In the fourth review for 2019, we look at how our income and growth portfolios performed in April. The purpose of these portfolios is to demonstrate an approach to portfolio construction. As the rule sets applied are of critical importance, we provide a quick recap on these.

Portfolio recap

In January, we made some adjustments to our Australian share ‘Income Portfolio’ and ‘Growth Portfolio’ (see https://switzersuperreport.com.au/here-are-our-portfolios-for-2019/ )

The construction rules for the portfolios are:

- we use a ‘top down approach’ looking at the prospects for each of the industry sectors;

- for the income portfolio, we introduce biases that favour lower PE, higher yielding sectors;

- so that we are not overly exposed to a market move, in the major sectors (financials and materials), our sector biases will not be more than 33% away from index. For example, the weighting of the ‘materials’ sector on the S&P/ASX 200 is currently 18.9%, and under this rule, our possible portfolio weighting is in the range from 12.6% to 25.2% (ie plus or minus one third or 6.3%);

- we require 15 to 20 stocks (less than 10 is insufficient diversification, over 25 it is too hard to monitor), and have set a minimum stock investment size of $3,000;

- our stock universe is confined to the ASX 100. This has important implications for the growth portfolio, because the stocks with the best medium term growth prospects will often come from outside this group (the so called ‘small’ caps);

- we avoid stocks from industries where there is a high level of exogenous risk, such as airlines;

- for the income portfolio, we prioritise stocks that pay fully franked dividends and have a consistent record of paying dividends; and

- within a sector, the stocks are broadly weighted to their respective index weights, although there are some biases.

Overlaying these processes were our predominant investment themes for 2019, which we expected to be:

- Economic growth to slow in the USA, Europe, China and Japan, but not into recession territory;

- The US Fed moving to a more neutral stance on US interest rates. If not pausing, only one or two more hikes in 2019;

- Interest rates in Australia to remain at historically low levels, with the RBA unlikely to move rates higher;

- AUD around 0.75 US cents, but with risk of breaking down if the US dollar firms;

- Oil price remaining well supported around US$50 per barrel. Base metal and iron ore prices to soften;

- A positive lead from the US markets;

- Growth in Australia to ease to around 2.5%, with no real pick-up in domestic inflation;

- Housing prices in Australia to ease moderately, but not collapse; and

- A Federal election in May, which may limit any market gains in the first half.

Performance

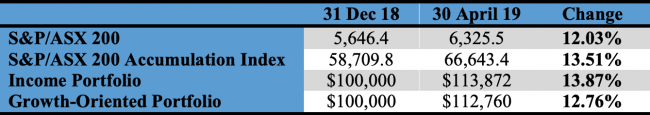

The income portfolio to 30 April is up by 13.87% and the growth-oriented portfolio by 12.76% (see tables at the end). Compared to the benchmark S&P/ASX 200 Accumulation Index (which adds back income from dividends), the income portfolio has outperformed the index by 0.36% and the growth oriented portfolio has underperformed by 0.75%.

Iron ore miners ease, banks gain in April

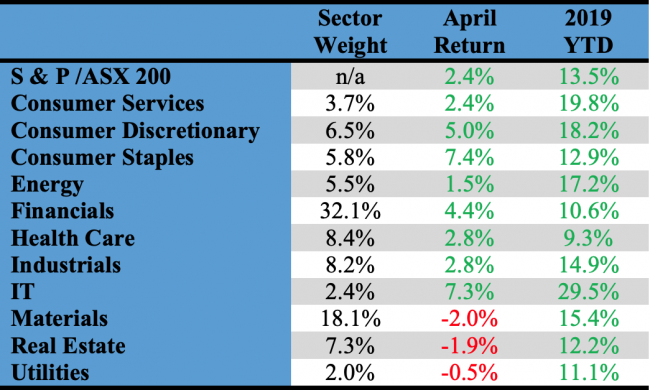

The market’s bifurcated behaviour continued in April, but this month, it was a case of materials down and financials up. With iron ore supply pressures easing, the materials sector led by heavyweights BHP, Rio and Fortescue lost a net 2.0%. The financials sector received a boost adding 4.4%. The largest sector on the ASX by market weighting at 32.1%, its year to date gain of 10.6% lags the overall market’s return of 13.5%.

The information technology continued its run to record a gain 7.3% in April. Stocks such as Afterpay and Appen have made this the best performing sector in 2019 with a return of 29.5%. The other strong performer was the consumer staples sector which added 7.4%. Gains by the major food retailers Woolworths and Coles, supported by “China facing” stocks like a2Milk, helped the sector.

All industry sectors are positive for the year. Leaving aside the small information technology sector, the gap between the next best performing sector, consumer services, and the worst performing sector, health care, is relatively narrow by historical standards. Returns for the 11 industry sectors in April and calendar 2019, plus their respecting weighting as part of the ASX 200, are shown in the table below.

Income portfolio

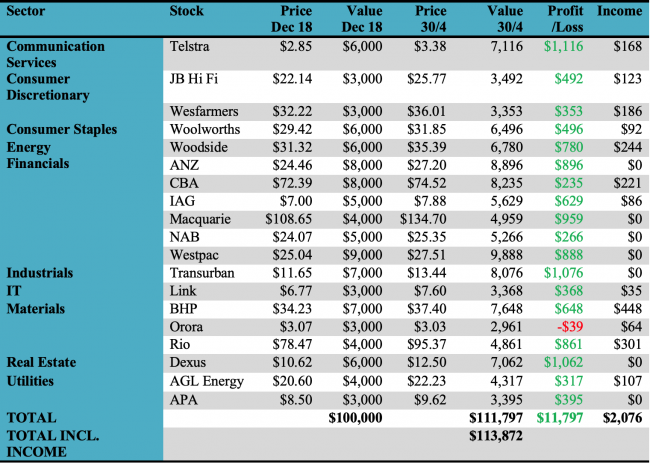

On a sector basis, the income portfolio is moderately overweight financials and utilities, and underweight materials and health care (where here are no medium or high yielding stocks in the ASX 100). Otherwise, the sector biases are reasonably minor.

On paper, it is roughly index weight in industrials. However, this exposure is being taken through toll road operator Transurban which is not your typical industrial stock.

In the expectation that interest rates in Australia are staying at record low levels, it has a defensive orientation and a bias to yield style stocks. In a bull market, we expect that the income portfolio will underperform relative to the broader market due to the underweight position in the more growth oriented sectors and the stock selection being more defensive, and conversely in a bear market, it should moderately outperform.

The portfolio is forecast to yield 5.78%, franked to 82.3%. The forecast yield is higher than would normally be expected due to the payment by BHP of a special dividend of $1.42 per share. When this is excluded, the yield drops back to 5.49%.

In April, the income portfolio returned 2.06% for a relative under performance of 0.31%. Year to date, it has returned 13.87% for an outperformance of 0.36%.

The return includes both capital and income. On the income side, the return (which takes into account dividends that the portfolio is contractually entitled to) is currently 2.08%, franked at 97.4%.

Helping in April was the strong performance of the major banks (except NAB), and consumer facing stocks Woolworths and Wesfarmers. Defensives Dexus and APA slipped.

No changes to the portfolio are contemplated at this point in time. The portfolio is not able to participate in the Woolworths off-market share buyback, which will be attractive to zero rate and low rate taxpayers.

The income-biased portfolio per $100,000 invested (using prices as at the close of business on 30 April 2019) is as follows:

Growth portfolio

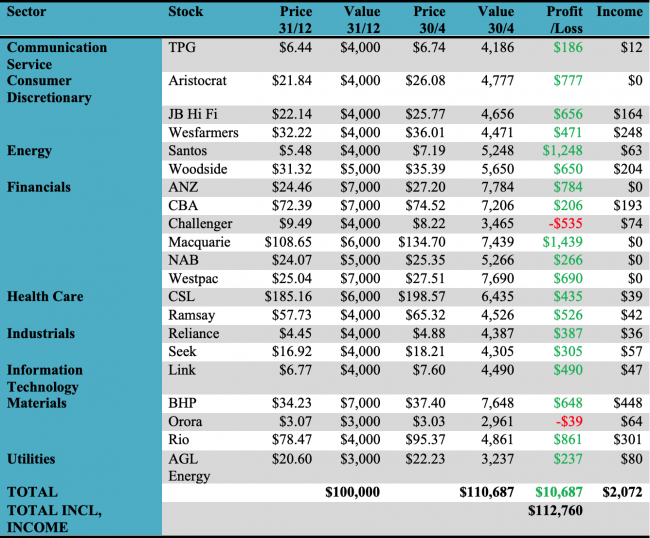

The growth portfolio is moderately overweight financials and energy, and underweight materials, consumer staples and real estate. Overall, the sector biases are not strong.

On paper, it is overweight consumer discretionary. Part of this exposure is through Aristocrat Leisure (which is servicing the gaming and gambling markets) and through conglomerate Wesfarmers.

The stock selection is marginally biased to companies that will benefit from a falling Australian dollar – either because they earn a major share of their revenue offshore and/or report their earnings in USD.

In April, the portfolio returned 2.80% for a relative outperformance of 0.43%. Year to date, it has returned 12.76% for an underperformance of 0.75%.

Gains by the banks (excluding NAB), Seek, Aristocrat and Reliance helped performance in April.

No changes to the portfolio are contemplated at this point in time.

Our growth-oriented portfolio per $100,000 invested (using prices as at the close of business on 30 April 2019) is as follows:

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.