This week, one of our selectors found a slice of value in the market with Domino’s Pizza.

Michael McCarthy of CMC Markets notes the fast food retailer has dropped more than 10% after peaking above $80.

“This is the sort of healthy pullback on which investors can buy high growth stocks that are always “too expensive” McCarthy says.

The chart below illustrates Domino’s growth story.

Domino’s Pizza

Source: Yahoo

McCarthy doesn’t like Fortescue Metals Group on the back of its recent executive shake-up.

“After more than tripling in share price this year, the company announced senior executive changes last week, including the departure of the CFO after only three months on the board,” he said.

“In my experience, this is rarely a good sign. In addition, the charts are showing a double top formation. Sell now to buy back later.”

Fortescue Metals Group

Source: Yahoo

Gary Stone of Share Wealth Systems is bullish on Resmed’s share price after it bounced off a key support zone.

“From its previous run-up, the RMD share price has completed a textbook 50% retracement from a high of $9.27 down to $8.39, where it has bounced off the key support zone between $8.20 and $8.35,” he said.

“There is a high probability that RMD will head higher to rise above its previous high close of $9.27.”

Resmed

Source: Yahoo

Out of favourNavitas has been caught in a down trend, but is now rising to a zone between $5.40 and $5.60 where it could find resistance, Stone notes.

“If it does, it could retrace to the mid to low $4’s”.

Navitas

Source: Yahoo

And Evan Lucas of IG Markets is eyeing off the attractive share price of Transurban Group after a recent pull back.

“The pull back in the stock was down to increase in yield product volatility. With calm returning, TCL looks attractive at current levels,” he says.

“5% distribution p.a (well above the hurdle rate) and EPS expanding at an estimated 77% in FY17, TCL remains a core stock to own.”

Transurban

Source: Yahoo

But he expects some further easing in the telco space outside of Telstra.

“Specifically Vocus,” says Lucas. “The news from TPM was that for share price growth to remain, M&A is the only option available, and after 24 months of consolidation targets, are becoming rare. I expect profit taking in the risker listings of this sector.”

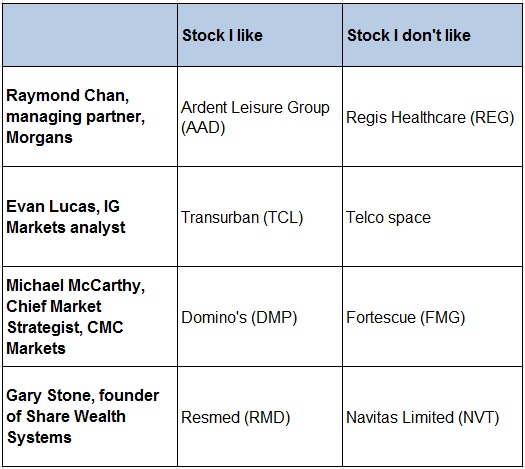

Our Super Stock Selectors is a survey of prominent analysts, brokers and fund managers. Each week we ask them to name a stock they like, and one they don’t like. We purposely ask for ‘likes’ and ‘dislikes’ instead of recommendations, so it provides an idea of what the market is looking at, rather than firm buys or sells.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.