Founded in 1978 in Melbourne and with its headquarters these days in Sydney, Computershare Ltd is an Australian stock transfer company that provides corporate trust, stock transfer and employee share plan services in a number of different countries. Growing largely through overseas acquisitions, the company currently has offices in 20 countries including the UK, Ireland, the US, Canada, the Channel Islands, South Africa, Hong Kong, New Zealand, Germany, and Denmark.

“We like CPU as a core portfolio holding at this stage of the cycle for its natural hedge against inflation (rising rates), for strong synergies to flow from the recent Wells Fargo Corporate Trust Services acquisition (in March this year, Computershare acquired WFCT business for $750 million) and for its leverage to a possible pickup in mergers and acquisitions.

Raymond says that CPU is a beneficiary should interest rates rise at the short end of the curve, although he acknowledges that so far the Federal Reserve has been unwilling to signal any rates rises.

“The stock has arguably suffered some indigestion following the WFCT acquisition but the deal is 15% accretive to value and medium-term earnings post synergies.

“The deal also significantly increases CPU’s leverage to a rising rates scenario (taking cash balances from $20 billion to $80 billion) adding weight to holding CPU as a medium-term inflation hedge,” he maintains.

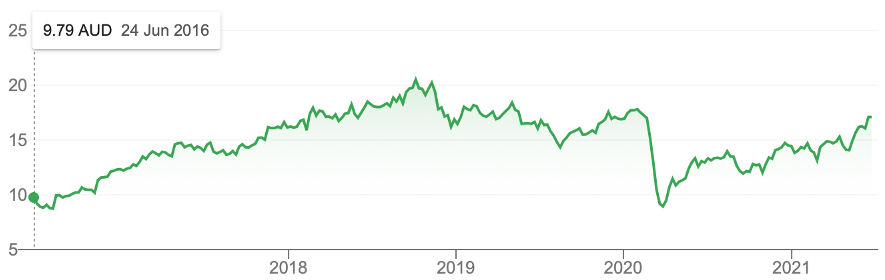

Computershare 5-year

And what does Peter (Switzer) think of CPU?

“The best reading was in October 2018 at around $20.50. Since March 27 last year, it’s up over 90%,” Peter said.

“FNArena says CPU has 5.1% downside.

“If it’s to rise and the chart is still looking promising, it would have to defy the analysts’ views.

“Macquarie’s analysts have a target of $20.95 and if they’re right, that would be 22.5% upside.

“The lowest target price is $13.90 and this view is shared by two analysts — Citi and Credit Suisse,” Peter added.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.