I have been a huge fan of JB Hi-Fi, Australia’s best retailer. It has been a winner for customers, staff and shareholders.

Consider these performance stats that Chairman Greg Richards relayed at the Annual General Meeting last Thursday. Since listing in October 2003:

- the share price compound annual growth rate is 20.7% to 22 October 2019, compared to 4.5% on the ASX 200 Accumulation Index over the same period;

- the earnings per share compound annual growth rate is 20.5%; and

- the dividend per share (fully franked) compound annual growth rate is 22%.

More recently, over the past five years:

- the share price compound annual growth rate is 18.6% to 22 October 2019, compared to 4.4% on the ASX 200 Accumulation Index over the same period;

- the earnings per share compound annual growth rate is 11.4%; and

- the dividend per share (fully franked) compound annual growth rate is 11.1%.

On Friday, the company’s share price closed at $37.19 – an all-time high!. Starting the year at $22.14, the stock has added a whopping 68%, plus paid two fully-franked dividends. totalling another $1.42 per share.

JB Hi-Fi (Oct 2014 – Oct 2019)

Source: nabtrade

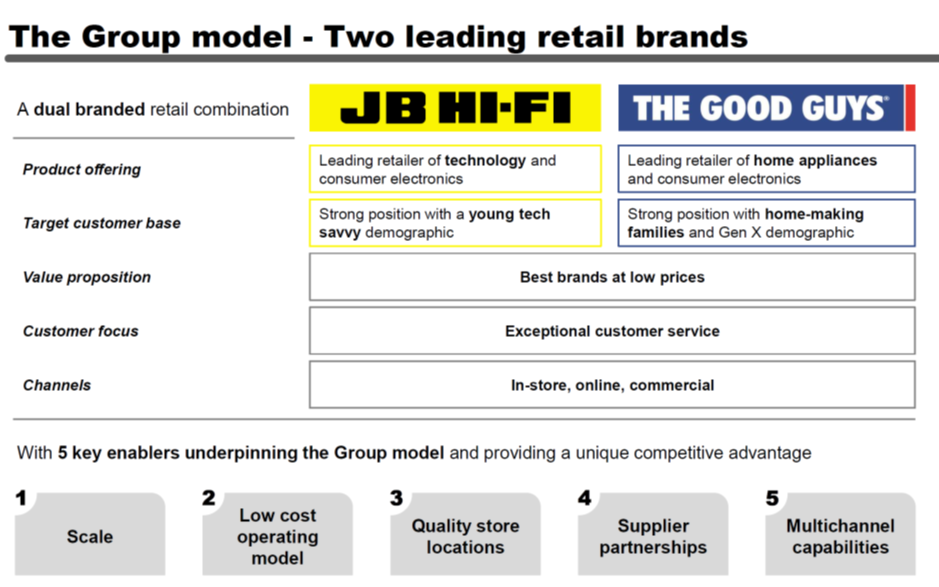

The JB Hi-Fi business comprises two retail brands: JB HI-FI, with a focus on Technology and Consumer Electronics; and The Good Guys, with a focus on Home Appliances and Consumer Electronics.

The value proposition for each brand centres around ranging the best brands at low prices, supported by focussed customer service through store, online and commercial channels. JB Hi-Fi says that five key enablers drive its competitive advantage:

- scale

- a low cost operating model

- quality store locations

- strong supplier partnerships

- multichannel capabilities.

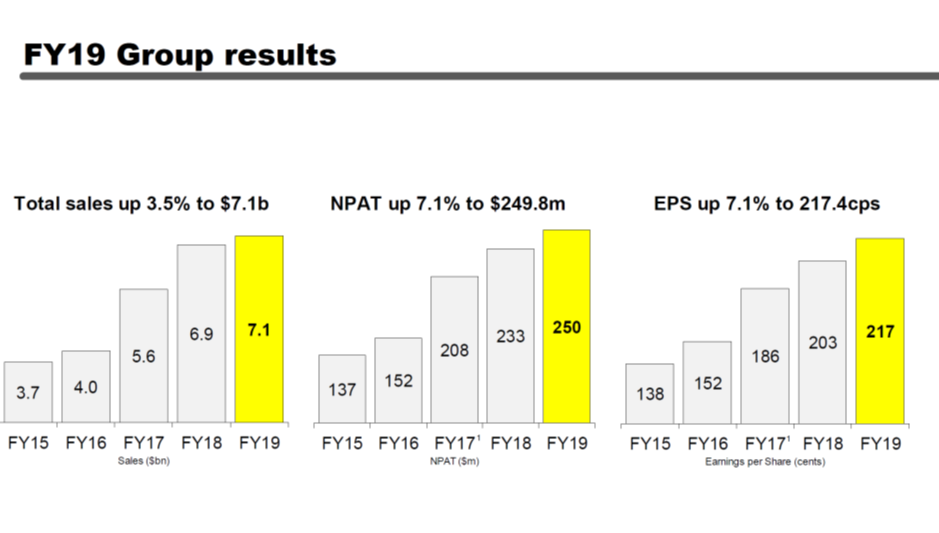

In FY19, a lift in sales of 3.5% to $7.1bn led to an increase in profit of 7.1% to $249.8m and earning per share to 217c per share. The dividend was increased from 132c per share to 142c per share.

For FY20, JB Hi-Fi has forecast sales of $7.25bn, a modest increase of 2.2% on the year before. JB Hi-Fi Australia (the consumer electronics business) is expected to contribute the bulk of the growth with an increase in sales of 2.4%, while the Good Guys is expected to increase sales by 1.5%.

The latest run up in the share price follows JB Hi-Fi’s confirmation of its full year sales guidance of $7.25bn and unlike some other retailers, a positive start to the year. For the first quarter, it reported:

- Sales growth for JB Hi-Fi Australia of 4.7%, with comparable store sales growth of 3.7%;

- In New Zealand, sales growth of 3.8%; (comparable 3.8%); and

- For the Good Guys, sales growth of -0.5%, with comparable sales growth of -1.8%.

While at first glance the Good Guys result looks disappointing, the months of August and September were considerably better than the performance in July. The JB Hi-Fi business also saw a small acceleration in August and September.

What do the brokers say?

The major brokers are moderately bearish on the stock, with 4 neutral recommendations and 2 sell recommendations (zero buy recommendations). The consensus broker target price, which has been moving higher over the last 12 months as JB Hi-Fi continues to confound the market bears, now sits at $31.24. This is a significant 16% discount to the current market price.

The brokers have JB Hi-Fi trading on a multiple of 16.9 times forecast FY20 earnings and 16.6 times FY21 earnings. While this doesn’t look out of line with the overall market, they are only forecasting EPS (earnings per share) growth of 1% in FY20 and 0.6% in FY21. The forecast dividend yield is 3.9% (fully franked).

There is no stock specific reason for the negativity apart from valuation, and a general negative sentiment about discretionary retailers due to current economic conditions and the disruption threat posed by the pure-play online retailers such as Amazon.

This brings us to the short sellers, who have been very active in JB Hi-Fi and had some very material positions. They have been very bearish on discretionary retailers, the threat to traditional retailers caused by the Amazon juggernaut, and in JB Hi-fi’s case, the challenges with the Good Guys acquisition. At one point, more than 19% of JB Hi-Fi’s total number of shares were short sold. This dropped away for a period, but even the latest figures from ASIC today show that just over 12% or 13.9m shares worth $510m are short sold.

What is becoming clear is that in the main, the short sellers aren’t going away. And while they have been spectacularly wrong about JB Hi-Fi, we know that they have very deep pockets and for high conviction positions, can hold these for many, many months.

Bottom line

For once I agree with the major brokers. While it is still the best retailer in Australia, JB Hi-Fi has had a terrific run in 2019 and is starting to look stretched on multiples and valuation. Take profits.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.