A big part of my job is to have access to a reliable economic and market crystal ball and then lay down the best strategy for the long-term investor. I could play the shorter game but that makes the timing thing more deadly and cutthroat. The long-term investment strategy only has one major problem and that’s the waiting time to see positive returns.

I guess you can’t have everything, but as long as your portfolio grows better than term deposit rates, I’ve done my job.

Lately I’ve been looking at index plays because I believe the period from the December quarter this year and rolling into 2024 should be good for overall returns as interest rates top out and then the market starts to guess when rate cuts will come. We’ve seen that every time the market thinks rate rises are over in the US, tech stocks and the Nasdaq Composite Index take off. However, when the rates outlook swings to “more to come”, which is the usual war cry of a nervous Federal Reserve, stock prices slump.

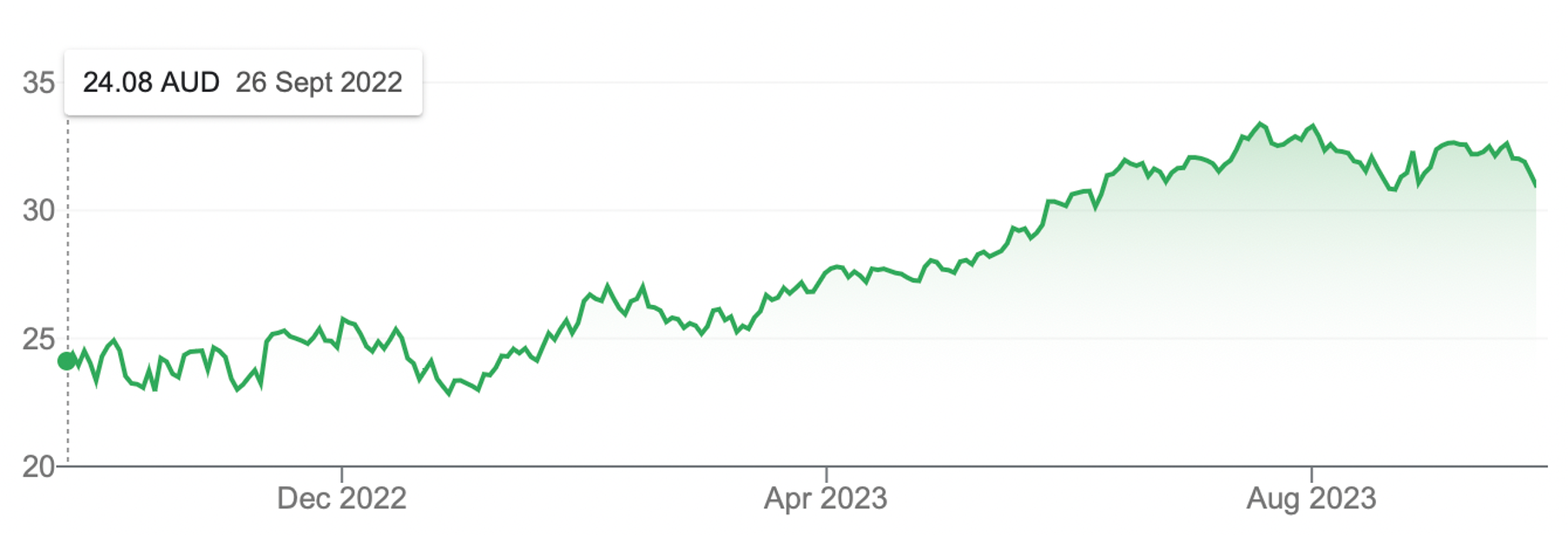

Back in November last year, I recommended the Nasdaq top 100 ETF with the ticker code HNDQ, which is hedged for an eventual rising dollar. I’m not alone in my thinking that the Oz dollar will rise over the next 12 months, as forbes.com revealed in early September, with Westpac tipping the Oz dollar at 76 US cents by June 2024 and NAB going a tick higher at 78 US cents. This is how HNDQ has performed over 2023.

BetaShares NASDAQ 100 ETF (Hedged)

That was a 32.58% gain, while the Nasdaq was up 27% and the S&P 500 gained 12.9%, majorly driven by the big tech stocks called the Magnificent Seven — Apple, Microsoft, Amazon, Google, Nvidia, Tesla, and Meta (Facebook).

The Nasdaq Composite had its best first-half performance in 40 years in 2023. The S&P 500′s gains over the first six months of the year marked the index’s best start to a year since 2021.

Meanwhile, the Dow is up only 2.5% year-to-date, while our S&P/ASX market index is up a mere 1.76%.

With dividends and franking credits, we might be more near 6-7% but it’s still a weak effort.

This week I was thinking about whether I should play a Dow ETF but there doesn’t seem to be a local product. If I played a US-based ETF for the Dow, I could be hurt by any rise in our dollar.

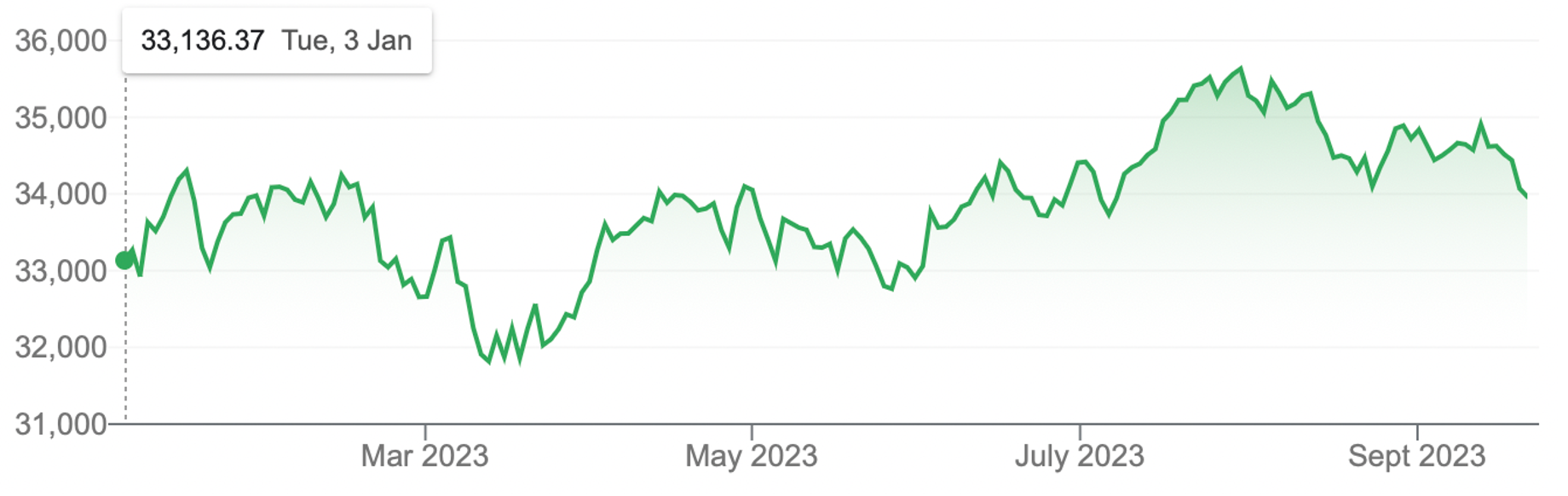

The chart below showed how the Dow had a nice period of rises between March 13 this year until the first of August (approximately 12%) that coincided with concerns about the Fed getting more negative about inflation, which escalated talk about higher interest rates.

At the same time, our S&P/ASX 200 rose 8%, which makes me more confident that if we can see the end of US rate rises without fears that a worse-than-expected recession is coming, then tech stocks that haven’t been chased by the market and good old-fashioned growth businesses in the Dow and the ASX 200 indexes will power the respective indexes higher.

I bet the Nasdaq will do well but their big companies have already had a lot of tailwinds in 2023. It’s why I like the following what I call my old-fashioned plays for the next 12 months:

- IHVV — the hedged play for the S&P 500 to give me US stock market exposure.

- VAS — this is Vanguard’s top 300 Aussie stocks, which pays a dividend of around 4% before franking.

- GEAR — this is the risky play on the Aussie stock market, which gives you a magnification effect, but remember, it works in both directions.

- HNDQ — a lot of this has already gone for a big rise but if you believe in the Nasdaq after rates stop rising and then fall, this should deliver.

One last point that has served me well over the years. I like to see how the current market looks compared to the line of best fit (see the black line below) that shows what the stock market tends to grow at over a long period of time. When the market breaks out of this line, it can be an early indicator that irrational exuberance has taken over.

This is a terribly dodgy picture, but it shows the big peaks when the market gave into gravity after big rises. Right now, the S&P/ASX 200 is on (or a tad below) that line as the chart below shows.

Using the same line idea, the Dow is above its long-term line but not dangerously so. The Nasdaq is even higher but it’s a lot lower than it was before the pandemic crashed the market.

Backing me up on my positive view for stocks is Bank of America’s Savita Subramanian, who raised her 2023 year-end S&P 500 price target to 4,600, saying the rally will broaden out from here. (CNBC) “The equity and quant strategist increased her S&P 500 target to 4,600 from 4,300 — placing it among the higher forecasts in CNBC’s Market Strategist survey. The new target implies a 6.4% upside for the broader market.

“’Recession averted’ says the consensus economist, but a fresh wave of bear narratives around equities have emerged,” Subramanian recently acknowledged. “However, the net message of our five target indicators is bullish.” The strategist expects even better returns for the average stock over the S&P 500, which is weighed by market value, as the rally broadens. I hope Savita is on the money but she’s not alone being positive. AMP’s Shane Oliver posted this on Friday, after listing all the headwinds out there right now: “However, our 12-month view on shares remains positive as inflation is likely to continue to trend down, taking pressure off central banks and any recession is likely to be mild.”

If they’re right (and I think they are), all you have to do is position your portfolio to net the benefits ‘if and when’ the three of us (Savita, Shane and me) are proved right. It’s not an easy job to do, predicting markets, but someone has to do it.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances