Like or loathe Trump, one thing about his presidency is certain: greater spending on defence and military technologies worldwide as geopolitical risks rise. Key European countries have pledged to lift defence spending amid pressure from Trump, concerns about US backing for NATO and an expansionary Russia.

The UK has committed to its biggest increase in defence spending since the Cold War, planning to lift spending to 3% of GDP in the long term, from about 2.3% now. Australia, too, is under pressure from the White House to lift its defence budget. US officials recently called on Australia to allocate the equivalent of 3% of GDP to defence, from about 2% now, and align with NATO defence-spending targets. These are tectonic shifts in defence and a tailwind for defence manufacturers – and Exchange Traded Funds (ETFs) that provide exposure to the sector.

This column’s readers will recall I nominated defence as one of two key sectors to benefit from a Trump administration (the other sector was energy).

I wrote on the eve of the US Presidential election in early November: “A Trump victory could be good for defence stocks on a few fronts. First, Trump has historically advocated for higher defence budgets and military modernisation to counter the rising military threat of China and Russia.

“Second, Trump’s ‘America First’ approach, and aggressive posturing, heighten geopolitical risk and the risk of military conflict. … Whatever happens, the likely outcome of heightened geopolitical risk is greater military spending in advanced economies, which is good for defence company earnings.”

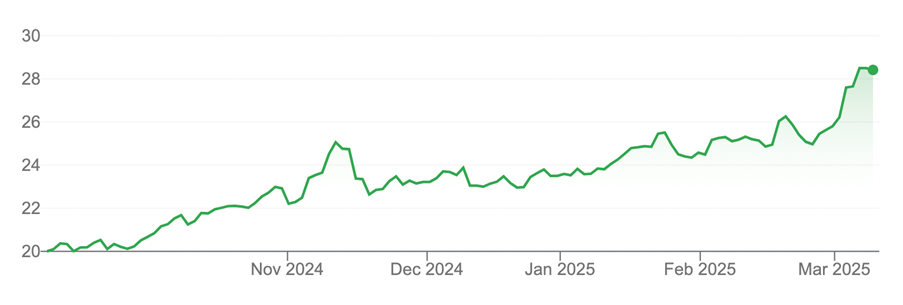

I identified the new VanEck Global Defence ETF (ASX: DFND) for readers as a preferred tool for global defence companies via ASX. DFND has rallied 11% in the three months to 28 February 2025 as interest in defence stocks grows. DFND only fell 1.4% over the past five trading days – well below broader market falls.

That said, it wouldn’t surprise if DFND and other defence ETFs eased or retreated more in the next few weeks given the strength of their rally and amid broader current weakness in global equities. That could be a buying opportunity.

First a few caveats. To be clear, I respect investors who avoid defence stocks on Environmental, Social and Governance (ESG) grounds. If they do not want to profit from war, or the build-up to war, that is their right.

Second, there is growing hype about defence expenditure and thus defence stocks. European leaders can talk about increasing defence budgets, but that money inevitably has to come from health, education and other government budgets. Governments can only raid their foreign-aid budgets for so long.

Clearly, increased defence spending in Europe will require hard decisions that will alienate many voters. Defence investment is slow-moving at the best of times, so expect a long lag between higher defence-budget and defence-sector earnings. This trend will take years, if not decades, to play out.

Investors could consider adding or increasing portfolio exposure to defence as a long-term play (7-10 years). That is, including defence ETFs as a thematic play to benefit from an expected increase in defence spending this decade and beyond.

This is also about ensuring portfolios can weather geopolitical risks that extend beyond traditional war. BlackRock has nominated 10 key risks: global trade protectionism, a Middle East regional war, US-China strategic competition, global technology decoupling, major cyber-attacks, major terror attacks, Russia-NATO conflict, emerging-market political conflict, a North Korea conflict and European fragmentation.

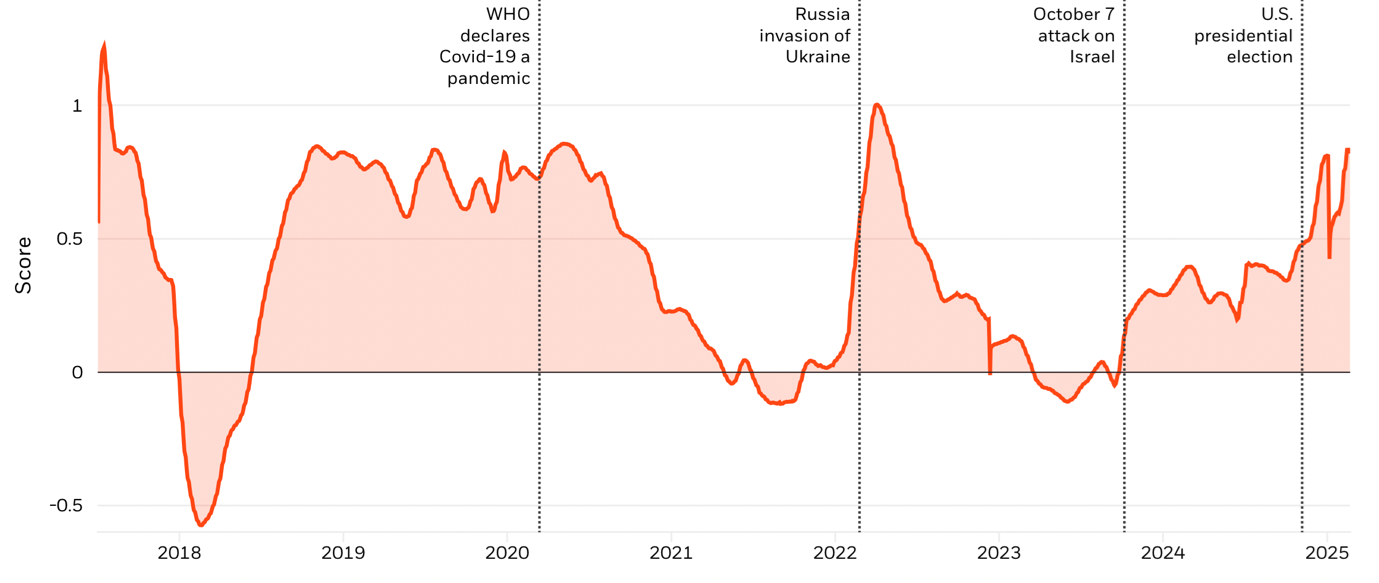

The BlackRock Geopolitical Risk indicator, which is based on negative or positive news media sentiment, has risen for the past two years. Defence companies are obvious beneficiaries of the need to contain rising geopolitical risk.

Chart 1: BlackRock Geopolitical Risk indicator

Source: BlackRock

Defence exposure via ASX

Australian investors seeking portfolio exposure to defence have to look overseas. Only a handful or so of defence stocks are listed on ASX and most are micro-cap companies. The main action in defence is by far overseas.

Local ETF issuers were quick to spot this opportunity and fill a gap on ASX for exposure to global defence companies. VanEck launched the market’s first defence ETF in September 2024. The Betashares Global Defence ETF (ASX: ARMR) and the Global X Defence Tech ETF (ASX: DTEC) soon followed.

I have covered the VanEck’s DFND ETF previously, so won’t repeat that here. Suffice it to say, I retain a positive view on the DFND ETF for investors who want concentrated exposure to the world’s largest defence stocks.

Chart 2: VanEck Global Defence ETF

Source: Google Finance

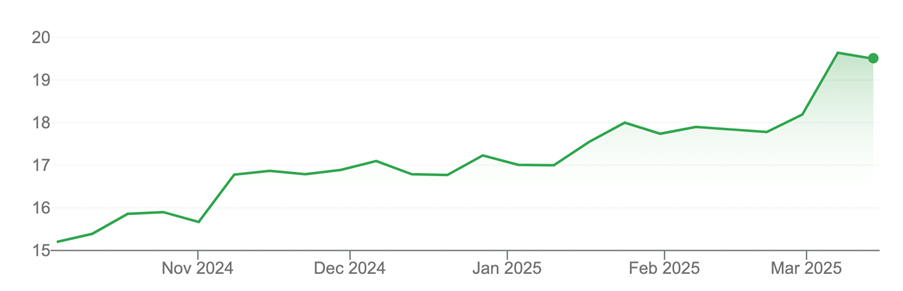

The Betashares Global Defence ETF is another consideration. ARMR provides exposure to up to 60 companies that derive more than half of their revenue from manufacturing military goods or services.

This is an important rule: many companies that provide defence technologies might not be specialist defence companies. Airbus, the French aviation giant, for example, makes military goods through its defence division, but is better known as the leading global manufacturer of commercial aircraft.

I like that ARMR only holds stocks headquartered in NATO or major NATO ally countries, such as Australia, Japan and South Korea. This eliminates the risk of holding defence companies in emerging markets with heightened sovereign risk and less predictable earnings.

ARMR has rallied almost 9% over three months to 28 February 2025. The ETF’s average Price Earnings (ratio) of 21.5 times is reasonable given its portfolio.

Chart 2: Betashares Global Defence ETF

Source: Google Finance

ARMR’s annual management fee of 0.55% compares to 0.65% for VanEck’s DFND. Both ETFs are unhedged for currency movement.

It’s hard to separate the two ETFs as they fulfil slightly different needs. DFND offers more concentrated exposure to global defence companies, including professional service providers. Investors who have more bullish view on defence – and are willing to take higher concentration risk – will favour DFND.

ARMR, in contrast, offers a more diversified portfolio and includes companies with operations beyond defence. ARMR also has more exposure to US defence stocks. As such, it arguably has less risk than DFND and its slightly lower management fee is another positive.

Bought and sold like a share, either ETF provides global defence exposure in a convenient, low-cost structure via ASX. I prefer more concentrated defence exposure at this point, mindful that companies with broader operations might also be included in other global indices, creating the risk of portfolio duplication via ETF. So, my preference for now remains DFND.

I’ll review the Global X Defence Tech ETF, which focuses more on defence technology companies, in a later column.

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 12 March 2025.