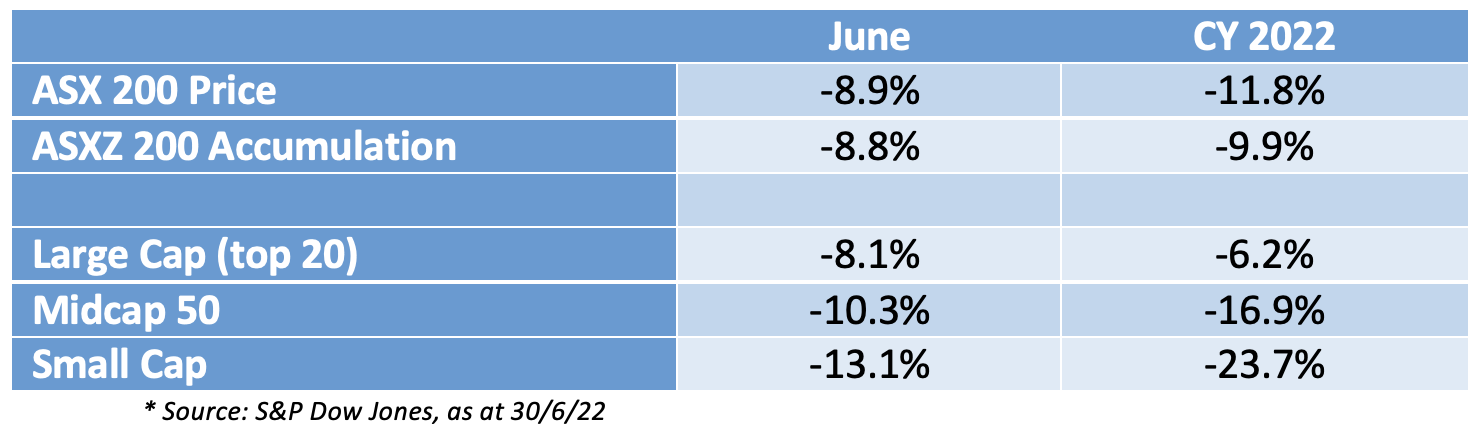

The Australian sharemarket followed the lead from Wall Street to record one of its steepest monthly losses in June. The S&P ASX 200 fell by 8.9% in June to be down 11.8% in 2022. Adding back dividends, the total return for the year sits just shy of -10%.

Interestingly, small- and mid-cap stocks have been absolutely pummelled. As is often the case when the market gets the wobbles, a ‘flight to safety’ occurred as institutions sought the liquidity and relative quality afforded by the major cap stocks. The ‘top 20’ stocks by market capitalization lost 6.2% on average, whereas the midcaps (stocks ranked 51st to 100th by market cap) are down 16.9%. The pain in small caps (stocks ranked 101st to 300th by market cap) is even worse – a staggering -23.7%.

Sharemarket Returns by Market Capitalisation

All industry sectors, with the exception of consumer staples, were negative in June. The consequences of higher interest rates (potentially bad debts for banks, reduced property valuations and higher borrowing costs for property trusts) finally caught up with the financial and real estate sectors which recorded double-digit losses. Resources, which is the second-largest sector on the ASX with a market weighting of 23.7%, was hit as the market shifted attention to the dreaded ‘R’-word (recession) and the impact it could have on the demand for mineral commodities.

Defensive sectors such as consumer staples, communication services, utilities and arguably health care fared better. The latter lost 3.1%, taking its year-to-date return to -11.8%.

Growth-oriented sectors information technology and consumer discretionary “lead” on a calendar year basis for losses, with the former shedding 37.2% since the start of the year. Energy is the main winner, up 30.5% as leaders Woodside, Santos and Oil Search benefit from higher oil and gas prices following the outbreak of the war in Ukraine. The tiny utilities sector is also up due to higher wholesale electricity prices and renewed corporate activity.

ASX Sector Returns

So what’s the immediate outlook for the markets? Technically, the US has qualified for a “bear” market, with most of the major indices (S&P 500, NASDAQ 100, Russell 2000) down more than 20%. The exception is the “large cap” Dow Jones index, which is only off 16.2% from its record high.

Percy Allen’s chart below shows the US S&P 500 (n black). The 30-day moving average (shown in red) has crossed below the 300-day moving average (shown in blue), signalling a downtrend. The Coppock momentum indicator (second chart, in green), although just positive, is also trending the wrong way.

US S&P 500 – 30-day and 300-day moving averages & Coppock

But a “bull point” for investors has been the recent fall in US government bond yields, which peaked for the benchmark 10-year bond at 3.5% in early June and is now hovering around 2.85%. Recession fears rather than a view that inflation has peaked appear to be the main driver, and that’s not great for stock prices. However, it is worth recalling that the “bear” market and the collapse in tech stock prices started due to a blowout in bond yields, and if the market is starting to realize that its expectation for interest rate increases is too aggressive, this could be a positive for share prices.

Interest rate expectations will be tested again towards the end of the month, when the US Federal Reserve meets on 26/27 July. Many market watchers expect another 75bp increase in July, and then some guidance as to what happens after that. In any event, 28 July should be a big day in our market.

The day before, 27 July, might be even bigger because that is when the Australian June Quarter Consumer Price Index is released. It will no doubt be higher than the 5.1% recorded for the March quarter, but if it gets into the 6’s, expect more pressure on the Reserve Bank to keep lifting interest rates.

In the US, it is hard to see the markets rallying substantially unless there is clear evidence that inflation has peaked and the cycle of interest rate increases is manageable. Australia, despite being behind the US in the “war on inflation”, will follow the lead.

I expect the next couple of months to be quite choppy because the market won’t be able to conclude the inflation question one way or the other. But I don’t expect a recession in Australia and think it is unlikely in the US. By the end of the year, I expect share prices to be higher.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.