Question 1: How long do bear markets typically last for?

Answer: Statistically, not that long. There is better data on the US markets than in Australia. According to CNBC, the average bear market lasts about 359 days – so about a year. A study by Seeking Alpha says that there have been 28 bear markets in the US since 1928, with an average decline of 35.6%. They lasted on average 289 days – or roughly nine and a half months.

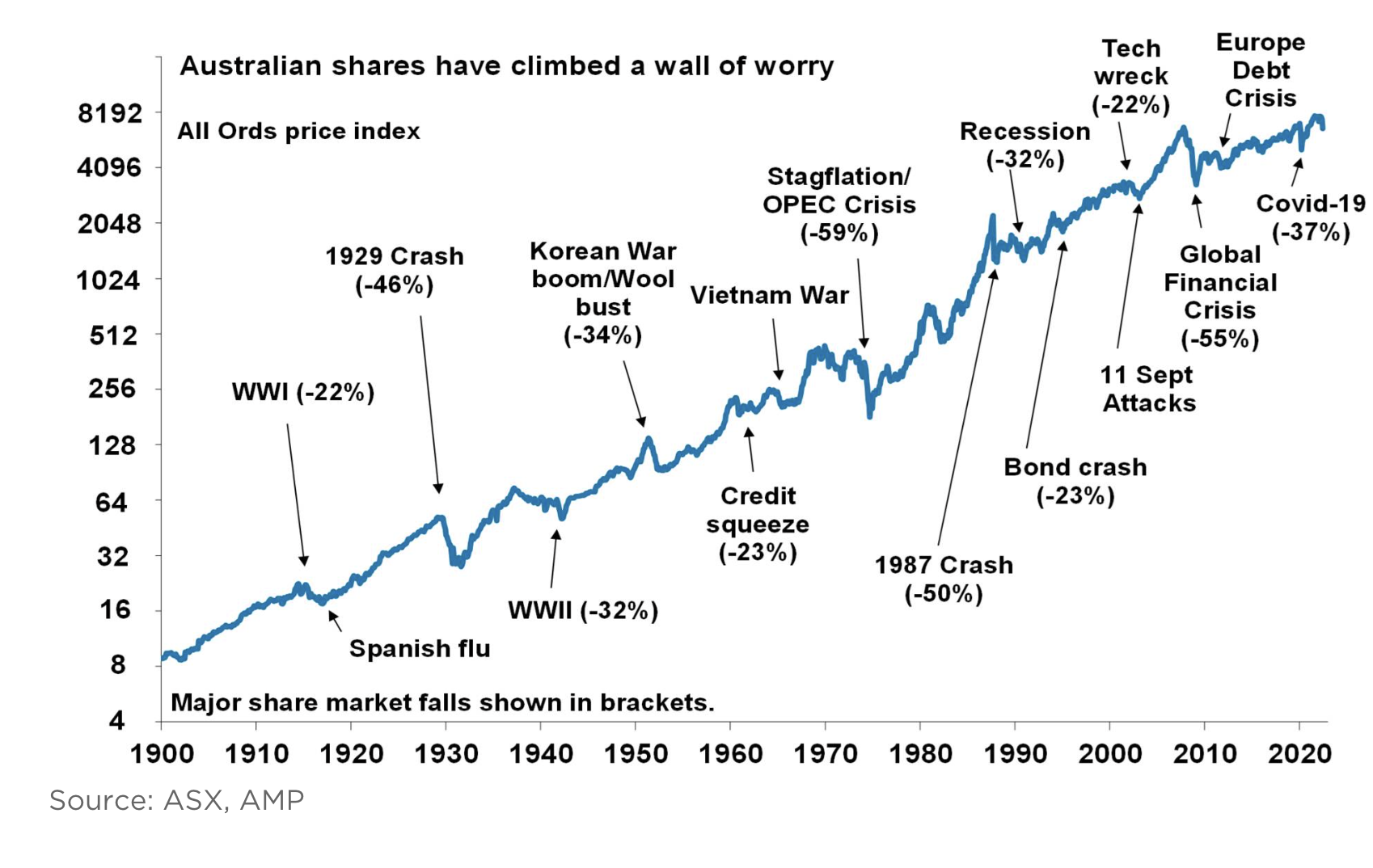

I found this graph from Shane Oliver at AMP Capital interesting, which looks back at the Australian share market since the 1900s.

Question 2: What is your view on ACDC, the battery tech and lithium ETF? Currently about $80 – would you consider this in buying territory after trading between $90 and $100 for about a year?

Answer: I quite like the look of ACDC (the ETFS Battery Tech & Lithium ETF) as a way of getting exposure to the sector. It is, however, only as good as the construction of the Solactive Battery Value-Chain index. This tracks 30 companies that are providers of electrochemical storage technology and mining companies that produce metals that are primarily used for the manufacturing of lithium batteries. It is global, with Japanese companies topping the weighting at 21.3% followed by the US at 16.1%. It also uses an ‘equal-weighting’ methodology.

Performance-wise, it has come off quite hard in 2022 as the prices of lithium concentrates have fallen, and some of the “hype” about EVs/lithium has faded. In the six months to end-May, the ETF has lost 9.6% compared to the MSCI World index of -10.3%. Over the last three years, it has done considerably better: 27.7% pa compared to the world index of 11.4% pa (in Australian dollars).

Question 3: Why have the prices on hybrid securities (capital notes issued by the major banks) fallen?

Answer: Three reasons. Firstly, margins in the wholesale markets have blown out (that is, the margin banks pay relative to the swap rate to borrow funds on similar terms) have increased. Secondly, whenever there is a big fall in bank ordinary share prices, the prices of hybrid securities tend to fall. This is not always totally logical, but it is what happens. Thirdly, there has been a flurry of new issues. Westpac is the latest with Westpac Capital Notes 9, which will pay a margin of between 3.4% and 3.6% over the 90-day bank bill rate.

Question 4: How do I claim a tax deduction for making a super contribution?

Answer: Firstly, you need to be eligible. For this financial year (21/22), you need to be under age 67 (as at the start of the financial year), or if aged from 67 to 74, you must pass the ‘work test’. If you are 75 or over, you are not eligible. Secondly, you need to have headroom within your concessional contributions cap of $27,500. Concessional contributions are your employer’s compulsory 10%, any amount you salary sacrifice, plus any amount you claim a tax deduction for.

Make the contribution to your super fund (or SMSF) before 30 June (the super fund must receive and bank the money on or before 30 June). Then before you lodge your tax return for 21/22, lodge with your super fund the ATO form ‘Notice of intent to claim a tax deduction for a personal super contribution’ – NAT 71121.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.