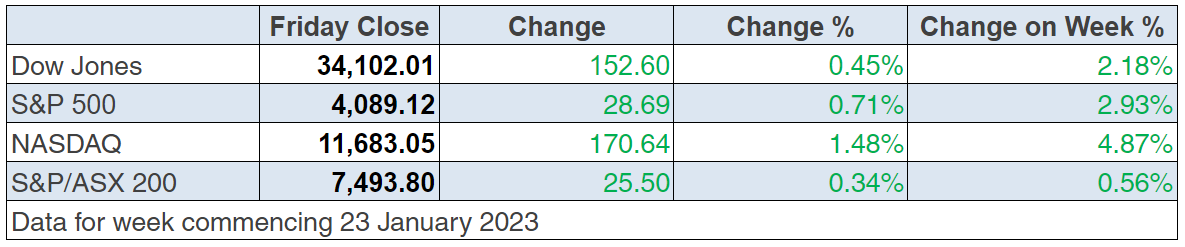

Market positivity continues to triumph over negativity with all three US stock market indexes up before the close. The Friday view on what looks like another winning week for stocks is that a better -than-expected economic growth number and the good reporting news for Tesla have been big drivers of these share price gains over the week.

And while true for the past week, the bigger picture says inflation is falling and the mild recession that I’ve been tipping could even end up as a notable slowdown! Ryan Detrick, chief market strategist at Carson Group, summed it up neatly with this: “We’re putting the final touches on an extremely strong January on the heels of lower inflation, and an economy that’s hanging in there…We’re not out of the woods though. We’ve still got the Fed next week, and they might want to throw some water on this rally.”

Detrick is absolutely spot on so we have three big watches for next week. First is what the Fed raises interest rates by. Second is the narrative that central bankers put out with the decision, which will tell the market how many more rate rises lie ahead. And finally, the jobs report on Friday, which will numerically show the impact of previous interest rate hikes on the US labour market.

You also can’t rule out that the Fed thinks that Wall Street is getting too positive and could damage the dampening of the economy that the Fed is actually trying to use to beat inflation.

There is another US reading to watch, which is the personal consumption expenditures price index. This index is the preferred inflation measurement for the Fed. It showed prices rose by 4.4% from a year ago, which was in line with the Dow Jones economists’ survey.

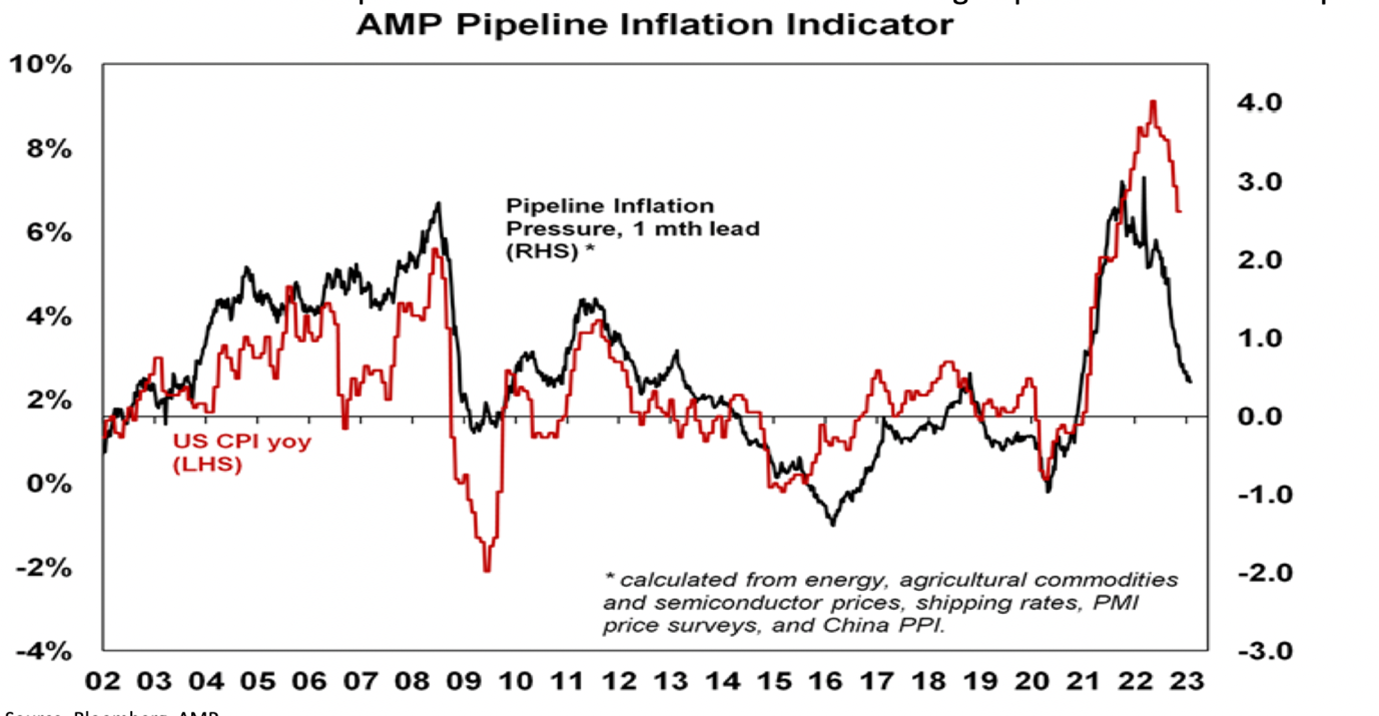

I also like this on US inflation from AMP’s Shane Oliver: “The [global] PMIs showed a continuing downtrend in input and output prices and reduced work backlogs and delivery times compared to 12-18 months ago. This adds to signs that inflation pressures are easing.”

He then added: “This feeds into our Pipeline Inflation Indicator which is continuing to point to a further sharp fall in US inflation ahead.”

Source: Bloomberg & AMP

As you can see, there’s good reason to believe that inflation is falling and interest rate rises in the US are close to over, and that will be good for growth/tech stocks and the overall stock market in 2023. You all know that this is my central thesis for the investing year ahead.

All this explains Wall Street’s current optimism and is partly why the Australian share market rose for the fourth week in a row and is now less than 2% below its all-time high. Gains in the ASX 200 were led by IT, consumer discretionary, property and utility shares. Bond yields generally rose slightly. Oil prices fell slightly, but metals and iron ore rose. The $A rose to its highest since June last year.

It all sounds like good news for many stocks that only the Fed or the US statistician could damage next week!

Helping the shares story was Tesla, which rose 11% after better-than-expected quarterly results.

And this good news watered down the slight negatives coming out of reporting season in the US so far.

Refinitiv reported the following on the subject: “So far, 126 companies in the S&P 500 have reported fourth-quarter earnings, with 69% topping consensus estimates. That compares with the average of the past four quarters of 76%. Analysts now see aggregate S&P 500 earnings dropping 2.7% year-on-year for the period.”

In reality, given the interest rate rises and the expectation that a US recession looms, this is not all that bad nor dramatic, though there are close to 370 companies still to do their show-and-tell, so that’s another watch over the next couple of weeks.

Adding to the more positive outlook was the much talked about re-opening of the Chinese economy, which Reuters says drove up China-exposed luxury firms, such as LVMH’s and Kering’s share prices, by between 0.8% and 1.7%, while rate-sensitive euro zone banks added 0.8%.

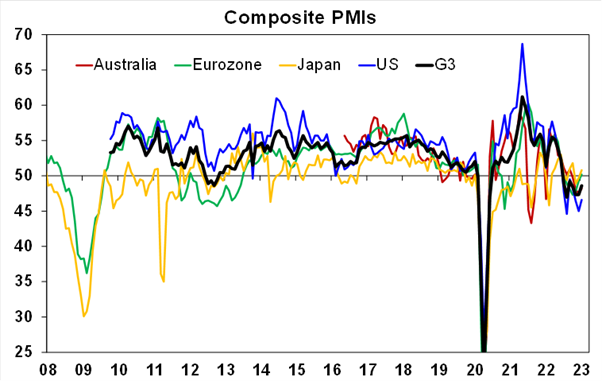

All this was helped by the good news over the last week that global business conditions (PMIs) improved slightly in January and global inflation pressures continue to ease.

“Europe continues to hold up far better than expected (see the green line in the next chart) suggesting that it may avoid recession, whereas the US is continuing to run very soft (the blue line) suggesting a higher risk of recession there. Overall, the PMIs along with China’s reopening suggest that the risk of global recession has receded a bit. (Note that the PMIs are business conditions surveys, and the composite refers to all business sectors.)

Source: Bloomberg, AMP

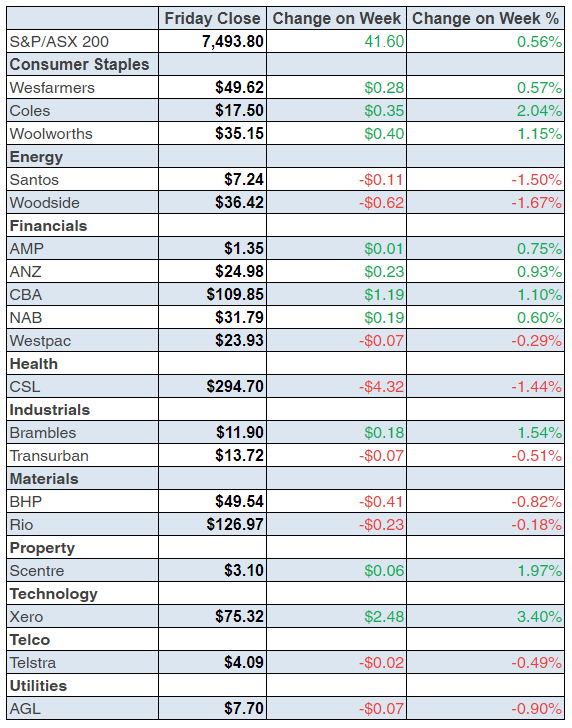

To the local story and the S&P/ASX 200 rose 0.2% to 7493.8. That’s four weeks of rises, which has brought a near 8% gain year-to-date.

The big news is that Tyro is back in play and talk says the major shareholder — Mike Cannon-Brookes — could be willing to sell out to Potential Capital. It might suit his bank balance but he will lose a lot of Tyro friends if he gives in too soon.

The $1.60 top offer looks low and the market took the share price up to $1.56 on Friday.

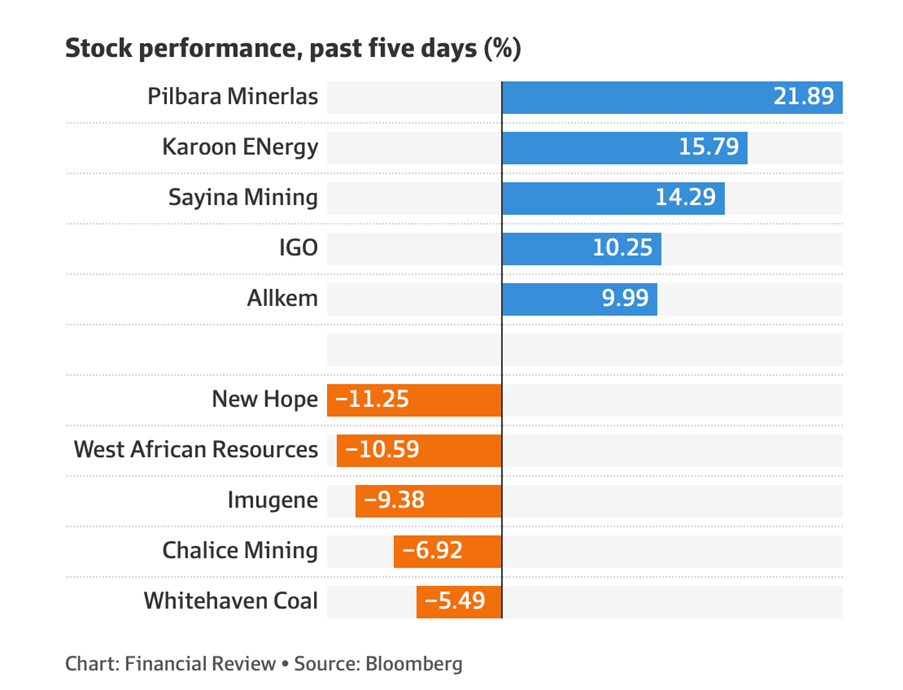

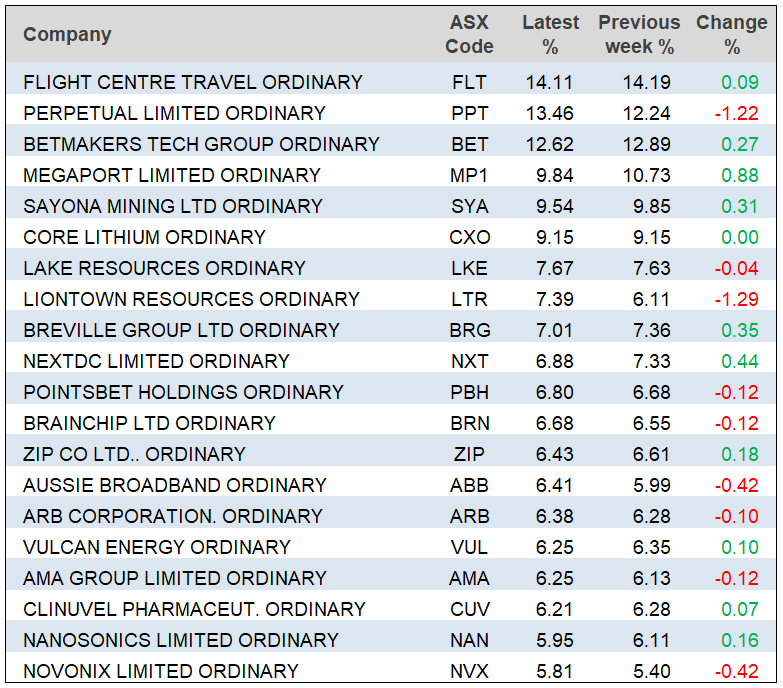

Here are the winners and losers for the week:

Happily for me, as the AFR reported: “Telco infrastructure company Megaport was the index’s top outperformer, climbing 7.2 per cent to $7.43” on Friday. To me, this is a bellwether stock for when tech is back in favour.

The banks did well on stories that the inflation number suggests three more rate rises.

What I liked

- The US economy grew at a 2.9% annual pace in the December quarter (survey: 2.6%) and durable goods orders rose by 5.6% in December (survey: 2.5%), which is good for those like yours truly ruling out a bad recession in the US.

- The ‘flash’ S&P Global composite purchasing managers index (PMI) for the US rose from 45 to 46.6 in January. The manufacturing PMI rose from 46.2 to 46.8 (survey: 46). The services PMI rose from 44.7 to 46.6 (survey: 45). They are contractionary figures but they rising.

- In light of recent positive economic data, EU investors at worst are hoping for only a mild recession there. Upbeat earnings results also encouraged investors during the week.

- The euro-zone composite purchasing managers index surprisingly rose from 49.3 to 50.2 in January.

What I didn’t like

- The headline CPI rose by a large 1.9% in the fourth quarter of 2022 and the annual rate increased to 7.8%. The RBA’s preferred measure of underlying inflation, the trimmed mean, increased by a big 1.7% in the quarter and the annual rate stepped up to 6.9%.

- NAB’s business conditions reading fell in December, and now sits at the lowest point since January 2022.

- NAB’s business confidence number rose a little but remains below long-term average levels.

Best news of the week

That Tesla better-than-expected report and favourable market reaction all adds to my case that tech will be re-loved. The mega-cap tech stocks have been smashed but one day they’ll be forgiven by the fickle market and it will be remembered that they are very good world-class businesses.

The week in review:

- In this week’s Switzer Report, I put together a list of 12 industrial heavyweights that I think is worth checking out for 2023. Here are a dozen stocks I like for the year ahead, if you’re the patient type.

- Paul Rickard talks about some of the best term deposit rates out there. Paul’s best guess is that shorter term deposit rates have a little higher to go, longer term deposit rates (past 2 years) may have already peaked. Here are the best term deposit rates ranging from 3 months to 5 years.

- James Dunn goes into 4 solid-material recycling stocks that he thinks could be leading the way in the “circular economy.”

- In our “HOT” stocks column today, Raymond Chan, Head of Asian Desk at Morgans explains why he says to add Santos (STO) to your portfolio.

- In Buy, Hold, Sell – Brokers Say, there were 8 upgrades and 31 downgrades

Our videos of the week:

- Playing stocks ahead – what should do well in 2023 | Switzer Daily

- Inflation Falling, Stocks are Rising | Switzer Daily

- Can politicians kill inflation and help stop interest rate rises? | Switzer Daily

- Could there be 3 rate risesahead? What happens to stocks? | Switzer Daily

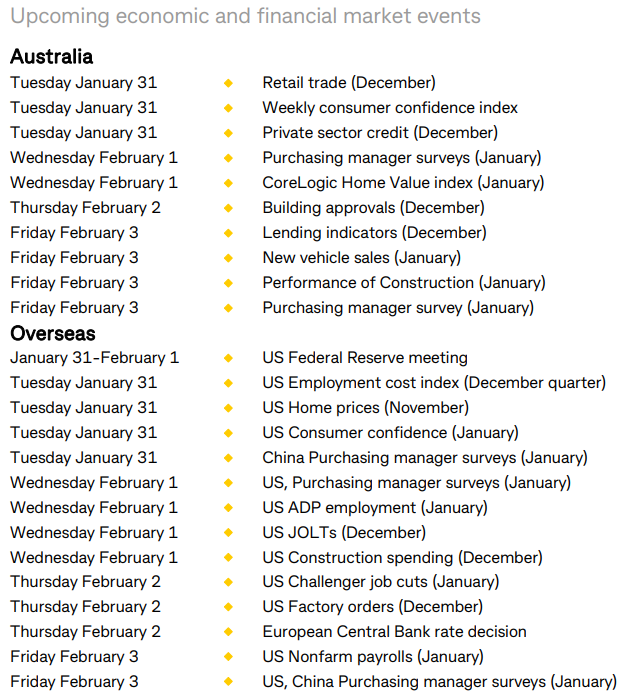

Top Stocks – how they fared:

The Week Ahead:

Food for thought: “The secret recipe for success in stock market is simple. 30% in market analysis skills, 30% in risks management, 30% in emotion control, and 10% in luck.”

– Benjamin Lee

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

I see 2023 as an investing year in two halves, though it won’t necessarily be exactly two half-years. I see the first half still good for what companies did well in 2022 — resources, energy and quality companies, such as the banks. (UBS likes Santos, IGO, BHP, Orica and South 32 to star again in the resources space. For financials, it likes ANZ, QBE, Steadfast and Suncorp, which are bound to do well in the first half of the year, if UBS’s smarties have done their homework.)

However, when inflation is really falling and interest rate rises are over, the out-of-favour tech and industrial stocks will be re-loved.

I always play the long game with stocks to get good prices but it does involve me having patience. Last year you might recall I kept saying that we’d have to wait for the December quarter before we saw the start of a rebound and our S&P/ASX 200 has put on a nice 15% since October 1!

S&P/ASX 200

As you know, I’m expecting an eventual rebound for tech (which is more likely in the second half) but in the past I’ve ignored industrials. Last week, UBS revealed what they like for 2023 and compiled a neat list of industrial companies that have potential.

– Peter Switzer, Switzer Report

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances