Experienced Fed watchers at Jackson Hole Wyoming, where central bankers gather once a year, did not expect a new message from the Fed chairman, just a tougher version of the central bank’s promise to slow inflation by raising interest rates. And that’s exactly what they got, and Wall Street turned its tail and ran.

Stocks were down and bond yields rose, which is what happens when a Fed boss talks tough on inflation and interest rates.

Many hard-head experts said Jerome Powell was too dovish — soft, implying rate rises were to be smaller soon — after the July FOMC meeting, which sets the official rate in the US, which is 2.25% to 2.5%. Some think the Fed’s equivalent to our cash rate will end at 3% this year but others are tipping a big 4%!

That said, Powell clearly saw no value in talking down the fear factor he needs to slow down spending and therefore inflation, so he had to talk tough. And until the next FOMC meeting on September 20-21, he and the Fed will watch the economic data drop to see what happens next.

“Our decision at the September meeting will depend on the totality of the incoming data and the evolving outlook,” Powell said.

After this tough talk at Jackson Hole, the smart money expects another 0.75% rate rise in the States and that should be good for spooking consumers and slowing down spending to pull back inflation.

Here are the big messages from Powell:

- The US central bank won’t back off in its fight against rapid inflation.

- “Restoring price stability will likely require maintaining a restrictive policy stance for some time.”

- “The historical record cautions strongly against prematurely loosening policy.”

- His hawkish rhetoric meant he was effectively saying: “Don’t expect us to ease up on rate rises anytime soon.”

- The run of economic data will be crucial to what the Fed does with rates.

I expect stocks to slip, as I predicted recently after a nice rebound since mid-June, until we see the next inflation reading on September 13 (thankfully it is not a Friday!).

Also, the August jobs report, out on September 2 will be important for what the Fed does with rates.

I believe Powell knows he has to hang tough until the data says “enough is enough,” but the US economy is not there yet.

This was Bloomberg’s take on his short speech: “He said restoring inflation to the 2% target is the central bank’s overarching focus right now even though consumers and businesses will feel economic pain. He reiterated that another ‘unusually large’ increase in the benchmark lending rate could be appropriate when officials gather next month, though he stopped short of committing to one.”

The bottom line for investors is that more buying opportunities are out there in coming weeks and if the inflation number is higher than 8.5%, then stocks will dive. If it’s a good inflation number, say 7%+, then stocks are bound to spike higher.

Watch this space for my take on the September 13 inflation reading.

To the local story and our market did a pre-Jackson Hole rally, which will be reversed on Monday and will put a downer in place for a week or so. Jerome Powell’s tough talk spooked Wall Street and other markets, like ours will follow suit.

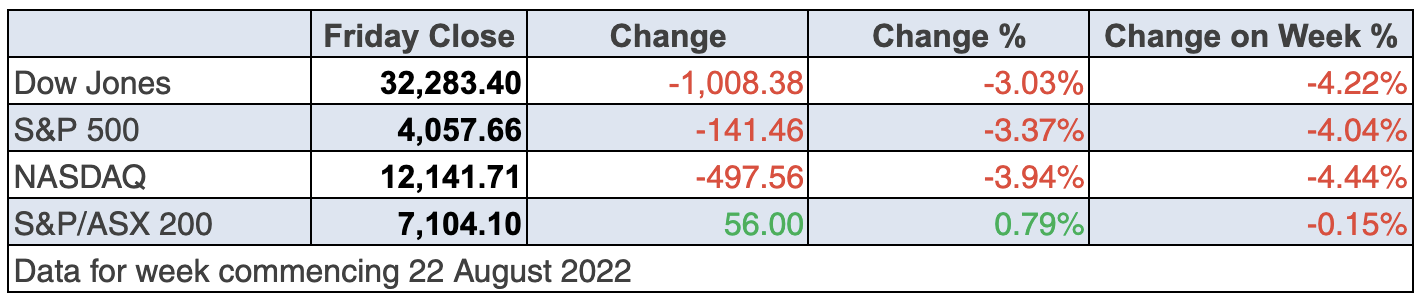

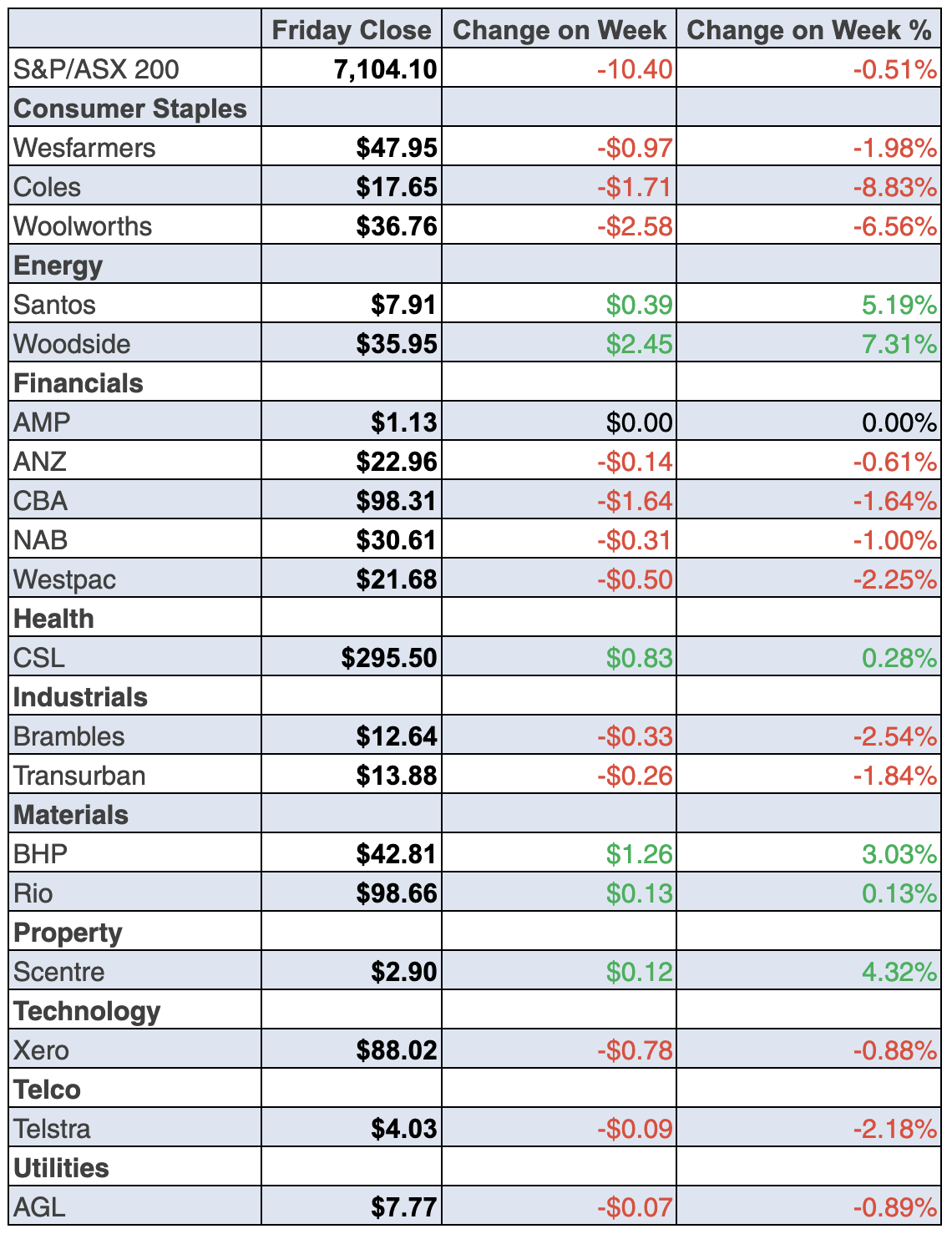

Ahead of his ‘come to Jerome’ speech, we sent our market’s S&P/ASX 200 up 0.8%, or 56 points, to 7104.1 on Friday. For the week, it was a 10-point loser.

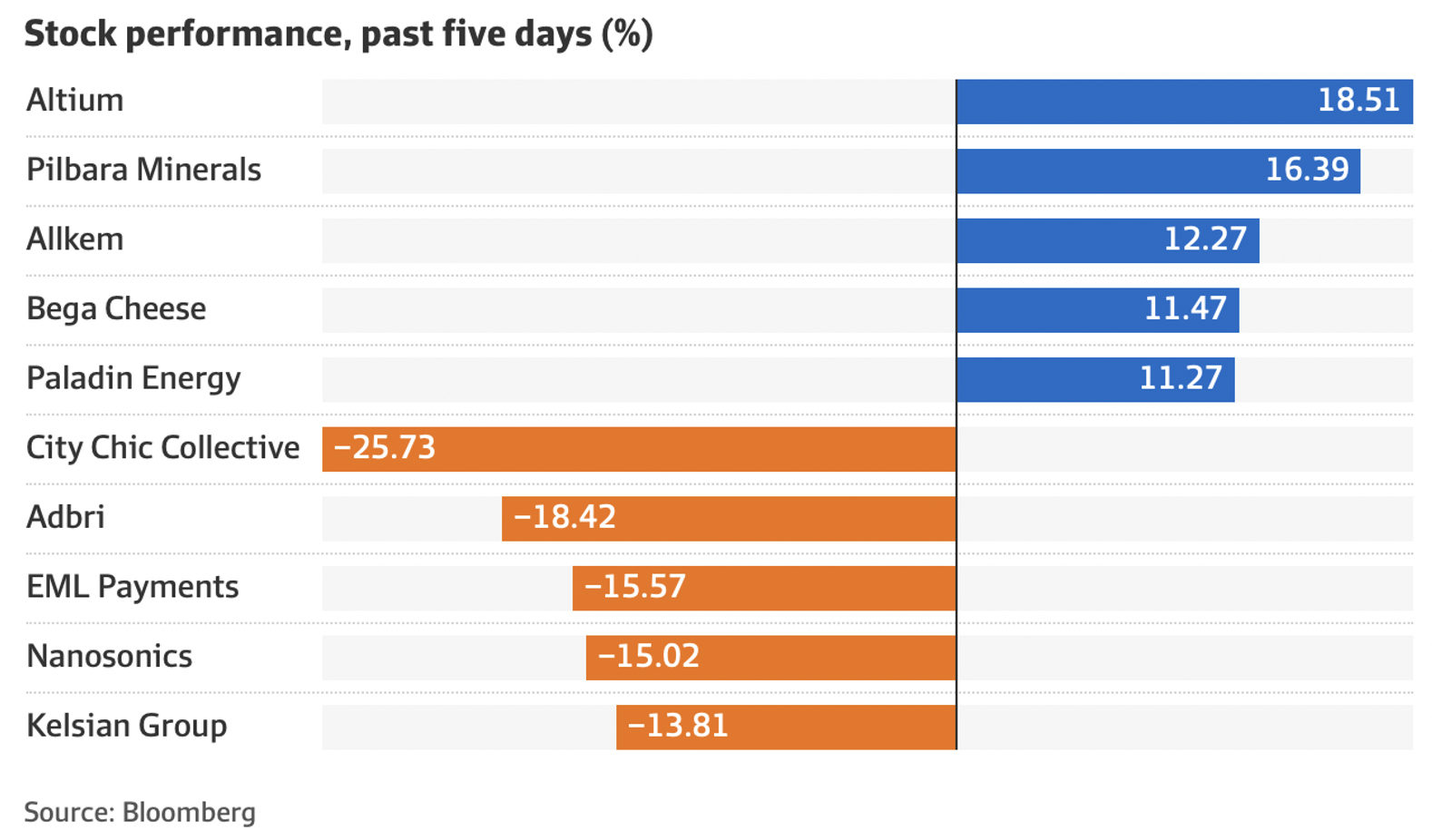

Here are the big winners and losers:

I was glad to see Bega Cheese stick it to its doubters after I suggested in a recent Boom! Doom! Zoom! webinar that the market’s view on this great company seemed excessively negative. Another good company, Wesfarmers, spiked 0.7% on a better-than-expected $2.35 billion profit result.

The AFR pointed out that “all four major banks advanced with ANZ rising 0.4 per cent to $22.96, CBA firming 0.5 per cent to $98.31, NAB climbing 1 per cent to $30.61 and Westpac gaining 0.4 per cent to $21.68.”

Cecile Lefort of the newspaper looked at the miners and this is what she found: “Mining giant BHP Group lifted 1.5 per cent to $42.81, while Rio Tinto’s shares rose by a similar margin to $98.66 and Fortescue Metals shares jumped 3.8 per cent to $19.87.”

What I liked

- The Internet Vacancy Index (IVI) from the National Skills Commission fell by 3.8% in July (or by 11,249 available positions) to 288,465 available positions. Recruitment activity decreased for the first time in seven months with the number of vacancies down from a 14-year high of 299,714 positions in June. Ordinarily, I would not like job positions falling but with high inflation, the job market has to soften.

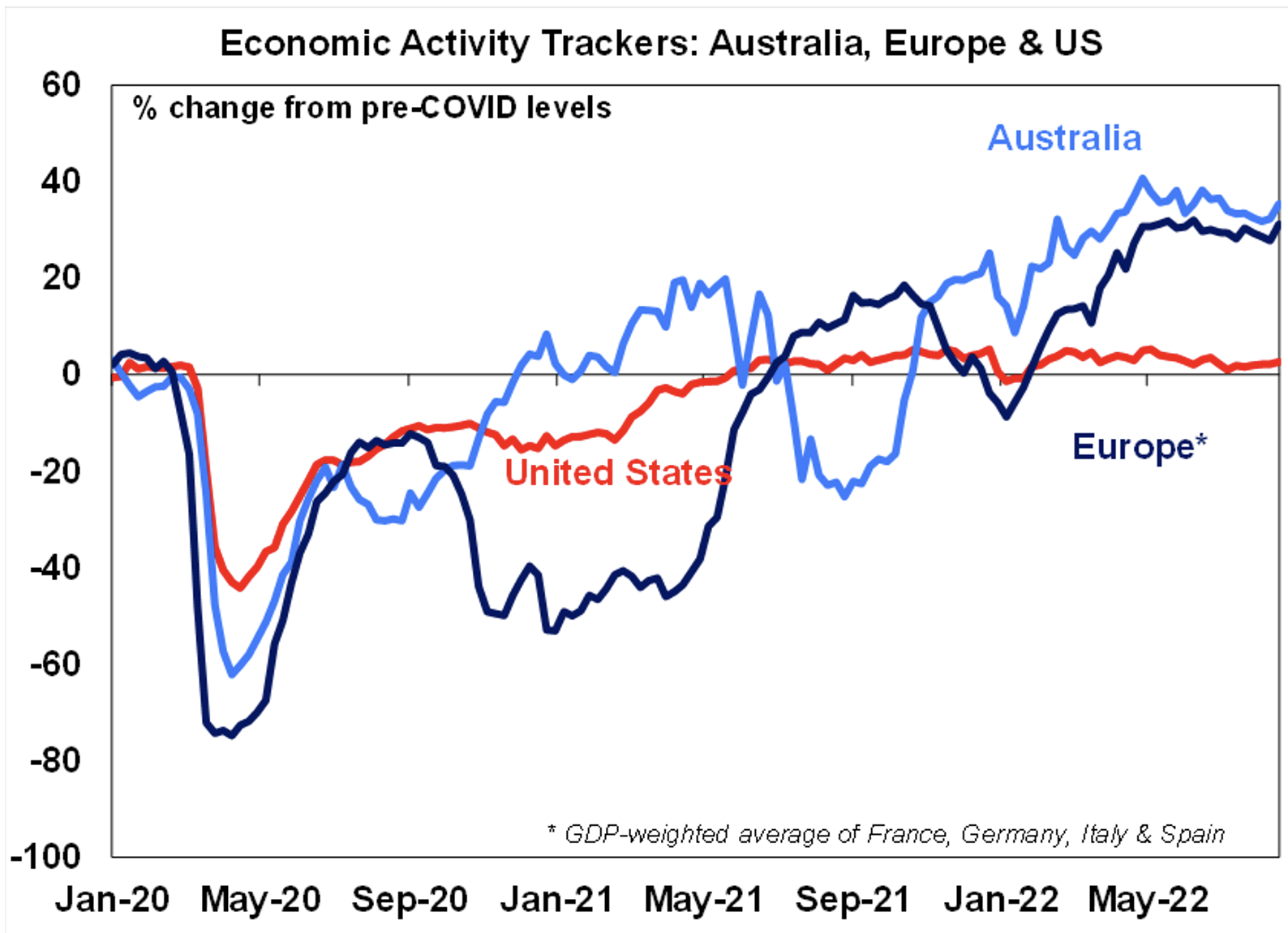

- The AMP Economic Activity Tracker in the US and Oz ticked up.

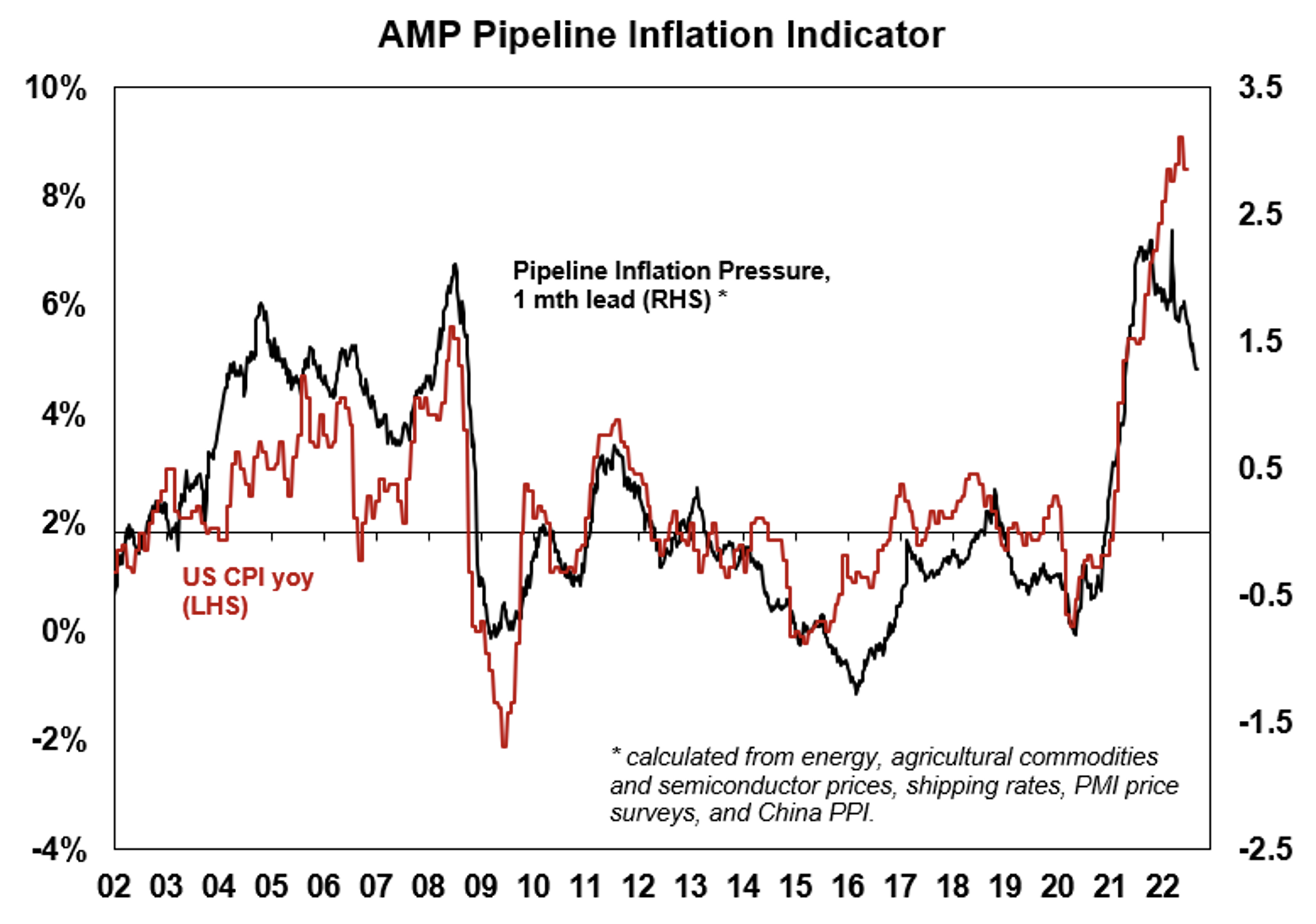

- The AMP Pipeline Inflation Indicator continues to decline as supply chain issues improve. But high commodity prices could see the inflation tracker start to shift up again in the short-term, or at least go sideways.

- The Australian composite PMI fell into contraction in August, with the index declining to 49.8 with manufacturing down to 54.5 (from 55.7) while services activity went negative to 49.6 (from 50.9) as activity slows from higher interest rates. We want activity to slow down to bring inflation down but importantly, I like that the falls are not drastic.

- The German Dax index gained 0.4% after data showed Germany’s economy expanded by 0.1% in the June quarter, beating analyst expectations for a flat outcome.

- China’s State Council also announced a 19-point stimulus package worth US$146bn (under 1% of GDP) to boost economic growth as China is facing many concurrent issues including drought, power shortages, property crisis and Covid-related restrictions

What I didn’t like

- Global PMI business conditions for August showed that the major countries’ composite PMI indices are now below 50, which means a contraction in activity.

- The US manufacturing PMI was down 0.9pts to an index of 51.3, while services were worse, down by 3.2ppts to an index of 44.1.

- The Eurozone manufacturing PMI fell 0.1pts to 49.7 and services were worse down by 1pt, although services activity is still positive with the index at 50.2.

- Commodity prices are rising again, although prices for most metals and agricultural commodities are well below mid-2022 highs.

- Oil is back up over $US90 a barrel.

- Fed Presidents at Jackson Hole talking about a Fed Funds rate of 4%. It’s now 2.25% to 2.5%. Better hope inflation falls faster than these guys/gals are predicting.

- The US economy, as measured by GDP, contracted at a 0.6% annualised rate in the June quarter (survey: -0.7%).

We’re in a tricky phase

My good economic mail tells me that the supply chain costs are becoming less inflationary and these could be crucial to the Fed’s view on how high interest rates will have to go. Keep your fingers crossed that my inside info is on the money because it would be great for stocks. Lower potential inflation means fewer interest rate rises and that’s a great stimulus for stocks.

The week in review:

- Current messages blowing from the US and local stock markets seem to suggest that my call that the current rally will look more entrenched and sustainable by the December quarter is believable. So, with that in mind, I outlined my winning formula in this week’s Switzer Report.

- The highlight of CSL’s profit result last week was the use of the word “strong”. Paul (Rickard) gives his view on this global leader in blood plasma products, number two globally in flu vaccines and soon to be the global leader in treatments for chronic kidney disease.

- Tony Featherstone asks the question: Is it time to buy REA, SEEK and Carsales.Com? Of the three, Tony favours SEEK and Carsales.Com and in his article this week he gives you his reasons for having this view.

- James Dunn looks at QBE, Suncorp and IAG and thinks investors are being offered very attractive total-return prospects by our three biggest insurers.

- In the first of a 3-part series, Michael Wayne, founder of Medallion Financial highlights REA as a real winner.

- In our “HOT” stocks column this week, Raymond Chan, Head of Asian Desk at Morgan’s explains why he likes CSL. Then, Michael Gable, Managing Director of Fairmont Equities highlights Woodside Energy (WDS) as currently a buying opportunity.

- In Buy, Hold, Sell, What the Brokers Say, there were 9 upgrades and 32 downgrades in the first edition and 9 upgrades and 24 downgrades in the second edition.

- And finally, in Questions of the Week, Paul answers your queries about why all companies don’t offer dividend re-investment plans?; Is lithium producer Pilbara Minerals still a buy?; Why do some companies that report strong earnings cop broker downgrades, and others that bomb, get upgrades?; Is poor old EML Payments worth a punt?

Our videos of the week:

- What is inflammation and how exactly is it caused? | The Check Up

- Should you buy this interesting US stock? + Are these companies a long-term hold? | Switzer Investing (Monday)

- Will US Fed Chairman prove to be a hawk or dove on interest rates + ELMO has reported strongly today | Mad about Money

- Who were the stars from reporting season; WOW, BXB, AMC, COL? + Where are the property hotspots? | Switzer Investing (Thursday)

- Boom! Doom! Zoom! | 25 August 2022

Top Stocks – how they fared:

The Week Ahead:

Food for thought: “Strive not to be a success, but rather to be of value.” – Albert Einstein

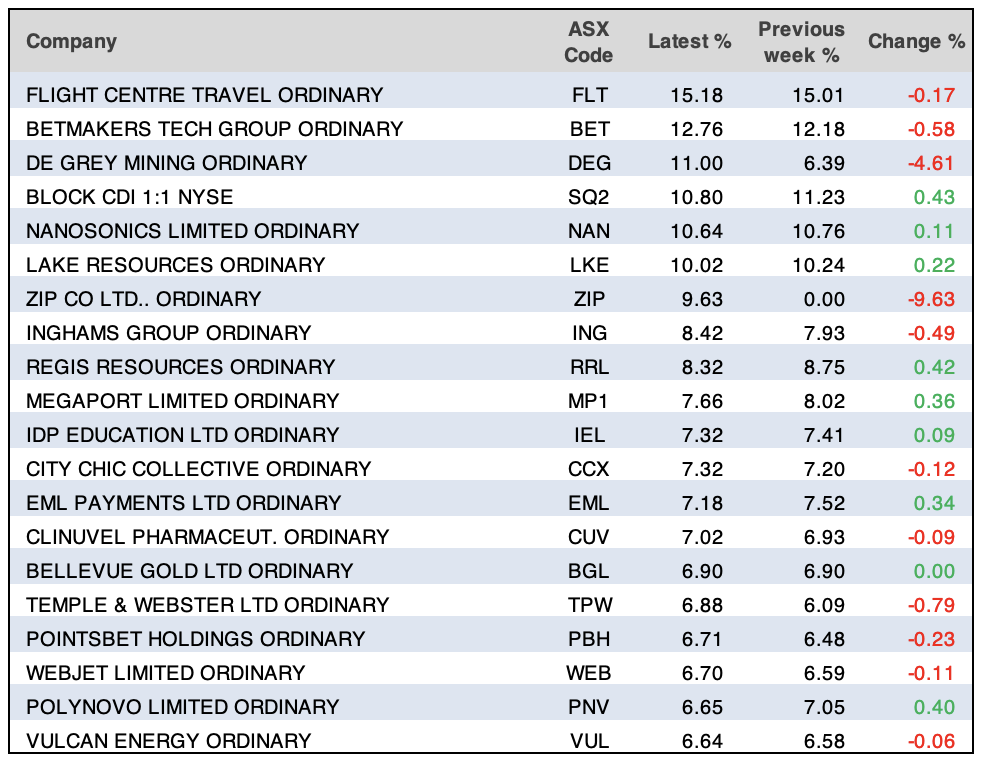

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

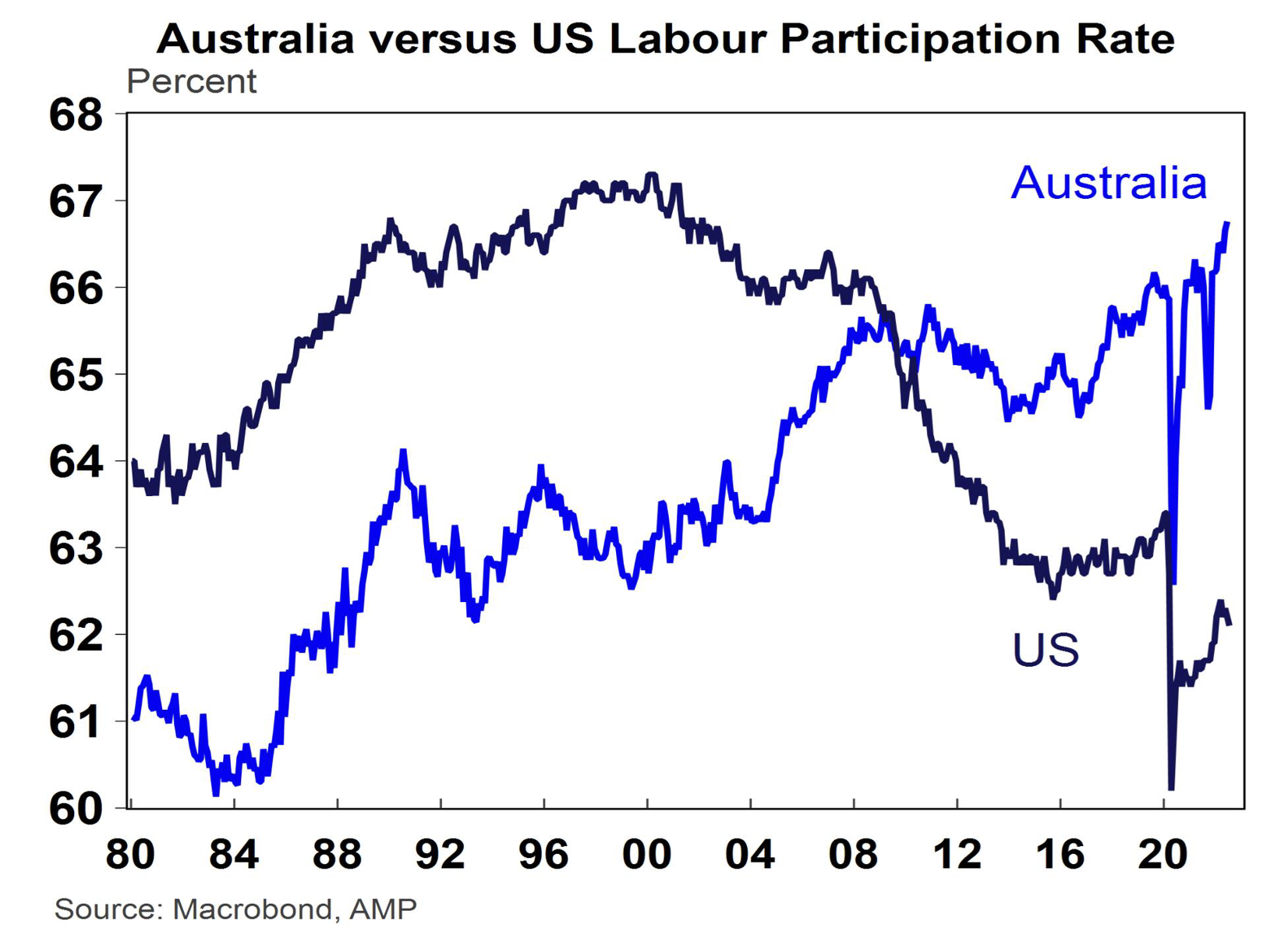

Chart of the week:

Our chart of the week is sourced from Diana Mousina of AMP Capital who provides some invaluable context for labour market dynamics in assessing the current terrain of Australia’s record-low unemployment levels and how it’s affecting wages.

“After an initial Covid-related decline in early 2020, the level of total employment bounced back to its pre-Covid average by early 2021 which indicates that demand for labour was solid (in contrast, US non-farm payrolls only got back to its pre-Covid level in July 2022),” Diana says.

“But, the supply of labour also surged over the past 2½ years, with the participation rate (the labour market as a share of the total working age population) now at 66.8% (a record high), versus the pre-Covid average of 66% which reflects employees wanting to take advantage of a strong labour market and a fall in the availability of short-term foregin workers (which are not captured in the Australian employment figures) because of the closed borders.

“In contrast, the US participation rate at 62.1% is well below its pre-Covid level of over 63% (see the chart below). The rise in Australian labour supply has played a role in constraining wages growth.

“Labour underutilisation (the sum of unemployment and the underemployment rate) is a measure of spare capacity and has fallen to 9.6% in Australia from its pre-Covid average of ~14%, which is its lowest level since 1982 (see the chart below). This indicates that the labour market has tightened, which should be positive for wages.

“Interestingly, underutilisation remains higher in Australia compared to the US (US underutilisation is at at 6.7%) and has been since 2014 which partly explains why US wages growth has also been stronger recently versus Australia,” she conludes.

Top 5 most clicked:

- Is it time to invest in losers that could soon be winners? – Peter Switzer

- Is CSL a good buy? – Paul Rickard

- Buy, Hold, Sell – What the Brokers Say (Monday) – Rudi Filapek-Vandyck

- “HOT” stock – CSL (CSL) – Maureen Jordan

- Is it time to buy REA, SEEK and Carsales.Com? – Tony Featherstone

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.