This week I want to tie up what the CEOs of companies have told us about stocks that analysts really like. The AFR’s James Morrison has taken the views of 27 CEOs who recently did their show-and-tell, so I’m looking for clues for companies with great potential in 2024.

1.Telstra (TLS)

First up, this is what Telstra’s CEO Vicki Brady told us: The company has challenges raising profitability, but she has the strategy to do that. But I liked this from Morrison: “As the amount of data we consume keeps growing at a rate of about 30 per cent per annum, the dominance of Telstra’s market-leading mobile business is growing.”

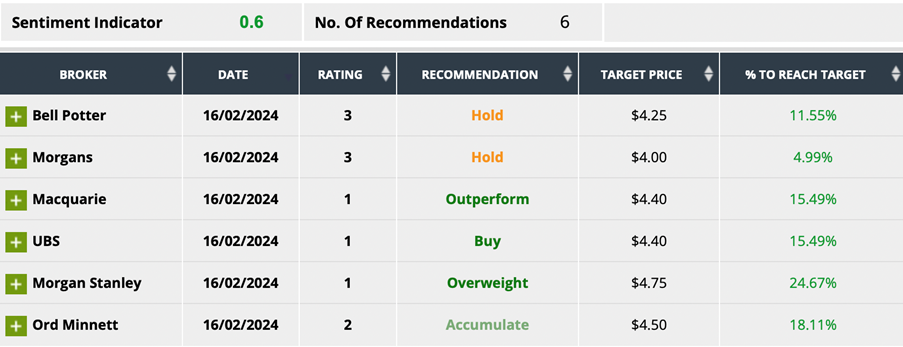

Analysts see a consensus rise of 15% but Morgan Stanley sees a 24.6% rise over the year. And six out of six experts on TLS like the company.

2.Mirvac (MGR)

This next one will surprise you, but Mirvac (MGR) has lots of fans. Five out of five analysts like the company and Ord Minnett is tipping a 43% rise, while the consensus prediction is a nice 16.9% rise.

Interestingly, the Mirvac’s Campbell Hanan was a little negative, saying the cost of construction is a “sleeper issue”. He argues the 13 rate rises haven’t helped but he also tells us that raw material prices are improving. I think the three rate cuts I expect later this year will help this company, if not in 2024 then in 2025.

3.Treasury Wine (TWE)

The third company rests on something I find very risky — China! Treasury Wine Estates (TWE) has a consensus rise of 6.1% factored in by analysts but this information from Tim Ford, CEO of TWE, that was passed on to Morrison is worth noting: “Could the most symbolic moment in the restoration of trade ties between Australia and China be weeks away? Tim Ford of Treasury Wine Estates certainly hopes so, and he has a plan to rapidly get Australian-made Penfolds back into the market if an agreement is reached, as expected. China’s economy looks different to five years ago, of course, but Ford would love to see the playing field evened again.”

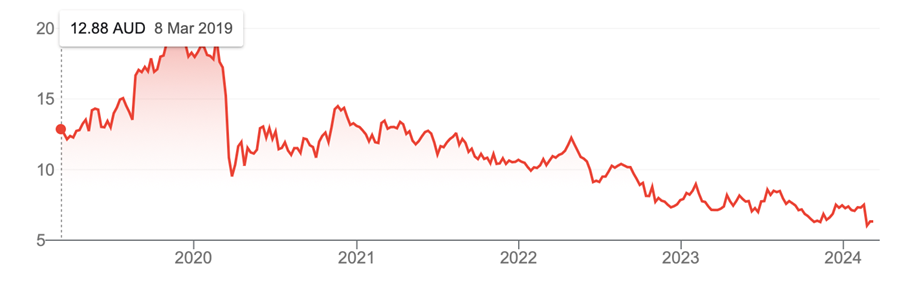

Right now, this is what the analysts are forecasting for TWE’s share price:

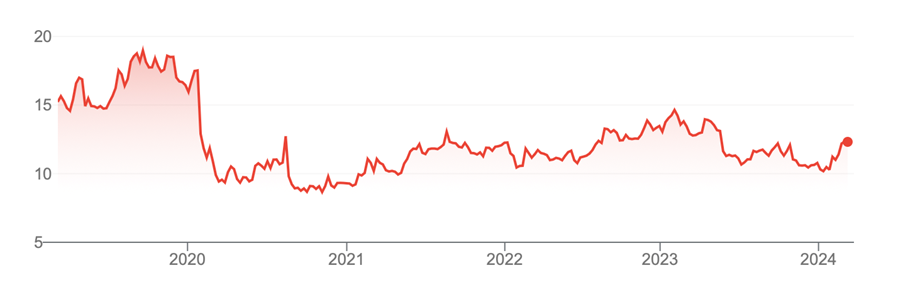

On that basis, TWE looks like a decent play for the next couple of years. Looking at its 5-year chart, which captures the backlash of the Trump-China trade war, the company’s share prices appear to be overdue for a sustained bounce.

Treasury Wines (TWE)

4.Lendlease (LLC)

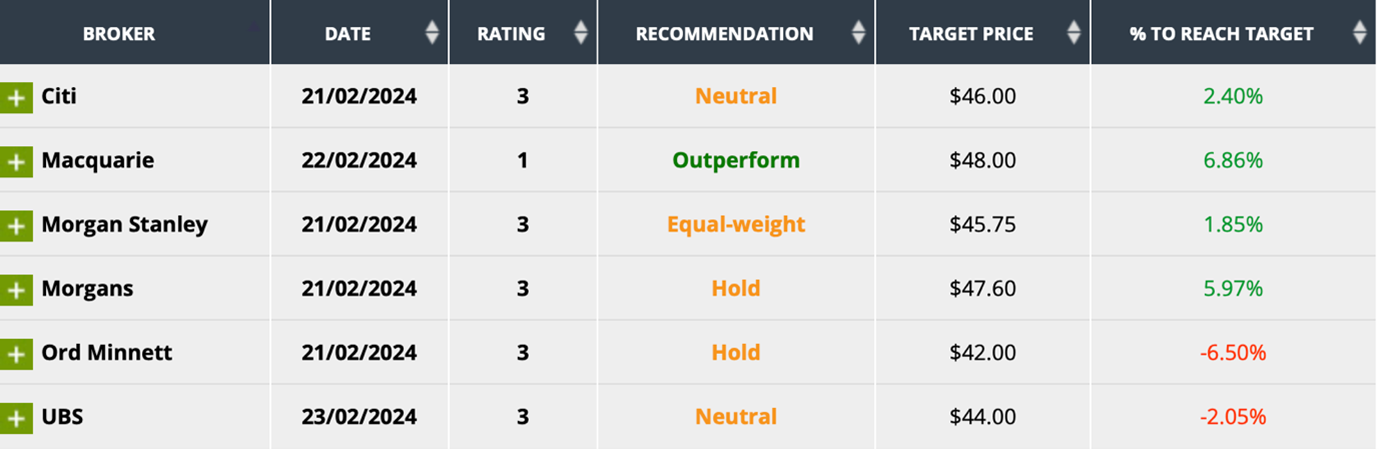

A company I find hard to get positive about is Lendlease. The analysts don’t agree with me, with a consensus rise of 47.1% predicted. Four our four rating experts are giving the business the thumbs up. UBS sees a 50% gain, while Ord Minnett is happy to forecast a 100.1% rise! This is one for the gamblers, with its 5-year chart not giving me anything to be positive about.

This is what the AFR’s James Morrison tells us from his learnings from LLC’s CEO, Tony Lombardo : “Sometimes, being a bit of a black box can be good for a company – just ask Macquarie Group. But for Lendlease, complexity has become a bit of a confidence killer. Chief executive Tony Lombardo has taken strides to clean things up, but this month’s decision to downgrade guidance, just two months after confirming it, shocked investors and raised questions of the visibility management has over the business.”

As you can see, LLC is for the adventurous punter. I don’t think Mr Lombardo helped. That said, lower interest rates and the perceived trend of more people coming back to work will help office block valuations.

5.BHP

My final suggestion coming out of what the analysts are predicting and what the AFR’s Morrison has shared with us, is to back BHP to do even better than what the analysts are expecting.

The consensus rise is tipped to be a low 1.4% and I’ll share the varied views of the expert watchers of the miner.

I think these guys are underestimating the economic comeback of China this year and what that could do to iron ore prices, copper, and other commodities. And the one-year chart makes me think a rebound is on the cards.

Finally, I like this from Morrison on the company’s CEO: “The relentless focus of BHP chief executive Mike Henry is rare. BHP has made the most of the missteps of great rival Rio Tinto to emerge as the lowest-cost operator in the Pilbara, and pulled off a string of smart deals, getting out of petroleum, diving into potash, and buying OZ Minerals. Henry could rest on his laurels, but the reorganisation and job cuts he’s announced in the wake of reporting season – which are basically designed to remove bureaucracy and speed up decision-making – show a determination to keep pushing the business.”

In summary, I like Telstra, Mirvac, Treasury Wine Estates and BHP for 2024. If I wanted to gamble, Lendlease might be a risky but interesting punt, though I would’ve liked a bigger leg up from its CEO!

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.