My team recently asked me to do a promotional piece for the Switzer Report where Paul and I talk about our best five stocks for 2022. As I have to do some legwork to come up with my best five, I thought I’d share it with my loyal subscribers first.

My first one doesn’t need any work at all — it’s BHP. This is a world-class company that will benefit from a booming global economy, and just about all credible market pundits are telling us to get ready for higher commodity prices next year. This is typical of the cyclical phase of the stock market, and while the positive outlook for the economy is set to push interest rates up in the US by mid-2022 at the latest, one of my favourite US market commentators says rising rates won’t hurt stocks.

His name is Jeremey Siegel, the Wharton finance professor at the University of Pennsylvania. And Siegel has been right on the stock market for decades. I know because I’ve relied on him when the majority has often been too negative or even too positive. That said, for an academic, he’s more times than not bullish because history shows it pays to be optimistic on Wall Street and the USA. “Despite some severe interruptions, our country’s economic progress has been breathtaking. Our unwavering conclusion: Never bet against America,” Warren Buffett said in one of his annual letters to clients. I’ve never forgotten Buffett’s words.

By the way, US history on interest rate rises also favours stocks next year.

“In the first year of the rates hikes, actually that has marked good stock markets,” Siegel said on CNBC’s “Halftime Report” on Friday. “Maybe late 2022 or 2023 [is] when you begin to get the wobbles in the stock market. Basically, the first year of increases, with the liquidity that’s in the market, I think still makes a positive market for 2022.”

1. First up, BHP: the BIG Australian!

The analysts surveyed by FNArena aren’t betting against BHP, with the consensus tipping a 9% capital gain. After dividends and franking, it looks like a 20%+ gain is a real possibility. The forecasted dividend for BHP next year is 9.8%!

And Macquarie’s expert is even more positive on the company, with a 27.6% upside call out there!

2. Second favourite: CSL

My next favourite company is CSL, which the analysts think will go up 4.3% (see our “HOT” stock today in Maureen’s article) but I reckon 10% will be really easy for this over-achieving company. It has been working on financing a possible takeover of Vifor, which has a market value of 8 billion Swiss francs ($8.6 billion) and Bloomberg reports that deliberations are ongoing and there’s no certainty they’ll result in a transaction. Either way, I think CSL could easily see its share price spike 10% in a boom year, when normalcy will be creeping back in. This company, which was disturbed by the pandemic, will start putting runs on the board, taking its share price with it over the full course of next year. By the way, CSL was a $331 stock before the pandemic and if that high can be surpassed, that’s my 10% rise there with the current price close to $300.

CSL Limited (CSL)

3. My simplest stock: any ETF for the overall market

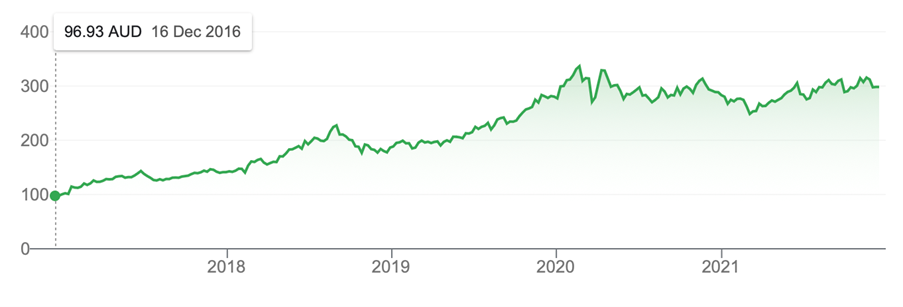

3. My simplest stock: any ETF for the overall marketMy simplest ‘stock’ is any ETF for the overall stock market. Goldman Sachs thinks the US market will rise 10% next year and this is for a market at all-time highs and nearly 40% above its pre-pandemic high. This graph shows that.

S&P 500

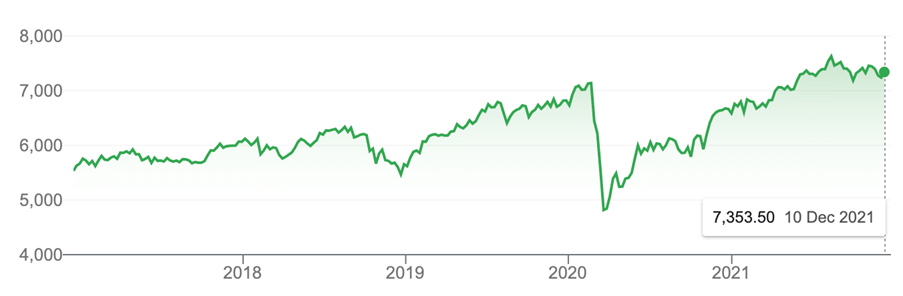

Meanwhile our S&P/ASX 200 Index is only up about 3% and it’s one reason why I think our market can play catchup with US stocks. The favourable outlook for commodities also will help our Index track higher. If we assume we only match the US index’s predicted rise and we add dividends and franking credits, I’m expecting a 15% overall return.

ASX 200

4. Flying high with Qantas (QAN)

My fourth stock is a classic reopening trade play and it has to be Qantas. It’s a blue chip business and it has a rival i.e. Virgin Australia, which is likely to let it win with the business class traveller.

One day, international travel will become normalised and Qantas will be the big beneficiary. The analysts expect a 19.9% gain ahead in 2022, with Morgan Stanley the most optimistic with a 39.72% upside forecast for the flying kangaroo’s share price.

5. Final favourite: ELMO Software (ELO)

My final favourite stock for next year has always been seen as a company that will benefit from the reopening of our economy. At first, it was thought ELMO Software would do better when companies got back to their CBDs and offices, which would’ve encouraged CFOs to think about investing in their payroll and HR issues.

However, with the prospect of lots of businesses having to get used to employees working from home, their need to manage staff remotely raises the demand for software to make it more seemless.

This is ELO’s pitch for business: “ELMO offers a comprehensive suite of cloud HR, payroll and rostering/time and attendance software solutions that can be configured however your organisation requires, and these are available within a single dashboard and single user interface. We can help your organisation streamline your HR and payroll processes to increase productivity, efficiency and reduce costs.”

The company has recently bolted on a small-to-middle size business offering founded in the UK and an expense reduction business. I suspect these acquisitions will produce positive results over 2022.

The one analyst that covers the company for FNArena agrees with my assessment with Morgan Stanley’s expert tipping a 56% gain ahead! As a shareholder, I hope he’s at least half right.

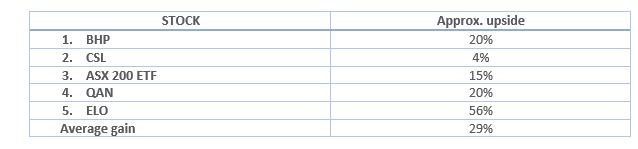

So let’s see what my 5 favourite stocks could net me if the analysts are right.

In the most optimistic worlds of P. Switzer and the company analysts who are paid to guess the future fortunes of listed Aussie companies, a 29% gain across these five stocks is on the cards. But as I always say, I’d be happy if I get half that!

And for those worried about inflation and how that could affect my selections, let me finish off with Prof. Siegel: “Stocks are real assets. I believe there’s a lot of pricing power in most of these stocks. You want to hold real assets in an inflationary time.”

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.