The objectives, methodology, construction rules and underlying economic assumptions for our model portfolios can be referenced here: (see https://switzersuperreport.com.au/our-portfolios-for-2020/)

These are long-only model portfolios, and as such, they are assumed to be fully invested at all times. They are not “actively managed”, although adjustments are made from time to time. A small adjustment was made at the end of February and another at the end of March.

Performance in 2020

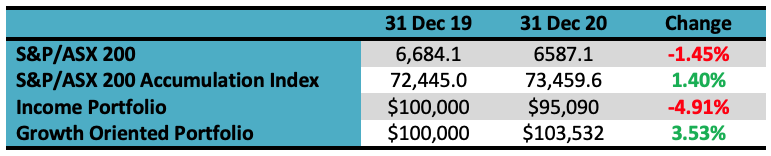

The income portfolio to 31 December has lost 4.91% and the growth oriented portfolio has gained 3.53% (see tables at the end). Compared to the benchmark S&P/ASX 200 Accumulation Index (which adds back income from dividends), the income portfolio has underperformed by 6.31% and the growth portfolio has outperformed by 2.13%.

Income Portfolio

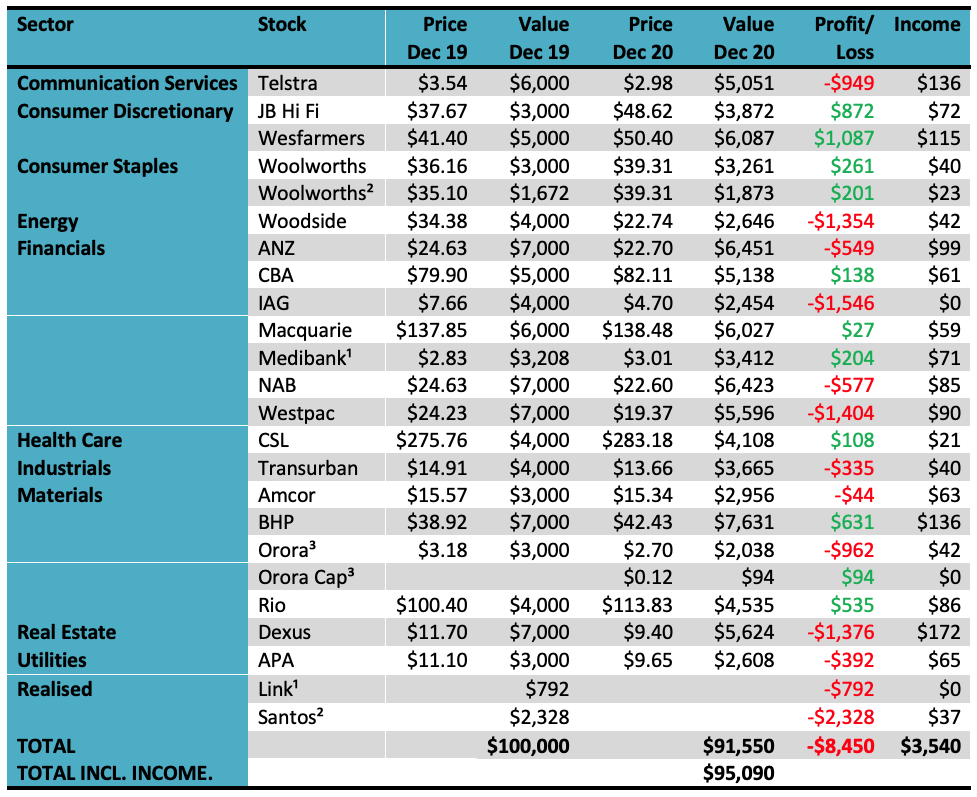

The objective of the income portfolio is to deliver tax advantaged income whilst broadly tracking the S&P/ASX 200.

The income portfolio was originally forecast to generate a yield on its opening value of 4.65%, franked to 78%. This has not been achieved in the Covid-19 environment, instead delivering a return of 3.54% ( franked to 70.5%).

In December, the income portfolio returned 1.38%, marginally ahead of the benchmark’s 1.21%.

The income biased portfolio per $100,000 invested (using prices as at the close of business on 31 December) is as follows:

¹ Link sold on 28 Feb at $4.70 to realise loss of $792. Net proceeds of $3,208 invested in Medibank at $2.83 (cum-dividend

² Santos sold 31 March at $3.42 to realise loss of $2,328. Net proceeds of $1,672 invested in Woolworths at $35.10

³ Orora capital return of 12.4c, special dividend of 37.3c, and 0.8 new shares for 1 existing share consolidation

Growth Portfolio

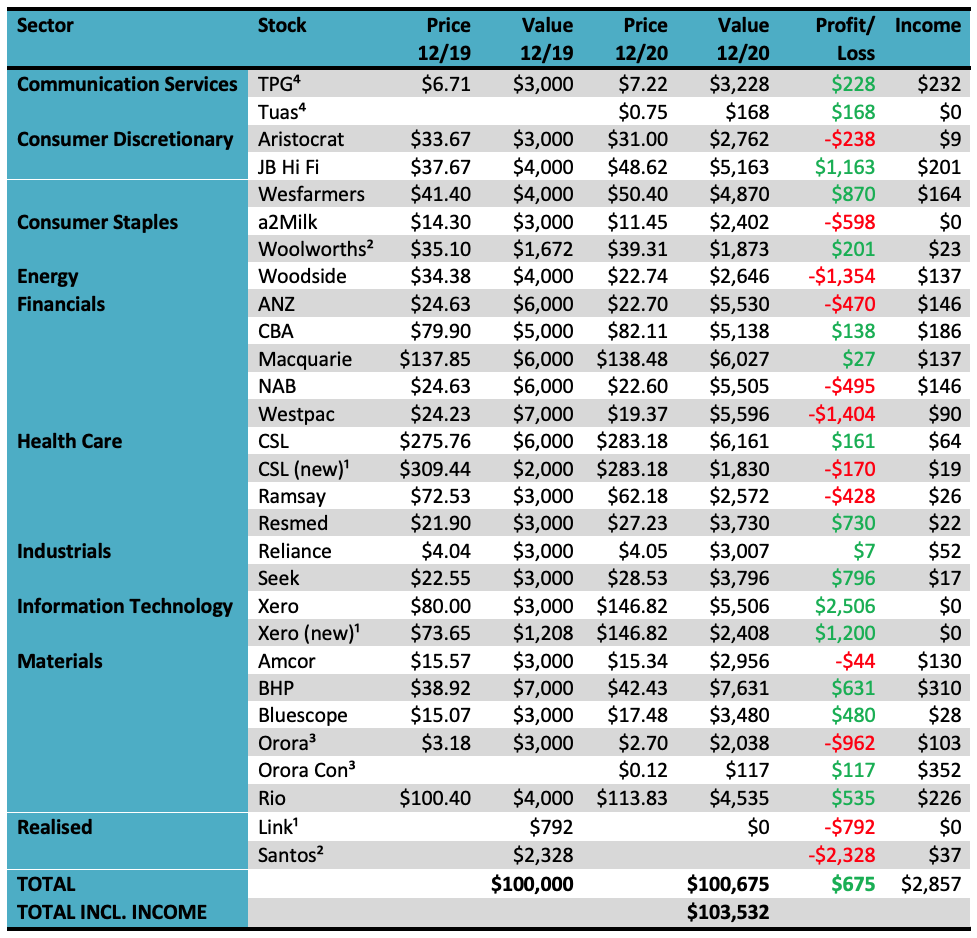

The objective of the growth portfolio is to outperform the S&P/ASX 200 market over the medium term, whilst closely tracking the index.

In December, the growth portfolio returned 1.53% compared to the benchmark’s 1.21%.

Our growth oriented portfolio per $100,000 invested (using prices as at the close of business on 31 December 2020) is as follows:

¹ Link sold on 28 Feb at $4.70 to realise loss of $792. Net proceeds of $3,208 invested in $2,000 CSL at $309.44 and $1,208 Xero at $73.55.

² Santos sold 31 March at $3.42 to realise loss of $2,328. Net proceeds of $1,672 invested in Woolworths at $35.10

³ Orora capital return of 12.4c, special dividend of 37.3c, and 0.8 new shares for 1 existing share consolidation

⁴ TPM/VHA Scheme of Arrangement. Includes special dividend of 33c and demerger of Tuas Ltd (1 share in TUA for every 2 shares in the old TPG)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.