I like companies that have a track record of:

- Growing top line sales or revenue growth.

- Improving their operating margin.

- Growing profits.

- Growing earnings per share.

- Increasing dividends.

- Strong cash flow, conservative gearing and prudent financial management.

- Delivering a high return on invested capital.

- Market/category leadership.

Throw in a first class management team, and a share price that is trading on a respectable multiple below the ASX average.

Retailer JB Hi-Fi fits this to a tee.

The problem is that JB-Hi Fi is in retailing and confronts the sector “headwinds” including anaemic sales growth, price deflation, disruption as sales move on-line and the threat of category killers such as Amazon. That’s why JB-Hi Fi remains one of the most shorted stocks on the ASX. According to the latest figures from ASIC, 16.4m JB Hi-Fi shares (worth around $490m) are short sold. This is equivalent to 14.3% of JB Hi-Fi’s total shares on issue.

This has come down from a high of about 19%, but it still makes JB Hi-Fi the seventh most shorted stock on the ASX. Fellow retailers Metcash and Harvey Norman rank sixteenth and seventeenth respectively.

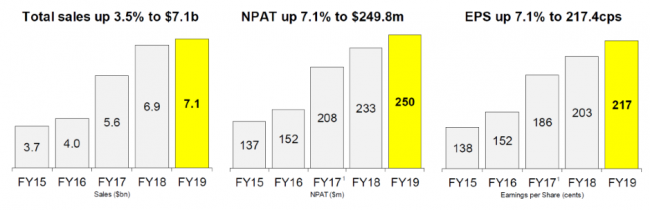

This morning, JB Hi-Fi met expectations again and delivered a very credible set of results. Here are the highlights:

- Net profit up 7.1% to $249.8m. This exceeded JB-Hi Fi’s prior guidance of NPAT to be in the range of $237m to $245m (up 1.6% to 5.1%);

- Sales up 3.5% to $7.095m (guidance was $7.1bn);

- Earnings per share up 7.1% to 217.4 cents per share

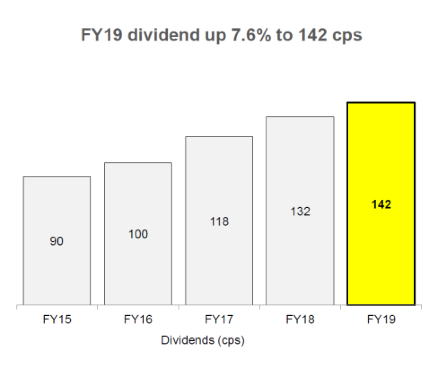

- Dividends for the full year up 10c to 142c per share (fully franked), with a final dividend of 51c per share (up from 46c);

- Cost of doing business (salaries, rent, advertising) up very marginally from 14.82% of sales to 14.89% of sales;

- Net debt down to $319.9m; and

- Return on invested capital up from 26.1% to 27.3%.

The following graphs show the company’s track record over the last 5 years.

JB Hi-Fi Australia (the traditional technology and consumer electronics business) grew overall sales by 4.1% and thanks to a strong performance in the final quarter, comparable store sales by 2.8%. EBIT of $301.7m was up 3.2% for the year, representing 81% of the Group’s total. The other main division, the Good Guys home appliances business which JB Hi-Fi purchased a few years’ back, delivered an improved performance. Sales growth resumed (up 2.2% for the year), and following gross margin improvement, EBIT jumped by 19.8% to $72.9m.

Looking ahead, JB Hi-Fi provided guidance for group sales in FY20 of $7.25bn (2.4% growth for JB Hi-Fi Australia and 1.5% for The Good Guys). “Whilst we continue to see variability in the sales environment, we enter FY20 confident in our ability to execute and grow market share”. They also reported that July had started well for JB Hi-Fi Australia (up 4.1% in total, with comparable store sales up 3.2%), however The Good Guys had started less strongly with sales down 2.1%.

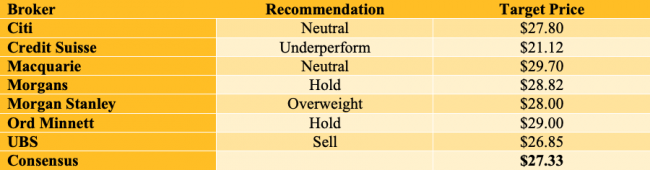

What do the brokers say?

Going into the result, the brokers were largely neutral on the stock. While all acknowledge the strength of the management team and their ability to execute, concerns over the retail environment and the maturity of the company’s growth profile, plus the risk of further online disruption, lead in the main to a cautious assessment. According to FNArena, of the 7 major brokers, there was 1 buy recommendation, 4 neutral recommendations and 2 sell recommendations. The following table shows the recommendations and target prices.

Here’s my view

The market’s initial reaction to the profit report was to send the shares 7% higher to around $30. This places the stock on a multiple 13.8 times FY19 earnings and assuming a 3% increase in FY20, 13.4 times FY20 earnings. The dividend yield is 4.7% fully franked.

Notwithstanding the challenging outlook for retail, these numbers don’t make the stock look that expensive – in fact, you could make a case that it looks quite attractive. That all said, I think it is unlikely that the shorters will give up on the stock and will probably look to reset their shorts at higher levels.

JB Hi-Fi meets the criteria of a great stock for an investor’s portfolio. But concerns about sector headwinds aren’t going to abate, nor are concerns that JB Hi-Fi’s growth profile might be maturing. So it is a stock to consider adding to your portfolio when the market (or the shorters) are keen to sell. I wouldn’t chase it at these prices, but I would certainly have it on my watchlist. Wait to buy.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.