Australia’s listed property trust sector has had a wretched year as rising interest rates crush investor sentiment. But opportunities are emerging within some niche trusts.

The S&P/ASX 200 Australian Real Estate Investment Trust (A-REIT) Index has slumped 21% year-to-date. The ASX 200 Index looks rosy by comparison, down 11%.

Three factors have hurt A-REITs:

- Interest-rate expectations.

Higher rates are on balance bad for interest-rate-sensitive sectors like A-REITs. Rising rates reduce A-REIT valuations and make their yield relatively less attractive to cash and bonds.

- COVID-19.

The pandemic has changed how we work and live, perhaps permanently for some. As more people work from home, demand for office space will ease. Some office owners will have to offer large incentives to attract new tenants or keep existing ones.

Moreover, as people buy more goods online, and spend less time at shopping centres due to COVID-19 or influenza fears, demand for retail space will fall.

I like the long-term outlook for fortress malls that are becoming multi-use enterprise centres and “mini-CBDs” in the suburbs. But their medium-term outlook is tricky.

- The third factor is economic and equity-market volatility.

Rising interest rates will inevitably slow Australia’s economy. With that comes lower property prices. Some Net Tangible Asset (NTA) valuations on A-REIT balance sheets will be marked down.

Like other listed sectors, A-REITs will feel the brunt as investors reduce their equity exposure in the face of higher volatility.

Thus, I’m wary of office and most retail A-REITs in this market, despite their price falls this year. There are, of course, exceptions. GPT Group (GPT), a diversified property investor, looks modestly undervalued at the current price.

But for the most part, large-cap A-REITs are fairly valued. It’s hard to find screaming value in the sector, using consensus analyst forecasts. The best part of the sector: industrial property – looks fully valued – judging by Goodman Group’s valuation.

Niche A-REITs are a different proposition. Unlike large-cap A-REITs, niche trusts focus on property sub-sectors. They include childcare centres, self-storage facilities, farms, petrol stations and convenience stores, holiday parks and healthcare properties.

Niche A-REITs can be more volatile than diversified, larger A-REITs, so suit more experienced investors with higher risk tolerance. Niche A-REITs typically pay lower dividends (as they are reinvesting funds for growth) but that is not true of all.

In the US, niche REITs are much larger than in Australia. US niche REITs include biotech labs, student accommodation, fast-food properties, prisons and other property types.

I suspect more niche A-REITs will emerge in Australia over the next few years. Institutional investors have latent demand for quality niche A-REITs that have higher growth prospects and add diversification to portfolios.

Readers will note I included Shopping Centres Australasia Property Group (SCP) in last week’s column on stocks that will benefit as people “trade down” as inflation rises.

SCP is not technically a niche A-REIT because it owns shopping centres. But its focus on neighbourhood and sub-regional shopping centres is far more niche than the large retail A-REITs. More people working from home is good for neighbourhood shopping centres and food inflation can boost supermarket margins in the short term.

Here are two other niche A-REITs that look interesting at their current price:

1. ARENA REIT (ARF)

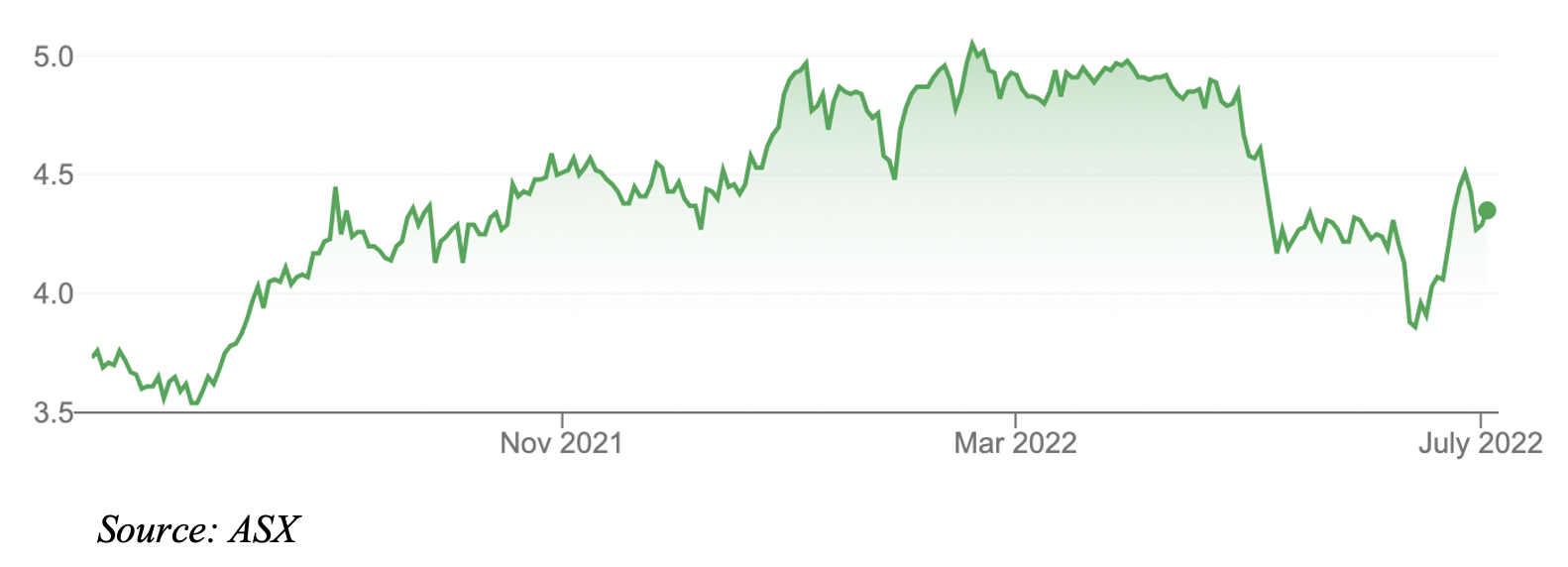

The owner of childcare and healthcare properties has been a mainstay in my coverage of niche A-REITs and small-cap yield ideas for this report over the past five years.

ARENA (ARF) has barely missed a beat over that period. Its five-year annual average return is a whopping 21%. Even in a falling market, ARENA’s one-year return is 25%.

Like other niche property owners, ARENA hasn’t been immune to the market sell-off. It fell from a 52-week high of $5.18 to a low of $3.48 in late June. But ARENA is popular among fund managers so didn’t stay there for long. Recent trades are around $4.30.

I like the long-term outlook for childcare property as a growing population and the continued increase in female participation in the workforce support childcare demand. I prefer companies that rent childcare properties rather than operate them.

ARENA is one of this market’s best-run small-cap stocks. The market understands ARENA’s qualities and has priced it accordingly. A forecast Price Earnings (PE) multiple of about 26 times, on Morningstar numbers, is high for a niche A-REIT.

At $4.30, ARENA trades at a significant premium to its last-stated Net Asset Value (NAV) per security of $3.02. ARENA grew its NAV by 18% over FY21, but a similar gain could be harder in FY22 as interest rates rise and property values moderate.

That said, ARENA’s valuation has looked challenging for several years now, but it keeps delivering. The well-run company deserves its valuation premium.

Gains might be slower from here and prospective investors in ARENA need at least a 3-5-year horizon. But with the Albanese government committed to childcare reform, and unemployment below 4%, rising demand for childcare property is a good bet.

More on ARENA will be known when it reports its FY22 result on August 11.

ARENA REIT (ARF)

2. Rural Funds Group (RFF)

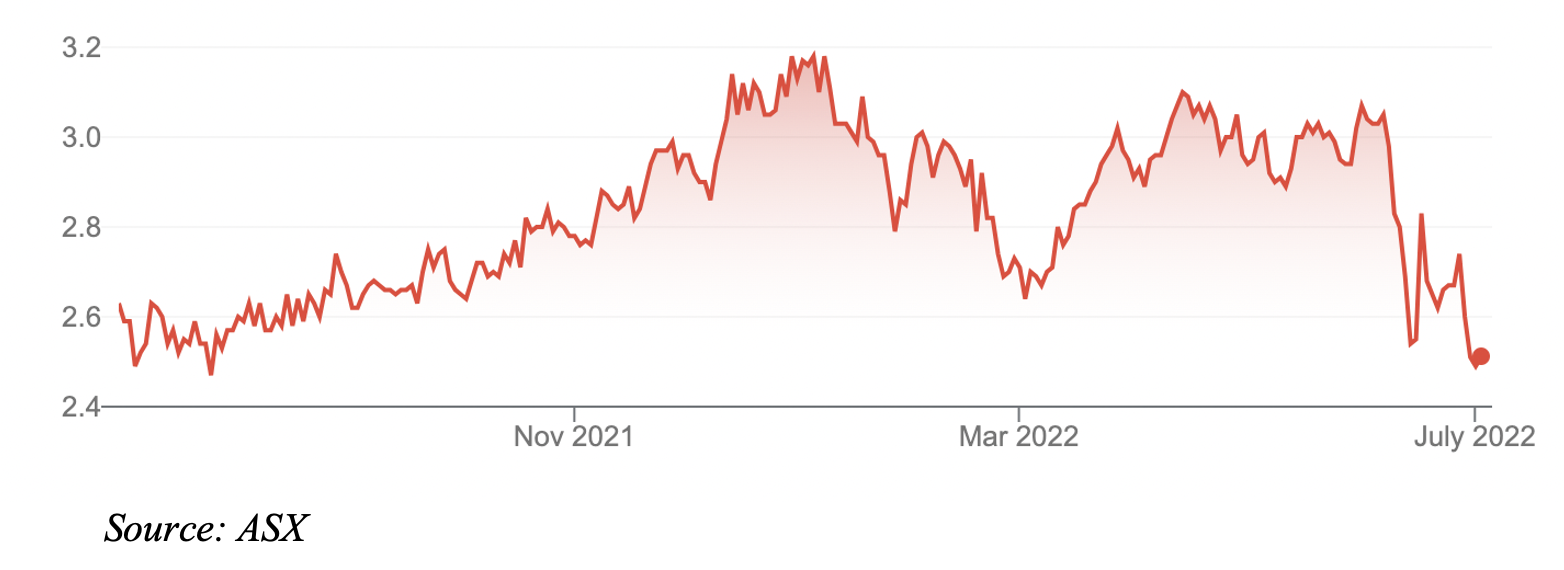

A recent TV report featured prospective farmers who complained about the boom in farm-land prices and the struggle of buying property in the sector. Growing competition from corporates for farmland was also driving prices higher.

Higher farm-land prices are bad news for young farmers who need to borrow to buy a property but good news for existing owners of farmland.

Rural Funds Group (RFF), the market’s largest agricultural REIT, owned 69 rural properties at end-December 2021. About 42% of its FY22 forecast revenue came from cattle, followed by almonds (40%), cropping (9%), vineyards (6%) and macadamias (2%).

Most of RFF’s properties are leased to corporate operators in Queensland and NSW. Stronger agricultural prices and good crop conditions for some commodities have meant these operators did not request any rental relief during COVID-19.

Moreover, about 44% of RFF’s rental income is inflation-linked and 39% of its lease revenue has some form of market-rent review mechanism.

On balance, RFF faces higher rates on its debt in the next few years but will benefit from inflation-linked revenues and rising farmland prices.

Yet RFF has fallen from a 52-week high of $3.22 to $2.49. The trust went ex-distribution in late June, but that doesn’t fully explain the recent price fall.

My guess is the market expects agricultural prices and farm values to moderate as interest rates rise. Soft commodities and farm values tend to do better in the early stages of inflation (there’s an obvious correlation between agricultural prices and farm values).

RFF wrote in its latest investor newsletter: “as we enter this end phase of the inflationary cycle, it is probable that farm values will not increase as they have most recently done. In our view, RFF’s values will most probably not decline either, due to ongoing productivity gains”.

At $2.49, RFF’s unit price compares to its last-stated NAV of $2.24 in its half-year FY22 result. The trust is yielding a touch over 4%.

Given the tailwinds in food prices and farmland, RFF appeals to investors who understand the features, benefits and risks of small-cap, niche A-REITs.

Rural Funds Group (RFF)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 5 July 2022.