wanted more of these 10 stocks below, but were they worth the investment?

My conclusion was at the time: “Clearly, not all these will spike at the same rate in the same time range, but they are quality companies, currently caught in a “let’s reject tech” phase and a rotation into stocks that the market will do well out of the reopening phase. But for my long-term holds, I want to invest in companies where I think I can see their prices rising over time.”

And I have to say I’m happy with these 10 stocks.

On March 15, I couldn’t resist asking the question: “Is Xero in the buy zone?” Of course, my answer was yes, and I provided good arguments to like Xero at the then prevailing price. The gain since that day is 22.8%!

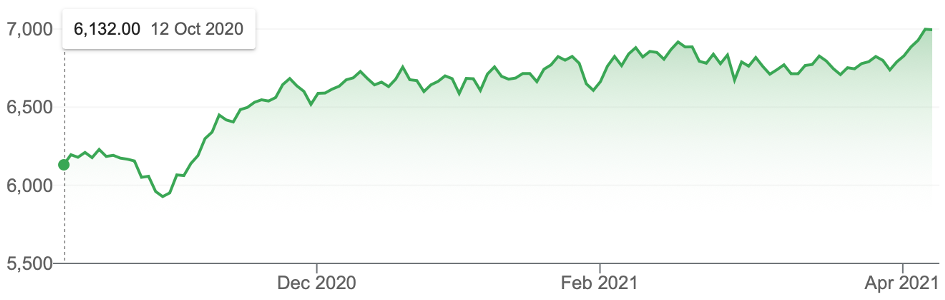

On March 22, I argued stocks offer more immediate potential over gold, so let’s see what the charts say about whether I got this right or wrong?

Over that time, stocks are up 3.5% as the chart below shows:

S&P/ASX 200

Meanwhile the gold price has been flat but for the year its down over 10%, while stocks are up 6.1% before we add in dividends, which you don’t get with gold.

Gold Price

On March 29, I looked at 9 value stocks ripe for the picking. I know it’s far too early to expect a result but let’s just see what’s happened in two weeks. These came from Reece Birtles, the Chief Investment Officer at Martin Currie Australia:

And my 3 were:

It’s far too early days but I’m expecting good news with these companies as the year progresses, as value stocks invariably do well in this part of the stocks cycle.

So what’s the stock tips summary?

There were 30 gainers, 7 losers and 4 flats, which makes me a pretty proud ol’ tipster.

And what’s my conclusion?

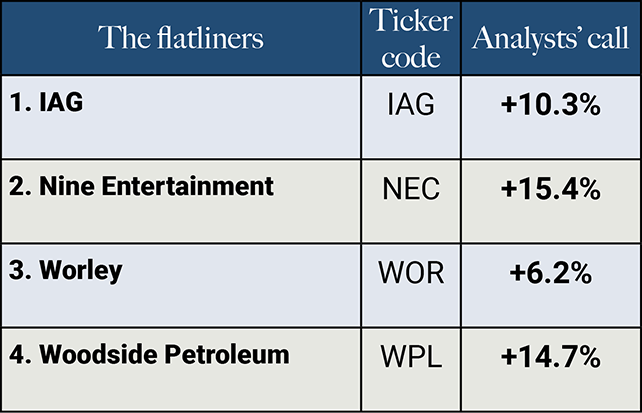

The flatliners and the losers are still worth backing as their time in the sun is ahead of them. But do the analysts agree?

Bottom line? Keep the faith! And let me throw in that I still think that ELO has good upside as reopening linked to vaccinations produces something I call “business normal”. I see James Dunn talks about this tech stock in his article today too so have a read.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances. All prices as of April 9, 2021.