Mining-services stocks can be great investments when resource companies boost exploration spending and get more projects into production.

And they can be horrible investments when mining capital-expenditure cycles turn, leaving mining-services companies with expensive equipment that depreciates as it sits idle.

Either way, mining-services stocks have a history of higher volatility during resource investment cycles. They do not suit conservative investors or those seeking reliable yield.

The good news is that mining-services companies are at a favourable point in the resource cycle. Rising commodity prices will encourage more mining companies to increase exploration expenditure – and other resource companies with rising share prices to raise equity capital.

That should mean higher demand for mining services in the next few years as soaring share prices in the resource sector translate into higher on-the-ground activity.

The opportunity could be amplified in this cycle due to cutbacks in exploration during COVID-19. Australian non-ferrous metals exploration budgets fell 12.5 per cent year-on-year, according to Standard & Poor’s World Exploration Trends 2021 report.

S&P forecasts global exploration spending to recover strongly amid the COVID-19 vaccine rollout and favourable metal prices. If S&P is correct, demand for mining services will rise.

Yet the share price of mining-services stocks is down this year. They include Monadelphous Group, Seven Group Holdings, Cimic Group, NRW Holdings, MACA and Emeco Holdings, among others. Energy-services provider Worley is mostly flat this year.

I reviewed several resource-services stocks for this column. In several cases, the common theme was falling share prices for much of this year and an upturn in recent weeks. The market, it seems, is finally paying more attention to some mining-services companies.

Here are favoured four resource-services companies:

1. ALS (ALQ)

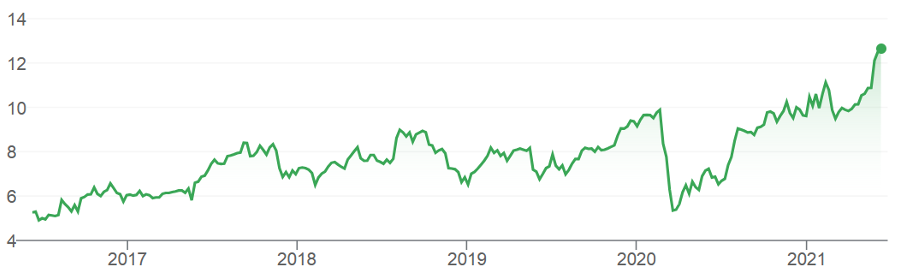

I first wrote about ALS for the Switzer Report in March 2018 at $7.37 and again at $7.24 in June 2019. ALS now trades at $12.66.

To recap, ALS provides testing services for global mining companies in geochemistry, metallurgy, mine-site service and inspection. A gold explorer might use ALS to test exploration samples. Coal and gas explorers test samples through ALS’s energy division.

In life sciences, ALS laboratories test environmental, food and pharmaceutical, electronics and animal health services. In industrial services, ALS provides laboratory work across industry.

ALS rallied in late May after reporting its FY21 result. Underlying net profit fell 1.5% to $185.9 million, but the company noted a significant improvement in second-half trading conditions. A 31% increase in ALS’s declared dividend for FY21 reflected the optimism.

ALS’ s commodity division starred with a 17.2% increase in organic revenue growth in the second half of FY21. The strong momentum continued into the first quarter of FY22 as large and small mining companies continued to increase their minerals exploration sample flows.

The life sciences divisions, about half of ALS by revenue, remained resilient with improving sample volumes in first-quarter FY22.

The recovery in ALS’s sample volumes in minerals reinforces this column’s hypothesis that the commodity-price boom is translating into higher mining-services demand, including providing mineral samples in labs. If that trend continues, ALS has further to rally.

Chart 1: ALS

Source: ASX

2. Worley (WOR)

The energy-services provider has had a few tough years. From a peak of just above $19 in late 2018, Worley sunk to $5.76 at the peak of the COVID-19-related sharemarket crash in March 2020. The company has since recovered to $12.24 after its price spiked higher following its June Investor Day.

Worley said it is on track for an improved second-half FY21 and that its project win rate is up on the previous half.

That’s part of Worley’s long-term strategy to become a bigger player in energy services for sustainability projects. Sustainability is now the most significant part of Worley and this type of business has higher profit margins.

That strategy is working. Ten of 16 recent project wins Worley listed (in slide 9 in its latest investor pack) have a sustainability element, such as renewable energy. Worley is building a valuable market position in advising on global sustainability projects.

I like the short-term thematic for Worley: rising demand for its services as companies spend more on energy and mining exploration. And I love its long-term thematic: the boom in sustainability as companies collectively pour trillions into decarbonising their operations.

Some good judges I know believe Worley is fully valued. The stock looks a touch undervalued to me given its recent performance in winning sustainability-related projects. This is a large addressable market in which Worley can build a lucrative position.

Chart 2: Worley

Source: ASX

3. NRW Holdings (NWH)

Like many mining-services stocks, NRW has struggled in recent years. After trading just above $3 in early 2021, it plunged to $1.54 in May 2021 and now trades at $1.641.

NRW had been volatile over the years. It traded above $4 in early 2012, and as low as 5 cents in early 2016 as the market lost confidence. Investors who bought NRW at the low points in its price cycles over the past decade did exceptionally well.

NRW provides diversified contract services to resource and infrastructure companies. They include civil and mining engineering, drilling, blasting and mining technologies.

For all the share-price volatility, NRW has a good record in project delivery and risk management. The latest investor presentation, in March, suggests NRW is on track and that calendar-year 2022 should see rising demand for its services.

The 2019 acquisition of BGC Consulting provided a step-change in NRW’s scale and earnings diversification. With some mining-services competitors shrinking over the past few years, NRW is in a good place to win more work in FY22 and leverage the BGC acquisition.

NRW suits experienced investors who understand the features, benefits and risks of investing in volatile, small-cap mining-services companies. The key with NRW and other stocks like it is to trade it through the mining-services cycle: this is not a set-and-forget investment.

Chart 3: NRW

Source: ASX

4. Mastermyne Group (MYE)

Based in Mackay in North Queensland, the coal-mining contractor is rarely mentioned in mining-services stories these days. That’s partly due to its size: Mastermyne is capitalised at $93 million and relatively thinly traded. And partly due to its commodity focus: coal.

Investors who believe coal is on the way out should look elsewhere. If, like me, you see rising metallurgical coal prices creating higher demand for coal services, Mastermyne is a micro-cap to watch over the next few years. About 95% of its earnings come from metallurgical coal.

Mastermyne is performing in line with company expectation, according to its latest investor presentation. Management says the company has a strong pipeline of major tenders in its NSW contracting business and is investing more in delivering whole-of-mine contracts.

The well-run Mastermyne is also expanding into hard-rock mining and says it has several tenders on the go. The Mastermyne Hard Rock division is being branded and acquisitions in that area are likely to accompany the company’s organic-growth strategy.

In the short term, underground work has recommenced at the Moranbah North and Grosvenor Mines, which Mastermyne services. Mining operations at both projects were temporarily suspended; Moranbah North had a temporary coal-heating event.

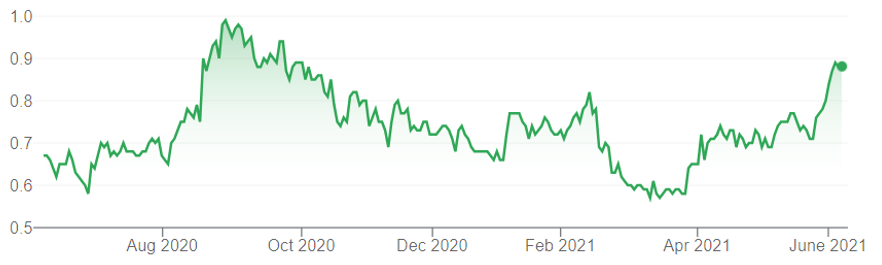

The market is paying more attention to Mastermyne. Its stock has rallied from a 52-week low of 55 cents in February 2021 to 88 cents. The price jumped this month after Mastermyne was awarded the Gregory Crinum underground whole-of-mine contract. The seven-year contract has a total value of $600-$660 million.

Mastermyne does not suit conservative investors. Nor will it appeal to investors who believe the coal sector will be left increasingly with stranded assets and thus less work for service companies, amid the move to renewables.

My view? Coal has fading long-term prospects, but the short-term looks buoyant for service companies in its sector, amid higher coal prices and mining activity.

Chart 4: Mastermyne

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 9 June 2021.