Over 2020 I shone the light on a number of hot stocks that historically weren’t my typical style of stock. History has shown that I prefer solid blue chip stocks that generally are good dividend payers and I’ve gone long these when the market sold off.

Long-time followers know I often use the rallying war cry to buy the dip. The strategy often means you can bring down the average holding cost of a company that you want to hold for a long time.

The influence of Warren Buffett on my investing style is there for all to see. The fact that I personally could not come at AMP in recent years was because it has had a management problem for too long, which has robbed it of its ‘blue’ status. And believing in the management is critically important to Warren and those who have learnt from his spectacularly successful ways.

That said, the huge sell off of the stock market in March of last year and then the magnitude of the stimulus repair programme led me to believe and tell you that I expected a big rebound in stocks. And for the first time in my recent investing life, I went outside of the blue chip group to look for stocks of the future.

In the past I’d been a Xero fan. It was one of my first real dalliances with tech stocks. But this year I saw the error of my ways and decided that I was happy with my core holdings of quality stocks and that it was time to add a few satellite potentially high return performers.

My self-named Z.E.E.T stocks

That gave way to my so-called ZEET stocks that is an acronym for Zip Co (Z1P), Elmo Software (ELO), EML Payments (EML) and Tyro Payments (TYR).

They had a good 2020 and recovered nicely out of the Coronavirus crash. But the question is: can they cement their position as companies of the future in 2021?

This year should see the huge global and local stimulus interact with vaccinations to help normalcy return. Every Australian who wants to be vaccinated is expected to be by the end of September, which will be good for open borders for Oz and eventually overseas!

Companies leveraged to the reopening trade should do well over 2021 and 2022, and I believe the ZEET stocks will be beneficiaries.

Below is what the analysts at FNArena think now about these companies going forward. These business watchers are not infallible but they take closer looks at listed companies than most of us. This is what they are thinking right now:

Even if these guys are half-right, there seems to be a lot of positivity around these companies. Let’s look at each one of these stocks.

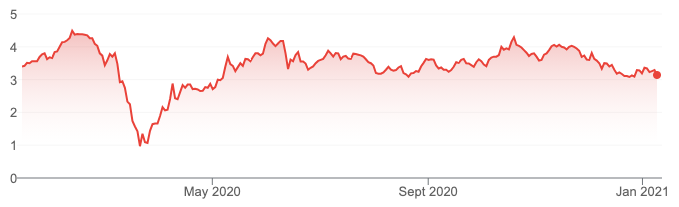

1. TYRO Payments (TYR)

Tyro has had a few technical problems with its machines used by some of its customers, which the analysts might not have picked up on fully yet. While there could be a hiccup in the short term, I’d be a buyer on any notable dip. Many fund managers think this is a company with real potential and when our economy’s borders open fully, it should be a winner.

Source: Google

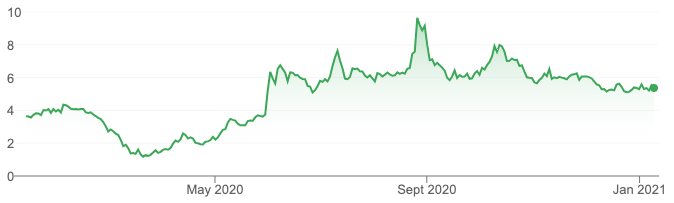

2. EML Payments (EML)

EML will also be a big beneficiary of a time when we can shop more freely, go to casinos and tourism is flourishing. Last year the analysts did not cover this company but its potential significance has changed that.

Source: Google

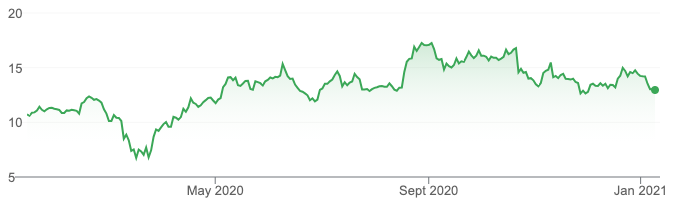

3. ELMO Software (ELO)

ELO is a company that’s leveraged to a more normal business environment, which 2021 should progressively bring. So it’s not surprising to see that it has a 41.8% upside potential, even if that number looks hard to believe.

Source: Google

4. ZIP (Z1P)

Finally Z1P, is the second-best player in the buy now pay later space, behind Afterpay. But this is a company that continues to expand and acquire related companies. The management is impressive and I believe it will continue to grow successfully. And I’m not alone, as the numbers above show.

Source: Google

Two more stocks I like

My next two bolter stocks are linked to my belief in the founder of both companies — Bevan Slattery. If you want to know why, try listening to my podcast interview with Bevan late last year.

The two companies are Megaport (MP1) and NextDC (NXT):

Both companies will grow with the success of the cloud. And as economies boom over 2021 and 2022, the Internet (which is heavily growth-related to the cloud) should deliver plenty of businesses to these innovative operations.

Over the years I’ve missed my chance to buy into NXT but the 2020 crash gave me my chance and I’m happy to buy more if there are market sell-offs.

Source: Google

The same goes for MP1.

Source: Google

My final ‘hot’ stock

My final hot stock is another that I’ve missed over the years, when the likes of Julia Lee of Burman Invest would say they’d like this bio-med company. And its name is Mesoblast (MSB).

Source: Google

Last year looked like it was going to be a winning one, with many expecting a ‘thumbs up’ from the Federal Drug Administration for one of its products. And there was a threat of legal action but against that there was news about an exclusive worldwide licence and collaboration agreement with Novartis for the development, manufacture and commercialisation of its mesenchymal stromal cell (MSC) product remestemcel-L.

However, its COVID-19 work was abandoned in December after a disappointing results.

This was always going to be my bad, wild and dangerous play of the year and it was more based on the gut-feeling that one of the company’s three products would eventually give a result. I bought it when it was trashed by the market losing 37% in a day, so the question is: should I stick with this once hot but progressively cooling stock?

Local analysts don’t cover the stock. But in the US where it is listed on the NASDAQ with American Depository Receipts (one ADR is equivalent to 5 ordinary shares on the ASX), the share price guess is interesting. CNN Business said this of the stock: “The 10 analysts offering 12-month price forecasts for Mesoblast Ltd have a median target of $16.63, with a high estimate of $27.26 and a low estimate of $4.64. The median estimate represents a +92.64% increase from the last price of 8.63.” These are all US prices.

And this chart from CNN looking at the past and the future tells me that I should stay along for the ride!

This is not my kind of company but my SMSF is filled with quality companies bought at damn good prices over the years and my dive into tech/payment stocks in 2020 after the crash, has paid dividends. So I’m sticking solid in 2021.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.