Although finishing with a small loss of 2.6% in May, the Aussie sharemarket continues to outperform the US and most other advanced economy sharemarkets. In price terms, the benchmark S&P/ASX 200 has lost 3.1% since the start of the year to close the month at 7211. Add back dividends received and the loss narrows to 1.3%.

But in the US, the tech-heavy NASDAQ has shed 22.8% while the broader S&P 500 is down 13.3% in 2022. The Dow Jones, which measures the performance of a basket of 30 stocks, has lost 9.2%. Interestingly, both the Dow Jones and S&P 500 crawled into the black in May.

So where is the relative “outperformance” coming from?

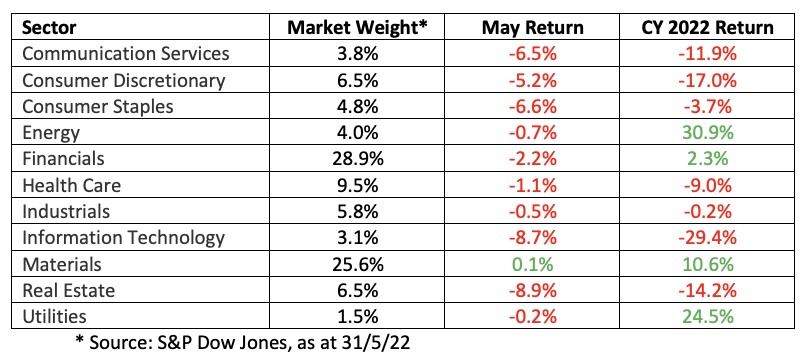

Three sectors stand out. Energy is obviously no surprise, with oil and LNG majors (Woodside and Santos) trading higher as the oil price rises. The sector dipped by 0.7% in May largely due to profit-taking in Woodside shares ahead of the BHP demerger (which will see BHP shareholders receiving Woodside shares) but has returned 30.9% in calendar 2022.

The second-largest sector, materials, is also driving the market. Weighing in at 25.6% of the total market capitalization, the sector was the only one to finish in the black during May with a return of 0.1%. Year to date, it is the third best performing sector with a return of 10.6%. Base metals and iron ore remain firmly bid as global economic growth recovers from the pandemic and supply chain issues linger.

The largest sector, financials, has also been a small winner. Better than expected profit results in February, the prospect of higher interest rates, and relative “safety” have led to significant investor support and the sector has returned 2.3% in 2022.

On the negative side, the information technology sector continues to wallow. A loss of 8.7% in May took the year to date loss to almost 30%. Healthcare, which is considered to be a “high growth” and “high multiple” sector, is also struggling. The third-largest sector by market capitalization, it is down 9.0% this year. Consumer discretionary is faring even worse, down by 17%. The prospect of higher interest rates is also starting to impact the property trust market, with the real estate sector faring the worst of all sectors in May with a loss of 8.9%. Since the start of the year, it is down by 14.2%.

Shareholders whose portfolio comprises ‘top 20’ stocks should be feeling a little more comfortable because this part of the market is in the black, returning 2.1% over the five months. Mid and small cap stocks aren’t faring as well. The small ordinaries index, which tracks companies ranked 101st to 300th by market capitalization, has shed 12.3%.

So what’s the immediate outlook for the market and can it finish higher in 2022?

Firstly, it is important to note that the long term bullish trend for the Australian sharemarket is still in place. Percy Allen’s chart below shows that for the Australian All Ordinaries Index (shown in black), the 30-day moving average (shown in green) is above the 300-day moving average (shown in blue). It was challenged in February and again in May, but the bull trend has held. The Coppock momentum indicator (second chart) is also moderately positive.

The indicators for the US stock market are less positive, with both short-term and medium-term trend indicators pointing to bearish markets. And where the US goes, we largely tend to follow.

In the US, the critical debate remains as to whether inflation has peaked. The reading last week on the Fed’s preferred measure, the PCE (personal consumption expenditure) falling to 6.3%, was encouraging but in itself is not enough. Yesterday’s Eurozone reading of inflation running at 8.1% in May, a record and up from 7.4% in April, shows that globally, inflation is a real concern.

The Federal Reserve meets on June 13/14 and is expected to increase the Fed Fund’s rate by 0.5% from about 0.875% to 1.375%. There is a chance that the Fed could increase it by 0.75%, which would signal that inflation is a bigger problem and put pressure on bond yields (higher) and equity prices (down).

Our Reserve Bank meets on Tuesday and is expected to increase the cash rate by at least 0.25%. Last month, it “surprised” the market by increasing it by 0.25% to a “non-round number” of 0.35% (it was widely tipped to increase it by 0.15% to 0.25% or a by a bigger 0.40% to 0.50%). Hence, there is a chance that the RBA may want to take it higher more quickly and to a “round number”, so an increase of 0.40% to 0.75% can’t be ruled out.

The other factor to consider is ‘tax loss’ and portfolio selling ahead of the end of the financial year. This normally hits in the last couple of weeks of June and does temper the market, which is sometimes followed by a rebound in July. With technology stocks being absolutely smashed in 2022, there are some sizeable losses for investors to consider and I wouldn’t be surprised to see more selling in June as investors “clear-out” their portfolio dogs.

I am in the camp that inflation is close to peaking, supply chain disruptions will normalise and global economic growth will stay strong. This should be good for company profits and stock prices, and the bull market will continue.

However, in the short term, I sense that the market is going to remain choppy as investors wait for the data to confirm (or not) their inflation prognosis. The market would get a boost from an early end to the Ukraine conflict, but this appears unlikely. In Australia, the ‘end of year’ impact could be quite a drag, especially for the technology sector.

Stay positive but keep some powder dry.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.