US equities are pricey so lock in some profits. What to do with that cash? European and Chinese equities are my two preferred global equity markets this year and here’s why. Read on…

On the weekend, a friend asked why I had become bearish on equity markets this year. He’d read my recent columns suggesting it was time to take profits.

To be clear, I still like the medium-term outlook for equities (1-3 years). Global rate cuts will be a tailwind for equities, albeit returns will moderate, and volatility will be higher than investors are used to, necessitating portfolio changes.

I am concerned about asset classes that keep defying gravity and look overvalued, notably some Australian banks, US equities and gold bullion.

I’ve followed markets long enough to know that selling into rallies, taking profits and rotating into undervalued assets is the key to long-term wealth creation.

Some retail investors, however, get seduced by rallies, believing they will last forever. Blinded by greed, they extrapolate gains too far into the future. They refuse to take profits when the smart money is quietly exiting.

Predicting short-term market moves is dangerous. Although nobody knows for sure what the market will do next week or next month, another market pullback before year’s end seems likely, given geopolitical uncertainty.

As I told my friend, selling into rallies now and lightening positions means building up cash to pounce on bargains during the next market pullback.

Reduce exposure to US equities

US equities are an obvious contender for profit taking. The S&P 500 Index (USD) in the US has a total return of almost 11% over three months to end-June 2025 – a remarkable rally given the uncertainty facing the US economy.

In calendar years 2024 and 2023, the S&P 500 returned 24.5% and 25.6% respectively. Consecutive years of 20%-plus gains are rare, even for a market as exceptional as the US. It’s hard to see those gains repeated this year.

At the end of June 2025, the S&P 500 traded on a forecast Price Earnings (PE) ratio of 22.5 times and Price-To-Book ratio of 4.7 times, S&P data shows. The indicated dividend yield was 1.2%. Whichever way one cuts it, US equities are pricey.

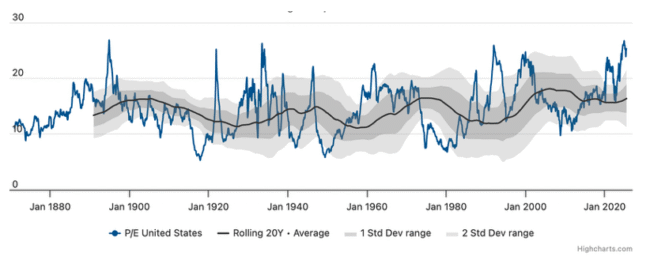

The chart below tracks the S&P 500’s historic PE ratio (currently about 25) over the past 145 years. Note how far the current PE exceeds the 20-year rolling average.

Chart 1: S&P 500 Historic PE ratio

Will US equities keep rising in the next few months? Who knows. I do know that investors who have enjoyed 20%-plus returns for the past two calendar years should take advantage of current strength to lock in some profits.

Positioning for a European revival

Assuming profits are taken, the next question is what to do with that cash. As mentioned, I’d let portfolio cash build up for now. Most developed markets look expensive, and few parts of sectors or themes scream value right now.

When the next market pullback arrives – possibly during the seasonally weak September/October period – I’d put that cash to work in European equities – an idea I have mentioned previously in this column this year. European and Chinese equities are my two preferred global equity markets this year.

I’m becoming more bullish on European equities. Like or loathe him, Trump has probably done Europe a favour in the long run by forcing the continent to stand on its own two feet, militarily and economically.

Start with defence. Trump is demanding NATO countries and other US allies spend more on defence as a proportion of their gross domestic product. In June, NATO countries agreed to boost annual defence spending to 5% of their GDP by 2035, from around 2% in 2024. That’s a huge increase in military expenditure.

The NATO commitment is more nuanced than headlines suggested. It requires NATO countries to allocate at least 3.5% of their GDP annually to defence spending and another 1.5% of GDP annually to critical infrastructure, such as cybersecurity.

Germany has gone one step better, announcing it will more than double its military spending by the turn of the decade, reaching 3.5% of GDP by 2029.

Germany is also boosting infrastructure. In March, it announced a 500-billion euro fund, much of which is earmarked for decarbonisation initiatives, transport and education – a move seen as a turning point in infrastructure spending.

As Europe’s largest economy, Germany is finally showing renewed economic leadership and a more determined approach to reinvigorating its economy. Watch other European countries follow Germany’s lead in coming years.

Then there’s China. The US-China trade war could see Chinese manufacturers pivot towards Europe and away from the US if high tariffs persist. More countries will look to diversify trading relationships, benefiting Europe.

In the medium term, higher defence and infrastructure spending in Europe, and possibly greater trade investment, could stimulate Europe’s economic revival.

Long term, expect a more dynamic European economy to emerge this decade. One that relies less on an increasingly erratic US under President Trump.

Also, a European economy that makes tough spending choices. More spending on infrastructure and other economy-boosting initiatives, and long overdue reform on social welfare spending, which is out of control in parts of Europe.

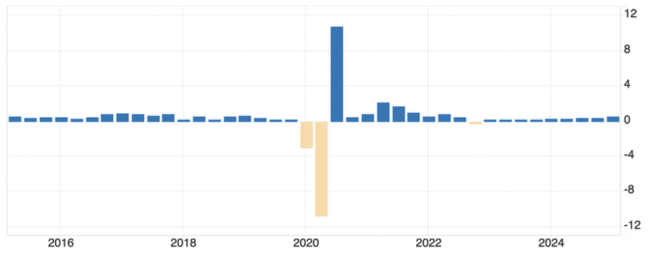

As the chart below shows, the EU’s economic growth this century has been anaemic. Over the past 20 years, economic growth has mostly been at or below 2%. Note how growth on a quarterly basis has limped along since mid-2022. The International Monetary Fund projects 1.3% growth this year.

Chart 2: European Union annual % change in GDP

Source: Trading Economics.

That’s the bad news. The good news is that European growth is starting to quicken, and higher infrastructure and defence spending will be tailwinds. That’s good for European equities this decade, although a recovery will take time.

Gaining European exposure

The market expects a stronger revival in Europe’s economy. The S&P Europe 350 Index (USD) has returned 23% year-to-date to end-June 2025, S&P data shows. That’s better than US equities this year and a sign that the smart money is reducing some exposure to US equities and increasing exposure to Europe.

It’s different long-term story. Over 10 years, the S&P Europe 350 Index has a modest annualised total return of 6.9%. In contrast, the US S&P 500 Index has returned a whopping 13.6% – almost double that of European equities.

The chart below shows the S&P 350 Europe Index compared to the S&P 500 Index (EUR) on a total-return basis over 10 years. Notice the big gap between US equities (blue line) and European equities (white line) this decade.

Chart 3: US versus European equities

Source: S&P Global

Watch this gap narrow this decade as more capital rotates from US to European equities in anticipation of a stronger European economic revival. Even a small percentage of capital rotation could boost European equities, given the dominance of US equity markets in global indices.

A handful of Exchange Traded Funds (ETFs) on ASX provide exposure to European equities, notably from iShares and Vanguard.

The iShares Europe ETF (ASX: IEV) tracks the S&P Europe 350 Index mentioned above. It provides exposure to 365 of Europe’s largest companies.

The ETF’s trailing PE of 17.4 times compares to about 25 times for US equities, measured by the S&P 500. The ETF’s price-to-book ratio is almost that of US equities. Sectors within Europe, such as banks, look cheap.

Reducing exposure to US equities and increasing exposure to European equities through IEV or a similar ASX-quoted ETF makes sense. Again, this idea is about portfolio rebalancing and profit taking – not exiting US equities completely.

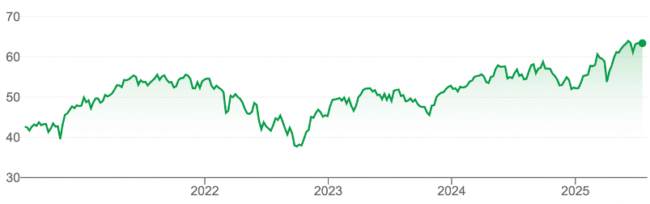

Chart 4: iShares Europe ETF

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis 16 July 2025.