With a couple of hours to trade, the US key market indices (the Dow and S&P 500) were on track for their best weeks since November 2020, which was a pretty important month if you recall.

The wonders of Google make historical research easier than ever before, so I know this was the headline on Pfizer’s website: ‘Pfizer and BioNTech Announce Vaccine Candidate Against COVID-19 Achieved Success in First Interim Analysis from Phase’.

This was a big news event so it’s not surprising that stock markets were positive back then. So what are the positives behind this good week? Try these:

1. Peace talks between Russia and Ukraine.

2. The oil price dropped below $US100 a barrel.

3. The Fed raised interest rates by only 0.25%.

4. Options trading was showing a shift out of metals and into tech.

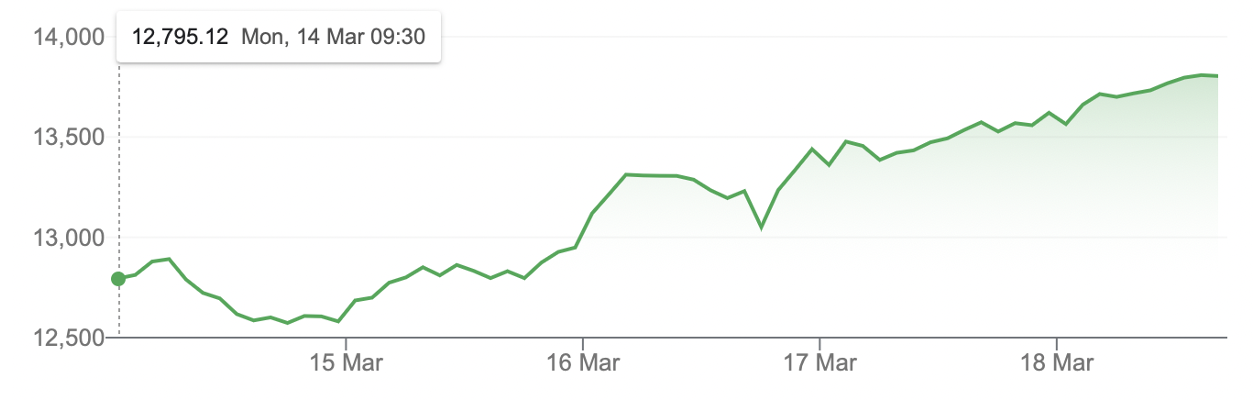

Nasdaq 5 days

This probably explains why the tech-heavy Nasdaq was up nearly 8% this week, as the chart above shows.

On war and peace talks, the progress isn’t great, but negotiations are happening, which the market liked. But how do you reconcile the intensity of the war with the positivity on European stock markets, with the Stoxx 600 up 5.2% for the week?

Well, if Putin is going to make a deal, he’ll do it while he’s got the upper hand on the ground with his troops and bombs. Let’s hope a deal that stops Ukrainians dying and being displaced happens soon. The market would love that!

Interestingly, travel and leisure stocks led the gains on EU bourses overnight, which is a sector clearly damaged by tourists not keen to holiday in a continent coping with a war and a new refugee challenge.

The related fall in the oil price has shown what might happen to this big pumper on the inflation rate if peace happens. Also, the oil story was helped by this revelation: “On Wednesday, the United Arab Emirates Ambassador Yousef Al Otaiba announced the UAE’s desire for increased oil production. The UAE will also nudge the Organization of the Petroleum Exporting Countries, or OPEC, to consider higher production levels.” (star-telegram.com)

That said, the oil price has gone back to $US104 for WTI Crude and this bears watching. Last week it was as high as $US130.50, its highest level since July 2008.

On the Fed’s interest rate rise, the market liked the 0.25% rise and what Jerome Powell said that ruled out over-the-top rises and the prospects of an early recession. This is how CommSec’s Ryan Felsman saw it: “US share markets climbed on Wednesday after US Federal Reserve Chair Jerome Powell struck a more positive tone on the prospects for US economic growth, despite policy tightening.”

There are doubters out there but the overall market is siding with Jerome on the outlook for the US.

For those looking for a potential fly in the ointment, it’s the BA.2 strain of Omicron. You have to be careful of the exaggeration of news headlines but we have to accept that these many versions of this Coronavirus have led to restrictions, economic implications and stock price knock-on effects.

The ABC reported on Wednesday that “Victorian health authorities say the new Omicron BA.2 sub-variant is showing up in half of wastewater tests in Victoria, suggesting it’s quickly becoming the dominant COVID-19 strain”. Health experts believe the BA.2 variant is about 25% to 30% more infectious than BA.1, based on recent data and the University of Melbourne’s Professor Nathan Grills gave us the key indicator to watch to gauge how problematic this might be for the economy and stocks. He said: “hospitalisation figures would remain the key statistic in charting the BA.2 outbreak”.

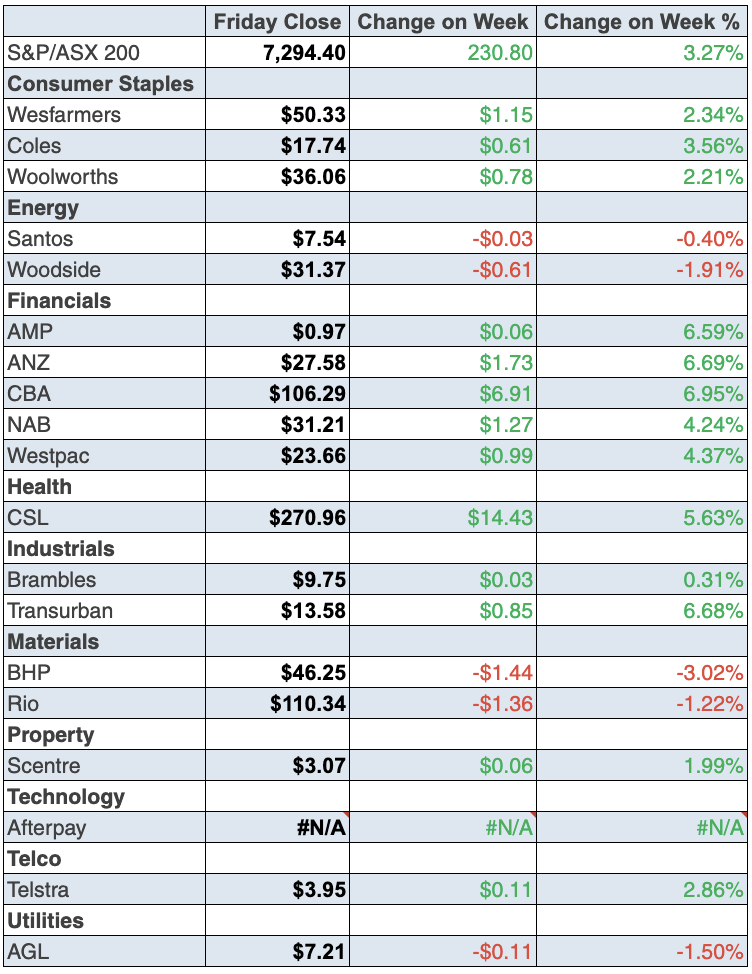

To the local story and our stock market continued to show resilience despite the many headwinds out there from Putin’s squeeze on Ukraine and petrol prices to China’s continued Coronavirus issues, which have inflation and interest rate rise implications. The S&P/ASX 200 Index put on 3.27% for the week to finish at 7294.4.

Considering these challenges, this five-day chart for stocks is pretty impressive but I must warn you that I reckon there’ll be a few weeks of ducks and drakes on peace and threats of escalating military action before a negotiated deal shows up. When it does, stocks will spike. This week’s showing is a sneak preview of the big relief rally that will come when peace breaks out.

S&P/ASX 200

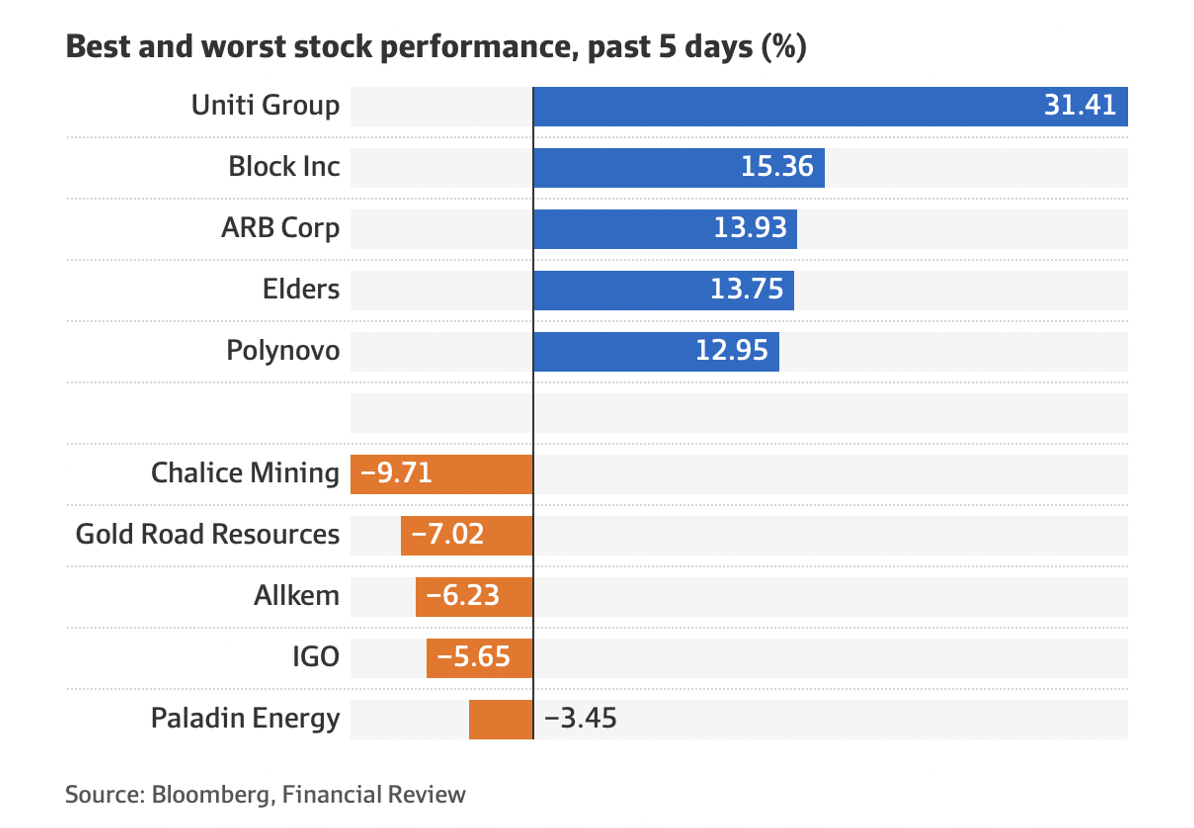

Here’s a snapshot of the winners and losers for the week:

An interesting sign that an eventual rotation back into tech and payments companies will eventually happen, is the gradual liking of payments stocks, as the AFR’s Alex Gluyas pointed out: “Square led the local technology sector higher again on Friday, rising 7.2 per cent to $168.88 capping off a strong week, and Zip Co added 1.6 per cent to $1.60.”

What I’ve loved this week has been the rebound for our banks! In case you missed it, the CBA was up 5.94% to $106.29, ANZ added 5.63% to $27.58, NAB was up 3.14% to $31.21, while Westpac gained 2.96% to $23.66. And not to be outdone, Macquarie, which is contesting to be our best bank, was up 5.97% to $194.80, making it the biggest bank gainer for the week.

What I liked

- Employment rose by 77,400 in February with full-time jobs up by 121,900 but part-time jobs were down by 44,500. Total employment hit a record high of 13.37 million in February.

- The participation rate rose from 66.2% in January to a record high 66.4% in February.

- The unemployment rate fell from 4.2% in January to 4% in February – a 13½-year low.

- A reading of business inflation was softer than expected and oil prices fell 6.5%, easing inflation concerns.

- The US Federal Reserve increased its target range for the Federal Funds rate by 25 basis points to 0.25% -0.50%, the first rate hike since December 2018. The Fed said it “anticipates that ongoing increases in the target range will be appropriate”.

- The Bank of England’s Monetary Policy Committee (MPC) voted 8-1 to raise the key Bank Rate from 0.5% to 0.75%. This is a good sign that normalcy is coming in the UK.

- In the US, industrial production lifted 0.5% in February (survey: 0.5%). The Philadelphia Fed manufacturing index rose from 16 to 27.4 in March (survey: 14.5).

What I didn’t like

- The ANZ/Roy Morgan weekly consumer confidence index fell by 4.3% to 95.8 in the past week. Household inflation expectations jumped to 5.6% last week, its highest level since November 2012. You can blame Putin and his petrol effect for that.

- Worries about a Covid outbreak in China and apprehension about interest rate decisions in the US and UK weighed on sentiment. Data also showed a record drop in the euro-zone ZEW economic sentiment survey in March.

- US consumer inflation expectations for the year ahead rose from 5.8% to a record 6% in February (survey: 5.9%).

A ‘fingers-crossed’ like

US President Joe Biden had a two-hour chat with China’s President Xi Jinping overnight and it comes “at a potential turning point for ties between the United States and China. White House officials are watching with growing concern the budding partnership between Xi and Russian President Vladimir Putin”.

This is a big issue for the world, the global economy and stocks going forward. Biden is often portrayed as a sleepy, non-performer but if he can get Xi to start playing a better global citizen game, it could be good for the world, the currently challenged Chinese economy and it could help our economy too.

Interestingly, China’s view on the tone of the call was skewed towards the positive — fingers crossed we can believe Beijing!

The week in review:

- This week in the Switzer Report, I discuss how I avoid buying stocks on the slide, driven by the old maxim/advice — “don’t catch a falling knife.” Instead, I wait for a stock price to bottom and maybe rise 5% or so before getting on board. But if we’re near the bottom because of the Ukraine war, then a small fall that gives way to a big rally might be a risk worth taking for some investors.

- Paul (Rickard) has been a huge fan of JB Hi-Fi, Australia’s best retailer, and this week he crunches the numbers to see who should and who shouldn’t accept JB Hi-Fi’s recent off market share buyback. And if you do accept, what your options are for re-investing the cash. Paul also shares his strong opinion on why investors should either avoid or sell listed investment companies AFIC and Argo, and perhaps opt for tried and true index ETFs.

- James Dunn says that by 2050, according to Anglo-Swiss mining and trading company Glencore – the world’s largest producer of cobalt – about 507,000 tonnes a year of cobalt will be required, driven mainly by electronic vehicle (EV) carmakers. Meanwhile, forecast supply growth will struggle to keep pace with this burgeoning demand. With these bullish indicators, James signals out 5 Aussie cobalt miners for those interested in this space.

- Tony Featherstone was writing his column this week just as the US Federal Reserve hiked interest rates – which he says is a monumental development for equity markets. Tony cites banks as an example of a sector that can outperform when rates rise. He favours US and European banks and says gaining exposure through Exchange Traded Funds (ETFs) on the ASX is an option. His article gives you two examples to consider.

- In our “HOT” stocks column this week, Raymond Chan, Head of Asian Desk, Retail at Morgans gives his reasons why he thinks Breville Group Limited (BRG) is a buy, and Michael Gable, Managing Director of Fairmont Equities, explains why he thinks Sims Ltd (SGM) is a buy.

- In Buy, Hold, Sell — What the Brokers Say, there were three upgrades and five downgrades in the first edition, and in the second edition, CommBank and Xero both receive upgrades while Elders is among the downgrades.

- In Questions of the Week, Paul Rickard answers your queries about a good income-providing share ETF; I want to invest offshore – what is IHVV? Which stocks are being axed from the ASX 200 when the indices are rebalanced? How much cash should I keep in my SMSF?

Our videos of the week:

- Is the market going up on possible peace talks? + We rate these stocks: NWL, CSL, AKE, TYR + more | Switzer Investing

- Is Paul Rickard sorry he bought Zip last week? + What will the Fed do with interest rates? | Mad about Money

- Why Paul Rickard bought Zip + A return thrill seeker investment Peter Switzer tried this week! | Switzer Investing

- Boom! Doom! Zoom! | 17 March 2022

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday March 22 – Weekly consumer confidence (March 20)

Tuesday March 22 – Monthly household spending indicator (Jan)

Tuesday March 22 – Reserve Bank Governor appearance

Wednesday March 23 – Skilled job vacancies (Feb)

Thursday March 24 – Labour force – detailed (Feb)

Thursday March 24 – S&P Global purchasing managers index (March)

Overseas

Monday March 21 – US Chicago Federal Reserve national activity index

Monday March 21 – US Federal Reserve Chair Powell speech

Monday March 21 – China loan prime rates (March)

Tuesday March 22 – US Richmond Federal Reserve index (March)

Wednesday March 23 – US New home sales (Feb)

Thursday March 24 – US Durable goods orders (Feb)

Thursday March 24 – US S&P Global purchasing managers index (March)

Thursday March 24 – US Current account (Dec quarter)

Friday March 25 – US Pending home sales (Feb)

Friday March 25 – US Consumer sentiment (March, final)

Food for thought: “You only have to do a few things right in your life so long as you don’t do too many things wrong.” – Warren Buffett

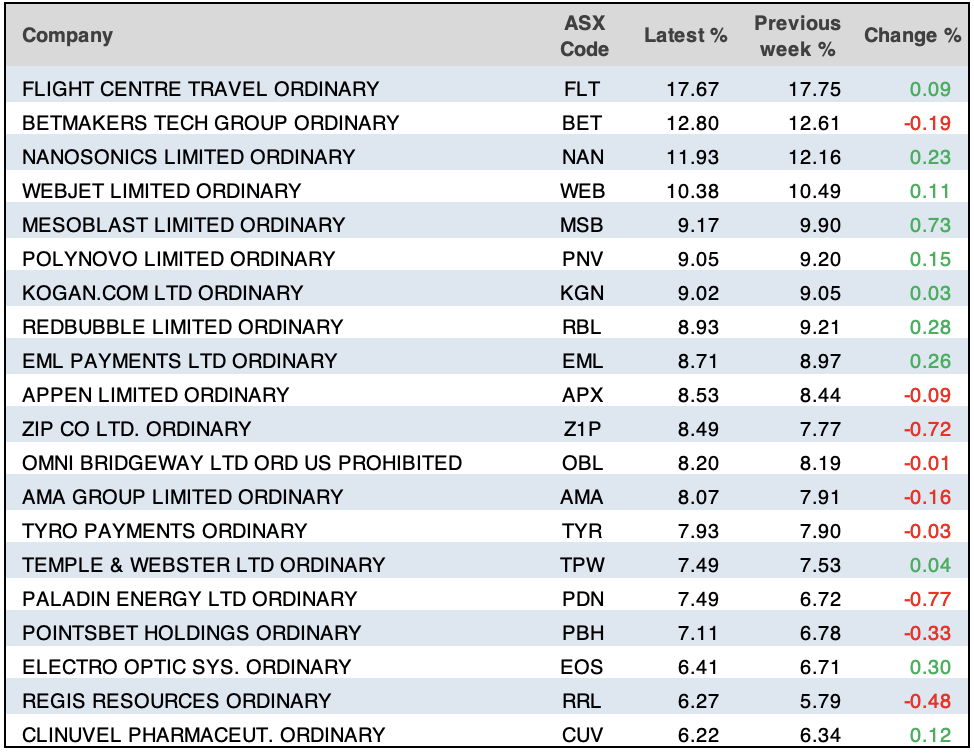

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

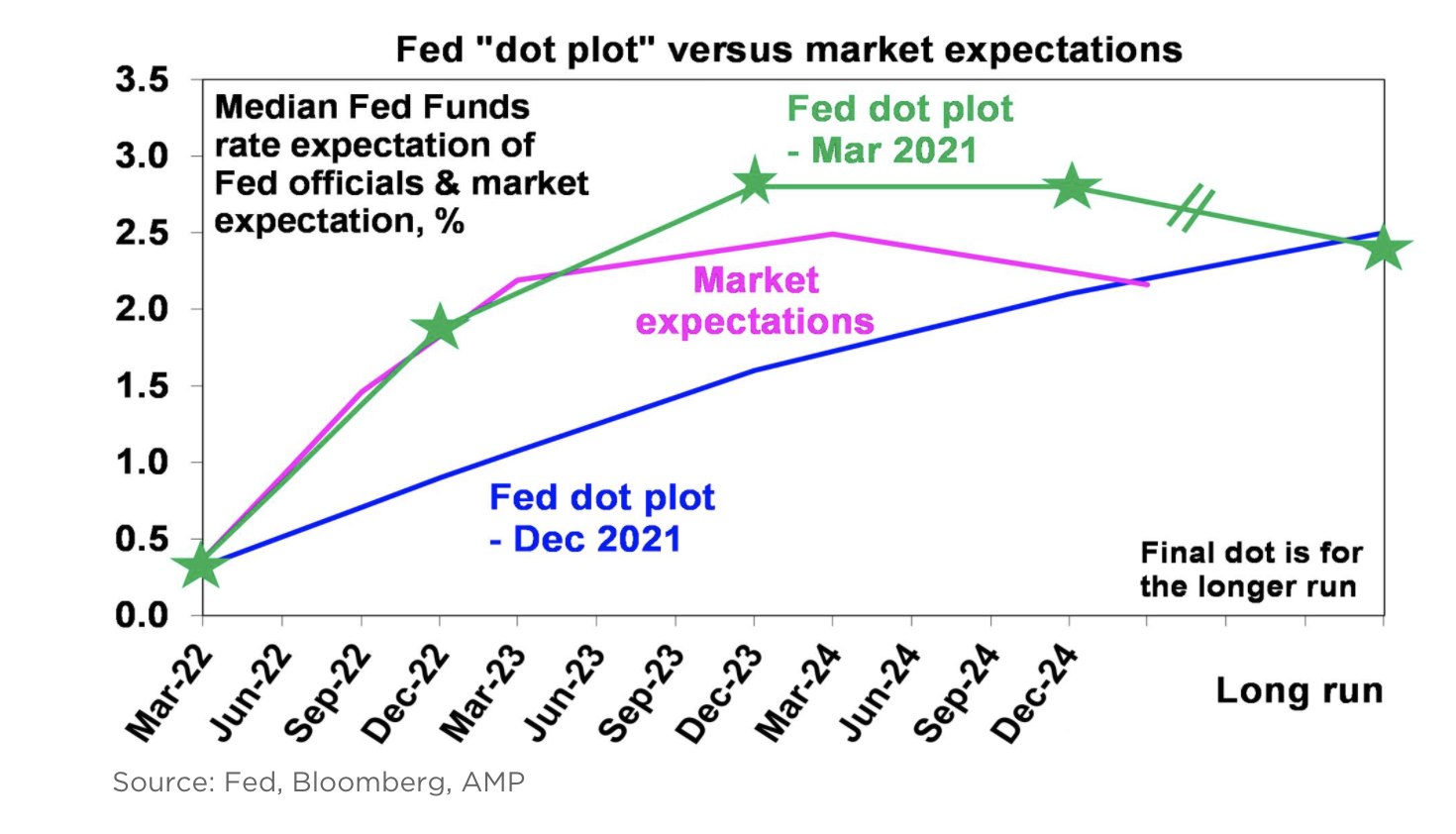

Chart of the week:

Our chart of the week reflects the Federal Reserve’s 25 basis point interest rate hike announcement on Wednesday and the interpretations from AMP Capital’s Shane Oliver.

“The so-called median ‘dot plot’ of Fed officials’ interest rate expectations has now moved up to seven 0.25% hikes this year from three in December and while the Fed sees uncertainty flowing from the war in Ukraine it’s now more focused on controlling inflation, seeing the US economy as strong.

“The Fed also signalled that it will likely start Quantitative Tightening (ie, running down its bond holdings – to be achieved by not replacing bonds as they mature) as soon as May,” Oliver said.

“The reasons for the hike are simple and are the same as seen in other countries. Economic activity has recovered, the labour market is very tight with unemployment at 3.8% consistent with the Fed’s aim of maximum employment, inflation is at a 40-year high and core inflation is at 6.4%yoy and it’s still rising.”

Top 5 most clicked:

- When should you gamble on war’s end and go long stocks? – Peter Switzer

- 2 financial ETFs to consider – Tony Featherstone

- 5 Aussie cobalt producers – James Dunn

- JB Hi-Fi’s buyback is an absolute “no brainer” for some shareholders – Paul Rickard

- AFIC and Argo are so overpriced – so why don’t investors sell? – Paul Rickard

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.