Most of you know my basic proposition for stocks going forward. I see a rising trend ahead, even if we have a sell-off in coming months. The next Fed decision could be a confidence-crusher for stocks in the short term, but I can’t see a chance of a confidence-killer looming, and neither can some smart experts.

Before I get to these respected analysts, let’s just recap on the big data drops and decisions on the horizon. Here they are:

- Locally, this Wednesday, it’s the CPI for May.

- Retail trade for May in Oz is on Thursday.

- On Tuesday, there’s a huge run of US economic data, including consumer confidence, home prices and home sales.

- Wednesday brings Fed boss Jerome Powell going public in a panel discussion.

- Thursday we see US economic growth.

- On Friday in the US there’s the personal consumption expenditures (PCE) core deflator, which is the Fed’s favourite inflation guide.

- Tuesday week, the RBA has an interest rate decision.

- Friday week, the June US Jobs Report is out on July 7.

- And US CPI is on July 12.

Many of these readings could KO the latest US rally, but on the flipside, if the data drops are better than expected and inflation falls and the threat of recession is relatively manageable, then growth/tech stocks will continue to go higher. Last week, I showed how the Magnificent Seven tech companies had driven the S&P 500 up 11%. But if you took out the gains of the M7 (Apple, Microsoft, Nvidia, Amazon, Meta, Tesla and Alphabet), the S&P 500 was up 0%!

I argue that when rate rises stop, we’ll see the market hunt for companies that have been oversold. This will give tailwinds to the S&P 500 and our own ASX 200 index. That’s my view and a reason why I’ll be a dip-buyer if July to October brings sell-offs.

But what are others thinking?

This from Sam Stovall, market historian and CFRA’s chief investment strategist, is worth noting: “With this year’s S&P 500 gain of nearly 15% YTD through June 16, history suggests investors hold onto their hats, since a stellar H2 may be in order.”

I pointed this out on Saturday, but it bears repeating. CNBC says Stovall’s research shows that “when the S&P 500 is up more than 10% through June (it has risen 14.5% year-to-date), the second half has averaged an increase of 8%, nearly double the typical 4.2% average return for the July-through-December period.

Importantly, this statistical scenario has come to fruition 82% of the time.

Who else is in the optimists’ camp when it comes to stocks this year and beyond?

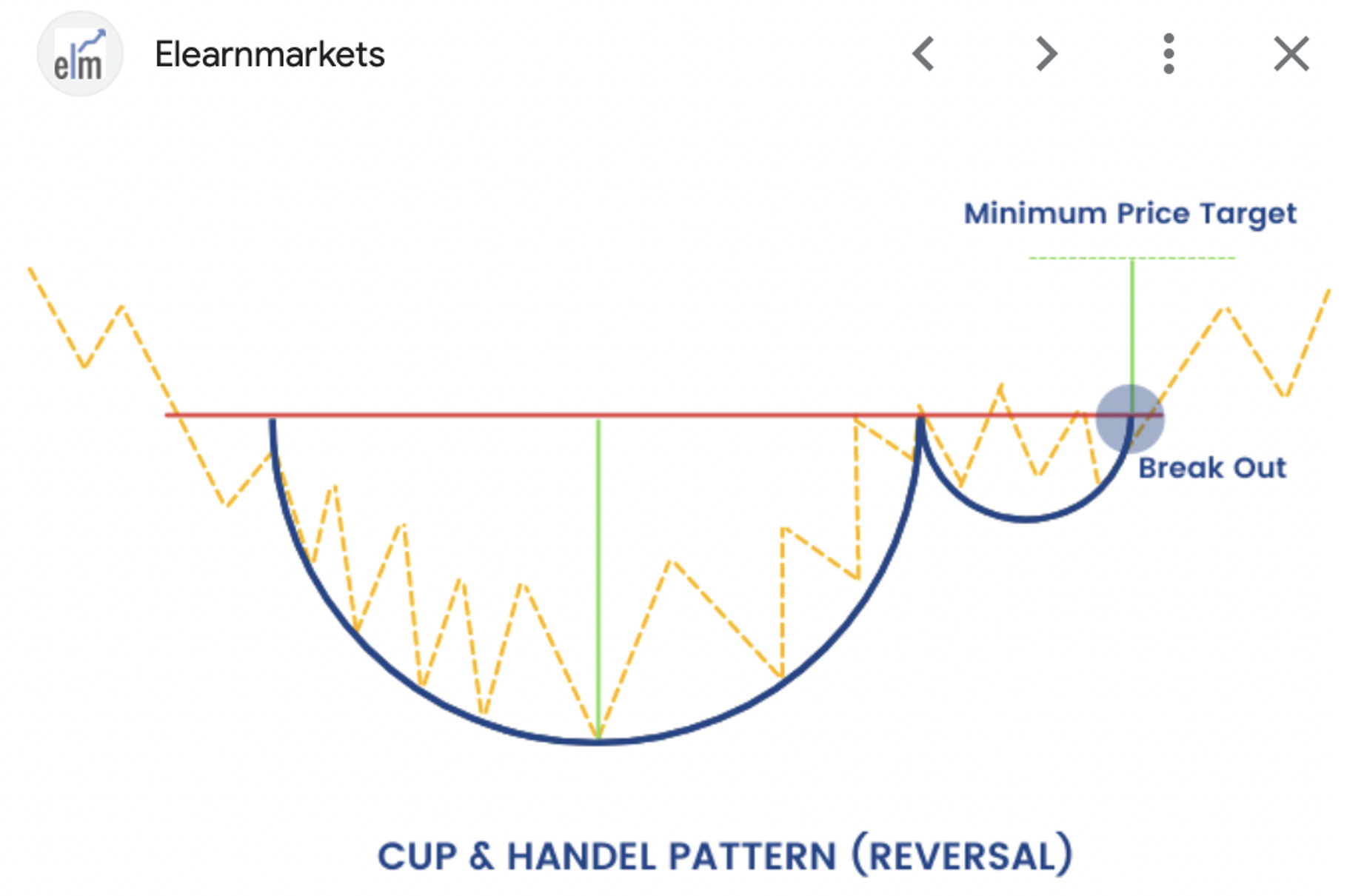

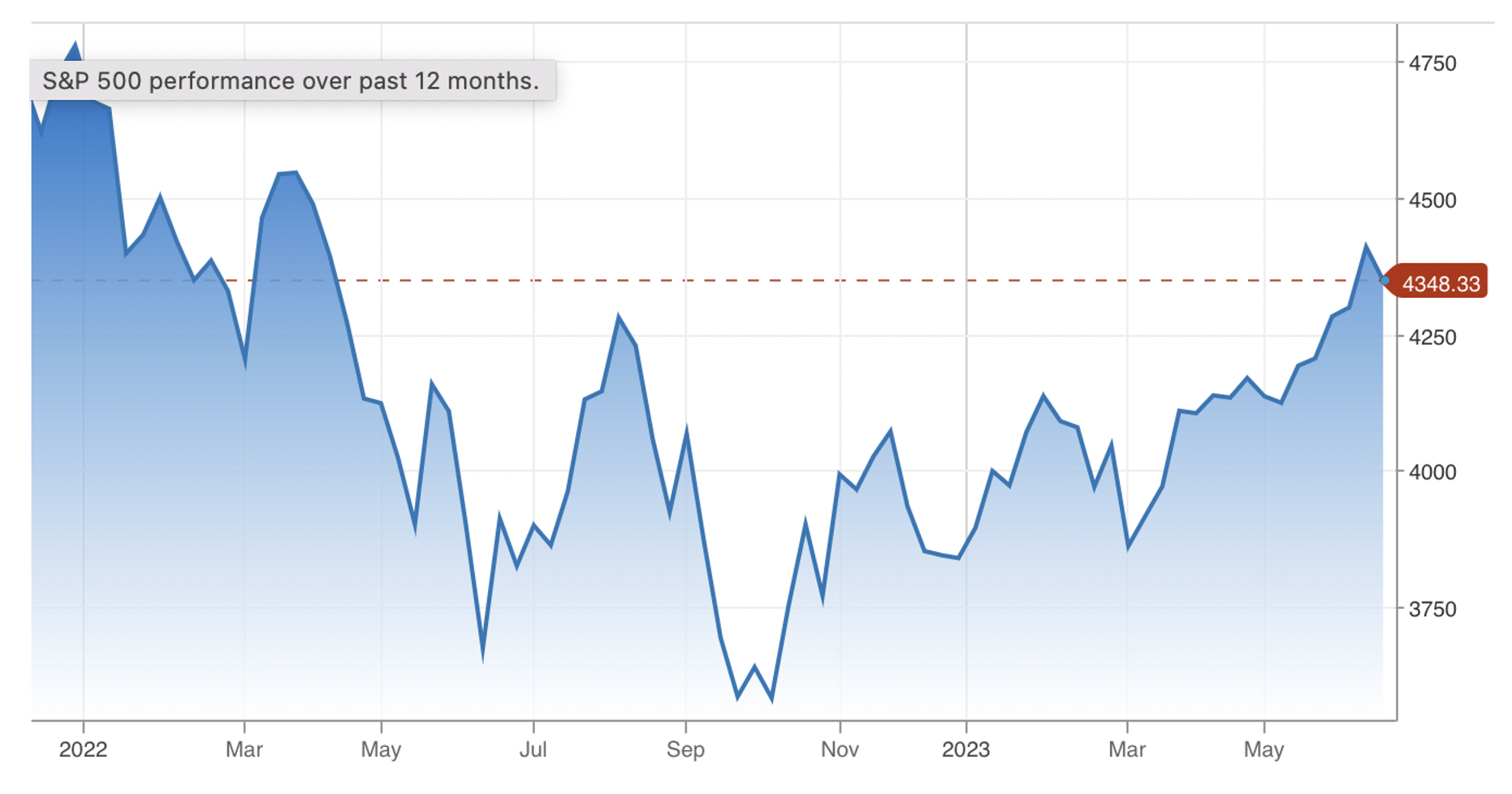

For starters, Bank of America’s chief equity technical strategist Stephen Suttmeier has the S&P 500 set on a target of 4580. It’s now 4348. If he’s right, that means he’s seeing a 5% gain, which I think will prove conservative by the time we get to Christmas. CNBC explains his positivity this way: “Part of Suttmeier’s optimism is based on the S&P 500 price chart showing a bullish “cup and handle” formation — the cup is U-shaped and the latest three-day pullback is the handle — which serves to confirm and, perhaps even more importantly, extend the earlier advance.”

I show a theoretical “cup and handle” pattern below and then show the current S&P 500 pattern.

But the positivity isn’t just technical-driven, as the following from Suttmeier shows: “New all-time highs for the S&P 500 advance-decline line and “a bullish breakout” for the 10-day moving average of new 52-week highs minus 52-week lows reinforce the market’s latest move upward, and price levels that previously served as resistance barriers (4166-4200 and 4300-4325), now serve investors as support levels instead.”

Meanwhile, those who expect good times for stocks ahead look at last week’s sell-off as a consolidation phase. Given his history at the Wall Street Journal, I rate CNBC’s Mike Santoli, so let me share his latest take on what happened with the S&P 500 Index last week.

He said it “…did little to alter either the favourable underlying market trend or the notion that more consolidation might be in store. The action was textbook in several ways, the indexes hotly overbought coming into the June 16 monthly options expiration, the week following the June expiration historically weak, and sentiment and investor positioning having migrated toward more optimism and risk seeking.

“The long-running weekly Investors Intelligence survey of professional market-advisory services has burst higher from persistent bearishness toward the upper range of net bullishness. The chart here shows this gauge mostly reflects underlying market action itself, and when at similar levels following a long stretch of subdued attitudes has typically not lined up with a significant market peak.

What the Fed’s Jerome Powell says at a public panel event this week about interest rates will impact stock prices. Next the reading from the PCE deflator (which is the Fed’s preferred inflation gauge) will be crucial to views on how many interest rate rises lie ahead.

In turn, that will either extend this consolidation phase or lead to another leg up. Either way, when rate rises are over, many growth/tech companies, which have been punished since early 2022, will get re-loved by the market.

I expect global fund managers like Magellan’s MHG and WCM’s WQG and WCMQ (which are exposed to good US and overseas growth companies) will have a number of better years ahead. By the way, I’m not arguing for the MFG stock, as it has company issues, but its funds are likely to have better performances in the years ahead. FNArena’s analysts see only a 1.9% upside for MFG, though Ord Minnett has a 23.56% higher call, while Morgans say 15.7%.

It’s amazing how the mighty can fall and how long it takes for them to recover, if they ever can!

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances